- Home

- »

- Nutraceuticals & Functional Foods

- »

-

L-carnitine Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![L-carnitine Market Size, Share & Trends Report]()

L-carnitine Market Size, Share & Trends Analysis Report By Process (Bioprocess, Chemical Synthesis), By Product (Food & Medicines Grade, Feed Grade), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-800-8

- Number of Pages: 151

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Consumer Goods

Report Overview

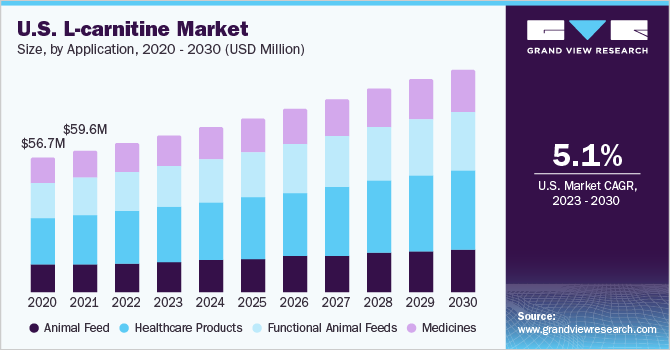

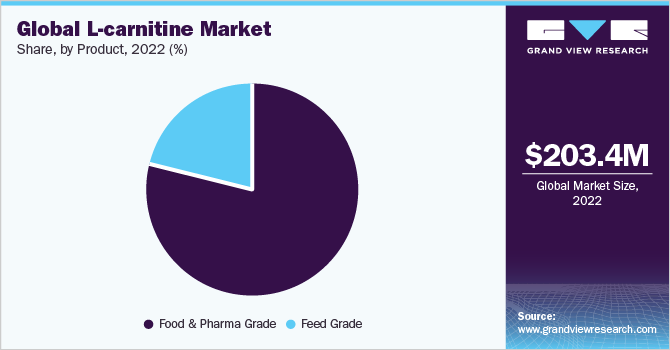

The global L-carnitine market size was valued at USD 203.4 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. The market is witnessing a high growth owing to a rising health-conscious consumer base, increasing number of product launches consisting of L-carnitine, and increasing demand from the animal feed industry.

The market is anticipated to be driven by the growing awareness regarding the product benefits such as improvement in the muscle repair process, reduction in muscle soreness, and muscle gain, leading to increasing product demand for various application industries, which is expected to consequently drive the market growth. Rising use of L-carnitine supplementation for post-exercise recovery, weight management, and healthy aging is expected to drive the market during the forecast period.

The U.S. is the third-largest market for biomedicines across the globe and is among the world leader in terms of biomedicines research and development. The expansion of medicines and biomedicines industries in the U.S. is expected to boost the utilization of L-carnitine in medicines to control the occurrence of diabetes, thyroid, blood pressure, and coronary heart diseases.

L-carnitine is taken as a supplement by the people with low levels of L-carnitine produced in their bodies. Low levels of L-carnitine in some people are attributed to the numerous factors including several medical issues such as skeletal myopathies, ingestion of several drugs, and genetic disorders. Rising awareness regarding timely checkups and increasing concerns regarding health issues among the mass along with a growing number of treatments for various diseases and disorders are expected to benefit the market during the forecast period.

L-carnitine has also been found to increase lactation and improve metabolism in cows, as per data published by the National Library of Medicine (US Government). It is also used for the muscle recovery, fuel efficiency, and antioxidant properties in dogs as well as horses, which reportedly experience performance benefits through L-carnitine supplements, as per data published by Oxford University Press. The benefits related to the L-carnitine supplements are expected to aid the market growth during the forecast period.

Moreover, researchers at the MRC Integrative Epidemiology Unit (IEU), Bristol Medical School, U.K. have concluded that L-carnitine and its derivative such as acetyl-carnitine provide strong protective effects against severe COVID 19 patients. The study highlighted that doubling of carnitine concentration in blood reduces the risk of severe COVID-19 by 40.0%. The study was performed on limited samples as large, randomized trials are expensive and time-consuming. However, such a promising result of L-carnitine on severe COVID 19 patients is expected to positively impact its demand during a shorter period.

Process Insights

The bioprocess segment dominated the market with a revenue share of 76.5% in 2022. This is attributable to the rising commercial demand for L-carnitine has compelled the manufacturers to improve their processes to upsurge production yield. Biological processes using microorganisms and enzymes are essentially asymmetric processes and have been offering high production yields.

