- Home

- »

- Next Generation Technologies

- »

-

Industrial Wireless Sensor Network Market Share Report, 2025GVR Report cover

![Industrial Wireless Sensor Network Market Size, Share & Trends Report]()

Industrial Wireless Sensor Network Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Type, By Technology, By Application, By End Use, And Segment Forecasts, 2020 - 2025

- Report ID: GVR-2-68038-325-6

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2014 - 2018

- Industry: Technology

Report Overview

The global industrial wireless sensor network market size was valued at USD 3.70 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 14.5% from 2020 to 2025. Industrial wireless sensor network (IWSN) is a network infrastructure that enables connectivity between sensor nodes and gateways without fiber cables. It also facilitates enhanced communication through radio nodes arranged in appropriate topologies. Thus, demand for IWSN has been increasing over the past few years and this trend is expected to continue over the forecast period.

The IWSN market is estimated to grow significantly over the coming years due to the growing network infrastructure demand and advances in Artificial Intelligence (AI), Machine Learning (ML), and big data analytics. These technologies have enabled companies to analyze the large volumes of data obtained from multiple types of sensors such as temperature, motion, pressure, gas, flow, and chemical, among others.

Emerging economies worldwide are emphasizing on improving communication links between industrial devices to ensure seamless communication using wireless systems. Thus, industries such as oil and gas, and utilities are implementing wireless sensor networks due to their capability to seamlessly operate in harsh remote locations.

The increasing demand for WirelessHART and ISA-100.11a technologies and their rapid adoption in the market is expected to drive market growth. The wide-scale implementation of wireless networks for monitoring applications and their compact size is expected to positively influence growth over the forecast period. However, factors such as limited bandwidth and battery life are proving to be a challenge for players in the market.

Growing regulations and policies imposed by government agencies, such as International Labor Organization (ILO) and Mine Safety and Health Administration (MSHA), have resulted in the large-scale implementation of wireless sensor networks (WSN) in different industries. Moreover, smart manufacturing and the Industrial Internet of Things (IIoT) have increased the implementation of wireless networks for data transmission.

In 2016, The United States Department of Energy estimated that 23.0% of the electricity is used in electric, motor-driven systems in the U.S. The implementation of a WSN in advanced energy management solutions reduced power consumption by 18.0%. Eaton Corporation deployed a self-configuring WSN that operates within a range of open wireless protocols and can be integrated with advanced energy management software. Various governments are launching different programs to enhance connectivity and introduce mobility of systems, along with easy access to data. For instance, in the U.S., El Paso city launched a project called ‘Digital El Paso’ to boost the application of wireless sensor networks. Such programs are creating growth opportunities for manufacturers in the IWSN market.

Industrial Wireless Sensor Network Market Trends

Major industries such as utilities, oil & gas, and automotive are adopting wireless connected devices such as sensor nodes, routers, and gateways for industrial applications such as environmental sensing, condition monitoring, and process automation. The rise in consumer adoption of connected devices has led to the implementation of wireless sensor network infrastructure. Furthermore, WSN communicate the sensor data for process monitoring and control. Process data such as pressure, humidity, temperature, flow, level, viscosity, and density are measured and collected through sensing units and transferred wirelessly to a control system for operation and management.

Wireless local area networks are rapidly growing popularity and are enabling users to access vital information anywhere and anytime. Thus, numerous industries are adopting wireless connectivity in order to establish points of contacts in remote locations and harsh environments wherein setting up wired systems becomes a tedious task. In IWSN, the sensor nodes are connected wireless through various technologies such as ZigBee, Wi-Fi, Bluetooth, and WirelessHART.

A WSN is an application-specific solution, designed to monitor and control physical environments from remote locations with enhanced accuracy. A large amount of information is distributed through various technologies from sensor nodes to the router/gateways. These nodes are connected through short range wireless links, which are used as an infrastructure to forward the information collected to the authorized base station. Hackers can hack these networks and start monitoring unencrypted traffic and sensitive information that can be used for other activities. These security issues involved with the wire network are proving to be a challenge for the industrial wireless sensor network market.

