- Home

- »

- Beauty & Personal Care

- »

-

Interdental Cleaning Products Market Size, Industry Report, 2019-2025GVR Report cover

![Interdental Cleaning Products Market Size, Share & Trends Report]()

Interdental Cleaning Products Market Size, Share & Trends Analysis Report By Product (Interdental Brushes, Toothpicks), By Distribution Channel, By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-133-7

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Industry Insights

The global interdental cleaning products market size was valued at USD 950.5 million in 2018 and is anticipated to expand at a CAGR of 4.6% over the forecast period. Increasing prevalence of dental caries and rising awareness related to dental hygiene are expected to drive the market. An increase in dental problems like plaque in between the teeth has also driven the market.

Increasing dental problems like cavities, bad breath, and inflammation of the gums are expected to fuel the product demand. There is a major portion of the teeth surfaces that are below the gum line, wherein a regular toothbrush cannot reach and may cause plaque with different dental problems. Hence, it is important to clean the interdental area to remove the plaque and for such cleaning, there are different products like interdental brushes, dental tapes, and toothpicks.

For instance, around 35-45 percent of the tooth surfaces are found to have interdental spaces, therefore flexible interdental brush is made to get rid of the problems of teeth. Major players are taking many initiatives to provide awareness related to dental hygiene and good breath. For instance, in 2015, the American Association of Orthodontists (AAO) had tied up with Oral-B to provide awareness programs related to good oral care among people.

Increasing disposable income in developing countries like India, China, and Japan may lead to the interdental cleaning products market growth. Many innovative products like dental floss, electric interdental toothbrushes, dental tapes, and tongue cleaner are growing rapidly and being adopted by high and middle-income people. For instance, in 2016, ADA (American Dental Association) announced that interdental cleaners such as interdental brushes and floss are an essential part of taking care of gums and teeth.

Product Insights

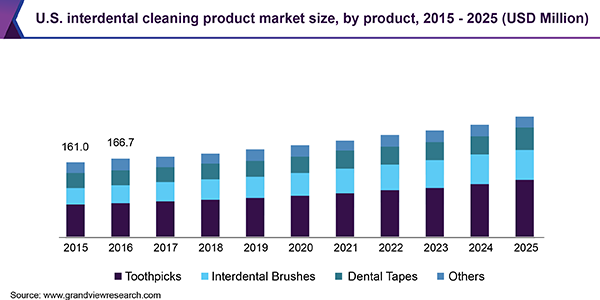

The toothpicks segment was the largest segment with a revenue of USD 410.0 million in 2018. It is anticipated to witness significant growth in the upcoming years. Growing awareness among people regarding the usage of toothpicks due to their high product availability across the globe is likely to drive this segment. The low cost of the toothpicks may also be the reason for the growth of the market globally. According to a survey, the maximum production of toothpicks is in countries like India, Africa, and Nigeria.

Interdental brushes are anticipated to expand at the fastest CAGR of 5.3% over the forecast period. An increase in technological advancements is the reason for the growth of the market. Battery-powered and electric toothbrushes are some of the new innovative products that are used by middle and high-income groups. The rise in the geriatric population may also be the reason for the growth of the market. Old age people suffer from more dental problems. According to a survey, in 2017, more than 37.0% of the total population suffers from plaque and interdental problems are of older age and the maximum is on and above 55 years ago.

Distribution Channel Insights

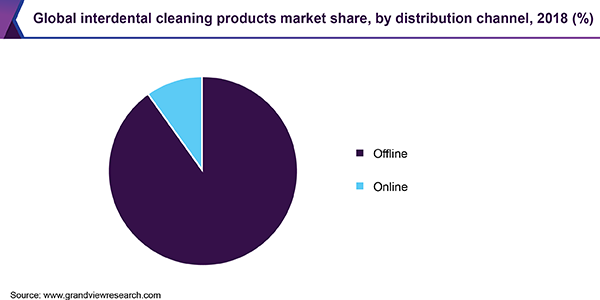

The offline segment held a 90.2% share of global revenue in 2018 and is expected to witness significant growth in the upcoming years. This segment is expected to maintain its lead throughout the forecast period. Some of the significant channels are pharmacies and supermarkets that are penetrating worldwide to increase their sales. Maximum products related to interdental cleaning are available in pharmacies and supermarkets.

Manufacturers are focusing on providing new and innovative products that make interdental cleaning products more attractive and easy to handle. A product is designed in such a manner that it saves from getting hurt and does not harm gums, and thus it becomes easier to use as well. All these features are observed by consumers when they go to supermarkets while buying interdental products. This can be a reason for the growth of the supermarket in the offline segment.

The online segment is projected to expand at a CAGR of 6.8% from 2019 to 2025 on account of increasing internet penetration. Technological advancements are one of the significant factors driving the online segment. Many e-commerce and online shopping apps like Walmart, Flipkart, Amazon, and eBay make it easy and useful for customers to use interdental cleaning products.

Though e-commerce has dominated the vast extent of the retail shops, it accounted for a small percentage of the total sales in retails across the world. Countries such as China, India, and other Southeast Asian countries are exhibiting the growth of extensive urbanization and industrial development. The rise in penetration of the Internet of Things and the internet is expected to boost the growth of the market.

Regional Insights

In 2018, Europe accounted for a 29.3% share of the total revenue due to the growing prevalence of oral problems and dental issues, mainly in the eastern parts of Europe. A massive increase in the geriatric population is also anticipated to drive the regional market.

Asia Pacific is expected to the fastest-growing regional market with a CAGR of 5.3% over the forecast period. This growth is attributed to the growing population and increasing awareness related to dental hygiene among people. Furthermore, increasing prevalence of dental camps and the rise in the use of interdental products in countries like India and China are expected to drive the market in the region.

North America is expected to witness significant growth in the coming years. An increase in disposable income in many countries like the U.S. has increased demand for advanced interdental products like fresh breath strips and electric toothbrushes. This, in turn, has boosted the market growth in the region. Furthermore, skilled dental clinics in the U.S. is anticipated to boost the market growth worldwide.

Interdental Cleaning Products Market Share Insights

Some of the major players of are TePe Plackers, Trisa AG, Lion, GUM, Dental, E-Clean, Oral-B, Den Tek, Colgate, Yawaraka, Curaprox, M+C Schiffer GmbH, Naisen Caring, INHAN, Piksters, Tandex A/S, Lactone, and Royal Philips N.V. Key strategies taken by major players are mergers, divestitures, joint ventures, new product launches, and partnerships.

Companies are focusing on establishing an effective sales channel and new product launches to gain market share. For instance, in 2017, Oral B launched Dubbed 2000 and PRO 600 rechargeable toothbrush in India. These toothbrushes are equipped with advanced pulsating technology for better removal of plaques. Both products are available on Amazon.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S., Germany, China, India, and Brazil

Report coverage

Revenue forecast, company share, competitive landscape, and growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Grand View Research has segmented the global interdental cleaning products market report based on the product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Interdental Brushes

-

Toothpicks

-

Dental Tapes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."