- Home

- »

- Advanced Interior Materials

- »

-

Global Iron Ore Pellets Market Size Report, 2020-2027GVR Report cover

![Iron Ore Pellets Market Size, Share & Trends Report]()

Iron Ore Pellets Market Size, Share & Trends Analysis Report By Product (Blast Furnace, Direct Reduced), By Trade (Captive, Seaborne), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-594-6

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Advanced Materials

Report Overview

The global iron ore pellets market size was valued at USD 47.63 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2020 to 2027. Expanding steel production in developing economies of Asia Pacific, such as India, China, and Vietnam, is a crucial factor expected to fuel market growth over the coming years. Iron ore pellets are spherical balls of iron ore that are used in steel manufacturing. The lockdown imposed across several countries across the globe due to the COVID-19 pandemic at the end of 2019 has halted the manufacturing activities, thereby severely affecting the iron pellet demand in the first half of 2020. However, according to several economic analysts, the global economy is likely to witness a big rebound from 2021, which is likely to spur the iron ore pellets industry growth in the near future.

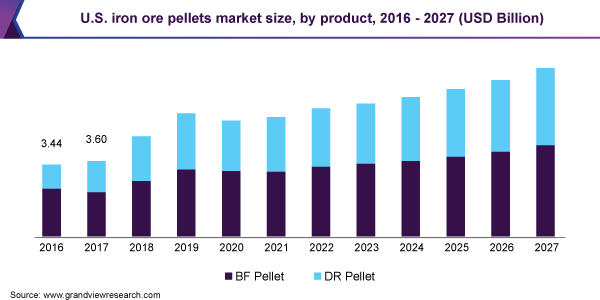

In 2018, demand for iron ore pellets in the U.S. benefitted from improved steel production that was driven by strong economic growth, high government-led fiscal stimulus, and strong business confidence. In 2019, demand for iron ore pellets in the country witnessed moderate growth due to steady growth in steel production.

The primary end-use industries of steel include construction and automotive industries. These industries play a major role in indirectly shaping the iron ore pellet demand as it is one of the primary raw materials used for steel manufacturing. Until 2020, the global construction sector witnessed strong growth that resulted in rising crude steel production, especially in China and other Asian countries, like India.

In the first half of 2020, due to the COVID-19 pandemic, government imposed restrictions in most of the construction activities severely hindered the steel production. However, according to the World Steel Association, the construction sector is likely to gain a major boost in the second half of 2020 in various regions due to government stimulus plans. Moreover, the focus of the governments and international institutions is gradually moving from emergency liquidity provision to economic recovery and support for production, infrastructure, and industry.

Iron Ore Pellets Market Trends

The demand for iron ore pellets is projected to be driven by steel demand across the key end-use industries. Construction is the largest end-use industry of steel. As per the World Steel Association, construction was valued at over USD 500 billion as of 2019, which was more than 50% of the global steel demand in terms of value.

The growing need for housing, owing to increasing population, is one of the key factors driving the demand for steel. As per World Population Prospects, published by the United Nations, global population is likely to touch 8.6 billion by 2030. This, in turn, is projected to boost demand for new homes, thus, contributing to the growth of steel and iron ore pellets.

The use of steel in the automotive sector is projected to push the demand for iron ore pellets over the coming years. The automotive industry is projected to grow on account of easy access to credit facilities and increasing need amongst people to own a vehicle. The demand for automobiles has been especially witnessing an upward trend in emerging economies such as India and China.

Steel products such as pipes & tubes are widely used in the oil & gas sector. Steel pipes are used for the transportation of gas & liquid, while steel tubes are used in concrete pilings, bearing casings, and conveyor belt rollers, among other applications. Growth of the oil & gas sector owing to rise in energy demand is projected to boost the demand for steel and consequently, drive iron ore pellets demand.

The use of aluminum as a substitute to steel, mainly in automotive applications, is projected to restrain the demand for steel, thus impacting the growth of the iron ore pellets market. Carbon fibers are also widely being used in the automotive industry due to their lightness, high strength, and load-bearing properties. Automobile manufacturers are under increasing pressure to meet the regulatory requirements pertaining to the environmental impact of vehicles.

Corporate Average Fuel Economy (CAFE) regulation initiated in the U.S. has doubled its target for average fuel efficiency from 2012 to 2025 owing to increasing emission of greenhouse gases. Similarly, the European Union is also enhancing its standards to reduce weight and increase the fuel efficiency of vehicles. This has prompted a change in the standards and policies concerning automotive vehicle weight across the globe. Reduction of vehicle weight through the use of lightweight materials such aluminum and carbon are therefore likely to pose a restraint for the iron ore pellets market during the forecast period.

Product Insights

Blast furnace (BF) pellets dominated the market for iron ore pellets in 2019 with a revenue share of 54.4% in 2019. It is a lower grade product when compared to iron pellets used in Direct Reduced (DR) method, and therefore has a lower cost compared to its counterpart. Blast furnace method is usually found in integrated steel plants. Lower cost of these iron ore pellets, coupled with the abundance of integrated steel plants found in developed economies, is the primary factor boosting the growth of the BF segment.

The direct reduced segment is predicted to exhibit the highest CAGR of 3.8% in terms of revenue from 2020 to 2027 owing to its rising demand in emerging economies of Asia Pacific. The operating costs as well as initial capital investments for direct reduction plants are lower than integrated steel plants, and therefore these plants are becoming more popular in developing economies, like India.

