- Home

- »

- Electronic Devices

- »

-

Industrial Refrigeration Systems Market Share Report, 2030GVR Report cover

![Industrial Refrigeration Systems Market Size, Share & Trends Report]()

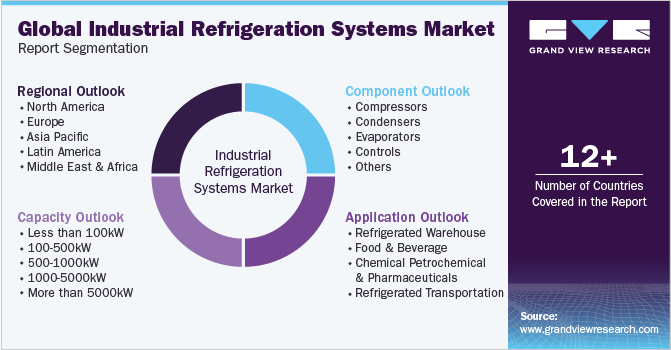

Industrial Refrigeration Systems Market Size, Share & Trends Analysis Report By Component (Compressors, Condensers, Evaporators, Controls, Others), By Capacity, By Refrigerant, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-101-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Semiconductors & Electronics

Market Size & Trends

The global industrial refrigeration systems market size was valued at USD 20.48 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. The rising usage of processed and packaged foods & drinks and the need to prevent spoilage are surging the demand for the industrial refrigeration system. Concerns over global warming have forced manufacturers to focus on natural refrigerants over harmful coolants. In recent years, the market for genuine refrigerant-based equipment has been overgrown due to natural refrigerants being inexpensive to produce and climate-neutral. In the forecast period, the market is expected to be impacted by the emergence of enhanced and improved cold chain systems across the globe.

Industrial refrigeration systems are used for refrigeration across various industries, such as pharmaceuticals, food & beverage, processing, and chemicals. These systems are generally used in places such as cold food storage, beverage production, dairy processing, ice rinks, and heavy industry. It helps remove heat from materials and large-scale processes by reducing the temperature to a required value.

E-commerce grocery sales are growing faster throughout the world than physical grocery sales. Additionally, cold chains play an integral role by minimizing harvest spoilage using technologies such as evaporator/passive coolers and absorption refrigerators. High temperatures and excessive heat, in addition to agro-climatic conditions, contribute to market growth. In developing countries, however, cold chain deployments are low due to the fewer budgets allocated for advanced equipment.

Leading companies in the market are focusing on technological advancements to provide simplified solutions. In June 2022, Emerson Electric Co. announced that it achieved a milestone for installing 200.0 million Copeland compressors worldwide, as Copeland compressors are used for both commercial as well as residential air conditioning, working under ideal conditions, achieving lower GWP and higher efficiency.

Companies are focusing on environmentally friendly technology such as Active Magnetic Regenerative refrigeration. The technology requires a magnetic solid, which acts as a refrigerant using the magnetocaloric effect and reduces energy consumption by almost 30%. Besides this technology, Artificial Intelligence, next-generation technology, and the Internet of Things create opportunities for manufacturers. Johnson Controls demonstrated how they make residential energy efficiency more affordable and accessible for homeowners with the help of robust financing options and rebates in September 2022.

Natural refrigerants such as Co2, hydrocarbons, and ammonia pose threats of toxicity and inflammation. However, their use has reduced the emission of greenhouse gases. Manufacturers are steadily switching to natural refrigerant options as they focus on the refrigerants’ Global Warming Potential and Ozone Depletion Potential due to the increasing awareness among consumers. For instance, in October 2022, Danfoss and Beijer Ref AB renewed their partnership contract which helped them to focus on new circularity practices and also provide high endurance, high utilization, and high material recirculation in products and service offerings.

The outbreak of COVID-19 globally impacted the industrial refrigeration systems market negatively to some extent due to the complete lockdown imposed by governments. Many industries were shut down during the period due to work stoppage, slowing down the growth of the market. Construction and transportation operations and supply chains were hindered on a global scale, leading to decreased refrigeration device manufacturing, which directly impacted the industrial refrigeration sector.

However, the market witnessed a demand for its products due to the global need for preserving vaccines in vast quantities to fight the extent of the pandemic. The U.S. Centers for Disease Control and Prevention (CDC) suggested using pharmaceutical or specially designed refrigerators or freezers to store vaccines properly. The guidelines for storage of vaccines indicated storage temperatures between 2°C and 8°C for refrigerators and -50°C and -15°C for freezers.

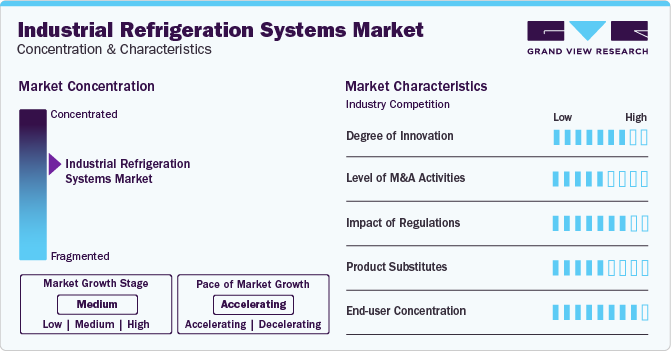

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The industrial refrigeration systems market is driven by a high degree of innovation and end-user concentration, owing to the increased demand for technologically advanced industrial refrigeration from different industries such as food and beverages, chemicals, and healthcare & pharmaceuticals, among others.

