- Home

- »

- Biotechnology

- »

-

Isothermal Nucleic Acid Amplification Technology MarketGVR Report cover

![Isothermal Nucleic Acid Amplification Technology Market Size, Share & Trends Report]()

Isothermal Nucleic Acid Amplification Technology Market Size, Share & Trends Analysis Report By Product, By Technology (NASBA, HDA, LAMP, SDA, SPIA, NEAR), By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-588-5

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global isothermal nucleic acid amplification technology (INAAT) market size was valued at USD 4,235.34 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.3% from 2023 to 2030. The Isothermal Nucleic Acid Amplification Technology (INAAT) is experiencing a notable surge in demand as a molecular testing technique, primarily attributed to the growing prevalence of infectious diseases. Tuberculosis, hepatitis, and influenza are among the leading causes of deaths caused by infectious diseases, especially in the developing countries. As a result, demand for rapid, user-friendly, and disease-specific testing options is expected to boost the adoption of INAAT offerings.

Furthermore, the COVID-19 pandemic has positively affected the market growth by expanding the demand for rapid and accurate testing alternatives for the detection of the SARS-CoV-2 virus. Several key players have developed new INAAT-based COVID-19 testing products and have secured emergency use approvals for such products from the U.S. FDA. For instance, commercially available products in this domain include Grifols Diagnostic Solutions Inc.’s Procleix SARS-CoV-2 assay and Lucira Health, Inc.’s Lucira CHECK-IT COVID-19 test kit. Such strategic initiatives fueled by the COVID-19 pandemic are likely to provide a significant stimulus to the market growth in the near future.

Rapid advancements in existing amplification technologies along with the introduction of novel technologies such as Single Primer Isothermal Amplification (SPIA), Loop-Mediated Isothermal Amplification (LAMP), Recombinase Polymerase Amplification (RPA), and Strand Displacement Amplification (SDA) are opening new avenues for applications of INAAT products. For instance, a research paper published in the Analyst Journal in June 2022 demonstrated the development of a smartphone integrated instrument that can rapidly test for Zika virus in a single blood drop using the LAMP technology. Such developments are likely to boost the market penetration of the technique in the near future.

Amplification techniques such as PCR are limited by requirement of instrumentation capable of thermal cycling and temperature control, which limits the applications of the technique for point-of-care applications. This creates significant growth opportunities for isothermal amplification techniques for use in molecular diagnostics, as these techniques have a lower energy demand and enable assay incubation in portable battery-powered devices. Similarly, strategic partnerships between companies that manufacture INAAT diagnostics and associated products are likely to boost market expansion prospects. For instance, Merck KGaA offers custom LAMP primers in partnership with New England Biolabs for applications of LAMP technologies in life sciences research and molecular diagnostics.

However, a critical factor limiting the market growth is the regulatory framework governing the development of INAAT-based diagnostics. Regulatory agencies such as the U.S. FDA, EMEA, and the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan, have stringent protocols for monitoring the manufacturing processes for INAAT production, which increases the challenges associated with INAAT manufacturing. Furthermore, lower awareness levels and uncertainty in regulations for INAAT-based diagnostics lead to restricted commercialization of INAAT products. In addition, the lack of a robust reimbursement framework in developed markets, such as the U.S., can significantly limit the purchasing power of the buyers. Such factors can impede market growth in the over the forecast period.

Product Insights

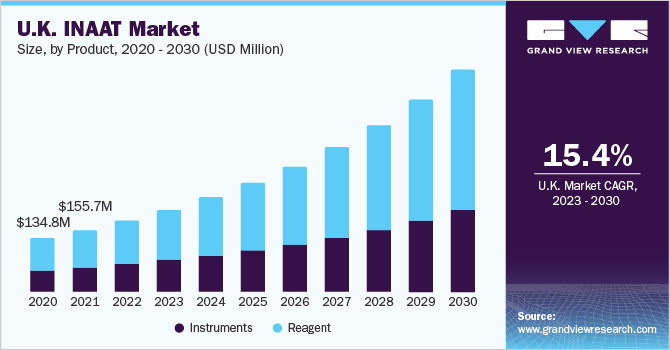

The reagents segment captured market share of 61.62% in 2022 due to their extensive usage in hospitals and primary healthcare settings, as well as increasing availability of polymerases with high strand displacement capabilities. Furthermore, with growth in the market penetration of INAAT diagnostics expected in the near future, adoption of associated reagents is projected to grow at a significant rate over the forecast period.

