- Home

- »

- Agrochemicals & Fertilizers

- »

-

Integrated Pest Management Pheromones Market ReportGVR Report cover

![Integrated Pest Management Pheromones Market Size, Share & Trends Report]()

Integrated Pest Management Pheromones Market Size, Share & Trends Analysis Report By Product (Sex Pheromones, Aggregation Pheromones, Alarm Pheromones), By Mode Of Application, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-323-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Report Overview

The global integrated pest management pheromones market size was valued at USD 910.7 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. Growing awareness regarding food security and concerns about the ill effects of synthetic crop protection chemicals are expected to drive the market. Integrated Pest Management (IPM) pheromones are considered clean and eco-friendly as compared to pesticides. IPM pheromones belong to the category of products that are used to trap, catch, or kill pesticides, mainly during agricultural activities, and are considered clean and eco-friendly as compared to pesticides.

Penetration of IPM pheromones in developing agro-economies, such as India, China, Brazil, and Thailand, is less as compared to other pesticides. It is one of the major factors restraining market growth. The long-term usage of pesticides, along with their effective results, restricts the adoption of new techniques by farmers. Governments across the globe are undertaking initiatives to educate farmers and cultivators regarding the benefits of IPM pheromones.

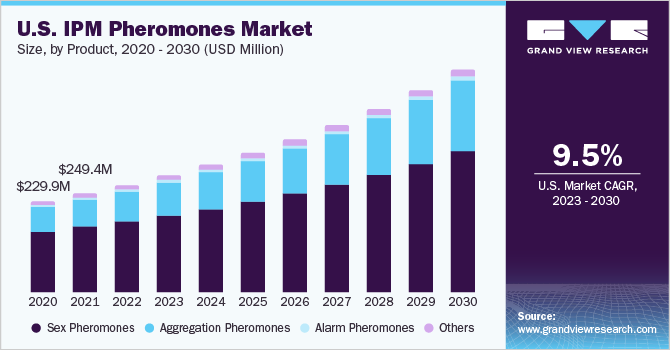

Globally, North America is the largest regional market in terms of the consumption of IPM pheromones on account of significant demand from the U.S. Sex pheromones emerged as the leading integrated pest management pheromone in the U.S. and accounted for a share of above 66% in 2022.

The U.S. government is taking initiatives to improve the agriculture sector of the country, which is anticipated to boost demand for IPM pheromones. The Federal IPM Coordinating Committee was established in 2001 by the United States Department of Agriculture (USDA) that provides interagency guidance on integrated pest management policies, programs, and budgets.

The USDA is also taking up an initiative to implement pest management on farms, homes, landscapes, and other structures. The goal is to implement integrated pest management practices on about 75.0% of the nation’s crop production. The U.S. is also one of the major exporters of agricultural products and hence farmers and government organizations are focusing on the development of sustainable farming techniques.

Incorporation of integrated pest management technology in crop protection offers a variety of benefits to farmers, environment, and pest management organizations. The application of integrated pest management techniques reduces the farmer’s economic risk while promoting low-cost pest management practices. It reduces the health risk of the field workers by encouraging the adoption of best management practices. The reduction in crop and land destruction is anticipated to propel the demand for IPM pheromones during the forecast period.

A significant obstacle in the large-scale implementation of IPM pheromones is their restricted use as an insecticide for specific targets. In the crop protection scenario, insecticide application is known to affect non-targeted species to a large extent. To target a wide number of species, suppliers of IPM pheromones need to extensively invest in R&D activities to identify and target different pests.

Product Insights

Major IPM pheromones are sex, aggregation, and alarm pheromones. Sex pheromones dominated the market with a revenue share of more than 66% in 2022. This is attributed to its wide usage in controlling insect population in the field. These pest management pheromones are considered highly effective for pest management as they curb mating disruption and larvae multiplication on crops and trees.

Sex pheromones are primarily extracted from female insects to attract males for mating as they deposit larvae eggs on crops, which then feed on crops, thereby negatively impacting yield. The Codling Moth Areawide Management Program (CAMP) was one of the first programs initiated in 1995 by the USDA for the control and management of Cydia Pomonella by mating disruption. It was undertaken to reduce the usage of conventional insecticides by 80% in five years.

Alarm pheromones exhibit low penetration and are anticipated to register a moderate CAGR of 5.9% from 2023 to 2030. These pest management pheromones are emitted by insects in response to approaching predators or rapid changes in the immediate environment. They are not useful in removing pests from a food source as they can only deter insects from reaching them.

Mode of Application Insights

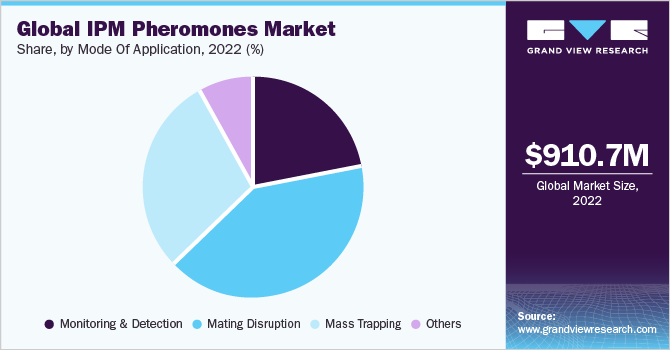

The application modes of pheromones include monitoring & detection, mass trapping, mating disruption, and others such as push-pull strategy and biological control. Mating disruption application dominated the market with a revenue share of over 41% in 2022. In mating disruption technology, male insects are confused by producing artificial dispensers, which delays their mating and reproduction of pests.

