- Home

- »

- Medical Devices

- »

-

Intracranial Aneurysm Market Size & Share Report, 2030GVR Report cover

![Intracranial Aneurysm Market Size, Share & Trends Report]()

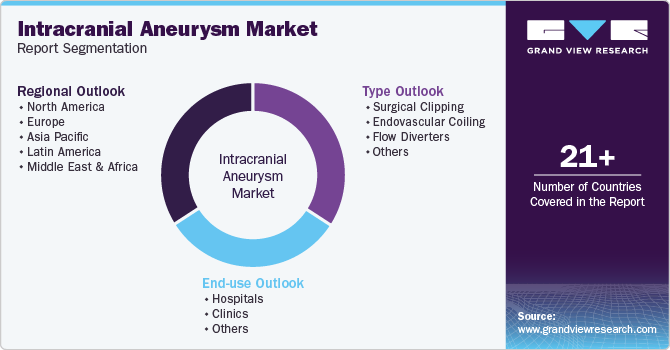

Intracranial Aneurysm Market Size, Share & Trends Analysis Report By Type, (Surgical Clipping, Endovascular Coiling, Flow Diverters), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-416-1

- Number of Pages: 137

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Intracranial Aneurysm Market Size & Trends

The global intracranial aneurysm market size was estimated at USD 1.26 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.12% from 2024 to 2030. Increasing incidence of neurological diseases is a major factor contributing to the market growth. According to the World Federation of Neurology article report published in October 2023, neurological disorders rank as the second leading cause of death and the primary cause of global disability.

A recent Global Burden of Disease study predicts a doubling of individuals affected by brain diseases by 2050, with about 40% of the current global population already impacted. Technological advancements and increasing preference for targeted therapy approach are factors expected to drive the market growth in the forecast period.

The prevalence of a variety of health disorders, including brain aneurysms, increases as the world's population ages. Elderly individuals are more likely to develop aneurysms, especially in the brain. For instance, as per the reports published by University Of Minnesota in March 2023, the Brain Aneurysm Foundation states that 1 in 50 Americans or approximately 6.7 million people-have an unruptured brain aneurysm. Annually, about 30,000 individuals in the nation experience the rupture of a brain aneurysm, translating to roughly one rupture occurring every 18 minutes.

The market is also driven significantly due to technological advancements. According to an article published by IntechOpen in February 2023, unruptured intracranial aneurysms (IAs) pose a significant public health concern, affecting 3-7% of the population. Neuroimaging breakthroughs, including magnetic resonance angiography (MRA), computed tomographic angiography (CTA), and digital subtraction angiography (DSA), have led to increased detection of aneurysms. Researchers are focusing on identifying risk factors and developing prediction models for various stages of aneurysm development, including initiation, growth, rupture, and intervention assessment. Noteworthy scoring systems like PHASES for rupture risk and ELAPSS for growth risk have been developed. However, these existing models primarily predict gap events and lack a comprehensive range of objective predictive analytics essential for shared decision-making.

The growing incidence of individuals experiencing higher blood pressure and damage to blood vessels serves as a significant catalyst for the expansion of the market. According to the WHO article published in September 2023, The report showed that about four out of five people with high blood pressure do not receive appropriate treatment. But if countries expand insurance coverage, 76 million deaths are expected to avoid between 2023 and 2050. 1 in 3 adults worldwide has high blood pressure issues. An estimated 1.28 billion adults aged 30 to 79 worldwide have high blood pressure, most of whom (two-thirds) live in low- and middle-income countries.This escalating trend in patients dealing with high blood pressure and vascular trauma influences an increased demand for interventions and treatments related to intracranial aneurysms.

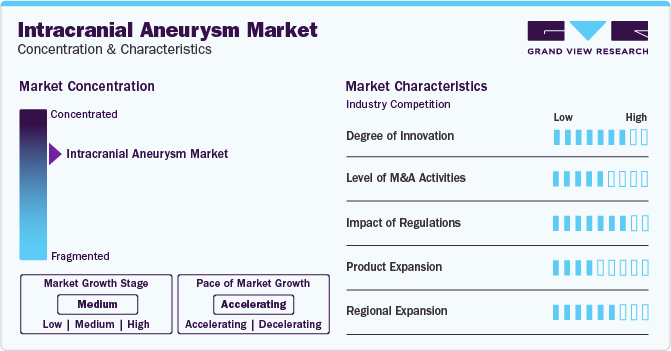

Market Concentration & Characteristics

The global market has experienced a significant degree of innovation, with innovations in both endovascular devices and delivery systems. There have been notable innovations in types of coils and stents, which are used to treat aneurysms.There have also been improvements in the delivery systems used to deliver these devices.

The level of M&A activity in the market can be considered moderate with several market players, such as Stryker, Medtronic, and MicroPort Scientific Corporation, being involved in merger and acquisition activities. For instance, in May 2023, the privately held, commercial-stage medical device company Cerus Endovascular Ltd., which designs and develops neuro-interventional equipment used in the therapy of intracranial aneurysms, was acquired by Stryker.