In addition, the industry is witnessing moderate to high mergers and activities (M&A) by the leading market companies, which further accelerates market growth. Such strategies by industrial refrigeration companies are aimed to expand market share and diversify the product portfolio. For instance, in March 2023, Industrial Refrigeration Pros (IR Pros), a provider of industrial refrigeration systems, acquired the assets of Refrigerated Mechanical Solutions (RMS), a California-based company specializing in planning, construction, design, and installation of industrial refrigeration systems.

The industrial refrigeration systems market is subject to increasing regulatory scrutiny. This is owing to the rising number of regulations aimed at reducing the environmental impact of industrial refrigerators. In the U.S., the Environmental Protection Agency (EPA) regulation governs the use of refrigerants in industrial systems. On the other hand, the Occupational Safety and Health Administration (OSHA) regulations are aimed at the safe operation and maintenance of industrial refrigeration systems. Regulations associated with the energy efficiency of industrial refrigeration have further led to the development of more efficient refrigeration systems. In October 2023, the U.S. EPA introduced the final “Technology Transitions” rule to reduce the use of HFCs under the American Innovation and Manufacturing (AIM) Act. This regulation is projected to encourage the use of more efficient and environmentally friendly technologies in the refrigeration industry.

End-user concentration is high in the industrial refrigeration systems market, as several industry verticals are adopting various industrial refrigeration systems. Food and beverage, pharmaceutical, chemical, and energy companies are among the prominent end users of industrial refrigeration systems.

Component Insights

The compressor segment accounted for a substantial revenue share in 2022 and is expected to retain its dominance throughout the forecast period, growing at a significant CAGR of around 7% from 2023 to 2030. The compressor systems are used for maintaining the required lower temperature and pressures and eliminating the vapor. The ability of this equipment to control the load over the evaporators makes it a significant unit in the industrial refrigeration system. The introduction of innovative compressor solutions by market companies to meet efficiency and refrigerant regulations associated with industrial refrigeration is expected to create lucrative growth opportunities for the market.

The compressor segment is expected to witness significant growth over the forecast period. This growth is driven by rapid industrialization, automation, and a surge in demand for oil-free compressors in the HVAC industry due to environmental concerns. Compressors play an essential role in refrigeration systems to ensure efficient cooling of materials and large-scale processes. The rising demand for energy-efficient compressors with a lower carbon footprint is expected to create growth opportunities for this segment.

Capacity Insights

The 500kW-1000kW capacity segment accounted for the highest revenue share in 2022. The cooling capacity range under this segment is majorly used for food & beverage storage as well as processing, especially for perishable and processed products. These cooling capacity ranges are also used by daily plants to keep the items stored for a longer period without contamination.

The 1000-5000kW segment is estimated to grow at a significant rate as the cooling capacity ranges are also used in warehouse refrigeration for cold storage purposes of other items such as vaccines, petrochemicals, and other items that can be deterred due to the lack of cool storage premises. The temperature range in the inner infrastructure of high-scale power plants is between 50-100 degrees Celsius. As these refrigeration systems ranging between 1,000kW-5,000kW capacities neutralize the effect of high temperatures on the shop floors, the demand for the same is set to grow in the future.

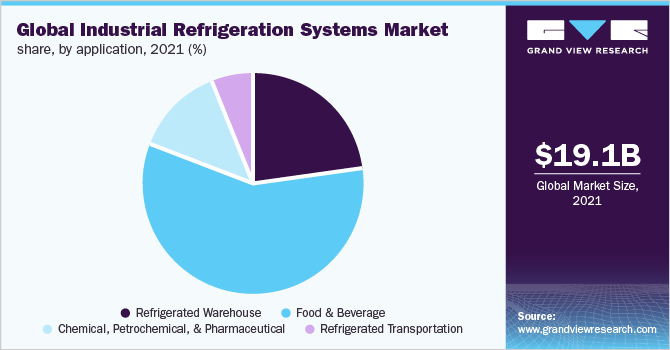

Application Insights

The food & beverage segment accounted for the dominant revenue share in 2022, and it is expected to dominate the market in the forecast period. The increasing disposable income and growing working professional base have resulted in an unprecedented demand for frozen and processed food products. Increasing global food consumption has created a demand for reliable and efficient industrial refrigeration systems that can handle large volumes of food products. Thus, companies are developing advanced industrial refrigeration systems capable of meeting the specific needs of the food and beverage industry.

The chemical, petrochemical, and pharmaceutical application segments are expected to attain higher growth during the forecast period. The rise in demand for temperature control of hazardous and sensitive chemical and pharmaceutical industries drives the growth of this segment. In addition, the increased demand for vaccinations to diminish COVID-19 and other infections has witnessed an upsurge during the past few years. The vaccinations require higher-level cooling units to store and distribute across the globe. This demand for a cold system led to an increase in the deployment of industrial refrigeration systems, thereby exponentially spurring the revenue generation of this application over the forecast period.

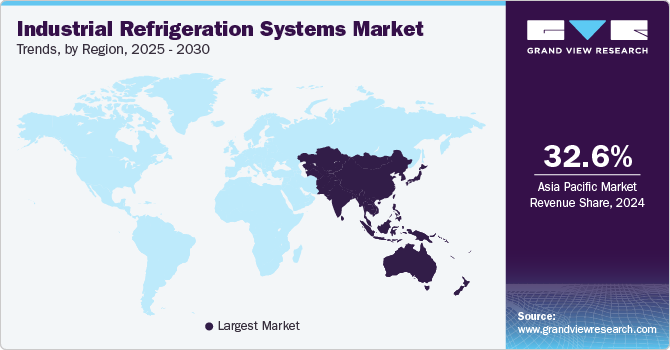

Regional Insights

North America accounted for the largest market revenue share of over 30.0% in 2022 and is expected to maintain steady growth during the forecast period. The expansion of the e-commerce industry is one of the factors contributing to the market development in the region. The proliferation of E-commerce in the U.S. and Canada impacted consumer buying behavior as online groceries have become a lifestyle requirement. This has boosted the adoption of refrigeration systems in the logistics and transportation industry. Moreover, the cold storage industry in North America is expanding with constant demand for improved refrigeration systems, fueling the market’s growth.

