- Home

- »

- Organic Chemicals

- »

-

Ketones Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Ketones Market Size, Share & Trends Report]()

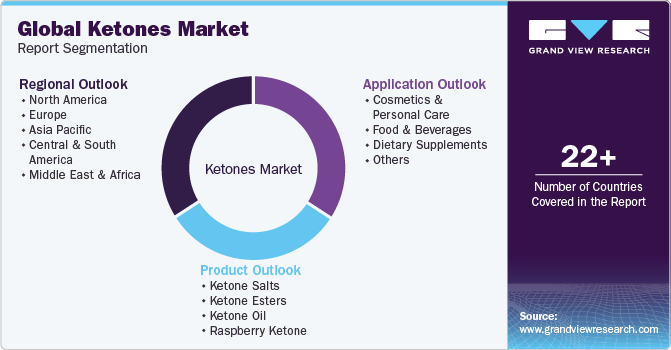

Ketones Market Size, Share & Trends Analysis Report By Product (Ketone Salts, Ketone Oil, Ketone Esters, Raspberry Ketone), By Application (Dietary Supplements, Food & Beverages, Cosmetics & Personal Care), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-998-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Ketones Market Size & Trends

The global ketones market size was valued at USD 22.52 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2030.The growing inclusion in dietary supplements is expected to boost market demand in the coming years. The increasing consumer awareness and preference for the ketogenic diet present opportunities for market growth. Additionally, the increasing use of ketone supplements among athletes and sportspersons is propelling industry growth. Ketones are largely utilized in cosmetics and personal care products. This is attributed to the growing demand for natural, herbal, and skin-friendly ingredients. Furthermore, acetone, which is the simplest ketone, is usually used in acetophenones, which are used for aromas in perfumes and nail paint removers.

Additionally, changing lifestyles and growing consumer awareness regarding the health benefits associated with product consumption are projected to positively influence industry growth. Ketones are used to repair hair and skin damage brought on by heat and other chemicals. Since the product serves as a versatile replacement for other kinds of chemicals commonly found in cosmetic products, demand for it is growing in the cosmetic and personal care industry. It has a rejuvenating effect on the skin and hair, which is anticipated to have a favorable effect on the demand for ketone in the cosmetic and personal care industry.

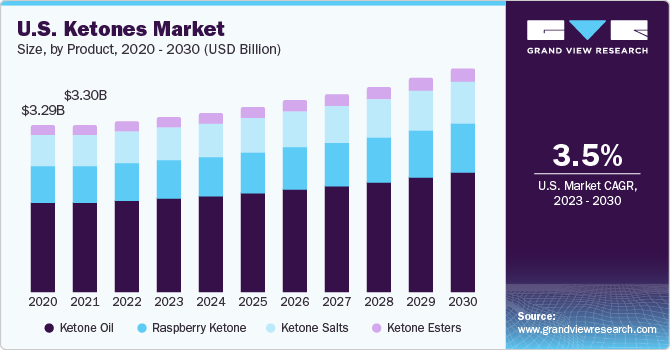

The market for ketone is expanding most quickly in North America. The surge in popularity of ketone supplements and other weight-loss foods and beverages is attributed to the increase in obesity instances in the North American region. The market is anticipated to grow as a result of these factors. Due to the strong customer demand, which is anticipated to fuel the expansion of the market, restaurants, and cafes in the area are also offering food and beverages that are based on ketone.

The pandemic has provided a significant drive for the market. Following the coronavirus pandemic, the market has grown due to the increased adoption of healthy living practices to preserve optimal health. Exogenous ketone is one of the supplements becoming popular among consumers, which is another factor fueling industry expansion. In the upcoming years, it is expected that the aforementioned tendencies will persist, supporting industry expansion.

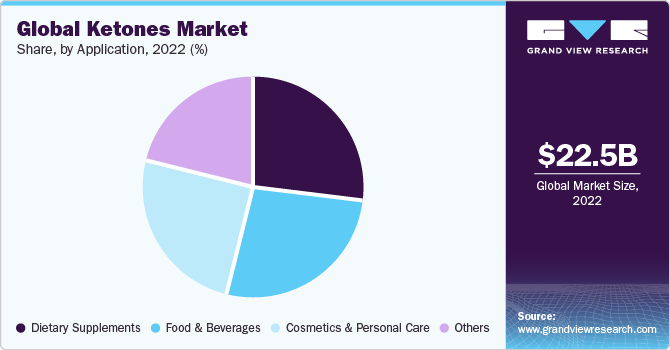

Application Insights

The dietary supplements segment accounted for the largest revenue share of 27.1% in 2022 and is expected to grow at the fastest CAGR of 4.1% during the forecast period. This can be attributed to the growing consumer awareness regarding personal health. The working population worldwide is focusing to consume the daily nutrient necessities owing to changing lifestyles and work schedules. This is increasing the need for dietary supplement products to meet the desired nutrients owing to high accessibility, which, in turn, is anticipated to drive the market over the forecast period.

