- Home

- »

- Pharmaceuticals

- »

-

Infertility Drugs Market Size, Share & Growth Report, 2030GVR Report cover

![Infertility Drugs Market Size, Share & Trends Report]()

Infertility Drugs Market Size, Share & Trends Analysis Report By Drug Class (Gonadotropins, Aromatase Inhibitors, SERMs, Dopamine Agonists) By End-user (Men, Women), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-016-5

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global infertility drugs market size was valued at USD 3,480.14 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. The market players are engaged in introducing novel medicines for treating infertility. For instance, key players including Oxolife are currently engaged in the development of first in class product candidate OXO-001, that improves the embryo implantation process by enhancing the binding on inner lining of endometrium in the uterus. Since there is no available substitute to improve the endometrium's conditions for the embryo implantation, the development of such products address a medical need that affects women undergoing assisted reproduction worldwide.

The presence of effective alternatives to medications and their increased adoption rate may have a negative impact on the market growth. According to a research article published in Reproductive Biomedicine, in November 2021, over 2.5 million IVF procedures are performed annually worldwide. Most European countries provide complete funding for several IVF procedures. Hence, the threat of substitutes is expected to be high during the forecast period. However, the market has witnessed the patient shift towards medical procedures including ART and IVF in combination with infertility medications, which may support the market growth.

Moreover, Medicaid coverage for family planning and maternity care services contrasts significantly with the corresponding lack of coverage for fertility services. Medicaid pays for about half of births in the US, and the program also covers the majority of publicly financed family planning services. As a result, there is limited access to assist low-income pregnancies even if many contraceptive and low-income services throughout pregnancy are generally provided. As of January 2020, only one state-New York-allows Medicaid to cover fertility in the U.S. These are the major barriers for the growth of market.

There are several initiatives undertaken by governments worldwide to support to infertility patients by providing insurance coverage for treatment. For instance, in March 2022, the Ministry of Health, Labor, and Welfare (MHLW) announced the reimbursement through the national health insurance scheme. This initiative increases patients’ access to treatment by lowering the cost 70% and increasing prescription rate for drugs.

The presence of a wide variety of medicines for the treatment of infertility conditions is also expected to positively contribute to the market. For instance, Crinone (progesterone gel), Ovidrel (choriogonadotropin alfa), Pregnyl (chorionic gonadotropin), Menopur (Gonal-F), Ganirelix Acetate Injection, Follistim A (follitropin beta), Clomid (clomiphene citrate), Bravelle (urofollitropin), Cetrotide, (cetrorelix acetate) and First-Progesterone are some of the fertility medications available in the market.

During the COVID-19 pandemic, the market witnessed a significant downward shift. Around 228 hospitals in 48 states witnessed a downfall in patient footfall for infertility services by 83% from March 2022 to April 2020. Moreover, in March 2020, the American Society for Reproductive Medicines (ASRM) issued a provision to cancel all diagnostic and treatment procedures including infertility.

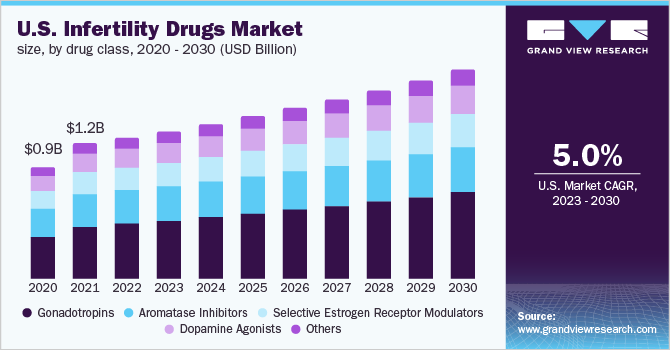

Drug Class Insights

The gonadotropins segment dominated the infertility drugs market with a revenue share of 39.70% in 2022 and is expected to witness highest growth over the forecast period. This can be attributed to the high cost of products and increased usage due to the higher efficacy. Gonal-F, Follitism, Menopur, and Bravelle are some of the most used gonadotropins to treat patients with infertility. Thus, high efficacy associated with gonadotropins may attract a new target population and broaden the source of revenue.

