- Home

- »

- Medical Devices

- »

-

Laboratory Supplies Market Size, Share, Growth Report 2030GVR Report cover

![Laboratory Supplies Market Size, Share & Trends Report]()

Laboratory Supplies Market Size, Share & Trends Analysis Report By Product (Equipment, Disposables), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-002-8

- Number of Pages: 112

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

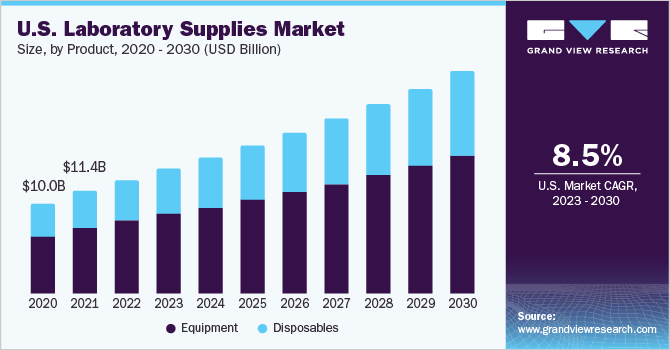

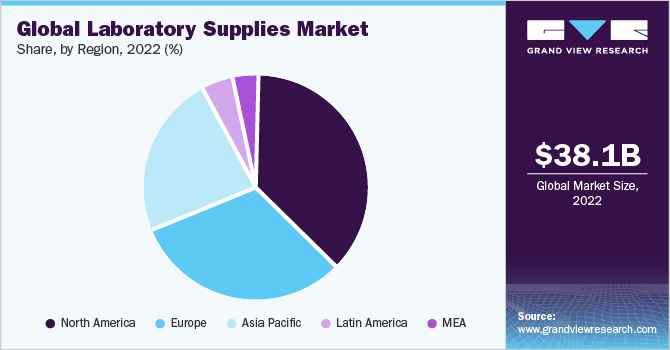

The global laboratory supplies market size was valued at USD 38.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. Based on industry insights, the market is majorly driven by the rise in funding and investment in R&D activities in pharmaceutical and biotechnology. The market is expected to grow steadily in the coming years owing to the continuous and stable supply of laboratory equipment. The Asia Pacific region accounted for the majority of growth during this period, owing to increased clinical diagnostic testing adoption, increased disposable income, a surge in research, development, and innovation activities, and increased disease prevention and early detection awareness.

The COVID-19 pandemic has increased demand for disposable items including gloves, masks, and other personal protective equipment (PPE), as well as laboratory disposables for COVID-19 testing and diagnosis. As a result, as more people and organizations prioritize safety and infection control measures, the disposable category will be the largest revenue segment in 2022. The COVID-19 pandemic has resulted in an increase in research pertaining to coronavirus. However, labs researching other diseases pre-pandemic were shut down as the major goal of the lockdown was to avoid close contact with others, which led to low demand for lab supplies. Demand for laboratory equipment and disposables increased, putting a strain on the worldwide supply chain, resulting in supply shortages and higher pricing. According to Stat News, many researchers have stated that widespread and lengthy shutdowns significantly impacted the pace of other scientific discoveries. Some of the initial disruptions have increased CROs' workload or reduced biopharmaceutical firms' internal lab testing capacities.

The demand for laboratory products is rising due to technological advancements in chemical and biological research. The increasing volume of clinical laboratory tests and life science research investigations drives the demand for laboratory disposable products. There is an increasing emphasis on improving healthcare outcomes, which has led to the adoption of improved laboratory equipment for faster and more accurate illness diagnosis and treatment, boosting the laboratory equipment and disposables market growth. The market is also projected to gain continuous demand for a constant supply of key laboratory devices and equipment among procurement managers in the pharmaceutical and healthcare sectors.

Laboratories need various equipment and instruments to run tests and research studies. General lab equipment and instruments can be found in educational labs, research labs, quality assurance, diagnostic testing in medical labs, R&D, manufacturing, and others. The use of laboratory equipment allows faster analyses that add value to the laboratory itself by increasing the capacity of the instruments, thus letting it perform more tests every day. Accelerated procedures have the potential to consolidate testing into a reduced number of instruments, thereby reducing maintenance requirements, consumable usage, regulatory documentation, and overall costs.

