- Home

- »

- Medical Devices

- »

-

Kidney Stone Retrieval Devices Market Size Report, 2030GVR Report cover

![Kidney Stone Retrieval Devices Market Size, Share & Trends Report]()

Kidney Stone Retrieval Devices Market Size, Share & Trends Analysis Report By Product Type (Lithotripters, Stone Removal Baskets, Ureterorenoscopes, Ureteral Stents), By Treatment, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-969-0

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Healthcare

Report Overview

The global kidney stone retrieval devices market size was valued at USD 2.66 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.7% from 2022 to 2030. The increasing number of technological advancements and the emergence of new procedures are some of the factors that are expected to drive the market for kidney stone retrieval devices during the next few years. For instance, percutaneous nephrolithotripsy (PCNL), a surgery for large kidney stones, involves making a few tiny incisions in the lower back. The stones are then broken up and removed using a small camera and equipment. Incisions and devices are now smaller owing to a technology known as "mini PCNL" or "mini perc". However, the adaptability of these devices to multiple procedures performed in the field is also expected to be a key factor that will affect market growth. Modern kidney stone removal treatments and equipment are more convenient, less painful, and more cost-effective compared to traditional surgeries. Open surgery entailed making an incision into the abdomen to remove a kidney stone that could not pass, and the surgery used to be very painful.

The COVID-19 pandemic had a substantial influence on many regions of the world and many countries are still recovering from the pandemic. In the early days of the pandemic, countries implemented lockdowns that significantly hampered the ability to carry out routine medical treatments. As a result, the global market faced a negative effect as the number of patients seeking diagnosis and treatments dropped drastically. The demand for kidney stone retrieval devices was uneven, with installation delays and a decline in manufacturing during the pandemic. The COVID-19 pandemic has also affected the world's supply chain network, and market players reported delays or interruptions in the shipments of several materials or components that go into manufacturing products.

According to the National Kidney Foundation (NIDDK), a kidney stone will occur in 1 in 10 individuals in their lifetime. Both industrialized and developing nations have seen an increase in the prevalence of kidney stone formation over the past few decades. Global warming as well as changes in dietary habits and physical inactivity are thought to be contributing factors to the formation of kidney stones. According to the National Library of Medicine, a kidney stone impacts 1 in 11 Americans, and it is reported that around 600,000 Americans experience urine stones each year. Moreover, about 12% of the Indian population is predicted to develop urinary stones, and of those, 50% may experience kidney function loss.

The rise in the prevalence of kidney stones and increased investment by private players in research and development of kidney stone retrieval devices are some of the factors driving the market. Moreover, the advancements in technology and the rise in demand for non-invasive and minimally invasive surgery have fueled the market growth. For instance, the “1.7 French NCompass Nitinol Stone Extractor” manufactured by Cook Medical is an advanced stone removal basket and has the smallest diameter currently available. It provides better irrigation and access during stone removal procedures.

The widespread use of imaging systems in kidney stone therapies is one of the major factors determining the overall market growth. In September 2019, Dornier MedTech (Dornier), a urology firm and expert in kidney stone therapy, introduced the innovative OptiVision technology for the Dornier Delta III. It is the first imaging system that uses post-processing made exclusively to enhance stone therapy results. Urologists can visualize stones more clearly with OptiVision during extracorporeal shock wave lithotripsy (ESWL) procedures.

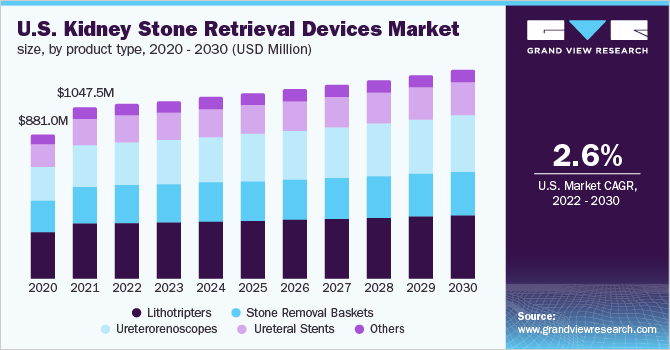

Product Type Insights

In 2021, the lithotripters segment dominated the market with a revenue share of over 30.0% owing to the increasing usage of these devices for treating kidney stones effectively. In addition, the low procedure costs and an increase in the utilization of shockwave lithotripsy procedures are the factors contributing to the segment growth. Third-generation lithotripters with cutting-edge technology are now being produced to increase the procedure's efficacy. Based on product type, the market is segmented into stone removal baskets, lithotripters, ureterorenoscopes, ureteral stents, and others.

