- Home

- »

- Petrochemicals

- »

-

Industrial Lubricants Market Size And Share Report, 2030GVR Report cover

![Industrial Lubricants Market Size, Share & Trends Report]()

Industrial Lubricants Market Size, Share & Trends Analysis Report By Product (Process Oils, General Industrial Oils, Metalworking Fluids, Industrial Engine Oils), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-180-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Industrial Lubricants Market Size & Trends

The global industrial lubricants market size was valued at USD 53.17 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030. Rapid industrialization in developing countries followed by a rise in the number of trade activities fuels the demand for industrial lubricants. Rising investments in R&D activities along with proper expansion channels help the growth of key players. Some industries slated to witness considerable growth include unconventional energy, chemicals, and mining. This trend is expected to further strengthen product demand in compressors, hydraulics, industrial engines, centrifuges, and bearings.

Over the past decade, emerging economies such as India, Japan, South Africa, China, and Brazil have witnessed a significant rise in the industrial sector. Industries such as the ones manufacturing foundry, plastics, metal consumer appliances, and more, along with mining industries have gained significant importance and thus demand high-quality industrial lubricants.

This trend has led to the increasing use of lubricants such as process oils, metalworking fluids, industrial oils, and engine oils. Stable industrial output in these markets is expected to continue to drive the demand for industrial lubricants. India has a significant market share of process oils, with over half of the total industrial lubricant demand. Rapid growth and development in power generation & distribution have driven the demand for transformer oils.

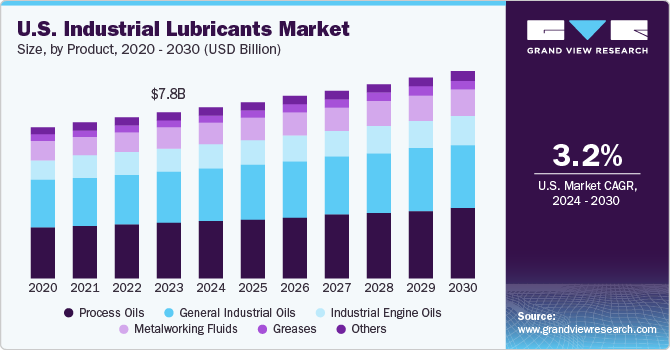

The U.S. is the largest consumer of industrial lubricants in North America with a revenue share of 81.6% in 2022. In terms of volume, the U.S. market for process oil accounted for the largest revenue share in 2022 and is estimated to expand at a CAGR of 2.7% during the forecast period. The U.S. has continuously evolved and made use of higher quality lubricants with longer oil drain intervals which have resulted in lower lubricant consumption as a result of efficiency.

Rising demand for a range of finished goods along with the subsequent need to expand production capabilities has compelled manufacturers to rely on machinery to automate their production process and processing activity. Initiatives such as continuously evolving emission standards, improving engine technology, and norms about mitigated carbon footprints that are being adopted in emerging economies such as China and India are touted to be among the key driving factors over the forecast period.

Changing consumer lifestyles and the adoption of Western living standards have boosted the demand for processed and frozen foods. Packaging line automation and adaption to high-pressure operations with robotics are expected to foster the processed foods market’s growth. The rising importance of agro-processing is expected to bring about further developments in the industry.

Increasing concerns and stringent regulations over contamination and environmental pollution where synthetic lubricants are used is a major cause of environmental pollution. Another issue faced is the disposal of used lubricants. Since most of the additives used in lubricants are petrochemical derivatives, they seriously threaten water pollution. Hence, rising environmental concerns regarding the use, disposal, and recycling of lubricants restrain the market growth.

Product Insights

Based on the product, the industrial lubricants market can be segmented into process oils, general industrial oils, metalworking fluids, and industrial engine oils. Process oils emerged as a dominant product segment accounting for more than 32.1% of the overall revenue in 2022. The segment is expected to maintain its dominance expanding at a CAGR of 4.0% during the forecast period.

The metalworking fluids segment is expected to witness the fastest growth over the forecast period. Metalworking fluids are extensively gaining popularity owing to their application for improving the quality of surface finish. These fluids are used for diverse niche applications including medical machining and more. The metal removal fluid concentrates are comprised of additives such as antioxidants and emulsifiers to increase tool life and minimize downtime.

