- Home

- »

- Display Technologies

- »

-

Interactive Tables Market Size, Global Industry Report, 2020-2027GVR Report cover

![Interactive Tables Market Size, Share & Trends Report]()

Interactive Tables Market Size, Share & Trends Analysis Report By Technology (LCD, LED, Capacitive), By Screen Size (32-65 Inch, 65 Inch & Above), By Application, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-188-7

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Semiconductors & Electronics

Report Overview

The global interactive tables market size was valued at USD 904.4 million in 2019 and is expected to expand at a CAGR of 7.2% over the forecast period. The market is expected to witness significant growth in the years to come owing to increasing digitalization in the education sector. Interactive tables create an entertaining environment for students to learn fundamental concepts using familiar characters, while focusing on their emotional and social development.

Interactive tables have made collaborative learning much easier. Increasing demand for such an interface from educational institutes across the globe has fueled the market growth. Furthermore, retailers emphasize on providing improved features and making these products easy to use, which, in turn, helps to boost the sales in the market.

Rapidly increasing adoption of interactive tables in the hospitality sector globally is expected to drive their demand over the coming years. The use of these products in the restaurants is not an entirely new concept. It has been used in several forms over the last few years in developed countries, but due to lack of capital investment, interactive restaurants were seen as more of a trend than a worthwhile business opportunity.

However, in the past few years, the trend has started to change as more transformation has been made within interactive technologies, such as the introduction of interactive kiosks, tables, and video walls. Besides, digitalization in education increases engagement, resulting in better learning retention. Similarly, interactive touch tables make content more entertaining and informative, thereby boosting the product demand in the education sector over the projected period.

Interactive tables were primarily designed for use in schools and higher learning education institutions. However, with the growing demand across other verticals, the use of interactive tables has witnessed tremendous growth. These are now used in restaurants, trade shows & exhibitions, medical and science fields, as well as museums. Furthermore, interactive tables make a better option for enhancing the corporate meeting for both clients and employees. They enable team members and guests to interact in a new way with better engagement.

Furthermore, factors such as internet penetration and changing consumer lifestyles have positively impacted the adoption of interactive tables. Besides, rising emphasis on gamification in the education system has boosted the product demand. Gamification is considered to be an effective tool in developing cognitive skills and encouraging effective interaction in classrooms. Furthermore, it enables the integration of 3D characters and game mechanics into effective courseware to make the learning process more interactive for students.

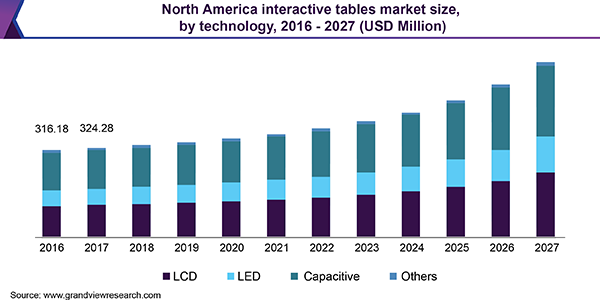

Technology Insights

The technology segment is categorized into Liquid Crystal Display (LCD), Light-Emitting Diode (LED), capacitive, and others. The capacitive segment accounted for the largest share of more than 43% in 2019. This is attributed to the touch and distance sensing, which is facilitated by touch and distance sensors. These sensors permit several gesture-based features, such as two-hand and multi-touch gestures, in these interactive touch tables. Besides, the capacitive display only registers fingers, which makes the functioning smooth without any interruption, thus contributing to significant growth of the capacitive segment.

The LED segment is expected to witness the fastest growth in the forecast period. Integration of LED technology has led to energy savings at a significant level. Thus, a decrease in energy consumption is compelling the enterprises to opt for LED-based interactive touch tables. Furthermore, these products are increasingly adopted as they consume less power, throw less heat, and are less expensive than capacitive interactive tables. This is eventually making the customers switch from capacitive to LED-based interactive tables.

Application Insights

The education application segment accounted for the largest share of more than 27% in 2019. Adoption of interactive tables in the education sector has led to mobilized learning, active participation, and creativity in the classroom. The education sector is anticipated to create growth opportunities for players in the interactive tables market. For instance, in July 2019, Promethean World Ltd announced the launch of its new product line, the ActivPanel Elements series in the U.S. This series was introduced to offer a more intuitive technology experience to the teachers who use it to improve student engagement.

Interactive tables in the retail sector allow customers to look through the store’s stock and check availability of inventory at a specific location. These tables also enable customers to organize items into their wish-list and later e-mail them for review. These offerings further help customers in enhancing their experience with convenience and efficiency. Besides, these tables are used in various other verticals, such as control rooms, showrooms, museums, and airport. In control rooms, these tables monitor networks, identify problems, and drive to a quick solution.

