- Home

- »

- Biotechnology

- »

-

Latin America Digital Biology Market Size Report, 2020-2027GVR Report cover

![Latin America Digital Biology Market Size, Share & Trends Report]()

Latin America Digital Biology Market Size, Share & Trends Analysis Report By Application (Drug Discovery & Disease Modelling), By Tools, By Services, By End-use, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-242-8

- Number of Pages: 116

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Healthcare

Report Overview

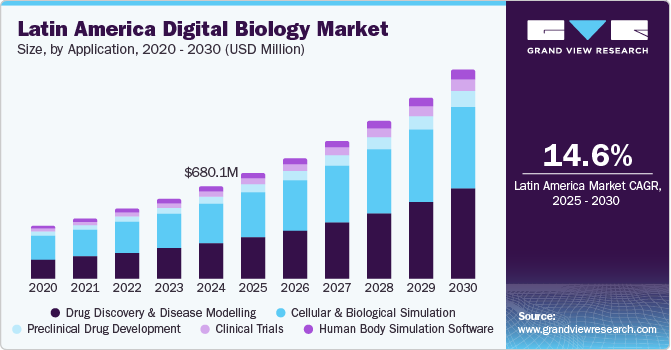

The Latin America digital biology market size was estimated at USD 273.0 million in 2019. It is expected to expand at a compound annual growth rate (CAGR) of 13.8% from 2020 to 2027. Rapid advancements in the information technology sector have enabled developments in biosimulation and computational biology to drive the market growth. Innovation in genome sequencers, sequence databases, multiple sequencing, gene finders, and protein visualization has increased the adoption of computational biology tools. Universities and companies are using grid computing for storage and processing of large amounts of data. Moreover, the development of advanced solutions is expected to drive the market during the forecast period, as they reduce the time required to analyze large sets of data.

The availability of enhanced computational tools is considered a major factor driving the market growth in the region. The companies operating in the region such as DUNA Bioinformatics, Genedata AG, Dassault Systemes are focused on the development of improved computational tools further driving the market growth in the region. For instance, in May 2020, Genedata AG introduced the latest version of Genedata Screener 17.0 advanced features. Such companies are anticipated to positively impact market growth by increasing product availability.

Furthermore, the increasing use of software tools in bioinformatics for processing large amounts of biological data by various Brazilian Universities is also expected to contribute to driving the market growth by increasing the application of computational tools in bioinformatics studies. Supportive government policies and increasing funding from the government have a major contribution in driving the digital biology market growth in Latin American countries.

For instance, the Brazilian government has established agencies and initiated programs to support scientific research in biotechnology. In addition to this, for the establishment of the Colombian Center for Bioinformatics and Computational Biology, the Colombian government invested a large amount in it.

Application Insights

Cellular and biological simulation dominated the overall market in 2019 with a revenue share of over 40%. Computational cell modeling and biology can help decipher the biological and physiological functions of cells. Cellular models can provide information on gene expression, calcium signaling, cell dynamics, mitochondrial functions, and cell motility.

Increasing demand for personalized medicine is expected to propel the demand for advanced tools, which are used to gain a complete understanding of genetic structures and functions. Computational simulation techniques provide details on dynamics and mechanisms of cell functioning, such as physiological behavior of cells; interaction between genes, proteins, & metabolites; and molecular functioning.

Digital biology solutions are finding use across several applications in bioinformatics and genomics in the Latin American countries, especially across Mexico and Brazil. Regulatory authorities, large-scale research organizations, and professionals are actively participating in collaborative research studies based on digital biology tools. Digital biology tools are gaining significant traction across cellular simulation-based research studies in Mexico.

Tools Insights

Databases dominated the 2019 market with a revenue share of over 30% in 2019. Kits and reagents form an essential part of any genomic study. Databases are in demand as large amounts of clinical and biological data are being generated during the development of advanced sequencing technologies, such as next-generation sequencing.

