- Home

- »

- Medical Devices

- »

-

Insulin Storage Devices Market Size & Share Report, 2030GVR Report cover

![Insulin Storage Devices Market Size, Share & Trends Report]()

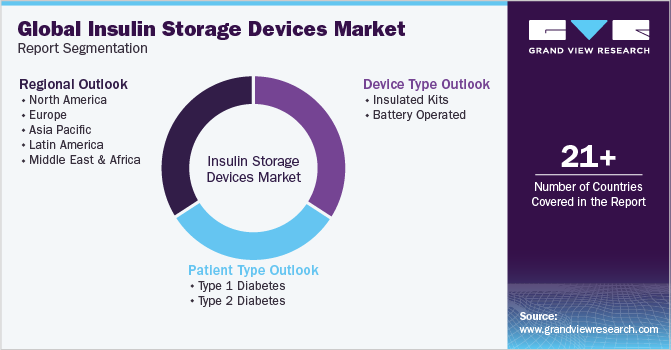

Insulin Storage Devices Market Size, Share & Trends Analysis Report By Device Type (Insulated Kits, Battery Operated), By Patient Type (Diabetes Type 1, Diabetes Type 2), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-422-2

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global insulin storage devices market size was valued at USD 873.7 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2023 to 2030. The increasing incidence of diabetes and the rising adoption of advanced insulin delivery devices are the key factors driving the market. Moreover, the rising demand for advanced storage options remains one of the major drivers of the market. The introduction of insulin pumps has increased the demand for long-term insulin-carrying solutions, which is anticipated to drive market growth in the forecast period.

With the boost in urbanization, sedentary lifestyle, and nutrition transition, there has been an increase in the obese population. According to the International Diabetes Federation (IDF), around 540 million people have diabetes, which is expected to reach 783 million by 2045. Other factors contributing to increasing cases of diabetes are the consumption of alcohol and tobacco and a high intake of refined carbohydrates.

Patients with type 1 diabetes produce little or no insulin and thus require treatment throughout their life. An appropriate storage solution is necessary for the effective preservation of insulin vials. The temperature outside the recommended range reduces the potency of insulin. According to the product labels, it is advised to store insulin in a refrigerator at temperatures ranging from approximately 36°F to 46°F, recommended by all three manufacturers in the U.S. When kept unopened and stored within this temperature range, the insulin remains potent until the expiration date indicated on the package. Moreover, rising awareness about diabetes preventive care and the effective use of insulin are also adding to the market growth. According to American Diabetes Association (ADA), 8.4 million people use insulin in the U.S.

Proper storage can help significantly reduce treatment costs by reducing drug loss. Patients need to maintain storage temperature to keep up insulin potency. Currently, the storage products are limited to insulated packages to portable refrigerators. Developing smart storage systems with specifications such as temperature alerts, expiry alerts, dose reminders, and auto messaging is expected to boost the insulin storage devices market growth during the forecast period. For instance, in September 2022, BIOCORP and SANOFI announced the end of the development of SoloSmart, an accessory that can be attached to SANOFI’s DoubleStar/SoloStar insulin pen. SoloSmart can record information about the insulin dose, time, and date of each injection and can further transmit the data to mobile applications via Bluetooth.

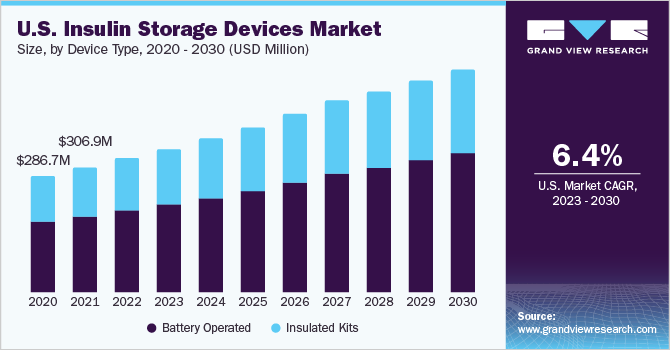

Device Type Insights

The battery-operated device segment accounted for the largest revenue share in 2022 and is expected to grow at the fastest CAGR during the forecast period. The dominance of battery-operated devices is attributed to the availability of a wide range of coolers and refrigerators based on patients' needs. Battery-operated coolers are becoming popular among the diabetes population owing to their portability, long battery life, and easy handling, which expand the usage of these devices during travels. For instance, DISONCARE offers its super capacity battery-powered mini fridge, with a battery of 16000 mAH; the standby time of the device is 8-10 hours.

The insulated kits segment is expected to grow by a considerable market share during the forecast period. Affordability and easy usage of insulated kits are the major factors driving the segment's growth. The segment is divided into cooling wallets, pouches, and insulated cooling bags. The cooling wallets segment is expected to dominate the market owing to its availability and popularity among geriatric patients.

