- Home

- »

- Medical Devices

- »

-

Injection Pen Market Size & Share, Global Industry Report, 2018-2025GVR Report cover

![Injection Pen Market Size, Share & Trends Report]()

Injection Pen Market Size, Share & Trends Analysis Report By Product (Disposable, Reusable), By Dosage (Fixed, Variable), By Application, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-445-1

- Number of Pages: 108

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Healthcare

Report Overview

The global injectable pen/injection pen market size was valued at USD 33.01 billion in 2017 and is expected to register a CAGR of 9.4% over the forecast period. Increasing incidence of diseases such as diabetes and arthritis, increasing geographical reach of market players, and high demand for safer and advanced drug delivery devices expected to drive the market during the forecast period.

Conventional methods of injecting drugs, such as syringes and vials, are rapidly being replaced by new methods such as injectable pens and drug delivery pumps, which are known to be more convenient and flexible. Injectors have significant applications in management of various chronic diseases such as diabetes, osteoporosis, growth hormone deficiency, and arthritis. Increasing prevalence of these diseases has a direct impact on demand for injectable pens.

Most injectors available today are reusable. These require replacement of only needles and cartridges and they can be used for longer time, making them cost-effective. Additionally, urgent need to reduce needlestick injuries and the presence of a wide distribution network of international players are driving the global market.

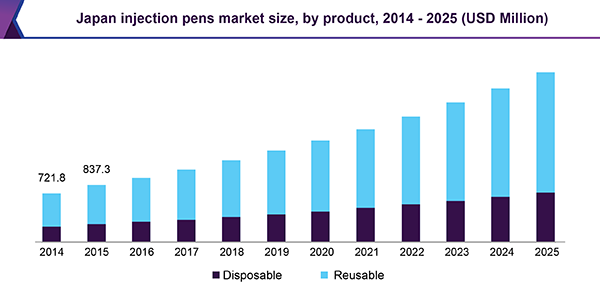

Product Insights

The traditional method of parenteral injection is fast being replaced with modern and more convenient methods such as injection pens and drug delivery pumps. Disposable devices come with a fixed dosage of the medication and thus, so do not require any installation of a cartridge. They are disposed when empty or when they are past usage date. On the other hand, reusable injectors require periodic loading of cartridge and dosage. The device requires replacement of needles and cartridges and can be used for many years. Reusable injectors are cost effective and enduring and this drives demand for the same.

The reusable injectors segment currently accounts for the largest share in the market. Novopen by Novo Nordisk A/S and Luxura by Eli Lilly and Company are a few examples of these devices. The segment is also expected to be exhibit the fastest growth over the forecast period. Commercially available reusable injectable pens mainly include Novopen, Luxura, Berlipen, AllStar, NovoRapid, basalgar, Bydureon, Epipen, and Genotropin.

Dosage Insights

Accuracy of dosage is crucial in order to ensure required results. Dosage can be of two types: fixed and variable. The latter is used extensively in chronic diseases such as diabetes, where amount of insulin changes according to blood sugar level. Variable dosage is the fastest growing segment. Rising application in conditions such as multiple sclerosis, hepatitis C, and cancer and high demand for customizable injectors are expected to catalyze demand for variable dosage devices.

These pens can be set to deliver dosage according to a patient’s individual needs and reduce the number of hospital visits. Some of the customizable variable injectors available today are UnoPen, ServoPen, and Ypsopen by Ypsomed, Madie by SHL Group, and Evo pen by Copernicus.

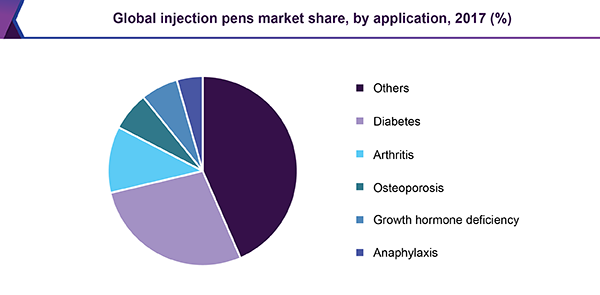

Application Insights

Injectable pens can be used for the prevention, treatment, and management of various diseases. Based on application, the injectable pens market is segmented into diabetes, anaphylaxis, osteoporosis, growth hormone deficiency, and arthritis. The diabetes segment dominated the market owing to high demand for safer insulin delivery devices. The segment is also expected to witness lucrative growth during the forecast period thanks to technological advancements in devices and therapeutics and expected approvals in the field over the coming years.

With their success in management of various chronic as well as acute diseases, injectable pens are being studied to expand their application in major diseases such as Hepatitis C, multiple sclerosis, and cancer, condition that require periodic dose injections. These studies provide a significant platform to ensure the growth of pen injectors during the forecast period.

Regional Insights

North America captured the largest injectable pen market share, followed by Europe. Increasing incidence of diabetes and growing obese population is contributing toward market growth. Obesity is one of the major causes of diseases such as diabetes, osteoporosis, and arthritis. According to the Organization for Economic Cooperation and Development (OECD), 47.0% of the population in the U.S. is estimated to be obese by 2030. Technological advancements, the presence of a wide distribution network of international players, and increase in geriatric population, which require safer delivery devices, are other factors driving the North America market.

Asia Pacific is expected to exhibit the fastest growth rate during the forecast period. China and India account for the maximum population in the region and provide lucrative growth opportunities. Adoption of advanced technologies, increasing accessibility to healthcare, and constantly improving healthcare infrastructure in the region are some of the factors likely to boost the Asia Pacific market over the forecast period.

Key Companies & Market Share Insights

Some of the key players in the pen injectors market are Owen Mumford Ltd.; Eli Lilly and Company; GlaxoSmithKline plc; Mylan N.V.; AstraZeneca; Novo Nordisk; Sandoz Inc.; and Sanofi. Key players have been adopting strategies such as product launch, collaborations, partnerships, mergers, and acquisitions to strengthen their position in the market. For instance, in October 2017, Eli Lilly and Company announced the launch of Humalog Junior KwikPen in the U.S. for the treatment of diabetes.

Injection Pen Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 44.18 billion

Revenue forecast in 2025

USD 67.9 billion

Growth Rate

CAGR of 9.4% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, dosage, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Greece; Denmark; Spain; Norway; Belgium; Austria; Japan; China; India; Thailand; Australia; Singapore; Malaysia; Sri Lanka; Bangladesh; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa; Qatar; Kuwait

Key companies profiled

Owen Mumford Ltd.; Eli Lilly and Company; GlaxoSmithKline plc; Mylan N.V.; AstraZeneca; Novo Nordisk; Sandoz Inc.; Sanofi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global injection pen market report on the basis of product, dosage, application, and region:

-

Product Outlook (Revenue, USD Billion, 2014 - 2025)

-

Disposable

-

Reusable

-

-

Dosage Outlook (Revenue, USD Billion, 2014 - 2025)

-

Fixed

-

Variable

-

-

Application Outlook (Revenue, USD Billion, 2014 - 2025)

-

Diabetes

-

Insulin

-

Non-insulin

-

-

Anaphylaxis

-

Osteoporosis

-

Growth hormone deficiency

-

Arthritis

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

The U.K.

-

Greece

-

Denmark

-

Spain

-

Norway

-

Belgium

-

Austria

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

Singapore

-

Malaysia

-

Sri Lanka

-

Bangladesh

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

Qatar

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."