- Home

- »

- Advanced Interior Materials

- »

-

Industrial Valves Market Size, Share & Trends Report, 2022GVR Report cover

![Industrial Valves Market Size, Share & Trends Report]()

Industrial Valves Market Size, Share & Trends Analysis Report By Product (Gate, Globe, Butterfly, Ball, Check), By Application (Oil & Gas, Power, Pharmaceutical, Water & Wastewater, Chemical, Food & Beverage), And Segment Forecasts, 2012 - 2022

- Report ID: 978-1-68038-797-1

- Number of Pages: 75

- Format: Electronic (PDF)

- Historical Range: 2011

- Industry: Advanced Materials

Report Overview

The global industrial valve market size was estimated at USD 58.31 billion in 2014. Rising automation on account of increased industrialization and expansion of existing facilities are projected to drive the market over the forecast period. Growing demand for flow control equipment is expected to favorably impact market growth. Smart valves with intelligent control systems are expected to gain significant importance which is expected to expedite their development.

U.S. industrial valves market share by product, 2012 - 2022 (USD Million)

Increased adoption of diagnostics and smart technology in industrial valves for monitoring process variables which include upstream & downstream pressure stem position, temperature, and the flow rate is expected to fuel demand over the next seven years.

Advancement of smart valves with integrated embedded processor and network capability for subsea oil & gas has increased the reliability and responsiveness of the systems, which is expected to be a high impact rendering driver.

Growing production and exploration spending in the oil & gas industry has spurred the demand owing to technological innovations, enabling access to resources in deep waters or unusual reservoirs such as high temperature, high-pressure, under-pressured, and unconventional or depleted reservoirs.

Increased pipeline installations and growth in unconventional oil & gas applications across downstream segment is expected to induce substantial growth prospects for the industrial valves market. Growing prominence of automation in the process industry has led to the increment in the demand for automated control valves.

Some factors which may hinder growth included emoting of coal usage and shutdowns of conventional coal-fired plants. Fluctuations in the raw material prices may reduce the usage and adoption of the technology. Additionally, compliance with stringent government regulations for conventional power plants may hamper industry growth.

Product Insights

The industry can be categorized by product into ball, butterfly, gate, globe, and check valves. Ball valves accounted for over 19% of the revenue share in 2014. These valves are primarily used for flow control and situations where tight shut-off is required. The technology assists in circulating systems on ships, chlorine manufacturers, and fire safe protection services.

The demand for butterfly valves has witnessed a considerable rise in the recent years owing to its evolving usage in the oil & gas industry. The increase in exploration & up-gradation activities due to substantial investments in pipelines and refineries in the oil & gas industry is estimated to fuel demand.

Check valves’ demand is anticipated to witness steady growth, with a CAGR of over 7% over the next seven years. These valves are unidirectional and avoid the process flow from returning to the system, thereby preventing it from damaging the equipment and disrupting the process. Increasing automation and requirements for controlling fluid flow in refineries have positively impacted the demand across industries.

Application Insights

Application sectors analyzed in the study include oil & gas, power, pharmaceutical, municipal wastewater, chemical, and food & beverage. Oil &gas segment accounted for over 21% of the overall revenue share in 2014. Increasing demand for deeper wells, longer pipelines and lower production costs along with the technological enhancement of processing, production, and transportation have contributed to the industrial valves market growth. Moreover, increasing pipeline installations and the need for monitoring & controlling from centralized location has propelled the smart valves production and demand in the industry.

Water & wastewater application is expected to witness significant growth, growing at a CAGR of close to 6%over the forecast period. Growing population and urbanization are expected to drive the adoption. Increasing need for isolating the pumps & equipment and for controlling the flow of wastewater and municipal water treatment is also expected to play a major role in increasing industry penetration.

Regional Insights

Asia Pacific market was over USD 20 billion in 2014. The escalating construction activities and booming consumption of chemicals are anticipated to positively impact production across the region. Furthermore, growing construction of new nuclear power stations and capacity expansions in petroleum refining plants are also expected to drive the demand. For instance, China is projected to invest in the construction of new coal-fired and scrubbers power plants.

North America market is expected to offer a huge platform for potential growth. Growing production of oil sands and shale gas offers great potential for growth across this region. The replacement of old and inefficient valves with more efficient valves for gas transportation in midstream infrastructure is anticipated to boost the overall valves demand.

The U.S. market is undergoing a revolution in the production of oil & gas from shale gas, and the developments have led the high investments in exploration and production in North America. The increasing trend for electricity generation from renewable sources of energy is expected to strengthen market potential.

Europe market demand was over USD 12 billion in 2014 and is anticipated to witness slower growth as compared to other regions. However, with the development of offshore sites and growing demand originating from Russia in the midstream segment of oil & gas, the demand for valves is expected to witness an increase across the region over the forecast period.