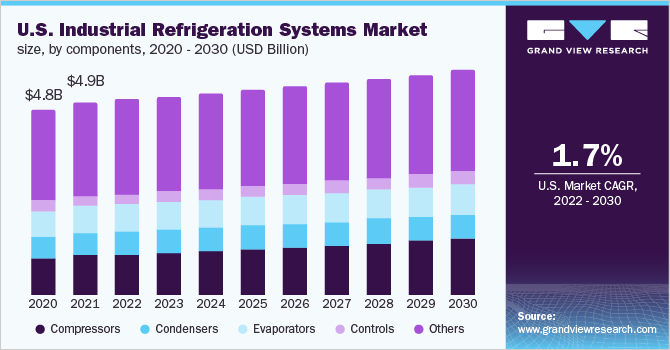

U.S. Industrial Refrigeration Systems Market Trends

The U.S. Industrial refrigeration systems market is expected to grow at a CAGR of 1.8% from 2024 to 2030. The upsurge in demand for the packaged food & drinks industry has contributed to the rise in the need for refrigeration solutions across warehouses, transportation, and chemical industries, thereby driving the growth of the industrial refrigeration systems market in the U.S.

Europe Industrial Refrigeration Systems Market Trends

Europe industrial refrigeration systems market is expected to witness a CAGR of over 18% from 2023 to 2030. This can be attributed to the high demand from industries including chemicals, food and beverage, and pharmaceuticals, which need refrigeration systems to maintain the safety and quality of the products. The region is witnessing high demand for environmentally friendly and energy-efficient refrigeration systems, further contributing to the industrial refrigeration systems market growth in Europe.

U.K. industrial refrigeration systems market accounted for over 18% revenue share of the European market in 2022. The rapid development of energy-efficient refrigeration systems and the government’s focus on reducing carbon emissions is fueling the growth of the industrial refrigeration systems market in the U.K.

Industrial refrigeration systems market in Germany is expected to witness a CAGR of nearly 5% from 2023 to 2030. Stringent government regulations on food safety and quality, along with the rising number of refrigerated distribution centers and warehouses, are boosting the growth of the industrial refrigeration systems market in Germany.

France industrial refrigeration systems market is expected to witness a CAGR of over 6% from 2023 to 2030. The high investment in the development of natural refrigerant technologies in France drives the growth of the industrial refrigeration market in France.

Asia Pacific Industrial Refrigeration Systems Market Trends

Asia Pacific industrial refrigeration systems market is anticipated to expand at a notable CAGR of 6% from 2023 to 2030, owing to the significant expansion of cold chain storage facilities in countries such as Japan, India, and China. China is the world's greatest producer of fruits and vegetables, followed by India. China and India export crops to various places across the world. The governments in these countries are introducing several projects to extend cold storage management and improve refrigeration and refrigerated warehouse management in their respective nations.

China industrial refrigeration systems market is anticipated to witness growth at a CAGR of over 5% from 2023 to 2030. High demand for refrigeration across industries, including pharmaceuticals, food & beverages, and cold chain logistics, is boosting the growth of the industrial refrigeration systems market in China.

Industrial refrigeration systems market in Japan is expected to witness a CAGR of over 5% from 2023 to 2030. Growing international and domestic trade of temperature-sensitive goods has boosted the growth of the industrial refrigeration systems market in Japan. For instance, according to the International Trade Administration, bilateral U.S.-Japan trade was worth USD 309 billion in 2022.

India industrial refrigeration systems market is expected to witness a CAGR of over 7% from 2023 to 2030. An increasing number of cold storage facilities and rising demand for efficient refrigeration solutions are contributing to the growth of the industrial refrigeration systems market in India.

Middle East & Africa (MEA) Industrial Refrigeration Systems Market Trends

Middle East & Africa (MEA) industrial refrigeration systems market is expected to witness a CAGR of nearly 3% from 2023 to 2030. The increasing commercialization trend of cold-chain logistics drives the market’s growth in the region. The governments in the region are also focusing on the development of environmentally friendly refrigerants, creating growth opportunities for the industrial refrigeration systems market in MEA.

Saudi Arabia industrial refrigeration systems market is expected to witness a CAGR of over 7% from 2023 to 2030. An increasing number of cold storage facilities and rising demand for efficient refrigeration solutions are contributing to the growth of the industrial refrigeration systems market in Saudi Arabia.

Key Industrial Refrigeration Systems Company Insights

Key companies in the industrial refrigeration systems market are focusing on introducing new technology and innovative products and concentrating on the advancement and acquisition of the components to gain a competitive edge. In January 2023, Johnson Controls announced that it acquired Hybrid Energy A/S, aiming to focus on heat pumps for district heating and industrial processes. Additionally, in January 2023, Danfoss and Salling Group collaborated with Microsoft Corporation to empower sustainable food retail through digitization. This collaboration helped Danfoss and Salling Group to develop digital services to track temperature and use of energy in supermarket refrigeration.

Additionally, companies are continually spending on research and development to create new features and environmentally friendly technologies. For instance, in June 2023, Daikin Industries, Ltd. opened the Daikin Sustainability & Innovation Center to promote environmental technologies and accelerate innovation in refrigeration.

