- Home

- »

- Advanced Interior Materials

- »

-

Latin America Maintenance, Repair & Overhaul Market Report, 2020-2028GVR Report cover

![Latin America Maintenance, Repair & Overhaul Market Size, Share & Trends Report]()

Latin America Maintenance, Repair & Overhaul Market Size, Share & Trends Analysis Report By Product (Industrial, Electrical), By End-use (Transportation, Food, Beverage & Tobacco), By Country, And Segment Forecasts, 2020 - 2028

- Report ID: GVR-4-68038-374-4

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Advanced Materials

Report Overview

The Latin America maintenance, repair and overhaul market size was valued at USD 28,344.9 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2020 to 2028. Growth in the frequency of the replacement cycles to reduce the production downtime by the players involved in industrial manufacturing is expected to drive the market over the forecast period. The market in the region was impacted by the onset of the pandemic, which led to the suspension of the manufacturing activities coupled with the postponement of maintenance, repair and overhaul (MRO) activities. In addition, suspension in the supply chain due to border closures also resulted in a decline in the sales of MRO products in the region resulting in a decline in the industry growth.

The MRO operations are necessary for the smooth running of the business and the COVID-19 pandemic disrupted the supply chain during the year 2020. The high dependence of Latin American countries on parts and component imports from regions like the Asia Pacific and Europe witnessed a decline due to lockdown measures, which, in turn, affected the market growth in 2020.

The rising trade from e-commerce platforms has radically added to the market growth across various countries in the region. The presence of various distributors and channel partners across the value chain has further facilitated direct sales in the market, which is directly smoothening the component procurement across various industrial production units.

Post the recession period, the MRO outsourcing services sector has increased significantly as most of the companies sought to cut costs on inventory and specialized workforce. Large multinational distributors in the region are focusing on meeting various customer needs to provide quality services at affordable prices.

The final prices of products utilized in MRO operations depend on the manufacturing capabilities of OEMs. Numerous players in the industry are engaged in contract manufacturing and outsourcing of products. Industry standards and customized specifications stated by market leaders are considered by third-party manufacturers while delivering the desired product.

Product Insights

The industrial product segment led the market and accounted for 70% of the global market share in 2020. The segment is expected to remain dominant over the forecast period owing to the repair and maintenance activities associated with the exceeding machine capacity work resulting in worn-out parts and components. The growing usage of the key components in MRO due to the increasing manufacturing and frequency of replacement cycles is expected to drive market growth over the forecast period. In addition, the demand for MRO products in the region is expected to be driven by the presence of key aerospace MRO companies, such as Aeroman.

The electric product segment is anticipated to grow at a CAGR of 5.8% from 2020 to 2028. Frequent maintenance and repair activities associated with power transmission using electric components are one of the major growth contributors to the product segment. A wide array of manufacturing facilities is focusing on the procurement of automation technology instruments to reduce the turnaround time for the operations, thus are increasing the demand for advanced power transmission tools. Growing technology trends to reduce the human efforts for heavy and risky operations is likely to introduce an easy mechanism for transmission operations.

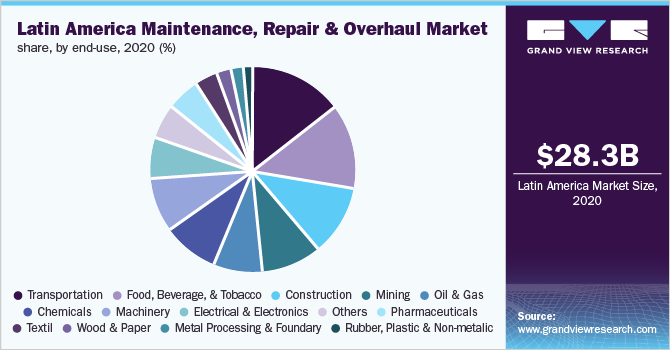

End-use Insights

The transportation end-use segment dominated the market in 2020 with a revenue share of more than 14% on account of government initiatives to improve and enhance the existing transport infrastructure. The high demand for key replacement products for the existing fleet for road, rail, and air transport is expected to drive the regional market over the forecast period. The food, beverage, and tobacco end-use segment is likely to grow at a CAGR of 3.8% over the forecast period. Rising food, beverage, and tobacco industries in the region to fulfill the demand of the increasing population from the countries including Brazil and Mexico are expected to result in an increased production, which is further expected to drive the MRO activities.

The oil & gas end-use segment recorded a demand value of USD 2,226.9 million in 2020, which is expected to ascend at a significant CAGR over the forecast period. In addition, rising shale gas operations in the countries including Argentina and Venezuela are expected to build several facilities across the region, thereby, supporting the component distribution requiring maintenance over the forecast period. The MRO activities in the mining end-use industry are anticipated to grow a steady CAGR over the forecast period. Notable mining activities cause machines under high stresses and load, which requires rigorous maintenance and repair activities for machines and vehicles including excavators, loaders, and graders. This, in turn, is expected to boost the market growth.