Industrial Valve Market Share Insights

Companies dominating market share include Flowserve Corporation, Kitz Corp., Curtiss-Wright Corp., Emerson Electric, KSB AG, and Pentair PLC. The valves manufacturers are anticipated to enhance their productivity either through developing new products or by replacing them with efficient goods.

Other potential players include CIRCOR International, Cameron International, AlfaLaval AB, AVK Group, Camtech Manufacturing FZCO, Delta-Pacific Valves Ltd., Goodwin PLC, GWC Valve International Inc., and Watts Water Technologies, Inc.

Key Companies & Market Share Insights

Tene Investment Funds Ltd. is expected to acquire a 74% controlling stake in Habonim Industrial Valves & Actuators Ltd., a northern Israel based company that caters to chemical, oil and gas industries. Habonim’s sales are majorly to international shores, and its sales per year are around USD 28 million to USD 42.5 million.

KCM Capital Partners LLC, a Chicago-based private investment firm, has acquired Industrial Valve Sales & Services LLC, an Alabama based company, with IVS looking towards an enhanced growth through this development.

In August 2019, Bonomi Group acquired FRA.BO.S.p.A, which is headquartered in Brescia, Italy. FRA.BO is a leading manufacturer of brass, copper, stainless steel, and bronze fittings for plumbing applications. With this acquisition, Bonomi hopes to become more competitive in worldwide flow-control and plumbing market.

RECENT DEVELOPMENT

-

In June 2023, Flowserve Corporation announced its Valtek® Valdisk™ high-performance butterfly valve which is licensor-approved for use in pressure swing adsorption (PSA) applications. The product is ideal for use in chemical plants, oil refineries, and other facilities which require control valves because tight shutdown is needed even during high cycle rates and bi-directional flows.

-

In April 2023, Kitz Corporation, an Industrial valve manufacturing company, expanded its production capacity of valves for the semiconductor manufacturing plant. This expansion helped to increase the production capacity of the semiconductor manufacturing equipment market.

-

In April 2022, Emerson launched Smart Valve Positioner designed to operate in a range of environmental conditions. This Smart Valve Positioner offers compact operation, dependable valve positioning, and safer and more effective operation.

-

In June 2023, Alfa Laval launched two hygienic valves, the Alfa Laval Unique Mixproof CIP and Unique Mixproof Process. The launched valves helped to extend its hygienic double-seat valve range to meet market demands.

Industrial Valves Market Report Scope

Report Attribute

Details

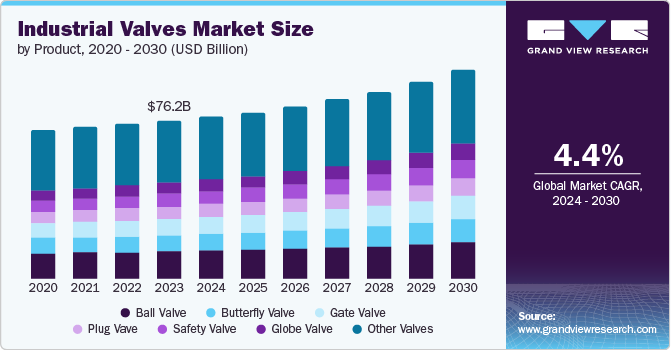

Market size value in 2020

USD 78.1 billion

Revenue forecast in 2022

USD 85.6 billion

Growth Rate

CAGR of 5.0% from 2015 to 2022

Base year for estimation

2012

Historical data

2011

Forecast period

2015 - 2022

Quantitative units

Revenue in USD million/billion and CAGR from 2015 to 2022

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

Flowserve Corporation; KITZ Corporation; Curtiss-Wright Corporation; Emerson Electric Co.; KSB SE & Co. KGaA; Pentair plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global industrial valves market size was estimated at USD 74.5 billion in 2019 and is expected to reach USD 78.1 billion in 2020.

b. The global industrial valves market is expected to grow at a compound annual growth rate of 5.0% from 2015 to 2022 to reach USD 85.6 billion by 2022.

b. The Asia Pacific dominated the industrial valves market with a share of 42.5% in 2019. This is attributable to the growing construction of new nuclear power stations and capacity expansions in petroleum refining plants.

b. Some key players operating in the industrial valves market include Flowserve Corporation; KITZ Corporation; Curtiss-Wright Corporation; Emerson Electric Co.; KSB SE & Co. KGaA; and Pentair plc amongst others.

b. Key factors that are driving the market growth include stringent government regulations, technological advancements propelling the use of smart valves and actuators, and increasing demand in the industrial sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."