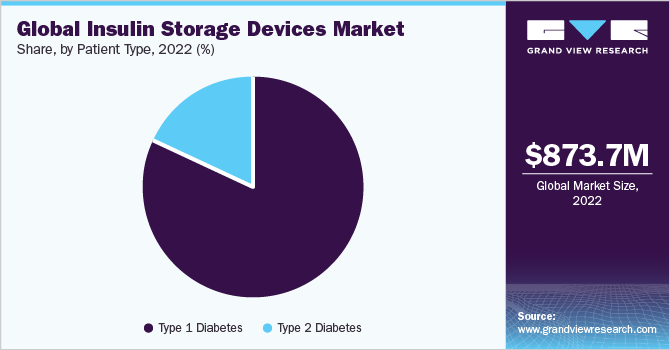

Patient Type Insights

The diabetes type 1 segment accounted for the largest revenue share of 82.4% in 2022. The segment's dominance is due to the rising need for insulins and the adoption of delivery and storage devices. According to the IDF Diabetes Atlas Report, out of the 8.75 million people globally living with type 1 diabetes in 2022, approximately 1.52 million individuals were under 20.

The diabetes type 2 segment is estimated to register the fastest CAGR of 8.0% over the forecast period. As type 2 diabetes is a lifestyle-associated condition, most patients belong to the adult and working population. Most of these patients prefer long-term insulin-carrying devices over frequent pharmacy visits. This is expected to boost the demand for insulin storage devices during the forecast period.

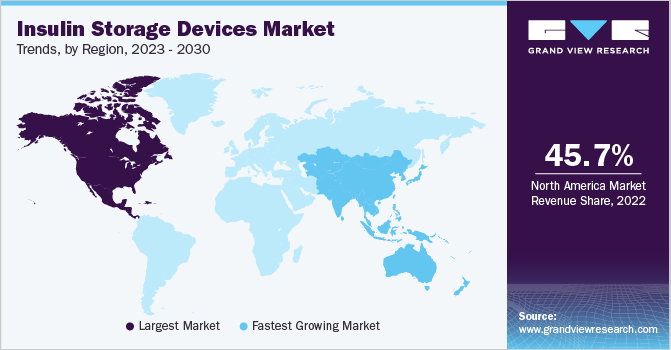

Regional Insights

North America dominated the market and accounted for the largest revenue share of 45.7% in 2022. The region's dominance is due to a large patient pool and favorable reimbursement policies. According to a report published by the Centers for Disease Control and Prevention (CDC), more than 130 million adults live with diabetes or prediabetes in the U.S. People who have diabetes require proper storage of insulin at controlled temperatures, increasing the demand for storage devices.

Asia Pacific is expected to grow at the fastest CAGR of 8.2% during the forecast period. The region's growth is attributed to the rising prevalence of diabetes and awareness drives for the effective use and storage of insulin. Government initiatives and educational programs are also expected to propel the market growth during the forecast period. Asia accounts for almost 60% of the world's diabetes population. In recent times, Asia has undergone rapid economic development and urbanization. An increasing number of the working population suffering from diabetes is propelling the region's demand for insulin storage devices. According to the National Center for Biotechnology Information (NCBI), the prevalence of diabetes is expected to grow in Asia Pacific countries and witness a growth in the diabetes diseased population in the region which will be 60% of the total diabetes cases.

Key Companies & Market Share Insights

The market is fragmented in nature owing to the presence of a large number of local players in the industry. The market is highly competitive as almost all the products are substitutes to each other and thus, are facing tough competition in insulin storage devices space. In September 2022, TempraMed launched VIVI Cap 3.0; the device aims to safely store insulin medication and ease travel burdens for insulin-dependent people. Furthermore, in July 2022, Godrej Appliances announced the launch of Godrej InsuliCool and Godrej InsuliCool+ devices for insulin storage. The following are some of the major participants in the insulin storage devices market:

-

ReadyCare, LLC

-

DISIONCARE

-

Medicool

-

Tawa Outdoor

-

Cooluli

-

ARKRAY, Inc.

-

zzolive

-

Zhengzhou Defrigus Electric Device Co., Ltd.

-

COOL Sarl-FR

-

Godrej.com

Insulin Storage Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 941.1 million

Revenue forecast in 2030

USD 1,507.1 million

Growth rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device Type, patient type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ReadyCare, LLC; DISIONCARE; Medicool; Tawa Outdoor; Cooluli; ARKRAY, Inc.; zzolive; Zhengzhou Defrigus Electric Device Co., Ltd.; COOL Sarl-FR; Godrej.com

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insulin Storage Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global insulin storage devices market on the basis of device type, patient type, and region:

-

Device Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Insulated Kits

-

Insulin Cooling Wallets

-

Insulin Cooling Pouches

-

Insulated Cooler Bags

-

-

Battery Operated

-

-

Patient Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Type 1 Diabetes

-

Type 2 Diabetes

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global insulin storage devices market size was estimated at USD 873.68 million in 2022 and is expected to reach USD 941.1 million in 2023.

b. The global insulin storage devices market is expected to grow at a compound annual growth rate of 8.08% from 2023 to 2030 to reach USD 1,507.1 million by 2030.

b. North America dominated the insulin storage devices market with a share of 45.67% in 2022. This is attributable to the presence of a large patient pool and favorable reimbursement policies

b. Some key players operating in the Insulin Storage Devices market include ReadyCare, LLC; DISIONCARE; Medicool; Tawa Outdoor; Cooluli; Arkray, Inc.; Zhengzhou Olive Electronic Technology Co., Ltd.; Zhengzhou Defrigus Electric Device Co., Ltd.; COOL Sarl-FR; and others.

b. Key factors driving the market growth include the increasing prevalence of diabetes and the rising adoption of insulin-delivery devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."