- Home

- »

- Next Generation Technologies

- »

-

IT Operations Analytics Market Size, Share Report, 2020-2027GVR Report cover

![IT Operations Analytics Market Size, Share & Trends Report]()

IT Operations Analytics Market Size, Share & Trends Analysis Report By Type (Visual, Predictive, Behavior, Root Cause), By Application, By Deployment, By End Use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-931-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Technology

Report Overview

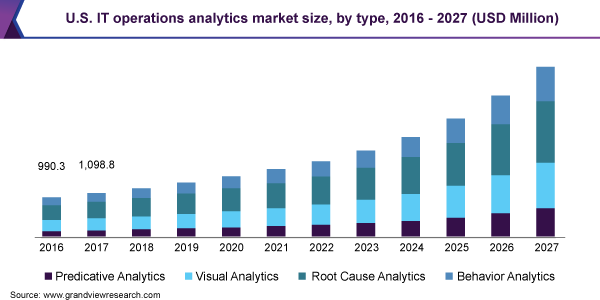

The global IT operations analytics market size was valued at USD 4.65 billion in 2019 and is expected to register a compound annual growth rate (CAGR) of 16.9% from 2020 to 2027. The growing dependence on software for operations, increasing consumption of big data, and the digitalization of industries powered by mobility and cloud are the prime factors driving the growth of the market. As big data and analytics technologies mature, analytics tools in operations become more accessible for general-purpose IT and analysts vis-à-vis increasing data sources, data volumes, and use cases. Moreover, IoT-led data explosion and the use of Artificial Intelligence (AI) and Machine Learning (ML) for operation analytics are likely to foster the market growth in the long run.

IT Operations Analytics (ITOA) is used to monitor systems and collect, process, analyze, and infer data from multiple sources of IT operations to assist users in decision-making and identifying potential threats. Operation analytics has become a strategic priority for organizations owing to the digitization efforts undertaken by incumbents belonging to different industry verticals. As per a recent industry report, around 600 executives surveyed from the U.S., China, Germany, France, and the U.K. claim that about 70% of the organizations are focusing on operations more than on consumer-focused processes for their analytics initiatives. The respondents also agreed that the use of operation analytics solutions plays a significant role in increasing profits and gaining a competitive advantage.

Despite the varying nature of businesses, the IT landscape has been striving with limited resources to cope with the dynamic IT infrastructure. Nearly every aspect of a business is logged in the IT operational data. IT services, technology infrastructure, and IT applications are in constant use, consequently generating data throughout the day. All the raw, poly-structured, and unstructured data is critical to managing IT operations efficiently. IT operation analytics solutions are likely to offer powerful tools that can help create necessary insights to proactively check for impacts, risks, and identify potential outages arising from IT operations in a business environment.

The industry research conducted in 2014 demonstrates that by utilizing operational data, manufacturing companies can realize savings of up to USD 371 billion globally, with operations accounting for a large part of this benefit. Data-driven operational improvements account for USD 117 billion of the total manufacturing industry size, with consumer-facing processes accounting for USD 38 billion. The disparity between the two lies in the vastness of improvements that can be realized using operational analytics, such as better capacity utilization, improved productivity, reduced downtime, accurate forecasting abilities, and greater flexibility in response to external circumstances.

The growing popularity and demand for ITOA solutions can be reiterated from an instance where a renowned Asian steel manufacturer deployed ITOA to transform the competitiveness and efficiency of 30-year old business practices. It used data pertaining to process innovation to detect the most critical quality issues and analyzed them for root causes. By constantly monitoring the process data, the company was able to identify problems early on and re-engineer processes as required. As a result, it achieved a 50% reduction in lead time for hot coil production and around 60% reduction in inventory. Similarly, in the petroleum industry, with the help of operations analytics in asset maintenance, British Petroleum was able to save around USD 200 million in CapEX in reduced non-productive asset time.

The outbreak of the COVID-19 pandemic in December 2019 has drastically impacted the production, supply, and demand for goods and services across the world. It has created a market and supply chain disruption by financially impacting industries and governments equally. However, amidst this economic uncertainty, the ITOA market is likely to witness growth owing to enhanced internet connectivity, decreased cost of components, increased demand for connected devices, affordable cloud computing services, and an increase in IT expenditure by governments across the world. Moreover, with the relaxation of restrictions across the globe and the resumption of industrial operations, the market is expected to witness growth post-2022.