Instrument segment is estimated to register considerable CAGR owing to rising investments for R&D in development of novel diagnostics for emerging infectious diseases such as COVID-19 are driving an increasing demand for INAAT instruments segment. Similarly, introduction of advanced diagnostic devices with enhanced accuracy, portability, and speed can considerably boost the market prospects for INAAT instruments for prevention of disease outbreaks.

Technology Insights

Loop-mediated isothermal amplification (LAMP) accounted for the largest market share of 16.10% in 2022. The technology enables multiple modes of detection such as use of real-time fluorescence using intercalators, or lateral flow and agarose gel detection. As a result, the technique can detect a broad range of RNA and DNA targets, such as Zika virus and SARS-CoV-2 virus, in human samples. Furthermore, demand for the technique is supported by its tolerance to inhibitors that enables use of crude samples and minimally purified nucleic acids.

The transcription mediated amplification (TMA) technology segment is projected to register fastest CAGR during the forecast period. Demand for this technology is fueled by increasing scientific awareness about its potential benefits, such as requirement of fewer steps and lesser processing time, for blood screening and diagnostic applications. Further, technological advancements along with growing investments by market players are expected to offer favorable environment for segment growth by 2030.

Application Insights

Infectious disease application segment accounted for the dominant share of 35.25% in 2022. Recent introduction of specific INAAT kits, and increasing incidence of HIV, hepatitis A & B, and sexually transmitted diseases are key factors anticipated to fuel the segment growth. Moreover, rising concerns over antimicrobial resistance and increasing focus on prevention of epidemic outbreaks in developing countries is expected to further propel the segment growth.

Blood screening segment is projected to register considerable CAGR during the forecast period. Certain factors such as rising number of blood transfusions and associated blood testing requirements across the globe are likely to have positive impact on the segment growth by 2030. Here, INAAT is widely used for evaluation of blood quality by screening of transfused blood for presence of any infectious organisms. Furthermore, increasing research activities for development of INAAT devices capable of detecting molecular biomarkers and multiple blood-borne pathogens are anticipated to broaden the growth prospects for the market.

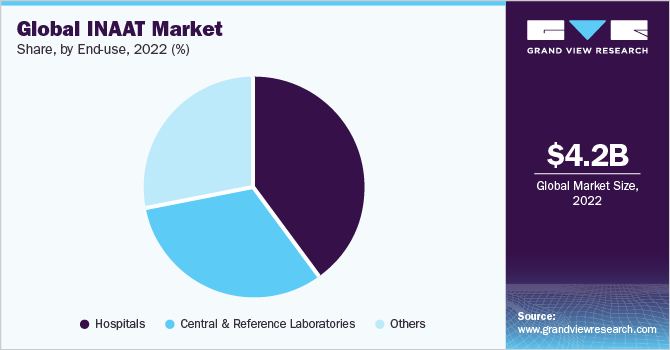

End-use Insights

Hospitals segment held the largest market share of 40.13% in 2022. This can be attributed to the development of miniaturized point-of-care INAAT instruments that enable single-level access for hospital-based analysis. Similarly, increasing throughput and automation offered by such technologies for processing of a large number of samples are expected to boost the segment growth.

Central and reference laboratories end-use segment is expected to exhibit significant growth over the forecast period due to an increasing number of reference laboratories and rising adoption of molecular diagnostic techniques in such laboratories. In addition, increasing funding from various public agencies such as the U.S. CDC and NIH is boosting the adoption of rapid analysis technologies for the mitigation of infectious diseases.

