- Home

- »

- Advanced Interior Materials

- »

-

Investment Casting Market Share Analysis, Industry Report, 2023 - 2030GVR Report cover

![Investment Casting Market Size, Share & Trends Report]()

Investment Casting Market Size, Share & Trends Analysis Report By Application (Aerospace & Defense, Oil & Gas, Mechanical Engineering, Automotive), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-896-1

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

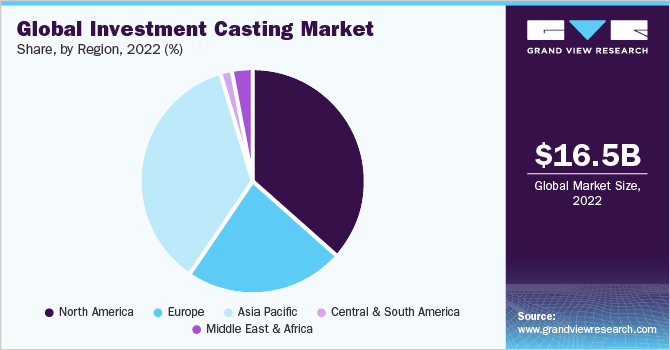

The global investment casting market size was valued at USD 16.55 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 5.0% from 2023 to 2030. An increase in air passenger traffic is projected to assist in the production of new commercial aircraft creating a positive impact on the demand for investment cast products. The increase in passenger traffic is closely attributed to the increasing per capita income and positive GDP across the globe, which has increased the demand for new commercial aircraft. For instance, in 2021, Airbus delivered 611 commercial aircraft, which was 8% more than in 2020. Similarly, Boeing delivered 340 commercial aircraft in 2021. The U.S has recovered from the economic contraction in 2020 caused by the COVID-19 pandemic. The economy’s real GDP increased by 5.7% in 2021 from a decrease of 3.4% in 2020.

The growth is attributed to investments and relief packages provided by the government to various industries including construction, automotive, defense & aerospace, railways, infrastructure, transportation, and medical. This, in turn, is expected to positively impact the market growth in the said forecast period.

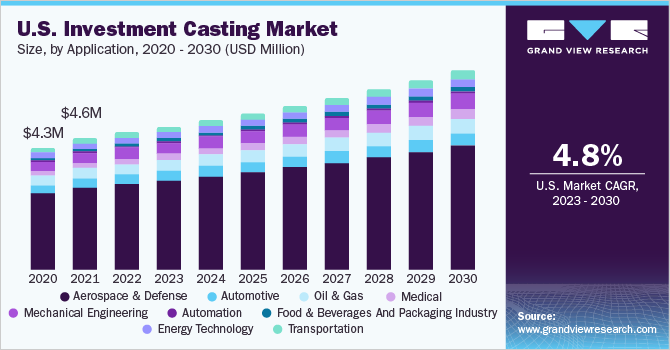

In the U.S., aerospace & defense emerged as a dominant segment in 2022 and accounted for a revenue share of more than 62.0%. Owing to the rise in demand for satellites and commercial & private jets, key players in the aerospace industry are opening new plants to cater to the demand. For instance, in October, Saab AB open its new aerospace plant in West Lafayette, Indiana.

The medical sector is another rapidly growing application segment of the market. The national health expenditure of the U.S. grew by 9.7% to reach USD 4.1 trillion in 2020, which was 19.7% of the country’s GDP. The hospital expenditure grew by 6.4%, which amounted to USD 1,270 billion in 2020. The growing investment in the medical industry is expected to propel the demand for investment cast products in the said forecast period.

Automation integration in the investment casting process, for example, is anticipated to enable manufacturers to optimize efficiency and minimize lead time. Multiple robotic arms are increasingly being used by large-scale factories to accomplish tasks such as wax model design, wax removal, and shell manufacturing. Manufacturers are expected to increase capacity utilization and efficiency because of the shift toward automation.

Application Insights

Based on application, aerospace & defense accounted for a revenue share of over 45.0% in 2022 of the global market. Investment cast products are majorly used in the aerospace industry to offer a wide range of critical applications. Highly engineered castings such as cable clamps, ball bearings, fuel valves, fuel manifolds, landing gear, brake systems, pitot probes, and other sensors are manufactured using the investment casting process.