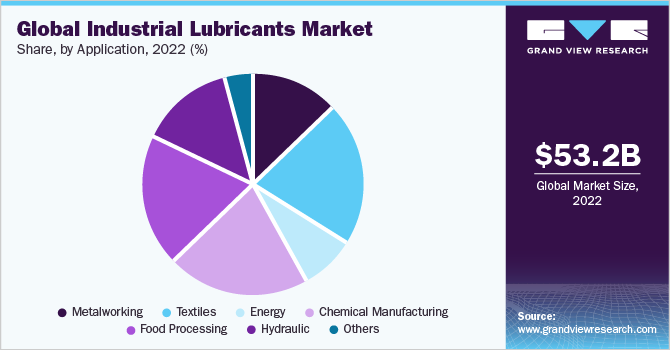

Application Insights

Chemical manufacturing dominated the market with a revenue share of over 21.0% in 2022. Chemical manufacturing and processing plant challenges include temperature extremes, continuous operation, and the threat of contamination from other chemicals, water, and particulates. Lubricants used in the chemical manufacturing application result in the lengthening of lubricant and equipment lifespan, reduced oil temperatures, increased production output, reduced friction, heat, wear, energy consumption, and extended oil drain intervals.

The metalworking segment is likely to witness rapid growth over the forecast period, based on increasing industrial activities and demand for metal in applications including machinery and building. Moreover, demand for metalworking processes, such as cutting, welding, and forming, across various applications, such as foundry, ships, aircraft, milling, and industrial machinery will drive the segment’s growth.

General industrial oils are also expected to experience healthy growth during the forecast period, due to the rise in awareness regarding machinery maintenance coupled with a change in maintenance strategies by industries to minimize machine handling costs.

Regional Insights

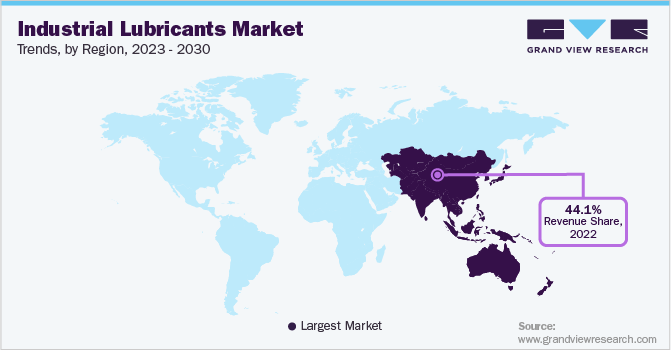

Asia Pacific held the largest revenue share of 44.1% in 2022 and is expected to witness the fastest CAGR of over 4.0% from 2023 to 2030, due to well-established end-use industries across emerging economies, such as India, Indonesia, Thailand, and Malaysia. Moreover, rising awareness regarding greater operating efficiency of industrial equipment after lubricant application is anticipated to fuel the demand.

Demand for industrial lubricants in North America and Europe is anticipated to remain at a higher level despite the relative stagnancy in industrial growth. Rising demand for oilfield chemicals due to drilling and exploration activities is expected to propel the market’s growth in North America. The resurgence in industrial activities along with the modernization of industrial machinery is the key driving factor determining European industrial lubricant demand over the forecast period.

Key Companies & Market Share Insights

The market is highly fragmented with a large number of global as well as local players. Companies are investing heavily in R&D and mergers to develop innovative products to gain a competitive edge in the industry. There has been a shift in trend towards the use of bio-based raw materials owing to rising awareness regarding the need for emission reduction and energy conservation.

The industry competition is inclusive of factors like distribution partnerships, technological innovations, product portfolios, strategic developments, and capabilities. Castrol announced the launch of two new cutting fluids to support the manufacturing of metal components. Some prominent players in the global industrial lubricants market include:

-

Exxonmobil Corp

-

Fuchs Group

-

The Lubrizol Corporation

-

Royal Dutch Shell

-

Phillips 66

-

Lucas Oil Products, Inc.