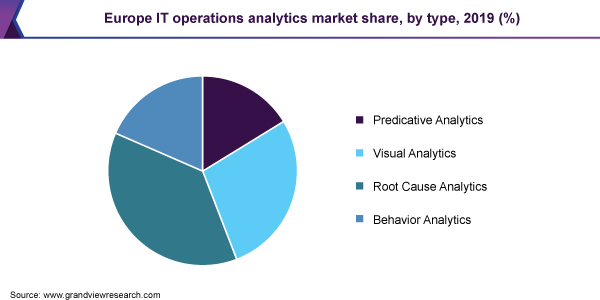

Type Insights

The root cause analytics segment accounted for the largest market share of over 30% in 2019. Increasing IT operations data, a number of sensors for fault diagnosis, and the number of Internet of Things (IoT) devices has led to an increase in the demand for root cause analytics in enterprises. The root cause is the primary reason for the drop in the quality or the overall device/ equipment effectiveness of an asset. The use of analytics in this domain has gained prime importance. Moreover, the demand for advanced root cause analytics solutions has been increasing due to the introduction of other technologies such as industrial IoT and AI.

Analytics has become a significant tool for Business Intelligence (BI) across various end-use industries. The development and enhancement of sensor technologies enable data from connected and IoT devices to be analyzed to generate various patterns and predict future variations and anomalies in products and services. The predictive analytics segment is expected to grow at a faster rate over the forecast period due to the generation of large amounts of data and the increasing implementation of big data solutions. Furthermore, a market study also states that the use of predictive analytics for operational functions can enable the global manufacturing industry to save up to USD 700 billion over the next two decades.

Deployment Insights

The cloud deployment segment of the IT operations analytics market accounted for the largest revenue share of around 70% in 2019. Cloud-based solutions have become the standard in multiple industries as they help organizations in reducing physical infrastructure costs, effective monitoring of data, and improving accessibility. A reduction in the total cost of ownership has become the key factor fueling the cloud deployment of ITOA solutions. However, challenges pertaining to data security, regulatory compliance, reliability, performance, operational control, transformation complexity, and data governance may hinder the cloud deployment of ITOA solutions.

The cloud deployment model offers increased operational flexibility, reduced maintenance, low operational manpower requirement, and convenience to enterprises by provisioning hassle-free integration. The collection of data from multiple devices, internal applications, consumers, and online media networks and the extraction of actionable insights have become a time and capital intensive processes for organizations. However, cloud computing solutions integrated with big data and AI and ML have allowed companies to seamlessly consolidate information from various communication channels and resources and analyze the information to make informed and right decisions.

End-use Insights

The BFSI segment held the largest market share of around 25% in 2019 owing to the increasing adoption of analytics solutions by banking and financial companies for their in-house operations. Operational analytics is likely to help banks in risk management, fraud management, and customer understanding to develop and retain a profitable customer base. Moreover, services such as digital wallets, payment gateways, online payments, and blockchain technology are likely to play an important role in automating complex workflow structures and facilitating the adoption of IT operation analytics solutions.

IT operation analytics solutions help in eliminating time-consuming redundant steps and errors that lead to low productivity and poor user experience. Operational analytics has become an important catalyst for ensuring digital transformation, increasing operational efficiency, and enhancing employee productivity in various industries. For instance, Consolidated Communications Holdings, a telecommunication company, asserts that operational analytics solutions helped the company in detecting all the main operational incidents that occurred, including silent failures, and also eliminated manual thresholds that resulted in cost savings worth USD 300,000 annually.

Application Insights

The Asset Performance Management (APM) segment accounted for the largest market share of around 40% in 2019. The use of analytics in asset performance management has witnessed significant growth in several industries owing to the increasing demand for digital solutions to manage the performance of assets and reduce operating expenses in enterprises. Analytics has helped companies in planning strategies for the maintenance of assets, avoiding unplanned outages, reducing maintenance costs, reducing downtime, and making informed decisions on the divestment of assets. Moreover, asset managers are also making investments in analytics to obtain actionable client insights for improving marketing efforts and sales productivity.

The growing popularity of digital APM solutions and the potential integration of the Industrial Internet of Things (IIoT) with APM systems are likely to generate a substantial amount of data for analysis. Moreover, the integration of an APM system with other solutions such as Geographic Information System (GIS) and mobile solutions is anticipated to increase the demand for ITOA solutions in the coming years. The ITOA vendors in the market are instrumental in offering integrated APM solutions supported by performance monitoring and analytics. For instance, in 2017, Oracle Corporation launched Oracle Utilities Work and Asset Cloud Service, which enabled utilities to increase asset reliability by discovering asset failures earlier and performing predictive maintenance with integrated APM and analytics.