Screen Size Insights

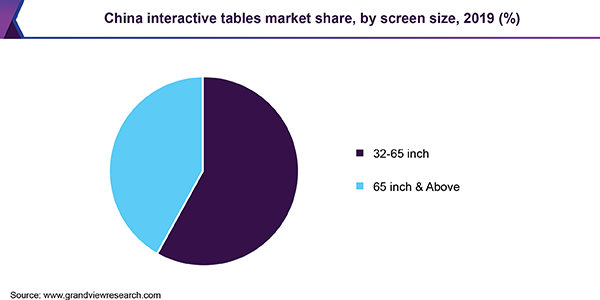

32 to 65 inch interactive tables accounted for the largest market share in 2019 and are likely to maintain the lead during the forecast period. They are mainly used in the trade shows & exhibitions, education, retail, and hospitality sectors. Moreover, these screen size touch tables are used in restaurants as menu boards to indicate prices, ingredients, and waiting time of the orders taken from customers. Furthermore, they are highly portable and can be transported from one place to another. Unlike a video wall touch screen display, these tables can be easily unplugged and transferred to another location without any hassle.

Interactive tables with 65 inch & above screen size are anticipated to witness considerable growth over the forecast period. The growth can be attributed to their benefits, such as improved efficiency, clear image quality, and 4K UHD resolution touchscreen displays. Moreover, these screen size interactive tables can be arranged as a collage and displayed on a table.

Regional Insights

North America is anticipated to account for the largest market share by 2027. This can be attributed to the presence of a large number of restaurants using interactive technologies in Canada and U.S. Strong presence of touch table solution providers and high adoption of touch table applications are some of the significant factors contributing to the product demand. In the present scenario, U.S. dominates the interactive display market in North America. Enormous adoption of interactive touch tables in the corporate, government, and education sectors in U.S. is also positively impacting the market growth in the region.

The Asia Pacific is likely to showcase lucrative growth in the coming years owing to strong base of tech-savvy population. Besides, there are several technology companies offering touch tables in China, thereby making the Asia Pacific an active participant in the overall market. Europe is anticipated to witness significant growth in the forecast period on account of the rising deployment of these tables in the educational institutes.

Interactive Tables Market Share Insights

Some of the prominent players in the market are Box Light Corporation, DigaliX, eyefactive GmbH, Garamantis GmbH, HORIZON DISPLAY, LLC, IDEUM, Intermedia Touch, MARVEL TECHNOLOGY (CHINA) CO., LTD, MMT GmbH & Co. KG., and TableConnect. Interactive table providers are focusing on new product development, which, in turn, would help in increasing their market presence.

For instance, in October 2018, IDEUM launched a new Pico Touch Coffee Table. This product was designed specifically for public and semi-public spaces. It has an audio jack, Wi-Fi, HDMI, Bluetooth 5.0, and USB. Besides, it has a built-in RFID reader and RFID software utility, allowing consumers to automate a variety of system tasks.

Report Scope

Attribute

Details

Base year for estimation

2019

Actual estimates/Historical data

2016 - 2018

Forecast period

2020 - 2027

Representation

Revenue in USD Million and CAGR from 2020 to 2027

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, U.K., Germany, France, China, India, Japan, Brazil, and Mexico

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global interactive tables market report on the basis of technology, screen size, application, and region:

-

Technology Outlook (Revenue, USD Million, 2016 - 2027)

-

LCD

-

LED

-

Capacitive

-

Others

-

-

Screen Size Outlook (Revenue, USD Million, 2016 - 2027)

-

32-65 Inch

-

65 Inch & Above

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Exhibition & Trade Shows

-

Education

-

Retail

-

Control Room

-

Hospitality

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global interactive tables market size was estimated at USD 904.4 million in 2019 and is expected to reach USD 927.4 million in 2020.

b. The global interactive tables market is expected to grow at a compound annual growth rate of 7.2% from 2019 to 2027 to reach USD 1,511.7 million by 2027.

b. North America dominated the interactive tables market with a share of 38.1% in 2019. This is attributable to the large scale adoption of interactive technologies by restaurants and relatively greater adoption of touch table applications in the region.

b. Some key players operating in the interactive tables market include Box Light Corporation, DigaliX, eyefactive GmbH, Garamantis GmbH, HORIZON DISPLAY, LLC, IDEUM, Intermedia Touch, MARVEL TECHNOLOGY (CHINA) CO., LTD, MMT GmbH & Co. KG., and TableConnect.

b. Key factors that are driving the market growth include increasing digitization in the education sector, increasing adoption of interactive tables in the hospitality sector and rising emphasis on gamification in the education system.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."