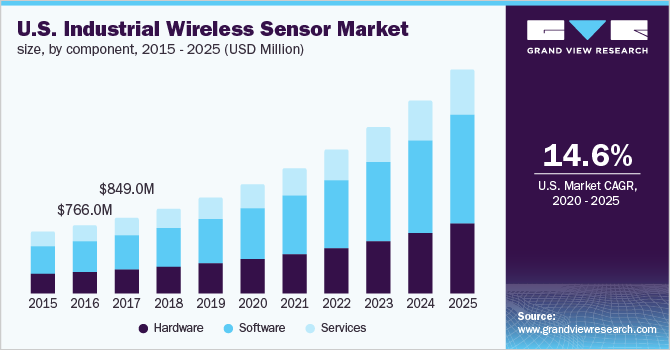

Component Insights

Based on the component, the market has been further segmented into hardware, software, and services. The software segment dominated the market in 2018 and is also anticipated to emerge as the fastest-growing segment over the forecast period owing to the increasing demand for service-oriented software architecture and self-organizing networks. The implementation of Software Defined Network (SDN) in IWSN to improve efficiency and sustainability has further boosted the market in industries.

The hardware segment also constitutes a significant share of the IWNS market. The growth of the hardware segment can be attributed to the increasing use of sensor nodes, routers, and gateways to create network infrastructure. The rising adoption of IoT and connected devices across industrial applications are also expected to contribute to the growth of the hardware segment. Furthermore, the IWSN can be easily deployed in locations which are technically unreachable, thereby offering them an edge over their conventional used wired counterparts. Moreover, the installation of the hardware enables easy integration of data, thereby allowing the centralization of monitoring applications.

Type Insights

Based on type, the market has been further segmented into temperature sensor networks, pressure sensor networks, level sensor networks, flow sensor networks, humidity sensor networks, motion & position sensor networks, gas sensor networks, light sensor networks, chemical sensor networks, and others. The flow sensor networks segment dominated the market in 2018 owing to the increasing application in oil and gas, chemical, and food and beverage industries for inferentially measuring flow rates of liquids or fluids. Moreover, numerous companies are developing piezoelectric flow sensors coupled with wireless sensor nodes to reduce power consumption in the oil and gas industry.

The gas sensor networks segment is expected to emerge as the fastest-growing segment over the forecast period owing to the large-scale application in industrial operations. These sensors help detect the concentration of harmful gases released into the environment during the manufacturing process. Moreover, the adoption of gas sensors in industries such as oil and gas, pharmaceuticals, chemical and petroleum, building automation, and food and beverages is increasing, as they are cost-effective and compact.

Technology Insights

Based on technology, the market has been further segmented into Bluetooth, ZigBee, Wi-Fi, Near Field Communication (NFC), cellular network, WirelessHART, and ISA 100.11a. The WirelessHART segment dominated the market in 2019 owing to their benefits such as the provision of a user-friendly environment by maintaining compatibility within existing devices, tools, and systems. WirelessHART is widely used in open wireless communication, which is further used for process measurement and monitoring applications. Moreover, it is extensively used in industries such as oil and gas, utilities, and manufacturing owing to benefits such as cost-effectiveness and reduced complexity.

The cellular network segment is expected to emerge as the fastest-growing segment over the forecast period owing to increasing usage for gateway communications. A cellular network is used to update information on cloud servers and the information can be accessed from any location. Increasing demand for the Internet of Things (IoT) and smart manufacturing is expected to further drive cellular technology in the industrial wireless sensor network market over the forecast period. Furthermore, the increasing deployment of specialized wireless cellular standards such as LTE-M and NB-IoT for IoT communication worldwide is anticipated to drive the segment growth.