Sex pheromones are largely used in mating disruption activities due to their ability to disrupt the behavior of male insects affecting the development of moths. However, one of the major disadvantages of mating disruption is that it is a targeted pest management technique and can only be used for certain species of moths. Mating disruption turns out to be ineffective in areas where the population of moths is too high.

Monitoring and detection is anticipated to expand at a CAGR of 7.9% during the forecast period. This application technique is considered to be an initial step of pest management as it helps in analyzing the type and quantity of pests in the field. It is also considered to be one of the early warning detection programs, where monitoring logs are used to analyze the data regarding pests.

Application Insights

Agriculture dominated the application segment with a revenue share of more than 82% in 2022. This is attributed to the growing trend of sustainable farming, along with stringent regulations on the usage of pesticides across the globe, which is anticipated to drive demand for IPM pheromones in this sector.

Inadequate knowledge among the farmers about the appropriate use of IPM pheromones is affecting product demand. However, outreach programs undertaken by the local governments are increasing awareness regarding the benefits of IPM pheromones among farmers in developing countries, such as China, India, and Indonesia. This is eventually fueling the product demand in the agricultural sector.

Some of the other applications of IPM pheromones are turf development, landscape gardening, and horticulture. The penetration of these pest management pheromones is low in these applications owing to the availability of low-cost substitutes. IPM pheromones are majorly used as insecticides and hence are likely to be less popular as compared to other agrochemicals.

Regional Insights

North America region dominated the market with a revenue share of more than 40% in 2022. This is attributed to the rising demand for IPM pheromones in the agricultural sector of North America as farming has become mechanized and heavily dependent upon an integrated system for supporting agribusinesses.

Farmers in North America have started adopting improved technologies, such as IPM, chemical and biofertilizers, and grain elevators. The growing need for effective pest management techniques to develop specialized crops has compelled many farmers to adopt integrated pest management programs for crop protection.

Adoption of the precision farming initiative by the federal government in Canada to develop ecological and economy-friendly methods is expected to provide avenues for the market during the forecast period. Under Budget 2017, the Canadian government allocated USD 70 million to support innovation in the agriculture and food industry. An additional investment of USD 25 million in agricultural technologies was also approved under budget 2017.

Europe is the second largest market and is anticipated to exhibit a CAGR of 7.1% from 2023 to 2030 due to the rising demand in countries, such as Spain, Italy, and the UK. The government bodies in the country are adopting several environmental quality objectives that are aimed at promoting biodiversity, which includes stringent regulations against pesticides.

Key Companies & Market Share Insights

Key players operating in the integrated pest management pheromones market are currently focusing on increasing product awareness by enhancing their footprint, innovation, product varieties, and R&D activities. Factors such as increasing demand for food crops and rising awareness about sustainable methods for pest management are expected to drive the market. Some of the major market players are Active IPM, Russell IPM, and AgbiTech.

A large number of companies are focusing on obtaining government approvals for the application of the product. Regulatory approval forms an important component of market competition. Industry participants are making significant investments in new product development to target new regions and improve their offerings. Some of the prominent players in the global integrated pest management pheromones market include:

-

Active IPM

-

Agrichembio

-

AgriSense-BCS Ltd.

-

Laboratorio Agrochem, S.L.

-

ATGC Biotech

-

Atlas Agro

-

Russell IPM

-

Hercon Environmental Corporation

-

Semios

-

Shin-Etsu

-

Sumi Agro France

-

Syngenta Bioline Ltd.

-

Trécé, Inc.

Integrated Pest Management Pheromones Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 977.7 million

Revenue forecast in 2030

USD 1,682.1 million

Growth rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode of application, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Indonesia; Brazil; Argentina; Egypt

Key companies profiled

Active IPM; AgrichemBio; AgriSense-BCS Ltd.; Laboratorio Agrochem, S.L.; ATGC Biotech; Atlas Agro; Russell IPM; Hercon Environmental Corporation; SemiosBIO Technologies; Shin-Etsu; Sumi Agro France; Syngenta Bioline Ltd.; Trécé, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Integrated Pest Management Pheromones Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global integrated pest management pheromones market report based on the product, mode of application, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sex Pheromones

-

Aggregation Pheromones

-

Alarm Pheromones

-

Others

-

-

Mode of Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Monitoring & Detection

-

Mating Disruption

-

Mass Trapping

- Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global integrated pest management pheromones market size was estimated at USD 910.7 million in 2022 and is expected to reach USD 977.7 million in 2023.

b. The global integrated pest management pheromones market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 1,682.1 million by 2030

b. North America dominated the IPM pheromones market with a share of 40.77% in 2022. This is attributable to high dependence on an integrated system for supporting agribusinesses.

b. Some key players operating in the integrated pest management pheromones market include Active IPM, Russell IPM, AgrichemBio, AgriSense-BCS Ltd., Laboratorio Agrochem, S.L., ATGC Biotech, Hercon Environmental Corporation, SemiosBIO Technologies, Shin-Etsu, Sumi Agro France, Syngenta Bioline Ltd., Trécé, Inc., and AgbiTech.

b. Key factors that are driving the market growth include rising awareness about benefits of IPM Pheromones and growth in commercial agriculture across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."