The most conventional process used to produce L-carnitine with the best yield is a bioprocess based on achiral precursors’ biotransProductation such as γ-butyrobetaine, crotonobetaine, and 3-dehydrocarnitine, or racemic mixtures such as D, L-carnitinamide, D, L-acyl carnitine, and D, L-carnitine, also, various microorganisms including Escherichia coli, Proteus mirabilis, Acinetobacter lwoffii, Bacillus, Penicillium, and Rhizopus.

The chemical synthesis process is slowly gaining momentum owing to its ability to produce L-carnitine on an industrial scale. There are several chemical procedures available for the synthesis of L-carnitine namely asymmetric synthesis, chemical multi-step racemization, enzymatic techniques, resolution through diastereomeric derivatives, and synthesis using chiral materials. However, many of these procedures are not feasible for industrial-scale production as they involve numerous time-consuming steps.

Chemical multistep racemization is one of the most popular chemical synthesis processes to produce L-carnitine, from which D-carnitine racemic mixture is generated as a byproduct. The process generally starts with raw materials such as epichlorohydrin and trimethylamine, followed by the separation of the mixture by fractioned crystallization.

Product Insights

The food & pharma grade dominated the segment with a revenue share of 79.1% in 2022. This is attributable to its wide usage for human consumption for numerous applications including healthy aging, male fertility, infant nutrition, weight management, and post-exercise recovery.

Though the product is found naturally in certain foods including meat, avocado, and beans, a certain level of L-carnitine is needed to maintain its adequate level in the body depending upon age, diet, and other factors. The product is consumed through various routes including oral consumption through nutritional supplements, medicines, functional food and beverages, and injections. It plays an important role in facilitating the recovery process in response to physical activity.

Feed grade L-carnitine is widely used as a key ingredient in animal medicines and animal feed. It is an essential component for the energy metabolism of animals and offers a wide range of benefits to various species, including weight management and healthy function of the heart and liver. Feed grade is extensively used by the livestock industry, pet food manufacturers, and producers of food for racing animals. The product is used widely in dry foods and treats for cats and dogs. It is also used as an antioxidant and for muscle recovery for working dogs.

Feed grade is essentially used in pet health supplements for risks related to heart disease, especially used in the cases of dilated cardiomyopathy. It is also used as an essential supplement for the treatment of diabetic ketoacidosis, hyperlipidemia, and obesity which are the conditions commonly found in dogs and cats. The product is also preferred for the medication of fatty liver syndrome.

Application Insights

Healthcare products dominated the market with a revenue share of 34.7% in 2022. This is attributable to its wide usage in numerous healthcare products including supplements for weight loss and enhanced stamina. With the growing consumption of healthcare products due to the rising prevalence of obesity, increasing consumer awareness regarding personal health and wellbeing, changing lifestyle, and growing spending capacity, the dietary supplement market is expected to reach USD 104.1 million by 2030. This rapid expansion of the dietary supplement industry is expected to offer lucrative opportunities to the manufacturers during the forecast period.

L-carnitine is an essential micronutrient required for the growth performance of various animal species, including poultry, swine, cows & cattle, horses, and companion animals. Dietary L-carnitine supplementation has beneficial effects on this animal nutrition status as it provides a sufficient amount of dietary energy and protein.

Supplementation of L-carnitine in the diet of animals significantly improves their body weight gain, feed intake, and feed conversion in broiler chicken. Supplementation of L-carnitine in feed improves energy utilization as well as fatty acid and therefore, lives weight gain and feed conversion efficiency may be improved in poultry.

Globally, the health-conscious population has been shifting from carbonated beverages to functional beverages, which can also be witnessed by the increased introduction of functional beverages such as kombucha, relaxation beverages, botanical ingredients-based beverages, in the recent past. Beverage manufacturers are increasingly capitalizing on such shifting consumer behavior through the introduction of new beverages fortified with substances such as L-carnitine.

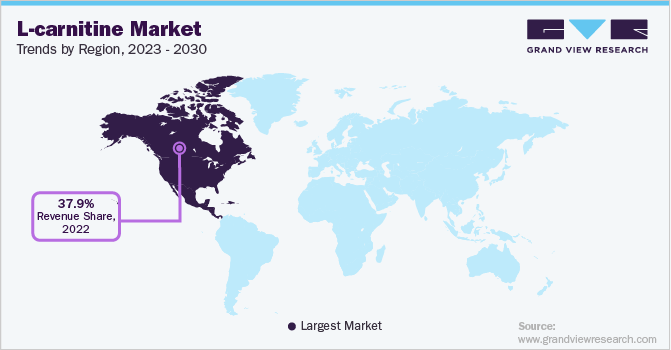

Regional Insights

North America dominated the L-carnitine market with a revenue share of 37.9% in 2022. This is attributable to the expansion of health conscious consumer base in the region. L-carnitine has proved to be an essential component for the treatment and prevention of various ailments, which has made it an attractive functional food and beverage ingredient.