-

Amsoil, Inc.

-

Bel-Ray Co., Inc.

-

Total S.A.

-

Kluber Lubrication.

-

Valvoline International, Inc.

-

Chevron Corp.

-

Clariant

-

Quaker Chemical Corp.

-

Houghton International, Inc.

-

Castrol

-

Blaser Swisslube, Inc.

-

Calumet Specialty Products Partners, L.P.

-

Petronas Lubricant International

-

Idemitsu Kosan Co., Ltd.

-

Yushiro Chemical Industry Co., Ltd.

Industrial Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 55.17 billion

Revenue forecast in 2030

USD 72.08 billion

Growth rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Switzerland; France; Italy; Spain; Netherlands; Russia; China; India; Japan; South Korea; Southeast Asia; Oceania; Kyrgyzstan; Brazil; Argentina; Chile; Colombia; Iran; Oman; UAE; Qatar; Kuwait; Saudi Arabia; South Africa; Angola; Nigeria

Key companies profiled

Exxonmobil Corp; Fuchs Group; The Lubrizol Corporation; Royal Dutch Shell; Phillips 66; Lucas Oil Products, Inc.; Amsoil, Inc.; Bel-Ray Co., Inc.; Total S.A.; Kluber Lubrication; Valvoline International, Inc.; Chevron Corp.; Clariant; Quaker Chemical Corp.; Houghton International, Inc.; Castrol; Blaser Swisslube, Inc.; Calumet Specialty Products Partners, L.P.; Petronas Lubricant International; Idemitsu Kosan Co., Ltd.; Yushiro Chemical Industry Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

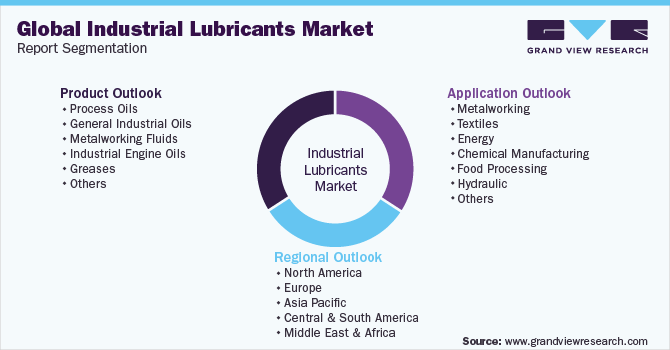

Global Industrial Lubricants Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial lubricants market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Process Oils

-

General Industrial Oils

-

Metalworking Fluids

-

Industrial Engine Oils

-

Greases

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Metalworking

-

Textiles

-

Energy

-

Chemical Manufacturing

-

Food Processing

-

Hydraulic

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Switzerland

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

Oceania

-

Kyrgyzstan

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

Saudi Arabia

-

South Africa

-

Angola

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the industrial lubricants market include xxonMobil Corp.; Fuchs Group; The Lubrizol Corp.; Royal Dutch Shell; Phillips 66; Lucas Oil Products, Inc.; Amsoil, Inc.; Bel-Ray Co., Inc.; Total S.A.; Kluber Lubrication; Valvoline International, Inc.; Chevron Corp.; Clariant; Quaker Chemical Corp.; Zeller+Gmelin GmbH & Co KG; Houghton International, Inc.; Castrol; Blaser Swisslube, Inc.; Calumet Specialty Product Partners, L.P.; and Petronas Lubricant International.

b. Key factors that are driving the market growth include rapid industrialization in developing countries and increasing demand for processed food.

b. The global industrial lubricants market size was estimated at USD 53.17 billion in 2022 and is expected to reach USD 55.17 billion in 2023.

b. The global industrial lubricants market is expected to grow at a compound annual growth rate of 3.9% from 2023 to 2030 to reach USD 72.08 billion by 2030.

b. Asia Pacific dominated the industrial lubricants market with a share of 44.2% in 2019. This is attributable to growing end-use industries across emerging economies, such as India, Indonesia, Thailand, & Malaysia and rising awareness regarding ability of lubricants to enhance the operating efficiency of industrial equipment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."