Key Industrial Refrigeration Systems Companies:

- Johnson Controls

- Emerson Electric Co.

- Danfoss

- GEA Group Aktiengesellschaft

- MAYEKAWA MFG Co. Ltd.

- BITZER Kuhlmaschinenbau GmbH

- DAIKIN Industries Ltd.

- EVAPCO Inc.

- Guntner GmbH & Co. KG

- LU-VE S.p.A

Recent Developments

-

In November 2023, DAIKIN Industries Ltd. introduced a fully electric and plug-in hybrid transport refrigeration product range aimed at reducing emissions from internal combustion engines.

-

In June 2023, Johnson Controls acquired M&M Carnot, a provider of natural refrigeration solutions with ultra-low global warming potential (GWP). This acquisition is projected to support Johnson Controls’ move to help customers meet sustainability goals. The acquisition also strengthened the portfolio of Johnson Controls, which meets environmental regulations.

-

In March 2023, Emerson launched the new Vilter-branded trans-critical CO2 compressor. According to the company, this compressor is designed for handling high-pressure industrial CO2 refrigeration.

-

In February 2023, Danfoss announced the construction of a compressor and sensor manufacturing facility in Apodaca, Mexico. This expansion strategy was aimed at meeting the demand for cooling technology from the U.S.

Industrial Refrigeration Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.48 billion

Revenue forecast in 2030

USD 27.66 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component; capacity; refrigerant; application; regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia, South Korea, Mexico, Brazil, Saudi Arabia, South Africa.

Key companies profiled

Johnson Control; Emerson Electric Co; Danfoss; DAIKIN Industries Ltd.; GEA Group Aktiengesellschaft; MAYEKAWA MFG Co. Ltd.; BITZER; EVAPCO Inc.; Guntner GmbH & Co. KG; and LU-VE S.P.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Refrigeration System Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels in addition to provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial refrigeration systems market report based on the component, capacity, refrigerant, application, and region.

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 100kW

-

100-500kW

-

500-1000kW

-

1000-5000kW

-

More than 5000kW

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Compressors

-

Rotary Screw Compressor

-

Centrifugal Compressor

-

Reciprocating Compressors

-

Diaphragm Compressors

-

Others

-

Condensers

-

Evaporators

-

Controls

-

Others

-

-

Refrigerant Outlook (Revenue, USD Million, 2018 - 2030)

-

Ammonia

-

Carbon Dioxide

-

Hydrofluorocarbon

-

Hydrochlorofluorocarbons

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigerated Warehouse

-

Food & Beverage

-

Chemical Petrochemical & Pharmaceuticals

-

Refrigerated Transportation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

-

Canada

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Latin America

-

Brazil

-

Mexico

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

Frequently Asked Questions About This Report

b. Key factors that are driving the industrial refrigeration systems market growth include increasing adoption of natural refrigerant-based refrigeration systems owing to strict regulatory policies, and the growing need for refrigeration for freezing, cooling, and chilling of food at large owing to the growth in food production.

b. The global industrial refrigeration systems market size was estimated at USD 19.73 billion in 2022 and is expected to reach USD 20.48 billion in 2023.

b. The global industrial refrigeration systems market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 27.66 billion by 2030.

b. North America dominated the industrial refrigeration systems market with a share of 32.94% in 2022. This is attributable to the rising demand for beverages, fresh food products, and medicines, and government initiatives to phase out HCFCs refrigerants and adopt natural refrigerants in various refrigeration applications.

b. Some key players operating in the industrial refrigeration systems market include Johnson Controls, Emerson Electric Co., Danfoss, GEA Group Aktiengesellschaft, MAYEKAWA MFG. CO., LTD., BITZER Kühlmaschinenbau GmbH, DAIKIN INDUSTRIES, Ltd., EVAPCO, Inc., Güntner GmbH & Co. KG, and LU-VE S.p.A.

Table of Contents

Chapter 1 Industrial Refrigeration Systems Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Information analysis

1.3.2. Market formulation & data visualization

1.3.3. Data validation & publishing

1.4. 1.4 Research Scope and Assumptions

1.4.1. List to Data Sources

Chapter 2 Industrial Refrigeration Systems Market: Executive Summary

2.1. Industrial Refrigeration Systems Market Snapshot

2.2. Industrial Refrigeration Systems Market - Segment Snapshot (1/2)

2.3. Industrial Refrigeration Systems Market - Segment Snapshot (2/2)

2.4. Industrial Refrigeration Systems Market - Competitive Landscape Snapshot

Chapter 3 Industrial Refrigeration Systems Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.1.1. Rising global consumption of processed food

3.3.1.2. Rising demand for natural refrigerant-based equipment

3.3.1.3. Government initiatives supporting the development of cold chain infrastructure

3.3.1.4. Advancements in technology

3.3.2. Market Restraint Analysis

3.3.2.1. Energy consumption and high installation & operating costs

3.3.2.2. Lack of skilled labor and high safety concerns

3.3.3. Industry Opportunities

3.3.3.1. Use of IoT-enabled refrigeration solutions for equipment monitoring

3.4. Industry Analysis Tools

3.4.1. Porter’s analysis

3.4.2. Macroeconomic analysis

3.5. Industrial Refrigeration Systems Market: COVID-19 Impact Analysis

Chapter 4. Industrial Refrigeration Systems Market: Component Estimates & Trend Analysis