Application Insights

Based on application, the market has been further segmented into machine monitoring, process monitoring, asset tracking, and safety & surveillance. The process monitoring segment dominated the market in 2019 owing to several advantages such as elimination of wiring constraints, easy maintenance, and reduced costs in comparison to the wired solutions. Furthermore, the capability of IWSN for activation and control of moving parts and machinery have been the key factors driving their adoption.

Asset tracking is expected to emerge as the fastest-growing segment over the forecast period owing to enhanced operational efficiency and reduced deployment and maintenance costs. Moreover, the availability of reliable solutions with improved battery life and a relatively long range of wireless connectivity has led to the widespread adoption of asset tracking solutions in the manufacturing and logistics industries.

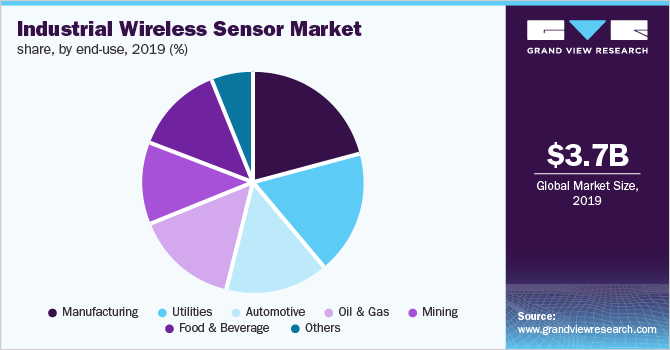

End-Use Insights

Based on end-use, the market has been further segmented into automotive, oil & gas, utilities, mining, food & beverage, manufacturing, and others. The manufacturing segment dominated the market in 2019 and is also anticipated to emerge as the fastest-growing segment over the forecast period owing to the increasing use of sensor networks and availability of predictive maintenance, quality control, and automated process management solutions are expected to boost the adoption of IWSN in the manufacturing industry.

Furthermore, the soaring need for energy-efficient manufacturing and green manufacturing is impelling players in the electronics industry to opt for better plant monitoring and control solutions, thus, aiding the growth of the IWSN market. The utility segment also constitutes a significant share of the IWSN market. The growth of the utility segment can be attributed to the rapidly increasing deployment of smart grid infrastructure worldwide. Smart grid technology is characterized by automatic metering infrastructure, full-duplex communication, distribution automation, renewable energy integration, and complete monitoring and control of the entire power grid.

The adoption of IWSN is also expected to gain traction in the oil and gas end-use segment. IWSNs have sensing, processing, and communicating capabilities, which make them ideal for monitoring different upstream, midstream, and downstream operations in the oil and gas industry. The use of IWSNs helps increase production, decrease accidents, and reduce maintenance costs and malfunctioning.

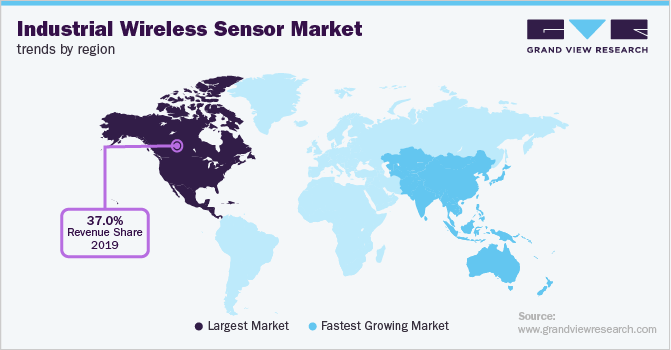

Regional Insights

The North American regional market dominated the global market in 2019. owing to the presence of a strong manufacturing sector. The companies in the region are also the early adopters of emerging technologies for process optimization and improving health and safety standards. Furthermore, the growing adoption of IWSN by oil and gas companies for offshore operations is some of the other major factors driving the growth of the North American regional market. The growth of the regional market can also be attributed to increasing research and development investments in wireless connectivity by key technology manufacturers.

