- Home

- »

- Medical Devices

- »

-

Intraoperative Imaging Market Size And Share Report, 2030GVR Report cover

![Intraoperative Imaging Market Size, Share & Trends Report]()

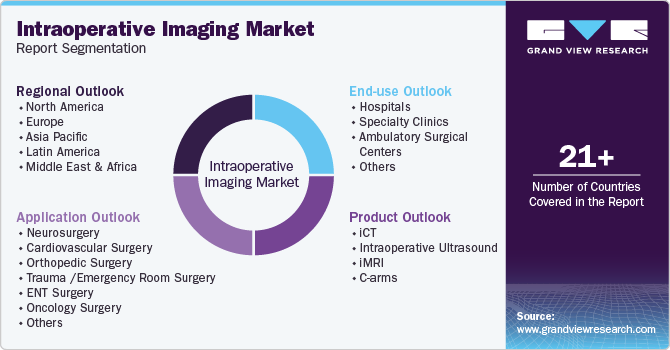

Intraoperative Imaging Market Size, Share & Trends Analysis Report By Product (iCT, iUltrasound, iMRI, C-arm), By Application (Neurosurgery, Orthopedic Surgery), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-484-0

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Intraoperative Imaging Market Size & Trends

The global intraoperative imaging market size was estimated at USD 3.44 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.70% from 2024 to 2030. The market growth can be attributed to an increase in the adoption of minimally invasive surgeries coupled with technological advancements. In addition, the increasing prevalence of chronic disorders and the rise in the geriatric population are major factors contributing to the market growth. The global geriatric population has grown dramatically, putting them at risk for various disorders. According to the WHO, the proportion of people aged 60 years or over in the world will be 1 in 6 by 2030.

Intraoperative imaging has become increasingly popular as an efficient tool for performing more accurate and effective surgeries. This approach not only leads to better patient outcomes but also enhances workflows and efficiencies for healthcare personnel both inside and outside the operating room. Intraoperative imaging technologies, such as iUltrasound, C-arm, and iMRI, have greatly extended surgical possibilities. The ability to see bones and soft tissue with extreme precision has transformed the surgical care of a variety of disorders, including neurology, orthopaedics, cardiology, vascular, and neurology. The constant advances in intraoperative imaging technologies, such as 3D technology and real-time imaging, are expected to boost market expansion. For instance, in March 2021, GE Healthcare received clearance from the FDA for OEC 3D, which is a surgical imaging system that can perform both 3D and 2D imaging. The OEC 3D aims to establish a new standard for intraoperative 3D imaging for spine and orthopedic surgeries by providing accurate volumetric images.

The rising adoption of minimally invasive surgeries that rely heavily on imaging procedures for indirect visualization of the surgical field during the entire procedure is expected to drive market growth. However, market expansion may face obstacles such as the high cost of intraoperative imaging systems and an increasing demand for refurbished imaging systems during the forecast period.

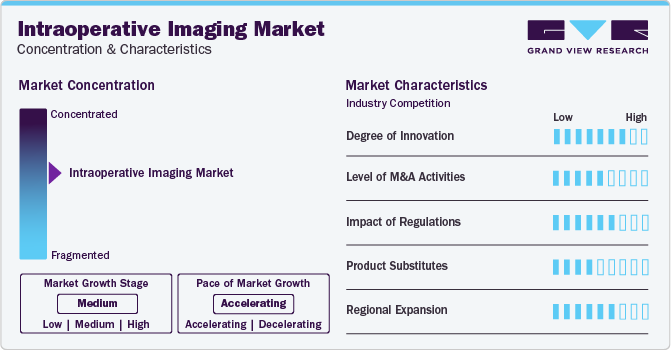

Market Concentration & Characteristics

The market growth has shown consistent growth owing to the growing demand for minimally invasive surgeries and advancements in imaging technology. The capability to perform real-time imaging during surgeries has been shown to reduce complications and enhance patient outcomes, resulting in increased adoption of intraoperative imaging systems in multiple medical specialities.

To expand their market reach and product offerings, companies are actively pursuing product expansion as a strategic approach. For instance, in April 2023, GE Healthcare, announced the availability of bkActiv for guiding urology, colorectal and pelvic floor surgeries. The expansion of the bkActiv system into urology, colorectal and pelvic floor surgeries provides surgeons in these fields the ability to visualize anatomical structures and have greater control throughout the procedure.