Demand for disposable goods is rising due to increased R&D efforts in the microbiology and pharmaceutical industries. Cell imaging consumables, test tubes, gloves, cuvettes, and pipettes are in high demand, which is anticipated to support the growth of the laboratory equipment and disposables market share. The need for laboratory disposables has also increased due to the discovery of new drugs, vaccines, and biopharmaceuticals, which is expected to fuel disposable segment growth in the coming years. Additionally, cell-based therapies and the growing emphasis on personalized medicine are projected to raise demand for laboratory disposables like cell culture consumables, which are needed to produce these therapies.

Technological advancements are also enhancing lab capabilities. Scientists and laboratory personnel may now operate more correctly and effectively than ever due to new methods and technologies. Lab life is getting more efficient as automation, miniaturization, artificial intelligence, and smart technologies become widespread. At the same time, there is more pressure than ever to provide results rapidly. So, laboratories need to be quick and flexible. The purchase process can be enhanced more effectively, a significant strategy for laboratory managers to boost productivity. The lab suppliers are further simplifying the product procurement and selection processes.

Laboratory equipment technological developments are also increasing its utilization. Modern laboratory instruments include user interfaces that make them simple to operate. Electronic pipettes with touchscreen operation and automated tip ejection are available from Brand Tech Scientific, Inc. This device has a smartphone-like screen that allows users to access functionalities with a simple swipe. In October 2022, Waters Corporation released the Extraction+ Connected Device, a new software-controlled device for the Waters Andrew+ Pipetting Robot that automates the processing of biological, food, forensic, and environmental samples utilizing solid phase extraction (SPE).

Product Insights

Based on product, the market for laboratory supplies has been segmented into equipment and disposable. The equipment segment dominated the market with the largest revenue share of 63.2% in 2022. This segment comprises essential equipment such as incubators, centrifuges, laminar hoods, air filtration systems, and microscopes. Each product plays a critical role in conducting research on cell or tissue culture, which is vital for studying drug toxicology, oncology therapies, and personalized medicine. These equipment items are indispensable for ensuring accurate and reliable results in these research areas.

The disposable segment is anticipated to grow at the fastest CAGR of 8.2% during the forecast period from 2023 to 2030 owing to the high equipment costs resulting in one-time installments for many years. With the help of the equipment, process controls, experiments, and quality assurance are carried out. It serves for quick capture and orientation in different categories.

Scientific institutions, such as laboratories, research centers, and corporations, require high-quality laboratory equipment to conduct a wide range of tests, investigations, and experiments. The strength, durability, and quality of the equipment determine the effectiveness of these exercises. They help to provide accurate results and increase productivity. This eventually drives higher demand for the equipment and accelerates market expansion.

Regional Insights

North America dominated the market with the largest revenue share of 37.7% in 202 and is also expected to grow at the fastest CAGR of 8.3% over the forecast period from 2023 to 2030. This is attributed to the presence of several biopharmaceutical and pharmaceutical firms engaged in R&D In addition, an increase in the number of grants, such as the National Institute of Health (NIH), to enhance research activities provided by government establishments is anticipated to boost the market growth. The quality and track record of firms that have operated in the region are believed to attract further investments for research during the forecast period.

Furthermore, the rising frequency of various infectious and non-infectious disorders in the United States and other key countries is raising demand for diagnostic tests, propelling the expansion of the laboratory equipment market and laboratory disposables. The biopharmaceutical industry is one of the region’s leading sectors in terms of funding research. Many companies are focusing on the development of new leads and storing an enormous number of samples, thereby creating demand for these products. Furthermore, a large number of companies are engaged in the development of therapeutics and vaccines due to the outbreak of coronavirus, hence boosting the market growth.

The technological advances in equipment and instruments made by the leading players contribute to an increase in the use of this laboratory equipment in research institutes, research laboratories, and diagnostic laboratories. In this location, high-tech equipment is in high demand since it gives outstanding accuracy while minimizing testing time. For instance, in June 2022, PerkinElmer, Inc. introduced the GC 2400 Platform, a sophisticated, automated gas chromatography (GC), headspace sampler, and GC/mass spectrometry (GC/MS) system aimed to assist lab teams in simplifying lab operations. The presence of multiple important players in this space, including PerkinElmer Inc., Bio-Rad Laboratories, and Bruker Corporation, is a primary driver of market growth in North America.