Canada is witnessing an increase in the number of IIoT startups. The companies operating in the country are trying to overcome key challenges in Canada, such as small population and inaccessible remote locations, through the usage of IIoT. This, in turn, would enable remote monitoring for numerous energy and mining projects, which is expected to drive the growth of industrial wireless sensor network market.

The Asia Pacific regional market is projected to emerge as the fastest-growing regional market owing to the rising implementation of smart manufacturing processes in countries such as China, India, and Taiwan. The MEA and Latin American regions are anticipated to witness considerable growth over the forecast period owing to increased applications of WSN in the oil and gas and mining industries.

The “Make in India” initiative launched in 2015 is acting as a major driver for the wider implementation of the Industry 4.0 trend in India, which is expected to further promote the demand for industrial wireless sensor networks (IWSN).

Key Companies & Market Share Insights

Key industry players operating in the market include Analog Devices, Inc.; ABB Limited, Lantronix, Inc.; NXP Semiconductors, Honeywell Process Solutions, Schneider Electric, STMicroelectronics N.V., Siemens AG, Texas Instruments Inc.; and Yokogawa Electric Corporation, among others. These market players are working on developing advanced industrial wireless sensors for multiple applications.

The presence of a large number of IWSN providers in the market is expected to create intense competition among players. These players are launching new products with advanced technologies and enhanced durability to maintain their foothold in the market. Established companies from corresponding businesses are developing associations for advanced technologies and this is anticipated to reduce the threat for existing players. For instance, Ericsson acquired Belair Networks to integrate the technologies and solutions provided by the company into its existing products and services.

Industrial Wireless Sensor Network Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 4.20 billion

Revenue forecast in 2025

USD 8.66 billion

Growth rate

CAGR of 14.5% from 2020 to 2025

Base year for estimation

2019

Historical data

2014 - 2018

Forecast period

2020 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2020 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; Japan; India; Brazil; Mexico

Key companies profiled

Honeywell International Inc.; ABB Ltd.; Analog Devices, Inc.; Honeywell Process Solutions; Lantronix, Inc.; NXP Semiconductors; Schneider Electric; Siemens AG; STMicroelectronics N.V.; Texas Instruments Inc.; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Wireless Sensor Network Market Segmentation

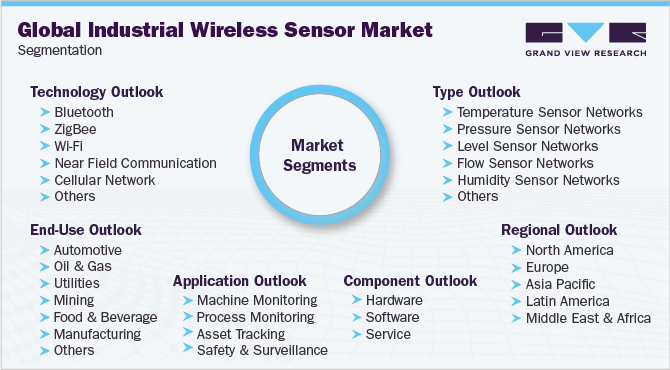

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global industrial wireless sensor network market report based on component, type, technology, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2014 - 2025)

-

Hardware

-

Software

-

Service

-

-

Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Temperature Sensor Networks

-

Pressure Sensor Networks

-

Level Sensor Networks

-

Flow Sensor Networks

-

Humidity Sensor Networks

-

Motion & Position Sensor Networks

-

Gas Sensor Networks

-

Light Sensor Networks

-

Chemical Sensor Networks

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2014 - 2025)

-

Bluetooth

-

ZigBee

-

Wi-Fi

-

Near Field Communication (NFC)

-

Cellular Network

-

WirelessHART

-

ISA 100.11a

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Machine Monitoring

-

Process Monitoring

-

Asset Tracking

-

Safety & Surveillance

-

-

End-Use Outlook (Revenue, USD Million; Million Units, 2014 - 2025)

-

Automotive

-

Oil & Gas

-

Utilities

-

Mining

-

Food & Beverage

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."