- Home

- »

- Medical Devices

- »

-

Intragastric Balloons Market Size, Share Report, 2021-2028GVR Report cover

![Intragastric Balloons Market Size, Share & Trends Report]()

Intragastric Balloons Market Size, Share & Trends Analysis Report By Balloon Type (Single, Dual), By Filling Material (Saline Filled, Gas Filled), By End Use, By Administration, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-424-6

- Number of Pages: 104

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The global intragastric balloons market size was valued at USD 14.9 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 11.9% from 2021 to 2028. The increasing prevalence of obesity is anticipated to drive market growth. Furthermore, the rise in demand for minimally invasive procedures is anticipated to further boost the market growth.

Obesity is a major health concern across the globe. The obesity pandemic is expected to continue increasing over the forecast period, thus fueling the market growth. For instance, according to the World Health Organization (2016) data, nearly 2 billion individuals were overweight, and out of which around 650 million were obese. In addition, it is estimated that, by 2025, 2.7 billion individuals will be overweight and around 1.0 billion will be obese.

Despite the high prevalence of obesity and the wide acceptance of weight-loss surgical procedures (such as gastric bypass and sleeve gastrectomy) by healthcare professionals, merely 1% or 2% of the obese population is eligible for these surgeries leading to high mortality due to obesity. For instance, according to World Health Organization data, globally, nearly 2.8 million individuals die each year due to obesity or overweight. This high mortality is anticipated to fuel demand for alternate and minimally invasive procedures such as an intragastric balloon.

The American Society for Metabolic and Bariatric Surgery (ASMBS) included the intragastric balloon in the list of procedures and devices approved by the society as a treatment option, in 2017. The sanction and endorsements of this treatment by the ASMBS is anticipated to increase the adoption of intragastric balloons.

The high costs and procedural complications associated with aspiration therapy and neuroblocking therapy is anticipated to increase the demand for intragastric balloons. Furthermore, the development of novel intragastric balloons to overcome the shortcomings of conventional balloons is anticipated to further boost market demand. For instance, the magnetic soft endoscopic capsule-inflated intragastric balloon developed in collaboration with Nanyang Technological University, Singapore, is a biocompatible, acid-resistant and robot system for weight loss, thus reducing the need for complex insertion tools and the likelihood of adverse effects.

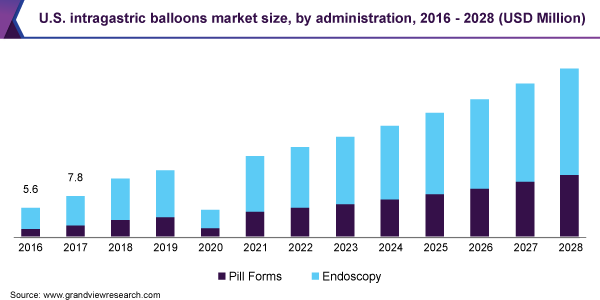

Administration Insights

The endoscopy segment dominated the market for the intragastric balloon and held the largest revenue share of 69.8% in 2020. Emerging endoscopic technologies are able to reproduce the few of the anatomic modifications performed during weight loss surgery and are equally effective. In addition, endoscopic technologies are less invasive and cost-effective when compared to bariatric surgery. These factors are anticipated to contribute towards segment growth.

The pill form segment is anticipated to witness lucrative growth over the forecast period. This can be attributed to the non-surgical nature of the technique, reversible treatment, and availability of swallowable capsule which enables easy ingestion and excretion of the intragastric balloon.

Filling Material Insights

The saline-filled segment dominated the market for the intragastric balloon and held the largest revenue share of 71.1% in 2020 due to the high product availability and significant weight loss produced by these systems. The gas-filled intragastric balloons segment is anticipated to grow at a rapid pace over the forecast period. The adverse events reported due to the use of saline-filled intragastric balloons are driving the demand for alternatives such as gas-filled intragastric balloons.

Balloon Type Insights

The single segment dominated the market for the intragastric balloon and held the largest revenue share of 75.2% in 2020 and the triple segment is anticipated to witness lucrative growth over the forecast period. The single intragastric balloon segment held the largest revenue share owing to the availability of a large number of products in the market and scientific evidence supporting its safety and efficacy. The benefits offered by the existing triple balloon system, such as minimal downtime and fully reversible treatment, are anticipated to increase the demand for this type of intragastric balloon.