Programs such as The Encyclopedia of DNA Elements (ENCODE) and The Cancer Genome Atlas (TCGA) have led to the generation of a large number of datasets. TCGA comprises measurements about somatic mutations, copy number variation, mRNA expression, miRNA expression, protein expression, and histology slides for around 7,000 human tumors.

Similarly, the ENCODE public research project has generated more than 2,600 genomic datasets from RNA-seq, ChIP-seq, CAGE, ChIA-PET, high-C, and other investigations. The project has generated 1,479 datasets for ChIP-seq to describe histone modification and transcription factor binding patterns in human cell lines.

Therefore, such projects generate big data and subsequently increase the need for storing and analyzing. Several databases have been developed to store the generated big data, e.g., DNA Database of Japan (DDJB), EMBL Nucleotide Sequence Database, GenBank, Institute for Genomic Research, PIR, and SWSS-PROT. These databases are large and, thereby, complex. GenBank is a database that stores data of about 3×1012 nucleotides.

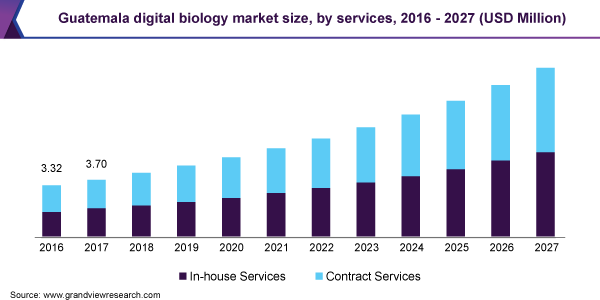

Service Insights

Contract services occupied the largest share of 51.37% in 2019. Computational biology tools are in high demand within the biopharma and life sciences companies due to their need for streamlining R&D processes and reduce timelines & costs associated with drug discovery and development.

The use of information technology for the simulation of living systems is challenging due to functional, structural, and regulatory processes being highly complex within a living system. Therefore, most biopharma manufacturers prefer outsourcing computational biology services to experts.

Outsourcing is an ideal choice for companies involved in wet-lab experiments and those not having expertise in modern computational biology. Thus, outsourced providers for computational biology services employ highly qualified staff within an industry that faces a shortage of skilled professionals. Therefore, pharmaceutical and healthcare corporations find it cost-effective to outsource services to a company that is already equipped with systems and has experience in handling challenges in this field.

End-use Insights

Academics and research generated the largest revenue share of around 60% in 2019. Biomedical informatics and computational biology program is the vanguard of computational biology, which is offered by many universities and research laboratories and is funded by the government and government research organizations. Computational biology is popular in academic institutions owing to many opportunities.

Researchers from across the globe are using computer-based technologies for biological research to resolve pressing healthcare issues. It plays an important role in academics as it provides quick information that facilitates academic research processes. Academic institutes are currently in the process of integrating and innovating analytical and computational approaches to resolve complex problems in oncogenic, evolutionary bioinformatics, proteomics, regulatory RNAs and stem-cell bioinformatics, structural bioinformatics, macromolecular dynamics, and drug designs.

The commercial/industrial segment is expected to expand at the fastest CAGR during the forecast period, owing to factors such as the drying pipeline of drugs, high demand for innovative drugs, and late-stage trial failures. Key players focus on developing computational approaches for modeling complete biological pathways related to any disease.

These approaches have a high potential for drug discovery, building molecular network models for disorders, and mining patient records and biomedical literature to drive the discovery of novel drug targets. Several pharmaceutical companies are adopting computational tools to reduce drug development timelines and enhance drug discovery pipelines.

Regional Insights

Brazil dominated the market with a share of 19.54% in 2019. An increase in economic activity has accelerated investments in Brazil’s research industry. Favorable government funding policies are supporting R&D efforts in the digital biology market. Owing to these factors, the digital biology market in the country is anticipated to witness considerable growth in the coming years.