4.1. Component Movement Analysis & Market Share, 2022 & 2030

4.2. Industrial Refrigeration Systems Market Estimates & Forecast, By Component (USD Million)

4.2.1. Compressors

4.2.1.1. Rotary Screw Compressor

4.2.1.2. Centrifugal Compressor

4.2.1.3. Reciprocating Compressors

4.2.1.4. Diaphragm Compressors

4.2.1.5. Others

4.2.2. Condensers

4.2.3. Evaporators

4.2.4. Controls

4.2.5. Others

Chapter 5. Industrial Refrigeration Systems Market: Capacity Estimates & Trend Analysis

5.1. Capacity Movement Analysis & Market Share, 2022 & 2030

5.2. Industrial Refrigeration Systems Market Estimates & Forecast, By Capacity (USD Million)

5.2.1. Less than 100kW

5.2.2. 100-500kW

5.2.3. 500-1000kW

5.2.4. 1000-5000kW

5.2.5. More than 5000kW

Chapter 6. Industrial Refrigeration Systems Market: Refrigerant Estimates & Trend Analysis

6.1. Refrigerant Movement Analysis & Market Share, 2022 & 2030

6.2. Industrial Refrigeration Systems Market Estimates & Forecast, By Refrigerant (USD Million)

6.2.1. Ammonia

6.2.2. Carbon Dioxide

6.2.3. Hydrofluorocarbon

6.2.4. Hydrochlorofluorocarbons

6.2.5. Others

Chapter 7. Industrial Refrigeration Systems Market: Application Estimates & Trend Analysis

7.1. Application Movement Analysis & Market Share, 2022 & 2030

7.2. Industrial Refrigeration Systems Market Estimates & Forecast, By Application (USD Million)

7.2.1. Refrigerated Warehouse

7.2.2. Food & Beverage

7.2.3. Chemical Petrochemical & Pharmaceuticals

7.2.4. Refrigerated Transportation

Chapter 8. Regional Estimates & Trend Analysis

8.1. Industrial Refrigeration Systems Market by Region, 2022 & 2030

8.2. North America

8.2.1. North America Industrial Refrigeration Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

8.2.2. U.S.

8.2.3. Canada

8.3. Europe

8.3.1. Europe Industrial Refrigeration Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

8.3.2. Germany

8.3.3. U.K.

8.3.4. France

8.3.5. Italy

8.3.6. Spain

8.4. Asia Pacific

8.4.1. Asia Pacific Industrial Refrigeration Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

8.4.2. Japan

8.4.3. China

8.4.4. India

8.4.5. South Korea

8.4.6. Australia

8.5. Latin America

8.5.1. Latin America Industrial Refrigeration Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

8.5.2. Brazil

8.5.3. Mexico

8.6. Middle East & Africa (MEA)

8.6.1. MEA Industrial Refrigeration Systems Market Estimates & Forecasts, 2018 - 2030 (USD Million)

8.6.2. Saudi Arabia

8.6.3. South Africa

Chapter 9. Industrial Refrigeration Systems Market - Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company Categorization

9.3. Participant’s Overview

9.4. Financial Performance

9.5. Product Benchmarking

9.6. Company Market Share Analysis, 2022

9.7. Company Heat Map Analysis

9.8. Strategy Mapping

9.8.1. Expansion/Divestiture

9.8.2. Collaborations/Partnerships

9.8.3. New Product Launches

9.8.4. Contract

9.9. Company Profiles

9.9.1. Johnson Controls

9.9.1.1. Participant’s Overview

9.9.1.2. Financial Performance

9.9.1.3. Product Benchmarking

9.9.1.4. Recent Developments

9.9.2. Emerson Electric Co.

9.9.2.1. Participant’s Overview

9.9.2.2. Financial Performance

9.9.2.3. Product Benchmarking

9.9.2.4. Recent Developments

9.9.3. Danfoss

9.9.3.1. Participant’s Overview

9.9.3.2. Financial Performance

9.9.3.3. Product Benchmarking

9.9.3.4. Recent Developments

9.9.4. GEA Group Aktiengesellschaft

9.9.4.1. Participant’s Overview

9.9.4.2. Financial Performance

9.9.4.3. Product Benchmarking

9.9.4.4. Recent Developments

9.9.5. MAYEKAWA MFG Co. Ltd.

9.9.5.1. Participant’s Overview

9.9.5.2. Financial Performance

9.9.5.3. Product Benchmarking

9.9.5.4. Recent Developments

9.9.6. BITZER Kuhlmaschinenbau GmbH

9.9.6.1. Participant’s Overview

9.9.6.2. Financial Performance

9.9.6.3. Product Benchmarking

9.9.6.4. Recent Developments

9.9.7. DAIKIN Industries Ltd.

9.9.7.1. Participant’s Overview

9.9.7.2. Financial Performance

9.9.7.3. Product Benchmarking

9.9.7.4. Recent Developments

9.9.8. EVAPCO Inc.

9.9.8.1. Participant’s Overview

9.9.8.2. Financial Performance

9.9.8.3. Product Benchmarking

9.9.8.4. Recent Developments

9.9.9. Guntner GmbH & Co. KG

9.9.9.1. Participant’s Overview

9.9.9.2. Financial Performance

9.9.9.3. Product Benchmarking

9.9.9.4. Recent Developments

9.9.10. LU-VE S.p.A.

9.9.10.1. Participant’s Overview

9.9.10.2. Financial Performance

9.9.10.3. Product Benchmarking

9.9.10.4. Recent Developments

List of Tables

Table 1 Industrial Refrigeration Systems Market - Key market driver impact

Table 2 Industrial Refrigeration Systems Market - Key market restraint impact

Table 3 Industrial Refrigeration Systems Market Revenue Estimates and Forecast, By Component, 2018 - 2030 (USD Million)

Table 4 Industrial Refrigeration Systems Market Revenue Estimates and Forecast, By Capacity, 2018 - 2030 (USD Million)

Table 5 Industrial Refrigeration Systems Market Revenue Estimates and Forecast, By Refrigerant, 2018 - 2030 (USD Million)

Table 6 Industrial Refrigeration Systems Market Revenue Estimates and Forecast, By Application, 2018 - 2030 (USD Million)

Table 7 Recent Developments & Impact Analysis, By Key Market Participants

Table 8 Company Heat Map Analysis

Table 9 Key companies undergoing expansions/divestitures.