Country Insights

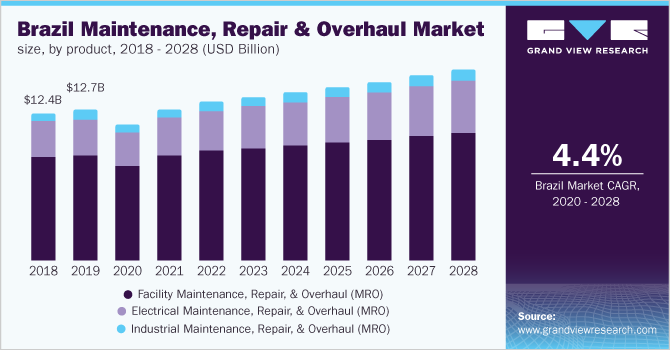

Brazil dominated the Latin America MRO market in 2020 with a revenue share of over 40% and is expected to retain the leading position over the projected period. A wide array of industries is responsible for the economic growth of the country including construction, transportation, food, beverage, & tobacco, mining, and machinery, which, in turn, is expected to have a positive impact on the market growth. The expansion of residential, commercial, and industrial sectors on account of steadily increasing economic growth in the region is expected to enhance construction activities, thereby, adding to the market growth over the forecast period. The construction industry in Brazil is likely to grow on account of the rising per capita income, growing population, and rapid urbanization.

Mexico accounted for the second-highest revenue share of 22.5% in 2020 and is anticipated to grow at a steady CAGR over the forecast period due to the rising manufacturing and industrial production activities. The market is significantly dominated by the automobile and aerospace end-use industries, which, in turn, is anticipated to increase the MRO activities for the same. The metalworking and automotive industries are the largest end-users for industrial machinery on account of increasing investments by multinational companies to boost production in countries including Brazil and Mexico. Furthermore, machines used in food processing, air & water purification, and packaging are some of the end-users contributing to the machinery end-use segment over the forecast period.

Key Companies & Market Share Insights

Major players in the industry are focusing on adopting various strategic initiatives including acquisitions and mergers to increase the distribution network for products and services. The majority of the players have their web portals including to attain sales growth through direct channels. In addition, frequent schedule and periodic maintenance offering by various players is likely to add to the market growth. Some of the prominent players in the Latin America maintenance, repair & overhaul market are:

-

Adolf Würth GmbH & Co. KG.

-

Applied Industrial Technologies

-

Motion Industries, Inc.

-

WESCO International, Inc.

-

Sonepar

-

W.W. Grainger, Inc.

Latin America Maintenance, Repair & Overhaul Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 31.54 billion

Revenue forecast in 2028

USD 41.01 billion

Growth rate

CAGR of 4.7% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Market representation

Revenue in USD million/billion and CAGR from 2020 to 2028

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Regional scope

Latin America

Country scope

Brazil; Mexico; Argentina; Peru; Chile; Colombia

Key companies profiled

Adolf Würth GmbH & Co. KG; Applied Industrial Technologies; Motion Industries, Inc.; WESCO International, Inc.; Sonepar; W.W. Grainger, Inc.; Fastenal Company; SOLUPARTS; SERVILUB; ABB Mining; Komatsu Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the Latin America maintenance, repair & overhaul market report on the basis of product, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Industrial MRO

-

Electrical MRO

-

Facility MRO

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2028)

-

Food, Beverage, and Tobacco

-

Textile

-

Wood & Paper

-

Mining

-

Oil & Gas

-

Metal Processing & Foundry

-

Rubber, Plastic & Non-Metallic

-

Chemicals

-

Pharmaceuticals

-

Electrical & Electronics

-

Transportation

-

Machinery

-

Construction

-

Others

-

-

Country Outlook (Revenue, USD Million, 2017 - 2028)

-

Mexico

-

Brazil

-

Argentina

-

Chile

-

Peru

-

Colombia

-

Frequently Asked Questions About This Report

b. The Latin America maintenance, repair and overhaul market was estimated at USD 28,344.9 million in 2020 and is expected to reach USD 31.54 billion in 2021.

b. The Latin America MRO market is expected to grow at a compound annual growth rate of 4.7% from 2020 to 2028 to reach USD 41.01 billion in 2028.

Which segment accounted for the largest Latin America maintenance, repair and overhaul market share?b. Brazil dominated the Latin America MRO market with the highest share of 40.3% in 2020. This is attributed to the increasing application of MRO products and services from various end-use industries including food, beverage, & tobacco, construction, transportation, and mining.

b. Some key players operating in the Latin America maintenance, repair and overhaul market include Adolf Würth GmbH & Co. KG., Applied Industrial Technologies, Motion Industries, Inc., WESCO International, Inc., Sonepar, and W.W. Grainger, Inc., and others.

b. Key factors driving the Latin America maintenance, repair and overhaul market growth include rising demand for maintenance, repair, and overhaul products and services for various end-use industries. In addition, ascending industrial, oil & gas, and mining output in countries including Mexico, Brazil, Argentina, and Peru is expected to raise MRO operations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."