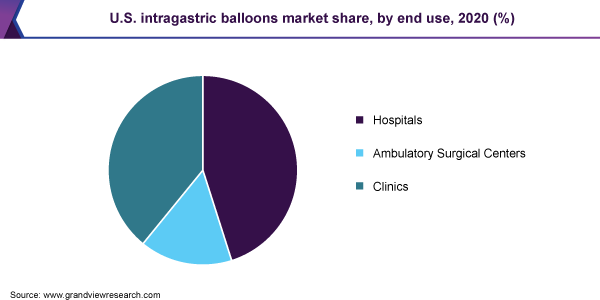

End-use Insights

The hospital segment dominated the market for the intragastric balloon and held the largest revenue share of 44.8% in 2020. This can be attributed to the availability of skilled professionals and the presence of sophisticated equipment in hospital settings. In addition, the availability of a large number of weight-loss treatment options requiring hospital stay is anticipated to contribute towards segment share.

Ambulatory surgical centers are anticipated to witness rapid growth over the forecast period due to high costs of hospitalization, rise in demand for minimally invasive procedures and treatment options.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 36.3% in 2020 in the intragastric balloons market. The high prevalence of obesity, availability of skilled professionals, and high adoption of weight loss treatments are some of the major factors contributing to the growth of the market in this region.

In Asia Pacific, the market for the intragastric balloon is expected to expand at a rapid pace over the forecast period. An increase in the number of obese populations, rise in an unhealthy lifestyle, and availability of treatment at relatively low cost in this region are some of the major factors driving the market in the region.

Key Companies & Market Size Insights

Mergers and acquisition, divestments, and new product development and launch are the key strategies adopted by the established market players while some emerging players are involved in obtaining funding for their product development and lunch. For instance, in 2020, Allurion Technologies Inc. raised nearly USD 34 million to facilitate the launch of its swallowable weight loss balloon. Some of the prominent players in the intragastric balloons market include:

-

Apollo Endosurgery, Inc.

-

Obalon Therapeutics, Inc.

-

Allurion Technologies, Inc.

-

Spatz3

-

Helioscopie

-

Endalis

-

MEDSIL

-

ReShape Medical, Inc.

-

Lexel Medical

Intragastric Balloons Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 45.7 million

Revenue forecast in 2028

USD 100.2 million

Growth rate

CAGR of 11.9% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Administration, balloon type, filling material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Switzerland; Belgium; Poland; The Netherlands; Turkey; Japan; China; India; Philippines; Australia; Thailand; South Korea; Indonesia; Malaysia; Singapore; Brazil; Mexico; Argentina; Chile; Colombia; UAE; South Africa; Saudi Arabia; Israel; Egypt

Key companies profiled

Apollo Endosurgery, Inc.; Obalon Therapeutics, Inc.; Allurion Technologies, Inc.; Spatz3; Helioscopie; Endalis; MEDSIL; ReShape Medical, Inc.; Lexel Medical

Customization Scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the intragastric balloons market on the basis of administration, balloon type, filling material, end-use, and region:

-

Administration Outlook (Revenue, USD Million, 2016 - 2028)

-

Pill Form

-

Endoscopy

-

-

Balloon Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Single

-

Dual

-

Triple

-

-

Filling Material Outlook (Revenue, USD Million, 2016 - 2028)

-

Saline Filled

-

Gas Filled

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Clinics

-

Ambulatory surgical centers

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

Belgium

-

Switzerland

-

Turkey

-

Poland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Malaysia

-

Philippines

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Chile

-

Colombia

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global intragastric balloons market size was estimated at USD 14.9 million in 2020 and is expected to reach USD 45.7 million in 2021.

b. The global intragastric balloons market is expected to grow at a compound annual growth rate of 11.9% from 2021 to 2028 to reach USD 100.2 million by 2028.

b. North America dominated the intragastric balloons market with a share of xx% in 2019. This is attributable to the rising high prevalence of obesity, availability of skilled professionals, and high adoption of weight loss treatments.

b. Some key players operating in the intragastric balloons market include Apollo Endosurgery, Inc.; Obalon Therapeutics, Inc.; Allurion Technologies, Inc.; Spatz3; Helioscopie; Endalis; MEDSIL; ReShape Medical, Inc.; and Lexel Medical.

b. Key factors that are driving the intragastric balloons market growth include the Increasing prevalence of obesity and the rise in demand for minimally invasive procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."