Trade Insights

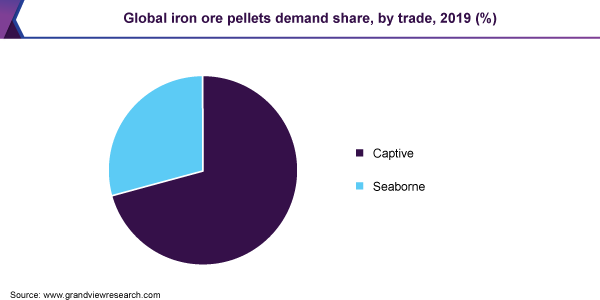

The captive segment dominated the market for iron ore pellets in 2019 with a volume share of 70.8% in 2019. This illustrates that most of the iron ore pellet production is consumed in-house or shipped to nearby customers for steel manufacturing. Most of the major steel companies across the globe such as ArcelorMittal, who account for a major share in global steel production, source their iron ore pellet requirements through their own manufacturing firms.

Seaborne trade is predicted to expand at the fastest CAGR of 4.0% in terms of revenue from 2020 to 2027. This significant growth can be attributed to the increasing demand for iron ore pellets from non-integrated steel manufacturing companies. Trading prices of iron ore pellets in different regions play an important role in determining the size of seaborne trade.

Regional Insights

Asia Pacific held largest share of the iron ore pellets market, with 41.9% in revenue terms in 2020. This trend is anticipated to continue over the forecast period. The growth in the region is attributed to developing economies such as China, India, and Vietnam, who are witnessing increasing spending in manufacturing segment along with other end-use industries and have wide crude steel production industry. The region was impacted as a result of the COVID-19 pandemic. However, countries such as China reported positive recovery by early 2021. The rapid growth in the construction & infrastructural projects in the region are expected to spur the demand for steel, and consequently drive iron ore pellet demand during the forecast period.

China recorded highest crude steel production in 2019 with volume of 996.3 million tons. It is also projected to remain the key consumer of iron ore pellets products in the long run. China accounted for highest share of the global steel market due to its large steel sector and widespread presence of end-use industries in the country.

North America is likely to reflect the highest growth rate during the forecast period, owing to demand from construction, aerospace & defense, and automotive industries. Despite the decline in steel demand in 2020 owing to the COVID-19, the increasing production of Electric Vehicles in the region, and revival of aircraft manufacturing operations is expected to drive steel demand. This is likely to in turn increase the demand for iron ore pellets in the coming years.

The U.S. is the fourth-largest steel producer in the world. Growing population coupled with increasing per capita disposable income of the middle-class population is expected to propel construction spending in residential sector. As per the Organization for Economic Co-operation and Development, the GDP of the U.S. accounted for USD 65,297.5 per capita in 2019 and is projected to grow at 2.4% by 2021. This is likely to prove conducive to the growth of the steel market in the country, thereby creating a positive impact on iron ore pellets market.

Key Companies & Market Share Insights

The market has been characterized by intense competition with some of the major industry players holding a considerable share. Vale and Rio Tinto are among the largest producers of iron ore pellets in the world. The majority of Vale’s iron ore mines are concentrated in Brazil and China. The market for iron ore pellets is largely dictated by multinational players who own established iron ore mines and processing facilities, thereby making entry of new players difficult. Major players focus on long term agreements with steel producers and compete majorly on price and quality. Some of the prominent players in the iron ore pellets market include:

-

Vale

-

Rio Tinto

-

Cleveland-Cliffs

-

BHP Billiton

-

US Steel

-

Fortescue Metals

-

ArcelorMittal

-

Bahrain Steel

-

LKAB

-

NMDC Limited

Iron Ore Pellets Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 45.2 billion

Revenue forecast in 2027

USD 63.5 billion

Growth Rate

CAGR of 3.7% from 2020 to 2027

Market demand in 2020

398,823.0 kilotons

Volume Forecast in 2027

539,164.0 kilotons

Growth Rate

CAGR of 3.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, Revenue in USD million, CAGR from 2020 to 2027

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, trade, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; Russia; China; India; Japan; Brazil; Iran

Key companies profiled

Vale; Rio Tinto; Cleveland-Cliffs; BHP Billiton; US Steel; Fortescue Metals; ArcelorMittal; Bahrain Steel; LKAB; NMDC Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels, and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global iron ore pellets market report on the basis of product, trade, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Blast Furnace (BF) Iron Ore Pellet

-

Direct Reduced (DR) Iron Ore Pellet

-

-

Trade Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Captive

-

Seaborne

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global iron ore pellets market size was estimated at USD 47.6 billion in 2019 and is expected to reach USD 45.1 billion in 2020.

b. The global iron ore pellets market is expected to grow at a compound annual growth rate of 3.7% from 2020 to 2027 to reach USD 63.5 billion by 2027.

b. Asia Pacific dominated the iron ore pellets market with a share of 48.2% in 2019. This is attributable to to large steel manufacturing base of China.

b. Some key players operating in the iron ore pellets market include Vale, Cleveland-Cliffs, ArcelorMittal, Rio Tinto, and BHP Billiton. Vale and Rio Tinto.

b. Key factors that are driving the market growth include the expanding steel production in developing economies of Asia Pacific such as India, China, and Vietnam.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."