Regional Insights

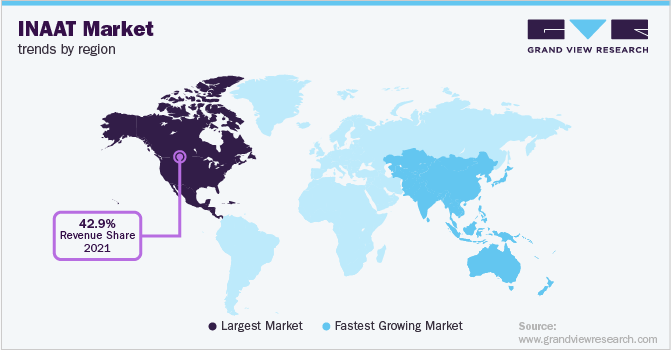

North America held the largest market share in 2022 with revenue share of 42.68% due to the established research infrastructure and growth in demand for nucleic acid amplification-based diagnostics for prevention of infectious diseases in the region. Furthermore, a high per capita expenditure on healthcare and increasing focus on point-of-care diagnostic methods is anticipated to drive the market growth.

Asia Pacific is expected to register the fastest CAGR during the forecast period. The increasing prevalence of chronic conditions, growing involvement of market players in the region and rising investments for research & development are estimated to play a major role in growth of Asia Pacific market during the forecast period.

Key Companies & Market Share Insights

The INAAT market is highly competitive due to the adoption of major strategic initiatives by key players. For instance, in May 2022, Meridian Bioscience, Inc. launched the new Lyo-Ready Direct RNA/DNA LAMP and Lyo-Ready Direct DNA LAMP Saliva Mix master mixes for isothermal amplification applications. Moreover, in February 2023, Sherlock Biosciencesannounced acquisition of Sense Biodetection in order to consolidate its position in the INAAT market. Some of the key players in the global isothermal nucleic acid amplification technology market include:

-

Alere, Inc.

-

bioMerieux SA

-

Eiken Chemical Co. Ltd

-

Hologic Inc.(Gen-Probe)

-

Lucigen

-

Meridian Bioscience, Inc.

-

Ustar Biotechnologies Ltd.

-

QIAGEN

-

Quidel Corporation

-

Thermo Fisher Scientific, Inc.

-

BD (Becton, Dickinson & Company)

-

OptiGene Limited

Isothermal Nucleic Acid Amplification Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4,746.4 million

Revenue forecast in 2030

USD 10,698.6 million

Growth rate

CAGR of 12.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Alere, Inc.; bioMerieux SA; Eiken Chemical Co. Ltd; Hologic Inc.(Gen-Probe); Lucigen; Meridian Bioscience, Inc.; Ustar Biotechnologies Ltd.; QIAGEN; Quidel Corporation; Thermo Fisher Scientific, Inc; BD (Becton, Dickinson & Company); OptiGene Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Isothermal Nucleic Acid Amplification Technology Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global isothermal nucleic acid amplification technology market report on the basis of product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagent

-

-

Technology Outlook, (Revenue, USD Million, 2018 - 2030)

-

NASBA

-

HDA

-

LAMP

-

SDA

-

SPIA

-

NEAR

-

TMA

-

RCA

-

RPA

-

SMAP2

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Screening

-

Infectious Disease Diagnostics

-

Cancer

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Central & Reference Labs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global isothermal nucleic acid amplification technology market size was estimated at USD 4,235.34 million in 2022 and is expected to reach USD 4,746.4 million in 2023.

b. The global isothermal nucleic acid amplification technology market is expected to grow at a compound annual growth rate of 12.3% from 2023 to 2030 to reach USD 10,698.6 million by 2030.

b. North America dominated the isothermal nucleic acid amplification technology market with a share of 42.68% in 2022. This is attributable to rising healthcare awareness coupled with growth in demand for nucleic acid amplification-based diagnostics to prevent infectious diseases in the region.

b. Some key players operating in the isothermal nucleic acid amplification technology market include Alere, Inc.; bioMerieux SA; Eiken Chemical Co. Ltd; Hologic Inc.(Gen-Probe); Lucigen; Meridian Bioscience, Inc.; Ustar Biotechnologies Ltd.; QIAGEN; Quidel Corporation; Thermo Fisher Scientific, Inc; BD (Becton, Dickinson & Company); OptiGene Limited

b. Key factors driving the isothermal nucleic acid amplification technology market growth include the increase in demand for molecular testing techniques to mitigate the rising prevalence of infectious diseases, as well as the increasing utility of rapid, user-friendly, and disease-specific testing options offered by INAAT techniques.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."