- Home

- »

- Consumer F&B

- »

-

Kombucha Market Size, Share & Trends Report, 2022-2030GVR Report cover

![Kombucha Market Size, Share & Trends Report]()

Kombucha Market Size, Share & Trends Analysis Report By Product (Conventional, Hard), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-250-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The global kombucha market size was valued at USD 2.64 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 15.6% from 2022 to 2030. Consumers have significantly shifted toward proactively tackling their health & wellbeing, and have dedicated themselves to improving their overall longevity, which has led to higher product acceptance. Kombucha is marketed as a product that eliminates toxins, boosts energy & immune system, and helps lose weight, which is driving the frequency of its consumption among consumers globally.

The COVID-19 pandemic has had a positive impact on the fermented beverage market, witnessing a slight increase as consumer demand shifted towards immunity-boosting beverages amid the rising rate of coronavirus infection. For instance, WonderBrew Kombucha surpassed its sales figures in 2020 over the preceding year by increasing its online presence.

Furthermore, as per Equinox Kombucha, the company faced numerous challenges to keep up with continually changing government guidelines and workplace safety measures during the lockdown. However, the company ramped up its direct-to-home orders and grew its e-commerce segment massively as 2020 progressed.

In a similar vein, in July 2021, Remedy Drinks announced the launch of a zero-sugar shelf-stable product in the U.S. The product will be offered in cans and will be available in four different flavors: peach, ginger lemon, mixed berry, and raspberry lemonade. Furthermore, the United States Food and Drug Administration (FDA) stated that this product is safe for human consumption when properly prepared and has been commercialized in a large number of countries.

In September 2020, Equinox Kombucha conducted consumer research of 2000 people in the U.K. on their thoughts about healthy foods and beverages, which revealed that 39% of people were eating healthier foods, 27% were eating more natural foods, and 23% were reading food labels more often. Nearly 33% of people knew what kombucha was, with 12% thinking it was a food item. Nearly 48% believe that probiotics are always better for improving gut health, and 14% believe that in order to cleanse the gut, detox is a must.

Several consumers are still unaware of the potential positive benefits of drinking authentic kombucha on their overall well-being and the state of their immune system. However, in the coming years, there is a massive opportunity for kombucha brands to educate consumers in the area of gut health and fermented foods & beverages.

Products like kombucha will be increasingly important to customers who are looking for food and drink items that help them stay healthy. Market players are improving their understanding of specific health outcomes provided by regular drinking of kombucha, as well as engaging with customers in the process of new product development and design.

Product Insights

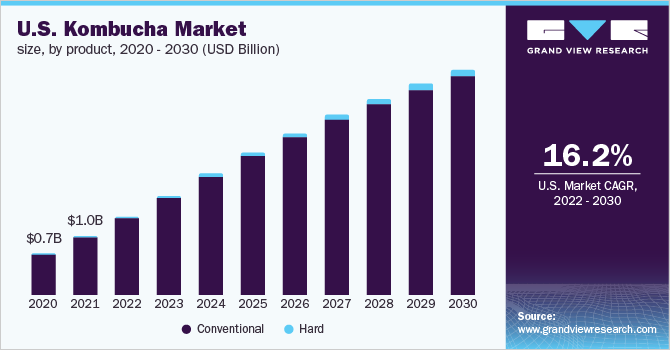

Conventional kombucha accounted for a dominant share of 98.4% of the global revenue in 2021. The rise of the conventional product aligns with the growing demand for healthy hydration and consumers' broad adoption of functional beverages. While kombucha has benefited from those accelerating trends, it is also evolving and innovating to propel the segment growth forward.

Health-Ade LLC, BREW DR. KOMBUCHA, and GT’s Living Foods are some of the prominent sellers of conventional kombuchas. They offer the product in a range of exotic flavors such as ginger, turmeric, lemon, pineapple, apple, pomegranate, strawberry, grape, watermelon, and cherry, among others. The growing availability of these products in a variety of offerings and flavors has escalated the segment growth.

The hard segment is anticipated to expand at a higher CAGR of 23.5% during the forecast period. Consumers are gradually inclining toward hard kombucha, as it is a strong alternative to other adult beverages. Several players are offering this product in crafted cocktails, in flavors such as elderflower, lemongrass, grapefruit & hibiscus, coffee, blueberry, and jalapeno, which is driving its consumption among consumers who are seeking innovative and gut-friendly beverages.

Consumers who are trying to seek hard kombucha in lighter flavors are trying novel options such as green tea-based kombucha sweetened with honey, mint, mango, and fruit flavors, and relatively less alcohol content. These novel offerings are driving the growth of the segment.

Distribution Channel Insights

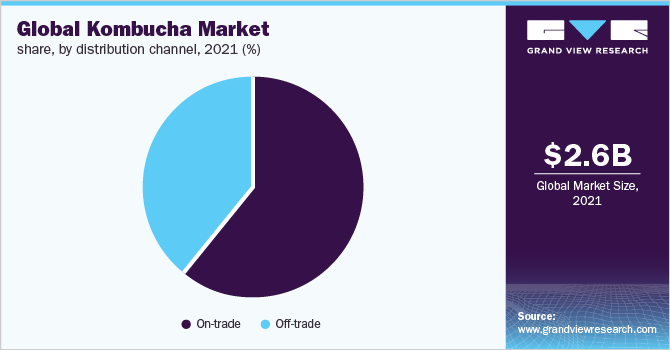

The off-trade segment is anticipated to expand at a higher CAGR of 17.1% during the assessment period. These beverages are now more readily available through various distribution channels, including supermarkets and convenience stores, health stores, and online retailers.