The food and beverages segment is expected to witness growth over the forecast period. Methyl isobutyl ketone is extensively used as a flavoring agent in manufacturing food products in the form of an adjuvant for synthetic flavors and also in the form of a fruit flavoring agent. Carvone is used as a flavoring agent in the manufacturing of rye bread to induce caraway seeds’ flavor.

The demand for natural ingredients in cosmetics and personal care is being influenced by the growing trend of sustainable products globally. The demand for natural products with qualities of anti-aging is increasing due to an increase in the aging population. On the other hand, younger generations are looking for more sustainable products and environmentally friendly products due to which the product market is expected to grow in the forecast period.

Product Insights

The ketone oil segment accounted for the largest revenue share of 53.6% in 2022. This can be attributed to its antioxidant, anti-microbial, and anti-inflammatory capabilities. Ketone oil is used in manufacturing cosmetics and personal care products as it is used as a carrier for active ingredients and viscosity regulators and as an emollient in sunscreens, lotions, and other cosmetics and personal care products.

The ketone salts segment is expected to grow at the fastest CAGR of 4.3% during the forecast period, due to the capability of these salts to increase ketone levels in blood without a keto diet just like ketosis and provide energy. These types of ketones utilize potassium, calcium, sodium, or magnesium as cations and are available in different categories such as powder, pills, and drinks.

The raspberry ketone segment is expected to witness growth over the forecast period owing to its advantageous properties to treat obesity. It increases metabolism, suppresses appetite, and increases fat burning process in the human body. The market is expected to grow due to the growing obesity among the population and the increase in the demand for natural food ingredients.

Raspberry ketone is also used widely for flavor in dairy products and beverages. The immense growth in the flavoring market can be attributed to the enhancements in the lifestyle of consumers and increased demand for processed beverages and foods. This will act as a key factor triggering the industry growth globally.

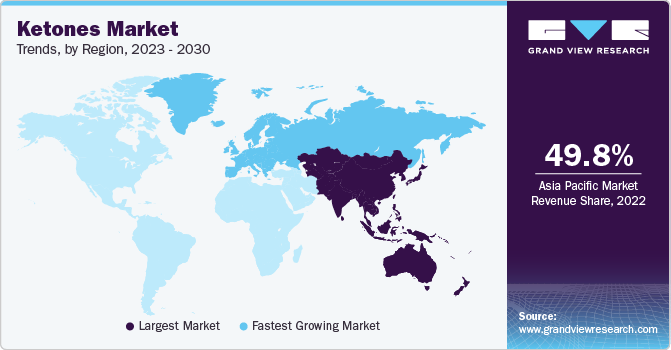

Regional Insights

Asia Pacific dominated the global market and accounted for the largest revenue share of 49.8% in 2022.This is attributed to the surge in demand for natural products such as ketones, considering the growth in the dietary supplements industry. This growth can be attributed to the rising prevalence of obesity and weight-related disorders. The surge in dietary supplement sales in the Asia Pacific is primarily due to consumers' busy schedules and high-stress levels, which have increased the incidences of lifestyle disorders such as obesity, high blood pressure, and diabetes.

Several sports nutrition product companies in the region are incorporating nutrients that support cognitive health and increase mental, emotional, and physical well-being. Ingredients such as raspberry ketones, originating from a natural source, are high in demand as they assist in weight loss and muscle strengthening. Furthermore, ketone increases the amount of cyclic AMP in the body, making it a popular element in dietary supplements. Thus, key players are introducing novel products with varied flavors and types in response to the millennial population's preference for flavors in sports nutrition. Consequently, due to the rising need for sports nutrition, the market is expected to witness high growth in the region over the forecast period.