The typical cost of a chorionic gonadotropin injection without health insurance costs around USD 397.83 per vial and with insurance, it costs USD 304.76 per vial. Furthermore, in March 2022, Bharat Serums and Vaccines Limited initiated a phase 3 clinical trial to evaluate the safety and efficacy of Recombinant Human Follicle Stimulating Hormone 900 IU in women patients aged 20 to 39 years. Moreover, QL1012 currently being developed by Qilu Pharmaceutical Co., Ltd is under phase 3 clinical trial for ovarian stimulation. Thus, the expected launch of gonadotropins such as may support the continued dominance at a highest growth rate over the forecast period.

Distribution Channel Insights

The hospital pharmacy segment dominated the infertility drugs market with a revenue share of 54.39% in 2022. This dominance can be attributed to increasing inpatient visits for consultations and the need for physicians’ prescriptions for drug purchases. According to NCBI study published, there were around 72,786 inpatient visits of women reported for treatment consultation in the U.S., as of February 2021. According to the Centers for Drug Control and Prevention (CDC), around 489 clinics in the U.S. offers infertility-related treatment services such as consultations and assisted reproductive technology (ART), as of 2019.

The online pharmacy segment is expected to grow at a high growth rate over the forecast period. The growth of the segment can be attributed to the presence of online clinical chains that provide scheduled delivery of medicines to patients and supports patient discretion due to social stigma associated with the condition. Moreover, the strategic tie-ups of online platforms with major fertility clinics may boost the growth of the online pharmacy segment.

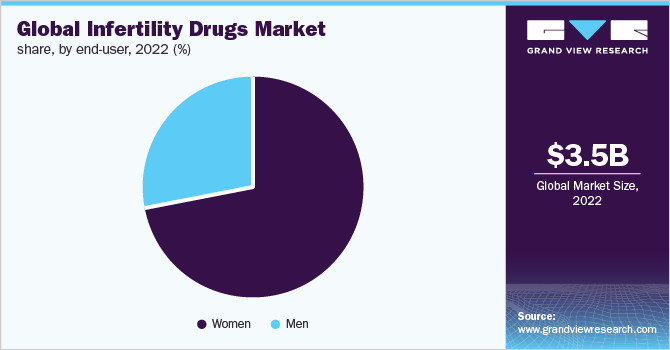

End-user Segment Insights

The women segment dominated the infertility drugs market with a revenue share of 72.43% in 2022. This dominance can be attributed to the fact that the wide availability of infertility drugs for women. According to the U.S. Department of Health and Human Services, about 11% of women are affected by infertility at reproductive age compared to 9% of men in the U.S. Furthermore, according to the Fertility Society of Australia and New Zealand, approximately 40% of total women suffer from infertility issues in New Zealand and Australia. Thus, the increasing prevalence of women’s infertility increases the demand for infertility medications worldwide, thereby driving the market.

The women segment is expected to witness fastest growth over the forecast period owing to the disease burden at reproductive age and adoption of sedentary lifestyle including consumption of alcohol and smoking that interferes with ovulation. According to an article, the global prevalence of Polycystic Ovarian Syndrome (PCOS) was found to be in range of 2.2% to 48.0% in countries including the U.S., China, India, and Australia among others in 2020. Hence, the rising volume of prescriptions for drugs and growing awareness of the condition in women is projected to the fuel market.

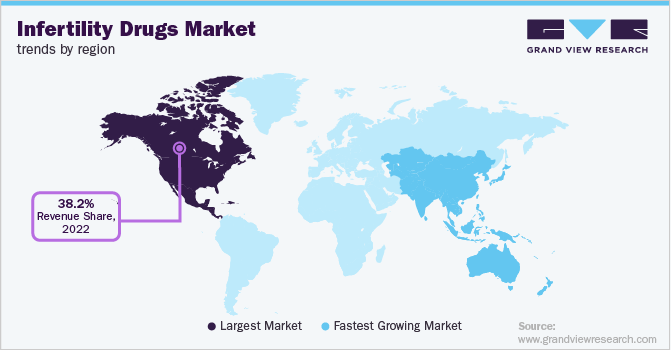

Regional Insights

North America dominated the overall infertility drugs market in terms of the revenue share of 38.2% in 2022, owing to the launch and rapid uptake of multiple infertility medicines. Increasing research activities in the region in the field of infertility are projected to open new opportunities in the region. For instance, in June 2020, Ferring B.V. and Igenomix entered into a four-year research collaboration to develop novel therapeutic products for the treatment of patients with pregnancy-related conditions.