The mechanical engineering industry is one of the primary capital goods suppliers and finds extensive demand. A rapid growth in production activities is anticipated to complement industry growth, thereby augmenting the demand for investment castings over the forecast period. Agricultural equipment with high durability and long life cycles for robust agricultural applications are manufactured using investment casting technology.

The increasing demand for shale gas is anticipated to further drive the demand for investment cast parts over the forecast period. Highly engineered cast products are utilized for land and offshore drilling operations as well as hydraulic fracturing applications. In addition, compressor components, impellers, valve components, flanges, electrical equipment & fittings, connectors, and housings used in the oil & gas industry are manufactured using investment castings.

Regional Insights

The Asia Pacific held a share of over 35.0, in terms of revenue, of the global market. The demand in the region is primarily driven by the sustainable growth of the automotive, aerospace, and industrial machinery manufacturing sectors. The region is the largest supplier of investment cast products owing to the presence of numerous small-scale and medium-scale manufacturers.

China is the largest producer of investment casting components in the Asia Pacific with over 1,500 foundries producing parts for the automotive and aerospace sectors. Japan is one of the emerging producers of investment cast parts given the presence of foundries for automotive turbochargers, gas turbines, and biomedical applications, whereas South Korea exhibits an increased product demand in the automotive industry.

Europe is anticipated to grow at a CAGR of 4.4% over the forecast period. The region has observed an increase in the use of new-generation alloys in aircraft components due to their ability to withstand high temperatures, which is likely to increase their usage in commercial and military types of aircraft. Rising penetration of the technology in the manufacturing of high-performance alloy parts is expected to drive the demand for investment casting in Europe’s aerospace segment over the projected period.

North America dominated the market and accounted for the highest revenue share of over 36.6% in 2022. This is due to the widespread use of investment casting for producing high-value-added parts for various industries such as aerospace & defense, oil & gas, and medical industries.

Key Companies & Market Share Insights

The leading market players have positioned themselves strongly by offering a wide range of investment cast products with various designs, materials, and specifications. Companies always tend to offer products using innovative and advanced methods to cope with customer demands.

The new entrants or emerging players, especially in developing economies, are likely to gain opportunities to establish themselves in the global investment casting industry. Rising foreign investments and increasing government initiatives for the development of the automotive sector, mostly in India, Taiwan, and China, are expected to boost market growth over the forecast period.Some prominent players in the global investment casting market include:

-

Arconic, Inc.

-

Doncasters Group Ltd.

-

Hitachi Metals, Ltd.

-

MetalTek International

-

Signicast

-

Precision Castparts Corp (Berkshire Hathaway)

-

Zollern GmbH and Co. KG

-

Impro Precision Industries Limited

Investment Casting Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.31 billion

Revenue forecast in 2030

USD 24.52 billion

Growth rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; France; Russia; U.K.; Italy; Spain; China; Japan; South Korea; India; Singapore; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Arconic, Inc.; Doncasters Group Ltd.; Hitachi Metals, Ltd.; MetalTek International; Signicast; Precision Castparts Corp (Berkshire Hathaway); Zollern GmbH and Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Investment Casting Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global investment casting market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Oil & Gas

-

Medical

-

Mechanical Engineering

-

Automation

-

Food & Beverages And Packaging Industry

-

Energy Technology

-

Transportation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Russia

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global investment casting market size was estimated at USD 16.55 billion in 2022 and is expected to reach USD 17.31 billion in 2023.

b. The investment casting market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 24.52 billion by 2030.

b. Aerospace & defense dominated the investment casting market with a revenue share of 45.9% in 2022. The large share of the segment is attributable to ability of investment casting process to produce complex components along with design flexibility, consistent dimensional accuracy, and high production rates.

b. Some of the key players operating in the investment casting market include Arconic, Inc., Doncasters Group Ltd., Hitachi Metals, Ltd., MetalTek International, Signicast, Precision Castparts Corp (Berkshire Hathaway), Zollern GmbH and Co. KG, and Impro Precision Industries Limited, among others.

b. Increasing production activities in aerospace & defense segment coupled with rising demand from industries such as medical, energy, and mechanical engineering are the key drivers for the investment casting market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."