The increased level of energy and stamina including other health benefits has made consumers more biased toward functional food and beverages inclusive of L-carnitine. The increased inclination towards L-carnitine supplements by consumers in North America is expected to propel growth of the market during the forecast period.

L-carnitine supplements are also used for the weight management in the treatment of obesity. Mexico and the U.S. have the highest obese populations in the world, which has resulted in increased consumption of supplements for curbing weight gain. This is further expected to drive the market in the region during the forecast period.

The nutraceutical industry in Europe is expected to grow due to an increase in the purchase of supplements as a preventive approach to health concerns. In addition, consumers prefer an herbal product over medicines due to the latter’s side effects. The growing acceptance of nutraceuticals to improve health without causing any potential risk of health issues is expected to propel the growth of the market throughout the forecast period.

Key Companies & Market Share Insights

The companies are working on their branding strategies in order to appeal to the target audience respective to the specific applications. The market is highly competitive in nature. The major companies in the market compete with not only other international companies but also with local players at the regional level. The industry is highly concentrated with a handful number of players controlling the large market share. The market exhibits the presence of numerous smaller players providing customized products to the end-users.

The market is expected to face pricing pressure owing to the intense competition. The industry has witnessed a trend of increasing mergers, which is expected to continue during the forecast period. The increased mergers in the market are anticipated to further boost the competition among the high-value players. The industry is expected to witness an increase in new market entrants, which is estimated to drive the competition. Some of the prominent players in global L-carnitine market include:

-

Lonza

-

Northeast Medicines Group Co., Ltd. (NEPG)

-

Biosint S.p.A.

-

Cayman Chemical

-

Merck KGaA

-

Tokyo Chemical Industry Co., Ltd.

-

Ceva

-

Kaiyuan Hengtai Nutrition Co., Ltd.

-

ChengDa Mediciness Co., Ltd.

-

Huanggang Huayang Medicines Co. Ltd.

-

HuBeiYuancheng Saichuang Technology Co.,, .Ltd.

L-carnitine Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 213.4 billion

The revenue forecast in 2030

USD 298.7 billion

Growth Rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Volume in tons, revenue in USD thousand, CAGR from 2023 to 2030

Segment scope

Process, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies Listed

Lonza; Northeast Medicines Group Co., Ltd. (NEPG); Biosint S.p.A.; Cayman Chemical; Merck KGaA; Tokyo Chemical Industry Co., Ltd.; Ceva; Kaiyuan Hengtai Nutrition Co., Ltd.; ChengDa Mediciness Co., Ltd.; Huanggang Huayang Medicines Co. Ltd.; HuBeiYuancheng SaichuangTechnology Co, .Ltd.

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information , which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global L-carnitine Market Report Segmentation

This report forecasts revenue and volume growth at global, regional and country levels in addition to provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global L-carnitine market report based on the process, product, application, and region:

-

Process Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Chemical Synthesis

-

Bioprocess

-

-

Product Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Food & Pharma Grade

-

Feed Grade

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Animal Feed

-

Healthcare Products

-

Functional Animal Feeds

-

Medicines

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global L-carnitine market size was estimated at USD 203.4 million in 2022 and is expected to reach USD 213.4 million in 2023.

b. The L-carnitine market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 298.7 million by 2030.

b. Healthcare application was the dominant application segment in terms of revenue, occupying over 34.7% in 2022, and is expected to experience significant growth over the forecast period. The rising use of L-carnitine supplementation for post-exercise recovery, weight management, and healthy aging is expected to drive the market over the forecast period.

b. Some of the key players in the L-carnitine market are Lonza, Northeast Pharmaceutical Group Co., Ltd. (NEPG), Biosint S.p.A., Cayman Chemical, Merck KGaA, Tokyo Chemical Industry Co., Ltd., Ceva, Kaiyuan Hengtai Nutrition Co., Ltd., ChengDa PharmaCeuticals Co., Ltd., Huanggang Huayang Pharmaceutical Co. Ltd., and HuBeiYuancheng SaichuangTechnology Co, Ltd.

b. The key factors that are driving the L-carnitine market include increasing product penetration among consumers that are suffering from chronic diseases & disorders coupled with increasing application of L-carnitine in animal feed which is aimed at animal growth performance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."