Asia Pacific is expected to witness a growth rate of 6.9% over the forecast period. The growth of the region is attributed to the presence of key players in the market and strategic initiatives undertaken by them to develop and commercialize new infertility medicinal products to treat patients. For instance, in September 2022, the Ministry of Health, Labor, and Welfare (MHLW) approved 12 drugs for extra infertility treatment indications including Novartis AG’s Letrozole and Pfizer’s Cabaser. This label expansion approval was anticipated to boost the market of novel drugs in Asia Pacific.

Key Companies & Market Share Insights

In June 2022, Mankind Pharma developed and launched a generic version of Dydrogestrone tablets for the treatment of patients’ pregnancy-related complications in India. This drug was an equivalent version of Abbott Duphaston tablets. This launch was expected to drive infertility treatment market. Some of the key players in the global infertility drugs market include:

-

Merck & Co., Inc.

-

Ferring B.V.

-

Organon Group of Companies

-

Abbott

-

Novartis AG

-

Bayer AG

-

Pfizer Inc.

-

Mankind Pharma

-

Teva Pharmaceutical Industries LTD.

-

Sanofi

Infertility Drugs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,680.76 million

Revenue forecast in 2030

USD 5.6 billion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends

Segments covered

Drug class, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait,

Key companies profiled

Merck & Co., Inc.; Ferring B.V.; Organon Group of Companies; Abbott; Novartis AG; Bayer AG; Pfizer Inc.; Mankind Pharma; Teva Pharmaceutical Industries Ltd.; Sanofi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

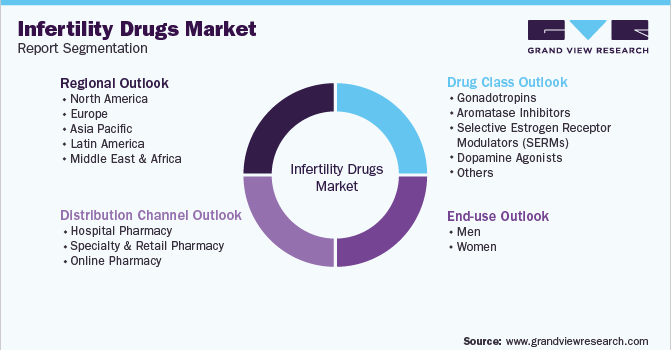

Global Infertility Drugs Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global infertility drugs market report based on drug class, end-user, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Gonadotropins

-

Aromatase Inhibitors

-

Selective Estrogen Receptor Modulators (SERMs)

-

Dopamine Agonists

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Specialty & Retail Pharmacy

-

Online Pharmacy

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATAM

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global infertility treatment drugs market size was valued at USD 3,480.14 million in 2022 and is anticipated to reach USD 3,680.76 million in 2023.

b. The global infertility treatment drugs market is expected to witness a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 5.6 billion by 2030.

b. Based on drug class, the gonadotropin segment accounted for a share of 39.96% in 2022 due to the high prescription and usage rate of gonadotropins due to their good efficacy and immediate result.

b. Some of the key players in the infertility treatment drugs market are Merck & Co., Inc.; Ferring B.V.; Organon Group of Companies; Abbott; Novartis AG; Bayer AG; Pfizer Inc.; Mankind Pharma; Teva Pharmaceutical Industries LTD.; and Sanofi, among others.

b. The major factors driving the market growth are the rising burden of infertility, presence of a strong product pipeline drugs, and increasing funding for infertility R&D.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."