DUNA Bioinformatics is a Brazil-based company operating in computational biology. The company offers several tools to serve different areas of bioinformatics. For instance, it provides services for computational analysis of metagenome, genome, and transcriptome, along with consultancy services and software development. The growing level of participation by local companies in developing novel biotechnology solutions from Brazil has contributed to its dominance throughout the forecast period.

The Brazilian Association of Bioinformatics and Computational Biology (AB3C) was established to address the shortcomings of the current digital biology landscape in the country. The organization arranges conferences related to bioinformatics and computational biology to propel the adoption of digital biology in the market.

Key Companies & Market Share Insights

The key strategies adopted by the companies operating in the market to expand their current services, client portfolio, staff, geographical presence, and acquire capital money to invest, grow, and develop their business include acquisition, joint venture, partnerships, and collaborations.

For instance, BIOAL S.A.C is a Peru-based company offering biotechnology services, including DNA and protein-based testing. The company collaborates with private and public institutions for the development of scientific research in genomics, biotechnology, and biological engineering.

The International Potato Center (CIP) uses computational biology for the analysis of genotypic data (GBS). This is a joint venture between CGIAR and CIP for enhancing nutrition from certain foods. The presence of such companies is anticipated to propel the market in the Latin American region. Some prominent players operating in the Latin America digital biology market include:

-

DUNA Bioinformatics

-

Precigen (Intrexon Corporation)

-

Dassault Systèmes

-

Genedata AG

-

Simulations Plus, Inc.

Latin America Digital Biology Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 310.2 million

Revenue forecast in 2027

USD 768.9 million

Growth Rate

CAGR of 13.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, services, tools, end-use, country

Regional scope

Latin America

Country scope

Brazil; Mexico; Argentina; Chile; Colombia; Peru; Ecuador; Dominican Republic; Guatemala; Cuba; Panama; Venezuela; Costa Rica; Uruguay

Key companies profiled

DUNA Bioinformatics; Precigen (Intrexon Corporation); Dassault Systèmes; Genedata AG; Simulations Plus, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Grand View Research has segmented the Latin America digital biology market report based on application, tools, service, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Cellular & Biological Simulation

-

Computational Genomics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Computational Proteomics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Pharmacogenomics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Transcriptomics and Metabolomics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

-

Drug Discovery & Disease Modelling

-

Target Identification

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Target Validation

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Lead Discovery

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Lead Optimization

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

-

Preclinical Drug Development

-

Pharmacokinetics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Pharmacodynamics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

-

Clinical trials

-

Phase I

-

Phase II

-

Phase III

-

-

Human Body Simulation Software

-

-

Tools Outlook (Revenue, USD Million, 2016 - 2027)

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Services Outlook (Revenue, USD Million, 2016 - 2027)

-

In-house

-

Contract

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Academics & Research

-

Industrial

-

- Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

Brazil

-

Mexico

-

Argentina

-

Chile

-

Colombia

-

Cuba

-

Uruguay

-

Peru

-

Venezuela

-

Costa Rica

-

Ecuador

-

Panama

-

Guatemala

-

Dominican Republic (República Dominicana)

-

Frequently Asked Questions About This Report

b. The Latin America digital biology market size was estimated at USD 273.0 million in 2019 and is expected to reach USD 310.2 million in 2020.

b. The Latin America digital biology market is expected to grow at a compound annual growth rate of 13.8% from 2020 to 2027 to reach USD 768.9 million by 2027.

b. Cellular and biological simulation dominated the Latin America digital biology market with the highest share in 2019. This is attributable to to increase in usage of computational methods in structural and functional genomics and epigenomics for analysis of gene sequencing.

b. Some key players operating in the Latin America digital biology market include DUNA Bioinformatics, Intrexon Corporation, Dassault Systèmes, Genedata AG, and Simulations Plus Inc.

b. Key factors driving the Latin America digital biology market growth include growing R&D costs and clinical trial failure rates triggering the demand for computational biology-based solutions, along with the advent of artificial intelligence and cloud computing technologies enhancing the utility of digital biology.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."