The ureterorenoscopes segment is expected to register the fastest CAGR of 5.2% from 2022 to 2030. It has been gaining popularity among a number of healthcare organizations due to the decreased downtime caused by damaged equipment, which consequently reduces treatment delays and cancellations, improves access to care, and is even more cost-effective than its conventional counterparts. Furthermore, an increase in minimally invasive treatments and growth in healthcare spending boost the growth of the ureterorenoscopes segment.

Treatment Insights

In 2021, extracorporeal shock wave lithotripsy held the largest revenue share of over 40.0%, owing to an increase in the number of patients suffering from kidney stones, a recurrence rate of kidney stones, and the adoption of minimally invasive treatments. The treatment is minimally invasive, typically well tolerated, and rarely necessitates the use of a stent, thus fueling the segment growth. The surgery lasts around an hour, after which the patient can leave. Shockwave lithotripsy has a short recovery period and the patient can resume normal activities in a few days. The less invasive ESWL procedure is frequently chosen because there are normally no scopes put into the urinary tract and no stents are implanted. Based on treatment, the market is segmented into extracorporeal shock wave lithotripsy, percutaneous nephrolithotripsy, and intracorporeal ureteroscopy.

The intracorporeal ureteroscopy segment is expected to exhibit the fastest CAGR of 5.0% during the forecast period. It is typically preferred due to its advantages in stone-free rates and the fineness it frequently offers. Ureteroscopy, which uses a more direct approach and is subsequently more effective than ESWL, provides the benefit of only requiring a small number of stone particles to be removed following the treatment.

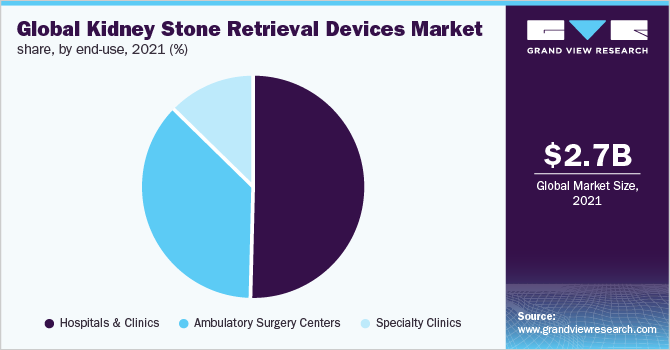

End-use Insights

The hospitals and clinics segment held the largest revenue share of over 50.0% in 2021 and is expected to retain its position during the forecast period. The necessary equipment required for kidney stone removal treatment is easily available in hospitals as compared to clinics and ambulatory surgical centers. Based on end-use, the market is segmented into hospitals and clinics, ambulatory surgery centers (ASCs), and specialty clinics.

The ambulatory surgery centers segment is likely to register a significant CAGR of 5.1% during the forecast period. These outpatient surgery centers are health care facilities where surgical procedures that do not require hospitalization are carried out. The majority of minor kidney stone operations can be completed in one day of surgery. The most preferred treatments, including shockwave lithotripsy, which are less complicated and do not require hospitalization, are carried out at ambulatory surgery centers.