The global market is witnessing significant product expansion, driven by advancements in diagnostic and interventional technologies. The introduction of innovative neuroimaging tools such as magnetic resonance angiography (MRA), computed tomographic angiography (CTA), and digital subtraction angiography (DSA) has expanded the range of diagnostic capabilities for detecting and characterizing intracranial aneurysms.

Intracranial aneurysm is experiencing significant regional expansion as healthcare infrastructures worldwide increasingly adopt advanced diagnostic and treatment modalities. With a rising prevalence of intracranial aneurysms globally, there is a growing demand for improved access to advanced technologies.

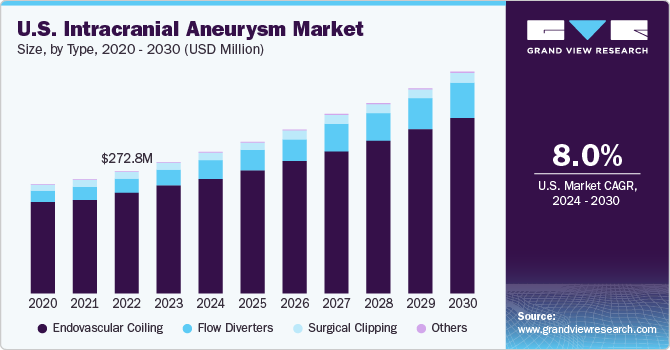

Type Insights

Based on type, the endovascular coiling segment led the market with the largest revenue share of 84.6% in 2023, the endovascular coiling technique is a minimally invasive procedure that employs a catheter to identify and treat aneurysms in the brain. This method involves navigating a catheter from the groin area through the artery leading to the aneurysm. Once positioned, embolic coils or liquids are introduced through the catheter to induce embolization, effectively preventing blood flow into the aneurysm. The advancements in the products designed for the treatments of neurological disorders developed by the industry key players drive the market's growth. For instance, in January 2024, is the IMPASS embolic coil device, this innovative device is designed for the treatment of Chronic Subdural Hematomas (CSDH), a condition affecting the outermost layer of the brain. Especially, the device has demonstrated successful application in in-vivo studies, specifically in the embolization of the middle meningeal artery (MMA). Fluidx Medical Technology, Inc. publicly disclosed this significant development, highlighting the role of technological innovation in driving progress within the field of neurological disorder treatments.

The flow diverters segment is anticipated to witness fastest CAGR over the forecast period. Continuous evolution of flow diverter technology boosts market growth. According to the SAGE Publications article published in October 2023, recent advancements involve surface modifications with various compounds to enhance blood compatibility, reducing the risk of clotting and thrombosis. These modifications aim to streamline deployment and, crucially, cover how to use a single antiplatelet therapy, eliminating the need for Dual Antiplatelet Therapy (DAPT). This innovation potentially expands the applications of flow diverters to include ruptured intracranial aneurysms, presenting a significant advancement in treatment options. Moreover, for instance, in June 2022, Stryker and Carmeda partnered to enhance the treatment of brain aneurysms. The collaboration integrates Stryker's established flow diverter technology with Carmeda's active heparin coatings. Stryker's flow diverter, utilizing Carmeda's covering, demonstrates a significant reduction in thrombin, a potent platelet agonist, and coagulation factor.

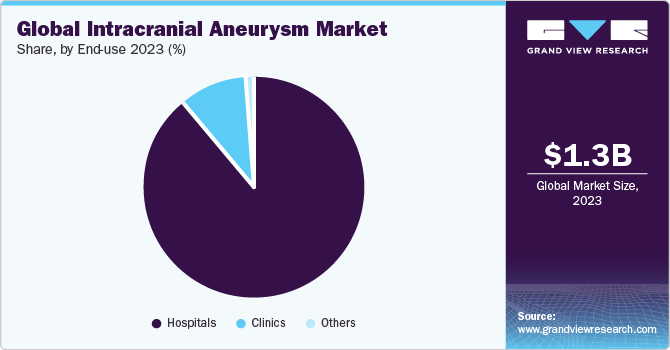

End-use Insights

Based on end-use, the hospital segment led the market in 2023 with the largest revenue share of 89.52%. This is attributed to the use of technologically advanced equipment in operation theaters and intensive care units, the increasing number of hospitals worldwide, and rising government funding for the hospitals. Technologically advanced devices are being used extensively in hospitals to provide better treatment. These devices are not only simplifying treatment procedures but are also helping provide better, faster, and more accurate results.

The clinic segment is also anticipated to witness a significant CAGR over the forecast period. Intracranial aneurysm procedures are among the most critical and complicated surgeries that are dependent on high-quality and durable equipment, which are used in hospitals. Hospitals are also better equipped to handle any post-operative complications and they include facilities for physical rehabilitation post surgeries. Also, hospitals are widely preferred by patients in comparison to emergency clinics owing to better healthcare facilities and the availability of advanced equipment. Thus, these factors are significantly boosting the segment growth.