The range of innovative flavors is also attracting an increased number of consumers, with companies offering novel flavors such as lavender, watermelon, peach, and passionfruit alongside their original beverages and marketing them through off-trade platforms. InstaCart, Minibar Delivery (ReserveBar Express Corp.), Drizly, and Total Wine & More are prominent sellers of these beverages.

The on-trade segment accounted for a larger revenue share of 61.2% in the global kombucha market in 2021 and is expected to maintain its dominance during the forecast period. Recently, growing inclination towards premium hand-crafted cocktails containing flavored kombuchas has led to an increase in their consumption through on-trade channels, including premium bars, pubs, cafés, restaurants, and other food service outlets.

These on-trade channels are offering non-alcoholic and gut-supporting kombucha cocktails in different ingredients and novel flavors, which has increased their consumption through these channels. This beverage has a very low alcohol percentage of about 0.5% to 2% which makes it a potential option for cocktails; in response, several bars and pubs are offering more affordable options to cater to the ongoing trend.

Regional Insights

North America made the largest contribution in the market in 2021 with 47.8% of the revenue share. The regional market has expanded rapidly, with the drink enjoyed by customers who are seeking a quality, healthier soft drink alternative. Consumers in the U.S. and Canada are seeking an ethical, sustainable, and low-sugar lifestyle, which has spurred the product demand.

In the region, the product has gained popularity as a signature drink that contains possible health benefits of fermented foods and probiotics, and the demand has resurged as a health product that is increasingly available in several stores. Furthermore, the USDA has certified certain ingredients used in organic kombuchas as safe to consume, hence driving the demand for organic kombuchas among American consumers.

Asia Pacific is poised to be the fastest-growing region during the forecast period. The product sustains its demand across the Asia Pacific owing to its rising awareness and visibility in countries such as China, Japan, Australia, Malaysia, and Vietnam. Consumers are looking for personalized beverage options that suit their lifestyle and are putting a lot more emphasis and importance on what they are consuming, which has driven the demand for mindful mixers like kombucha in the region.

Several brands are highlighting their probiotic properties, as well as wellness-friendly ingredients such as enzymes, organic acids, vitamins, and minerals that are typically low in calories, sugar, and carbohydrates, as well as often being organic, non-GMO, and gluten-free, in product beverages.

Key Companies & Market Share Insights

The market is characterized by the presence of a few well-established players and several small and medium players. Majority of the market share is captured by key players, who are adopting various strategies, including new product launches, expansion of product portfolios, and mergers & acquisitions. For instance:

-

In February 2022, Remedy Drinks extended its product line by launching the product in wild berry flavor in the U.K. The ‘Remedy Kombucha Wild Berry’ beverage initially will be stocked exclusively at Tesco stores. The retail giant further plans to launch ‘Remedy Kombucha Mango Passion’, along with doubling the distribution of its existing flavors (raspberry lemonade and ginger lemon) in commitment to increasing its sale of healthier products.

-

In July 2021, Remedy Drinks, an Australian brand, collaborated with the e-commerce and digital marketing company RooLife Group Ltd., to market and sell its kombucha drinks in China in order to support and drive sales and distribution activities. The company witnessed a strong demand for the product, as the Chinese consumers are embracing the healthy food trend and seeking premium “better for you” beverages such as kombucha.

-

In July 2021, Nova Easy Kombucha, known for its hard and non-alcoholic varieties, launched a new product line of high-performance non-alcoholic products that features pre-workout ‘POWER’ kombucha blend comprising naturally-derived caffeine to boost performance, and ‘RECOVERY’ blend, formulated with probiotics to promote a healthy gut. The products are designed for health-conscious consumers seeking for an all-natural, and low-sugar option.

Some of the key players operating in the global kombucha market include:

-

GT’s Living Food

-

København Kombucha

-

Remedy Drinks

-

GO Kombucha

-

Læsk

-

Lo Bros.

-

VIGO KOMBUCHA

-

Brothers and Sisters

-

BB Kombucha

-

MOMO KOMBUCHA

-

Real Kombucha

-

Equinox Kombucha

Kombucha Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.53 billion

Revenue forecast in 2030

USD 9.70 billion

Growth Rate

CAGR of 15.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Netherlands; Switzerland; China; India; Japan; Australia; Brazil; Argentina; UAE; South Africa

Key companies profiled

GT’s Living Food; København Kombucha; Remedy Drinks; GO Kombucha; Læsk; Lo Bros.; VIGO KOMBUCHA; Brothers and Sisters; BB Kombucha; MOMO KOMBUCHA; Real Kombucha; Equinox Kombucha

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global kombucha market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Conventional

-

Hard

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

On-trade

-

Off-trade

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Netherlands

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global kombucha market size was estimated at USD 2.64 billion in 2021 and is expected to reach USD 3.53 billion in 2022.

b. The global kombucha market is expected to grow at a compound annual growth rate of 15.6% from 2022 to 2030 to reach USD 9.70 billion by 2030.

b. North America dominated the kombucha market with a share of 47.8% in 2021. The market in the region has expanded rapidly, with the drink enjoyed by customers who are seeking a quality, healthier soft drink alternative.

b. Some key players operating in the kombucha market include GT’s Living Food, København Kombucha, Remedy Drinks, GO Kombucha, Læsk, Lo Bros., VIGO KOMBUCHA, brothersandsisters, BB Kombucha, MOMO KOMBUCHA, Real Kombucha, Equinox Kombucha.

b. Key factors that are driving the kombucha market growth include an increasing number of market players improving their understanding of the specific health outcomes that are provided by regular drinking of kombucha as well as engaging with customers in the process of new product development and design.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."