Europe is expected to grow at the fastest CAGR of 4.3% during the forecast period, owing to the high production of customized personal care products and growing consumer awareness regarding their health benefits. The region has also emerged as one of the top markets for personal care and cosmetics. Companies in the region are thus substituting natural ingredients for synthetic chemicals, partially due to increasing demand and partly due to a shift toward sustainable raw materials. Concerns over the harmful effects of chemicals and synthetic compounds in personal care products can further provide growth opportunities for the market.

Key Companies & Market Share Insights

The key companies of the market are expanding significantly due to ongoing product innovation supported by the quick uptake of cutting-edge technologies. In order to function in the market space effectively, emerging firms in the sector are focusing on vertical integration of their operations. They are also working with well-known brands to strengthen their worldwide brand presence.

Large companies are spending on R&D activities to create innovative goods and expand the application areas for their products. In addition, the businesses have used other approaches to grow such as mergers and acquisitions. For instance, in January 2020, KetoSports, Inc., which sells ketone health supplements, was majority owned by Limitless Venture Group, Inc. The goal of this project was to increase the former company's business.

Key Ketones Companies:

- Health Via Modern Nutrition Inc.

- Ketone Aid

- Pruvit Ventures, Inc.

- Caldic B.V.

- Ketologic

- Genomatica, Inc.

- Keto and Co

- Ancient Brands, LLC.

- Compound Solution Inc.

- BPI SportsZhou Nutrition

Recent Developments

-

In January 2023, Tecton achieved a significant milestone by introducing the world's first ketone hydration beverage. This innovative drink utilizes the potential anti-inflammatory and anti-oxidant properties found in ketone esters.

-

In January 2022, Health Via Modern Nutrition Inc. launched Ketone-IQ, the company's latest proprietary drinking ketone.

-

In June 2022, Abbott revealed its ongoing efforts towards creating an advanced bio wearable device integrating a sensor capable of continuous monitoring of glucose and ketone levels. This groundbreaking system has earned the prestigious breakthrough device designation from the U.S. Food and Drug Administration.

-

In October 2022, Caldic B.V. announced the acquisition of Betaquímica S.A.The product line and value-added services from Betaqumica is anticipated to greatly improve Caldic's chemical industry offering and broaden its current presence in Iberia and beyond.

-

In November 2022, Genomatica, Inc.announced the launch of Avela natural (R)-1,3-Butanediol, a new functional ingredient, marking its entry into the market for functional foods and beverages. The cutting-edge, sugar-free product offers a quick, easy, and practical way to boost levels of beta-hydroxybutyrate (BHB) ketone, the primary fuel created in the body when it enters ketosis.

-

In March 2021, EKF introduced STAT-Site WB β-Ketone and Glucose Handheld Analyzer.It provides readings of glucose and β-ketone from the entire bloodstream in a matter of seconds.

Ketones Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 23.10 billion

Revenue forecast in 2030

USD 30.25 billion

Growth rate

CAGR of 3.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in kilo tons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Belgium; China; Japan; India; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Health Via Modern Nutrition Inc. ; Ketone Aid ; Pruvit Ventures, Inc.; Caldic B.V.; Ketologic; Genomatica, Inc.; Keto and Co; Ancient Brands, LLC.; Compound Solution Inc.; BPI Sports; Zhou Nutrition

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ketones Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ketones market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Ketone Salts

-

Ketone Esters

-

Ketone Oil

-

Raspberry Ketone

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Cosmetics & Personal Care

-

Food & Beverages

-

Dietary Supplements

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Belgium

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ketones market size was estimated at USD 22.52 billion in 2022 and is expected to reach USD 23.10 billion in 2023.

b. The global ketones market is expected to grow at a compound annual growth rate of 3.8% from 2023 to 2030 to reach USD 30.25 billion by 2030.

b. Asia Pacific dominated the ketones market with a share of 49.9% in 2022. This is attributable to the surge in demand for natural products such as ketones considering the growth in the dietary supplements industry.

b. Some key players operating in the ketones market include HVMN Inc., Ketone Aid Inc., Pruvit, Caldic B.V., Ketologic, Genomatica, Inc, Keto & Company, Ancient Nutrition, Ketone Aid Inc, Compound Solution Inc., BPI Sports, Zhou Nutrition, Boli Naturals.

b. Key factors that are driving the ketones market growth include growing inclusion of ketones in dietary supplements, increasing consumer awareness and preference for the ketogenic diet.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."