Intraoperative imaging has undergone a high degree of innovation, owing to remarkable technological advancements that have positioned it at the forefront of medical diagnostics. Advancements such as artificial intelligence, integrated multimodal imaging approaches, and augmented and virtual reality technologies are key contributors to market growth. Also, there has been a growing interest in developing portable, handheld imaging devices that can be used in a variety of clinical settings, including emergency and trauma situations.

Manufacturers of intraoperative imaging systems are increasingly engaging in integration through merger and acquisition activities. This strategic approach aims to augment technological capabilities, broaden market reach, and ensure competitiveness in the rapidly evolving healthcare landscape.

Regulatory policies have a significant impact on intraoperative imaging devices, as they are instrumental in ensuring patient safety, enhancing the quality of care, and encouraging innovation in the medical devices industry. However, complying with these rules and regulations can prove to be expensive for manufacturers, which may ultimately impact the cost and accessibility of these devices.

The impact of regulatory policies on intraoperative imaging devices is significant. These policies help to ensure patient safety, improve the quality of care, and promote innovation in the field of medical devices. However, complying with these regulations can be costly for device manufacturers and may affect the cost and availability of these devices. In conclusion, regulatory policies play a crucial role in ensuring the safety, efficacy, and quality of intraoperative imaging devices.

The geographical reach of intraoperative imaging has been expanding at a moderate to high level, primarily driven by increased adoption in developed economies such as the U.S. and Japan. However, in underdeveloped or developing economies, the adoption of intraoperative imaging is relatively low due to factors such as limited healthcare access, inadequate regulations, and underdeveloped healthcare infrastructure.

Product Insights

Based on product, the C-arm segment led the market with the largest revenue share of 31.11% in 2023. This is due to its flexibility to move around the patient, allowing it to achieve the best angle for a high-quality image while keeping the patient comfortable. In addition, developments in terms of technology are likely to drive the segment during the forecast period. For instance, in September 2023, Philips launched an image guided therapy mobile c-arm system - Zenition 30, the most recent inclusion in the Zenition mobile C-arm series of the company, known for its exceptional versatility. The Zenition 30 is designed to provide a unique combination of personalized control and image clarity, aimed at enhancing the efficiency of clinical procedures. The platform is built on the proven Zenition platform, which is known for its ease of use and workflow efficiency. At a price point that meets today's economic and business goals, the Zenition 30 is an ideal solution to improve decision-making speed and accuracy in a range of medical procedures.

The iMRI segment is expected to grow at a lucrative CAGR during the forecast period. The iMRI system's provides high-quality images allowing for greater precision in difficult surgeries and providing real-time images, minimizing the chances of inaccuracy and the absence of ionizing radiation. These have aided the development of iMRI as a crucial tool for surgeries. The iMRI is commonly used in neurological surgeries since intraoperative scans allow neurosurgeons to assess anatomical and pathological structures, reduce inaccuracies caused by brain displacement, and update neuronavigational data. In addition to brain surgeries, iMRI is also utilized in various medical fields such as surgical oncology, radiation oncology, and ophthalmology.

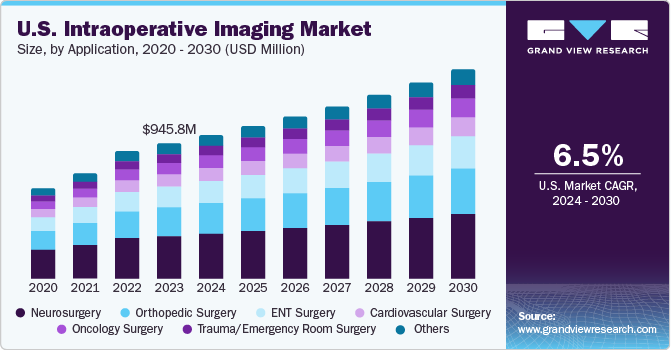

Application Insights

In terms of application, the neurosurgery segment led the market with the largest revenue share of 30.92% in 2023. As a result of the increasing burden of neurological disorders, including epilepsy, stroke, Parkinson's disease, migraine, brain tumours, multiple sclerosis, Alzheimer's disease, and other dementias. For instance, according to a report published by WHO in February 2023, epilepsy is a prevalent neurological condition, affecting around 50 million people across the globe. Intraoperative imaging results are life-changing, allowing neurosurgeons to operate with better precision and accuracy, minimizing the need for additional procedures, and preventing patients from contracting an infection while transferring in and out of the operating room.