Table 10 Key Companies undergoing collaborations.

Table 11 Key companies launching new products

Table 12 Key companies engaged in contracts

List of Figures

Fig. 1 Industrial Refrigeration Systems Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot (1/2)

Fig. 8 Segment Snapshot (2/2)

Fig. 9 Competitive Landscape Snapshot

Fig. 10 Industrial Refrigeration Systems Market Value, 2022 - 2030 (USD Million)

Fig. 11 Industrial Refrigeration Systems Market - Industry Value Chain Analysis

Fig. 12 Market Dynamics

Fig. 13 Key Market Driver Impact

Fig. 14 Key Market Restraint Impact

Fig. 15 Key Market Opportunity Impact

Fig. 16 Industrial Refrigeration Systems Market: PORTER’s Analysis

Fig. 17 Industrial Refrigeration Systems Market: PESTEL Analysis

Fig. 18 Industrial Refrigeration Systems Market, by Component: Key Takeaways

Fig. 19 Industrial Refrigeration Systems Market, by Component: Market Share, 2022 & 2030

Fig. 20 Compressors Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 21 Condensers Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 22 Evaporators Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 23 Controls market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 24 Others market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 25 Industrial Refrigeration Systems Market, by Capacity: Key Takeaways

Fig. 26 Industrial Refrigeration Systems Market, by Capacity: Market Share, 2022 & 2030

Fig. 27 Less than 100kW Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 28 100-500kW Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 29 500-1000kW Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 30 1000-5000kW Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 31 More than 5000kW Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 32 Industrial Refrigeration Systems Market, by Refrigerant: Key Takeaways

Fig. 33 Industrial Refrigeration Systems Market, by Refrigerant: Market Share, 2022 & 2030

Fig. 34 Ammonia Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 35 Carbon Dioxide Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 36 Hydrofluorocarbon Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 37 Hydrochlorofluorocarbons Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 38 Others Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 39 Industrial Refrigeration Systems Market, by Application: Key Takeaways

Fig. 40 Industrial Refrigeration Systems Market, by Application: Market Share, 2022 & 2030

Fig. 41 Refrigerated Warehouse Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 42 Food & Beverage Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 43 Chemical Petrochemical & Pharmaceuticals Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 44 Refrigerated Transportation Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 45 Industrial Refrigeration Systems market by region, 2022 & 2030, Revenue (USD Million)

Fig. 46 Regional marketplace: Key takeaways

Fig. 47 North America Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 48 U.S. Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 49 Canada Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 50 Europe Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 51 Germany Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 52 U.K. Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 53 France Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 54 Italy Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 55 Spain Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 56 Asia Pacific Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 57 China Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 58 India Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 59 Japan Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 60 South Korea Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 61 Australia Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 62 Latin America Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 63 Brazil Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 64 Mexico Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 65 MEA Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 66 Saudi Arabia Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 67 South Africa Industrial Refrigeration Systems market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 68 Key Company Categorization

Fig. 69 Company Market Share Analysis, 2022

Fig. 70 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Industrial Refrigeration System Component Outlook (Revenue, USD Million, 2018 - 2030)

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Diaphragm Compressors

- Others

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Industrial Refrigeration System Capacity Outlook (Revenue, USD Million, 2018 - 2030)

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Industrial Refrigeration System Application Outlook (Revenue, USD Million, 2018 - 2030)

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Industrial Refrigeration System Region Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- North America Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- North America Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- North America Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- U.S.

- U.S. Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- U.S. Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- U.S. Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- U.S. Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- U.S. Industrial Refrigeration Systems Market, by Component

- Canada

- Canada Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Canada Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Canada Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Canada Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Canada Industrial Refrigeration Systems Market, by Component

- North America Industrial Refrigeration Systems Market, by Component

- Europe

- Europe Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Europe Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Europe Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Europe Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Germany

- Germany Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Germany Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Germany Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Germany Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Germany Industrial Refrigeration Systems Market, by Component

- U.K.

- U.K. Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- U.K. Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- U.K. Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- U.K. Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- U.K. Industrial Refrigeration Systems Market, by Component

- France

- France Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- France Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- France Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- France Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- France Industrial Refrigeration Systems Market, by Component

- Canada

- Canada Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Canada Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Canada Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Canada Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Canada Industrial Refrigeration Systems Market, by Component

- Canada

- Canada Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Canada Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Canada Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Canada Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Canada Industrial Refrigeration Systems Market, by Component

- Europe Industrial Refrigeration Systems Market, by Component

- Asia Pacific

- Asia Pacific Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Asia Pacific Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Asia Pacific Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Asia Pacific Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- China

- China Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- China Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- China Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- China Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- China Industrial Refrigeration Systems Market, by Component

- Japan

- Japan Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Japan Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Japan Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Japan Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Japan Industrial Refrigeration Systems Market, by Component

- India

- India Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- India Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- India Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- India Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- India Industrial Refrigeration Systems Market, by Component

- Canada

- Canada Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Canada Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Canada Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Canada Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Canada Industrial Refrigeration Systems Market, by Component

- Canada

- Canada Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Canada Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Canada Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Canada Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Canada Industrial Refrigeration Systems Market, by Component

- Asia Pacific Industrial Refrigeration Systems Market, by Component

- Latin America

- Latin America Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Latin America Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Latin America Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Latin America Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Brazil

- Brazil Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Brazil Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Brazil Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Brazil Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Brazil Industrial Refrigeration Systems Market, by Component