Key Companies & Market Share Insights

Key players in the laboratory supplies market are introducing new products with advanced features and technologies that ease the operation of samples. There is a trend for smaller and easy-to-use instruments with built-in connectivity. For instance, in January 2020, Double Helix Optics announced the launch of an upgraded version of its product, featuring multiple channels and enhanced imaging and tracking capabilities. The newly launched SPINDLE2 module, equipped with the patented Light Engineering point spread function (PSF) technology, offers researchers in academic, institutional, pharmaceutical, and biotech settings the ability to incorporate simultaneous, multi-color 3D imaging and tracking with exceptional precision depth capability into their existing microscope platforms. This advancement empowers scientists to achieve unprecedented levels of imaging accuracy and depth while utilizing their current microscope setups.

Additionally, in October 2022, Waters Corporation announced the launch of a new software-controlled product called Extraction+ Connected Device designed for the Waters Andrew+ Pipetting Robot. The Extraction+ Connected Device automates and records solid phase extraction methods utilized in the preparation of samples for various research applications such as biological, food, forensic, environmental, and clinical studies. This innovative solution streamlines and standardizes the extraction process while providing comprehensive documentation for enhanced accuracy and reproducibility.

Similarly, in June 2022, Waters Corporation announced the launch of the Waters Arc HPLC System, a novel high-performance liquid chromatograph (HPLC) designed for routine testing across various industries, including pharmaceutical, food, academic, and materials sectors. This advanced system offers reliable and efficient performance to meet the analytical needs of these markets. Additionally, Waters Corporation has introduced the enhanced data back-up and recovery solution, Waters Empower BC LAC/E with SecureSync. This purpose-built solution is specifically designed for organizations that operate in distributed laboratory environments. It provides improved data security and integrity, ensuring the safety and accessibility of critical data for efficient laboratory operations. Some prominent players in the global laboratory supplies market include:

-

Agilent Technologies, Inc.

-

Bio-Rad Laboratories, Inc.

-

Bruker

-

Danaher

-

FUJIFILM Holdings Corporation

-

PerkinElmer Inc.

-

Sartorius AG

-

Shimadzu Corporation

-

Thermo Fisher Scientific Inc.

-

Waters Corporation

Laboratory Supplies Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 41.35 billion

Revenue forecast in 2030

USD 68.77 billion

Growth rate

CAGR of 7.5% from 2023 to 2030

Base year for estimation

2022

Historic data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million /billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Bruker; Danaher; FUJIFILM Holdings Corporation; PerkinElmer Inc.; Sartorius AG; Shimadzu Corporation; Thermo Fisher Scientific Inc.; Waters Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

Global Laboratory Supplies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory supplies market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Incubators

-

Laminar Flow Hood

-

Micro Manipulation Systems

-

Centrifuges

-

Lab Air Filtration System

-

Scopes

-

Sonicators & Homogenizers

-

Autoclaves & Sterilizers

-

Spectrophotometer & Microarray Equipment

-

Others

-

-

Disposables

-

Pipettes

-

Tips

-

Tubes

-

Cuvettes

-

Dishes

-

Gloves

-

Masks

-

Cell Imaging Consumables

-

Cell Culture Consumables

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the laboratory supplies market with a share of 37.7% in 2022. This is attributable to rising R&D investment in this region that is creating the need for laboratory products.

b. Some key players operating in the laboratory supplies market include Bio-Rad Laboratories, Inc.; Bruker Corporation; Danaher Corporation; Fujifilm Holdings Corporation; Agilent technologies Inc.; PerkinElmer Inc.; Shimadzu Corporation; Thermo Fisher Scientific, Inc.; and Waters Corporation.

b. The global laboratory supplies market size was estimated at USD 38.1 billion in 2022 and is expected to reach USD 41.35 billion in 2023.

b. The global laboratory supplies market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 68.77 billion by 2030.

b. Key factors that are driving the laboratory supplies market growth include increasing funding & investment in research & development activities in the field of biotechnology & pharmaceutical; and advancements in the field of biological and chemical research.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."