The orthopedic surgery segment is expected to grow at a CAGR of 7.57% during the forecast period. The rising cases of road traffic accidents is the major factor contributing to the segment growth. According to the WHO, the economic cost of road traffic accidents is significant, with most countries losing around 3% of their gross domestic product (GDP) due to such crashes. With the rise in orthopedic surgeries, the use of intraoperative imaging systems is expected to increase as well. As these imaging systems provide real-time guidance during surgeries, resulting in improved surgical outcomes.

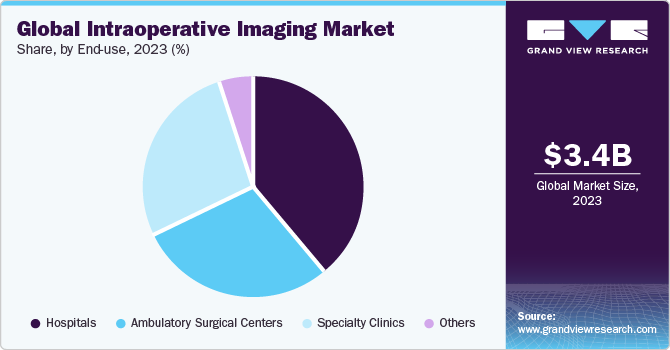

End-use Insights

Based on end-use, the hospital segment led the market with the largest revenue share of 39.17% in 2023 and is expected to continue its dominance during the forecast period. This can be attributed to the increase in adoption of technologically advanced intraoperative imaging systems in hospitals for better patient outcomes. For instance, in July 2022, the Helena Theurer Pavilion at Hackensack Meridian Hackensack University Medical Center has installed an intraoperative magnetic resonance imaging (MRI) system, thereby becoming the first hospital in New Jersey to acquire this system.The addition of this innovative technology is expected to enhance the surgical care provided by the hospital to patients who are suffering from brain tumours.

The ambulatory surgical centers segment is expected to grow at a fastest CAGR over the forecast period 2024 to 2030, primarily due to the increasing adoption of advanced technologies by these centers. One of the major benefits of ASCs is that they are comparatively more affordable for patients and insurance providers, as they do not require patients to stay overnight. This advantage can significantly reduce the overall healthcare costs for patients. Another significant advantage of ASCs is that they generally have a lower risk of infections as compared to hospitals, mainly because they are smaller and less crowded. In addition, patients usually experience shorter waiting times and a more streamlined experience in ASCs.

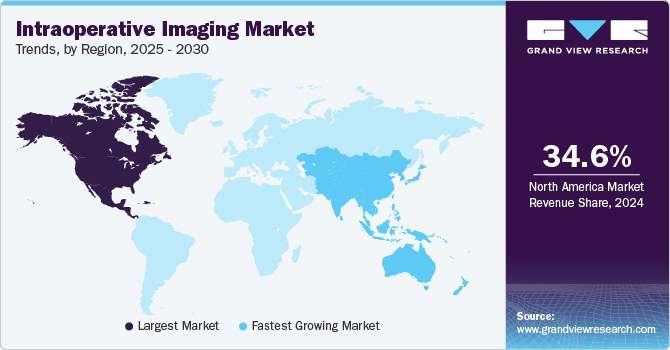

Regional Insights

North America dominated the market with the revenue share of 34.7% in 2023, as there is a presence of a significant number of market players in the region and their constant efforts in developing new products, investing in acquisitions, and R&D activities to support easy operations and ensure the availability of authentic medical-grade imaging systems is expected to boost the market growth. For instance, in April 2021, Activ Surgical, a digital surgery pioneer based in the U.S., announced the U.S. Food and Drug Administration (FDA) clearance of the company's ActivSight Intraoperative Imaging Module for enhanced surgical visualization. This imaging module offers surgeons real-time intraoperative visual data and imaging, hence improving patient outcomes and operating room safety.

The U.S. market is expected to grow the fastest CAGR over the forecast period due to the increasing prevalence of chronic disorders, as well as the presence of key players who are focusing on innovation and developing imaging technology with the aim of improving visualization and efficiency during surgical procedures.