Regional Insights

North America accounted for a major revenue share of approximately 35% in 2019 owing to the early adoption of IT operations analytics solutions. The U.S.-based companies are the most successful and advanced in their implementation of operational analytics initiatives. The regional market growth is primarily driven by the U.S., which hosts 17 of the top 20 big data companies. Moreover, the U.S. government is instrumental in making concrete decisions in the domain. In 2012, the U.S. pronounced “Big Data Research and Development Initiative”, with six federal agencies and more than USD 200 million committed to making improvements in big data. Additionally, more than 45% of U.S.-based enterprises have made analytics a fundamental part of their decision-making process, compared to 28% in Europe.

The Asia Pacific region is anticipated to register the highest CAGR over the forecast period owing to the increasing awareness of operational analytics among enterprises in emerging countries such as China and India. The growing popularity of cloud computing and the adoption of IoT and smart technologies are the key growth drivers expected to boost the regional ITOA market. The regional digital landscape is expected to be shaped by an intelligent cloud and intelligent edge owing to government and private enterprise initiatives. The growing set of connected devices and systems that gather and analyze data is expected to help create a new class of connected applications and tools to boost the operational abilities and business outcomes for enterprises.

Key Companies & Market Share Insights

The market is a consolidated market with prominent players occupying substantial shares. IBM Corporation; BMS Software Inc.; Microsoft Corporation; and Oracle Corporation are some of the major players. In the coming years, the key players are likely to consolidate through strategic partnerships, agreements, and acquisitions and mergers to secure their market positions over the forecast period. Numerfiy, SignalFx, Wavefront, ControlUp, InfluxDB, and Nexthink are some of the start-ups expected to pose potential competition in the market. In November 2019, Apptio, Inc., a provider of SaaS solutions, increased access to its reporting platform for business users through its Self-Service Analytics. This enabled users to explore and analyze their technology finance data whenever and however they want to. Moreover, users will also be able to create personalized reports of their financial data, analyze anomalies and trends, and customize reports and visualizations that can be effortlessly shared across the organization. Some of the prominent players in the IT operations analytics market include:

-

Apptio, Inc.

-

BMC Software Inc.

-

ExtraHop Networks

-

Glassbeam Inc.

-

Hewlett Packard Enterprise Development LP

-

IBM Corporation

-

Microsoft Corporation

-

Oracle Corporation

-

SAP SE

-

Splunk Inc.

IT Operations Analytics Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 5.22 billion

Revenue forecast in 2027

USD 15.55 billion

Growth Rate

CAGR of 16.9% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, deployment; end-use; region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

IBM Corporation; Microsoft Corporation; BMC Software Inc.; Oracle Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global IT operation analytics market report on the basis of type, application, deployment, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Predictive Analytics

-

Visual Analytics

-

Root Cause Analytics

-

Behavior Analytics

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Asset Performance Management

-

Network Management

-

Security Management

-

Log Management

-

-

Deployment Outlook (Revenue, USD Million, 2016 - 2027)

-

On-premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

BFSI

-

Healthcare

-

Retail

-

Manufacturing

-

Government

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

The Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global IT operations analytics market size was estimated at USD 4.65 billion in 2019 and is expected to reach USD 5.22 billion in 2020.

b. The global IT operations analytics market is expected to witness a compound annual growth rate of 16.9% from 2020 to 2027 to reach USD 15.55 billion by 2027.

b. The root cause analytics segment accounted for the largest market share of 35% in 2019. Increasing IT operations data, a growing number of sensors for fault diagnosis, and the increasing number of Internet of Things (IoT) devices have led to an increase in the demand for root cause analytics in enterprises.

b. Some key players operating in the IT operations analytics are IBM Corporation, BMC Software Inc., Microsoft Corporation, and Oracle Corporation. Some of the other players in the market include Apptio, Inc., ExtraHop Networks, Glassbeam Inc., Hewlett Packard Enterprise Development LP, SAP SE, and Splunk Inc.

b. Key factors that are driving the market growth are the growing dependence on software for operations, increasing consumption of big data, and digitalization of industries powered by mobility and cloud computing. Moreover, IoT-led data explosion and the use of artificial intelligence (AI) & machine learning (ML) for operation analytics are likely to foster the growth of the market in the long run.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."