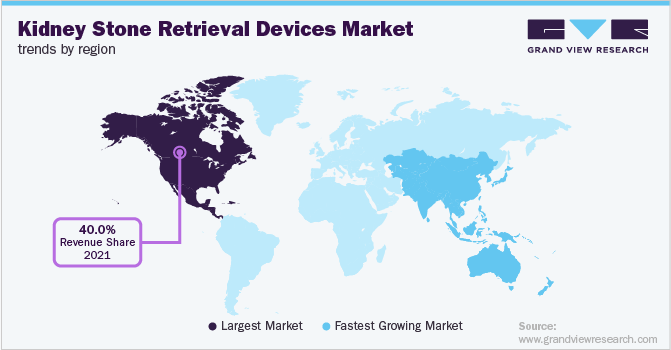

Regional Insights

North America dominated the market and held a revenue share of over 40.0% in 2021. The increasing prevalence of kidney stone cases, the adoption of minimally invasive techniques, increased competition among market players, and significant expenditure on research and development to produce advanced technologies are contributing to the market growth in North America. There has been a steady growth in the number of patients with kidney stones from various states in the U.S. and Canada, thereby fueling the demand for kidney stone retrieval devices.

Asia Pacific is expected to expand at the fastest growth rate of 5.6% during the forecast period due to the rising frequency of kidney stones, rapidly expanding healthcare infrastructure, growing government backing, and an increasing number of startups in this region. In September 2021, Boston Scientific Corporation acquired Lumenis Ltd. for an upfront cash payment of USD 1.07 billion. It acquired Lumenis Ltd.’s global surgical business, which is into the development of energy-based medical solutions. This acquisition will allow Boston Scientific to use different medical solutions offered by Lumenis Ltd., including MOSES technology, which will help them expand throughout the Asia Pacific.

Key Companies & Market Share Insights

Leading industry players are adopting strategies such as partnerships, collaborations, acquisitions & mergers, and agreements to survive the highly competitive environment and expand their business footprints. For instance, in June 2022, Dornier MedTech and Endoluxe signed a multi-year exclusive distribution contract. Dornier and Endoluxe provide products and systems targeted toward the urology market, offering innovation and value. In September 2018, STORZ MEDICAL and Siemens Healthineers entered into an agreement of sales partnership. The two businesses planned to jointly promote each other's systems in order to provide their clients' patients with access to the most recent urological diagnostic imaging and minimally and non-invasive therapy technologies. Some prominent players in the global kidney stone retrieval devices market include:

-

Boston Scientific Corporation

-

Olympus Corporation

-

BD

-

Cook

-

Coloplast Group

-

Dornier Medtech

Kidney Stone Retrieval Devices Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.75 billion

Revenue forecast in 2030

USD 3.69 billion

Growth rate

CAGR of 3.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 – 2020

Forecast period

2022 – 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Product type, treatment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE

Key Companies Profiled

Boston Scientific Corporation; Olympus Corporation; BD; Cook; Coloplast Group; Dornier Medtech

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kidney Stone Retrieval Devices Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global kidney stone retrieval devices market report based on product type, treatment, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Lithotripters

-

Stone Removal Baskets

-

Ureterorenoscopes

-

Ureteral Stents

-

Others

-

-

Treatment Outlook (Revenue, USD Million, 2017 - 2030)

-

Extracorporeal Shock Wave Lithotripsy

-

Percutaneous Nephrolithotripsy

-

Intracorporeal Ureteroscopy

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgery Centers

-

Specialty Clinics

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Colombia

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global kidney stone retrieval devices market size was estimated at USD 2.66 billion in 2021 and is expected to reach USD 2.75 billion in 2022.

b. The global kidney stone retrieval devices market is expected to witness a compound annual growth rate of 3.75% from 2022 to 2030 to reach USD 3.69 billion by 2030.

b. North America dominated the kidney stone retrieval devices market in 2021 with a share of 43.23%. The increasing prevalence of kidney stone cases, the adoption of minimally invasive techniques, increased competition among market players, and significant expenditure on R&D are attributed to the market growth in North America.

b. Some key players operating in the kidney stone retrieval devices market include Boston Scientific Corporation, Olympus Corporation, BD, Cook, Coloplast Group, and Dornier Medtech among other players.

b. The increasing number of technological advancements and the emergence of new procedures are some of the factors that are expected to drive the market for kidney stone retrieval devices during the next few years. Moreover, the rise in demand for non-invasive and minimally invasive surgery also fueled the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."