- Mexico

- Mexico Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Mexico Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Mexico Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Mexico Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Mexico Industrial Refrigeration Systems Market, by Component

- Latin America Industrial Refrigeration Systems Market, by Component

- Middle East and Africa

- Middle East and Africa Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Middle East and Africa Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Middle East and Africa Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Middle East and Africa Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Canada

- Canada Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Canada Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Canada Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Canada Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Canada Industrial Refrigeration Systems Market, by Component

- Canada

- Canada Industrial Refrigeration Systems Market, by Component

- Compressors

- Rotary Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

- Other Compressors

- Condensers

- Evaporators

- Controls

- Others

- Compressors

- Canada Industrial Refrigeration Systems Market, by Capacity

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 5000kW

- Canada Industrial Refrigeration Systems Market, By Refrigerant

- Ammonia

- Carbon Dioxide

- Hydrofluorocarbon

- Hydrochlorofluorocarbons

- Others

- Canada Industrial Refrigeration Systems Market, by Application

- Refrigerated Warehouse

- Food & Beverage

- Chemical, Petrochemical & Pharmaceuticals

- Refrigerated Transportation

- Canada Industrial Refrigeration Systems Market, by Component

- Middle East and Africa Industrial Refrigeration Systems Market, by Component

- North America

Industrial Refrigeration Systems Market Dynamics

Driver: Rising consumption of processed food items globally

Rising disposable incomes, industrialization, and other demographic shifts have resulted in considerable changes in food consumption habits of the global population in recent years. Improvements in food supply chains, accompanied by economic development and the gradual elimination of dietary deficiencies, have also resulted in drastic changes to consumption patterns over the last decade. These factors, coupled with a rapidly expanding frozen foods market, are expected to fuel global demand for commercial refrigeration systems in the near future. A significant increase in the working-class population, coupled with busy lifestyles, changing consumer purchasing patterns, availability of a wide range of frozen food products in different categories, and better value proposition have led to the growing demand for cold storage facilities.

Restraint: High energy consumption, installation, and operating costs

Industrial refrigeration systems impact the environment in different ways, including high energy consumption of several refrigeration processes involved in the pre-processing of temperature-sensitive goods. Refrigeration systems are energy-intensive, and their installation requires skilled labor. High investment costs and the complexities arising during installation could hamper the widespread adoption of these systems to a certain level, especially in developing economies. A refrigeration system consists of different components, including evaporators, compressors, controls, and condensers. In custom-designed systems, each part may come from a different manufacturer, or equipment may come as an integrated packaged unit. The tailored systems of assembled components are individually tested and rated under design operating but are not an integral unit system. Therefore, based on the deviation between the real operating conditions and the test conditions, coupled with the interactions between the various components in the system, it is possible that the individual components in the assembled refrigeration plant would not provide optimal operation, resulting in lower operating efficiency and higher operating costs.

Opportunity: Emergence of IoT-enabled solutions for equipment monitoring

Internet of Things (IoT) is becoming a vital part of industrial refrigeration, bringing with it innovative features such as increased efficiency, real-time monitoring, and maintenance and diagnostics. IoT technology-enabled systems offer customers tracking abilities for power consumptions, internal and external humidity, temperature, and more. Users can make informed decisions about their power consumption and operations by using accurate refrigeration systems trends. Through real-time monitoring, personnel can manage their systems from their smartphones or smart devices and set alarm on reaching a certain temperature which becomes a crucial factor at times of emergencies. For instance, with intelligent industrial refrigeration monitoring, systems can operate at full capacity when required and can operate with a lower power consumption when less cooling is required, leading to reduced costs. The IoT technology also enables the user with insights to schedule maintenance on their systems when needed and predict problems before they arise.

What Does This Report Include?

This section will provide insights into the contents included in this industrial refrigeration systems market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Industrial refrigeration systems market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Industrial refrigeration systems market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the industrial refrigeration systems market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for industrial refrigeration systems market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of industrial refrigeration systems market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Industrial Refrigeration Systems Market Categorization:

The industrial refrigeration systems market was categorized into four segments, namely component (Compressors, Condensers, Evaporators, Controls), application (Refrigerated Warehouse, Food & Beverage, Chemical Petrochemical & Pharmaceuticals, Refrigerated Transportation), capacity (Less than 100kW, 100-500kW, 500-1000kW, 1000-5000kW, More than 5000kW), and region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa).

Segment Market Methodology:

The industrial refrigeration systems market was segmented into component, application, capacity, and region. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The industrial refrigeration systems market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into ten countries, namely, the U.S.; Canada; the UK; Germany; France; China; India; Japan; Brazil; Mexico.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Industrial refrigeration systems market companies & financials:

The industrial refrigeration systems market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Johnson Controls operates as a diversified industrial and technology company across the globe. The company designs, manufactures, and offers solutions that enhance the operational efficiencies of buildings and various systems related to the automotive industry. The company offers building control systems, building automation, HVAC equipment, seating and interior systems, and integrated facility management services. Johnson Controls also offers energy management consulting, technical services, and operations of real estate portfolios, industrial refrigeration products, residential air conditioning, and heating systems. The company has marked its presence in Asia, the Middle East, South America, and European regions.

-

Emerson Electric Co. operates its business through two segments, namely Commercial & Residential Solutions, and Automotive Solutions. The company has a wide customer base across the industrial, commercial, and residential markets worldwide. The company’s Automotive Solutions segment offers actuators, valves, software, regulators, analytical and measurement instrumentation, and process control systems. The segment caters to the automotive, oil & gas, chemicals, food & beverage, metal & mining, refining, and water supply industries. The company’s Commercial & Residential Solutions segment offers commercial air conditioning, facilities for the climate control industry such as residential heating and cooling, and industrial & commercial refrigeration.