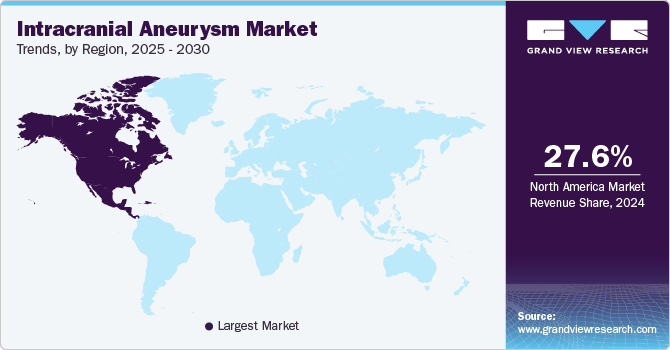

Regional Insights

North America dominated the market with the revenue share of 26.65% in 2023 owing to the presence of well-established healthcare infrastructure, the rising geriatric population, and the high incidence of hypertension and stroke. In addition, the increasing occurrence of intracranial aneurysms and the escalating demand for minimally invasive surgeries are driving the market growth in this region. Moreover, numerous initiatives being taken by different organizations are expected to boost market growth. For example, The Bee Foundation (TBF), a non-profit entity, is dedicated to raising awareness and decreasing the mortality rates associated with cerebral aneurysms via pioneering research.

The Asia Pacific market is anticipated to witness the fastest CAGR over the forecast period. This is attributed to factors, such as the growing aging population, high lifestyle stress, rising incidence of hypertension, improvement in the quality of diagnosis, and increasing patient affordability. These factors have together resulted in a considerable number of intracranial aneurysm procedures in Asia Pacific. Furthermore, the potential for expansion in emerging markets like Brazil, India, and China could further boost regional market growth. For example, the growing trend of medical tourism in India due to the lower costs of intracranial surgeries compared to developed nations like the U.S. is anticipated to stimulate market growth. Specifically, the cost of aneurysm surgery in India averages around USD 7,000, in contrast to the USD 30,000 charged in the U.S.

Key Intracranial Aneurysm Company Insight

Medtronic plc, Stryker Corporation, MicroPort Scientific Corporation, and B. Braun Melsungen AG are some of the leading players operating in the global market. These players adopt various strategies to maintain their market dominance. Strategies such as new product development, patent protection, regulatory approval, and collaborations and partnerships are widely adopted by these players.

RAUMEDIC AG, Terumo Corporation, Delta Surgical, and Integra LifeSciences are other market player’s functioning in the market. The emerging market players adopt various strategies to improve their footprint in the market. Strategies such as focus on innovation, geographic expansion, and strategic partnerships help these companies achieve their goals.

Key Intracranial Aneurysm Companies:

The following are the leading companies in the intracranial aneurysm market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these intracranial aneurysm companies are analyzed to map the supply network.

- Medtronic plc

- Stryker Corporation

- MicroPort Scientific Corporation.

- Johnson & Johnson Services, Inc.

- MicroVention Inc.

- B. Braun Melsungen AG

- Integra LifeSciences

- RAUMEDIC AG

- Terumo Corporation

- Delta Surgical

Recent Developments

-

In May 2023,Stryker Corporation acquiredCerus Endovascular Ltd., a medical devices company involved in making neurointerventional devices for the treatment of intracranial aneurysms. With this acquisition, Stryker aims to expand its product portfolio foraneurysm treatment solutions

-

In October 2023, a study published in the BMJ Journal of Neurointerventional Surgery demonstrated that PreSize, an AI software, is more accurate thanhuman clinicians in predicting placement of a stent in a patient’s brain. This development shows how the integration of AI could provide growth opportunities for the players operating in the market

-

In June 2022, the Indian subsidiary ofMedtronic plc launched pipeline vantage embolization device in India for the treatment of brain aneurysms

Intracranial Aneurysm Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,380.58 million

Revenue forecast in 2030

USD 2,331.09 million

Growth rate

CAGR of 9.12% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Stryker; MicroPort Scientific Corporation.; Johnson & Johnson Services, Inc.; MicroVention Inc.; B. Braun Melsungen AG; Integra LifeSciences; RAUMEDIC AG; Terumo Corporation; Delta Surgical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Intracranial Aneurysm Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global intracranial aneurysm market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Clipping

-

Endovascular Coiling

-

Flow Diverters

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intracranial aneurysm market was estimated at USD 1.26 billion in 2023 and is expected to reach USD 1,380.58 million in 2024.

b. The global intracranial aneurysm market is expected to grow at a compound annual growth rate of 9.12% from 2024 to 2030 to reach USD 2,331.09 million by 2030.

b. North America dominated the intracranial aneurysm market with a share of 26.65% in 2023. This is attributable to the increasing cost of treatment, rising aging population, and a greater incidence of hypertension and stroke in the region.

b. Some key players operating in the intracranial aneurysm market include Medtronic, Microport Scientific Corporation, B. Braun Melsungen AG, Stryker Corp, Johnson & Johnson Inc, Microvention, Inc, and Codman Neuro.

b. Key factors that are driving the intracranial aneurysm market growth include the increasing prevalence of hypertension and aneurysm among the aging adult population as well as technologically advanced products by key players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."