The Europe market is expected to grow the lucrative CAGR during the forecast period. The growth can be attributed to the increasing awareness about early disease diagnosis and the growing preference for surgeries. These factors are expected to be the major contributors to the market growth.

The UK market is expected to grow fastest CAGR over the forecast period owing to its leading position as a supplier of various diagnostic and surgical equipment such as intraoperative imaging, dental, and orthopedic applications. This is expected to generate sales and boost the UK market in the coming years.

The France market is expected to grow the fastest CAGR over the forecast period due to the increasing incidence of chronic illnesses such as cancer, cardiovascular diseases, and neurological conditions that may necessitate surgical procedures.

The Germany market is expected to grow the fastest CAGR over the forecast period due to the increasing adoption of technologically advanced medical imaging devices by hospitals and clinics. With the advancements in medical technology, there is a growing demand for this equipment, and more hospitals and clinics are expected to invest in it in the future.

In Asia Pacific, the market is estimated to witness the fastest CAGR during the forecast period, due to the growing need for advanced imaging equipment in the region. Additionally, the increasing prevalence of chronic disorders, coupled with the rising geriatric population, is expected to boost the market growth in the region. As per UNFPA, the geriatric population in the region will triple between 2010 and 2050, reaching close to 1.3 billion people.

Key Intraoperative Imaging Company Insights

The key players are working to improve their product offerings by upgrading their products, leveraging important cooperative drives, as well as considering acquisitions and government approvals to increase their client base and get a larger part of the entire industry. For instance, In January 2023, GE Healthcare announced that it will acquire IMACTIS to enhance its capabilities in interventional guidance. This strategic move aims to strengthen their overall portfolio and expand their offerings in the interventional imaging space. This acquisition is a shows GE Healthcare's commitment to executing its strategy of enabling precision care and driving growth.

Key Intraoperative Imaging Companies:

The following are the leading companies in the intraoperative imaging market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these intraoperative imaging companies are analyzed to map the supply network.

- GE HealthCare

- Siemens Healthcare GmbH

- Medtronic plc

- Koninklijke Philips N.V.

- Canon Medical Systems Corporation

- Shimadzu Corporation (Medical Systems)

- Brainlab AG

- Ziehm Imaging GmbH

- IMRIS

- NeuroLogica Corp.

Recent Developments

-

In September 2023, a strategic collaboration for research and product development programs has been announced by Mayo Clinic and GE HealthCare. The objective of this collaboration is to revolutionize the experience of patients and clinicians in the field of radiology and to facilitate the delivery of innovative therapies

-

In October 2023, a new cranial stabilization system has been launched in the market by IMRIS and Black Forest Medical Group. This innovative system is specifically designed to facilitate intraoperative MRI imaging in neurosurgical applications

-

In November 2022, Canon, Inc. decided to establish an entirely new subsidiary, which would be called Canon Healthcare USA, INC. Canon boosted the development of medical business by expanding its position in the American medical market

Intraoperative Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.66 billion

Revenue forecast in 2030

USD 5.41 billion

Growth rate

CAGR of 6.70 % from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE HealthCare; Siemens Healthcare GmbH;

Medtronic plc; Koninklijke Philips N.V.; Canon Medical Systems Corporation; Shimadzu Corporation (Medical Systems); Brainlab AG; Ziehm Imaging GmbH; IMRIS; NeuroLogica Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intraoperative Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global intraoperative imaging market report based on the product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

iCT

-

Intraoperative Ultrasound

-

iMRI

-

C-arms

-

X-ray

-

Intraoperative Optical Imaging

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgery

-

Cardiovascular Surgery

-

Orthopedic Surgery

-

Trauma /Emergency Room Surgery

-

ENT Surgery

-

Oncology Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intraoperative imaging market size was estimated at USD 3.44 billion in 2023 and is expected to reach USD 3.66 billion in 2024.

b. The global intraoperative imaging market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 5.41 billion by 2030.

b. The neurosurgery segment dominated the intraoperative imaging market with a share of 30.92% in 2023. This is attributable to the increasing prevalence of neurological disorders.

b. Some key players operating in the intraoperative imaging market include GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., Medtronic, IMRIS, Ziehm Imaging GmbH, Brainlab AG, Shimadzu Corporation, and NeuroLogica Corp.

b. Key factors that are driving the intraoperative imaging market growth include a growing number of complex surgeries performed globally and the rising demand for minimally invasive solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."