-

Danfoss is a Denmark-based supplier of HVAC products. The company delivers technologies and solutions for AC drives, power, heating, and cooling applications. The Danfoss Group operates its business through four business segments, namely Power Solutions, Cooling, Drives, and Heating. The company’s Power Solutions business segment offers hydraulic systems and components for off-highway machinery. The Cooling segment offers products pertaining to the air conditioning and refrigeration industry. The Danfoss Drives segment offers low-voltage AC drives, medium voltage ac drives, power modules, and stacks for several industries. Its Heating business segment offers solutions related to residential heating, commercial heating, and district energy. Danfoss has 72 factory sites and 23 R&D sites across the globe. The company has customers in around 100 countries. It serves multiple markets such as automotive, food and beverage, energy and natural resources, mobile hydraulics, refrigeration, and air conditioning, industry, residential buildings, commercial buildings, and district energy.

-

DAIKIN INDUSTRIES, Ltd. sells and manufactures air conditioning systems and chemical products. Daikin operates through Air Conditioning, Chemicals, and Other segments. The company’s Air Conditioning segment comprises absorption refrigerators, air-conditioning systems, multiple air-conditioning systems, heat-pump hot-water supplies, packaged air-conditioning systems, room air-conditioning systems, air purifiers, and room-heating systems. The company also offers water chillers, freezers, marine-type container refrigeration, turbo refrigerator equipment, industrial dust collectors, air-handling units, air filters, and refrigerating and freezing showcases. Daikin Industries, Ltd. has marked its presence in the U.S., Canada, the Middle East, Europe, and Asia.

-

GEA Group AG offers products and solutions for food processing technology and related industries. The company specializes in machinery, plants, and process technology and component. It offers process technology, services, and solutions to marine, dairy farming, dairy processing, pharma, food, and beverage industries. GEA Group operates through five divisions, namely Refrigeration Technologies, Farm Technologies, Food & Healthcare Technologies, Liquid & Powder Technologies, and Separation & Flow Technologies. The company’s Refrigeration Technologies division offers industrial refrigeration, sustainable energy, and heating solutions for various industries such as oil & gas, dairy, beverage, and food. It also provides chillers, compressors and compressor packages, custom-engineered systems, cooling and heating installations, heat pumps, and controls.

-

MAYEKAWA MFG. CO., LTD. is a Japan-based manufacturer of compressors and provides solutions for food processing, industrial refrigeration, petrochemical, oil & gas, and social infrastructure industries. The company provides a range of products such as compressors, compressor parts, oil pumps, and control panels. The company offers automated deboning machines under the DAS brand name. The compressors sold under the MYCOM brand name are used in industrial freezing/refrigeration, heat pump, and gas markets across the globe. Under the CHORUS brand name, the company offers freezer solutions for a broad range of products such as livestock, agricultural, seafood, baked goods, sweets, and prepared foods. MAYEKAWA MFG. CO., LTD.’s manufacturing facilities are located in the U.S., Brazil, Mexico, Belgium, Serbia, India, South Korea, and Japan.

-

BITZER is a German manufacturer of air-conditioning and refrigeration systems. The company offers reciprocating compressors, screw compressors, scroll compressors, heat exchangers, pressure vessels, electronic components, and ammonia compressor packs. It also provides compressors for air-conditioning, refrigeration, heat pumps, and transport applications. BITZER group companies include ARMATURENWERK ALTENBURG GMBH, ElectraTherm, KIMO RHVAC Controls GmbH, VaCom Technologies, and Wurm GmbH & Co. KG Elektronische Systeme. The company offers its products, solutions, and services in more than 90 countries via 72 locations across the world.

-

EVAPCO, Inc. is a U.S.-based heat transfer and cooling products manufacturer serving the commercial HVAC, industrial refrigeration, power, and industrial process markets. The company’s product lines include water treatment systems, thermal ice storage, RVS vessels and packages, hygienic air handling systems, evaporators, closed circuit coolers, and condensers. EVAPCO, Inc. supplies its products through its sales network of more than 170 offices. The company’s products are manufactured and engineered in 25 locations in 10 countries, spanning the Middle East & Africa, North America, Latin America, Europe, and the Asia Pacific.

-

Guntner GmbH & Co. KG, has been operating as an eminent German manufacturer of refrigeration components and systems. The company’s broad product portfolio includes condensers, air coolers, dry coolers, controls, and accessories. It has a manufacturing network that includes plants located in Brazil, Mexico, Indonesia, Romania, Hungary, and Germany. The company serves multiple markets such as industrial refrigeration, commercial refrigeration, air-conditioning, automotive, foodstuffs, pharmaceutical, and energy. The company’s footprint spans North America, Latin America, Europe, the Middle East & Africa, and Asia Pacific regions.

-

LU-VE S.p.A. is an Italian manufacturer of heat exchangers and ventilated appliances for the refrigeration, air conditioning, and cooling of the industrial processes market. The company’s product lines include industrial refrigeration, air-conditioning, air-cooled equipment, close control air-conditioning, commercial refrigeration, glass doors, closing systems, and heat exchangers. LU-VE S.p.A. offers industrial refrigeration systems through brands such as AIA, Spirotech Heat Exchangers Pvt. Ltd., and LU-VE Exchangers. The company has 15 sales locations located in 15 countries globally, including Australia, Austria, Belgium, Finland, France, Germany, India, Italy, Netherlands, Russia, Spain, Thailand, UAE, the U.K., and Vietnam.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Industrial Refrigeration Systems Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Industrial Refrigeration Systems Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.