- Home

- »

- HVAC & Construction

- »

-

Lawn Mowers Market Size, Share And Growth Report, 2030GVR Report cover

![Lawn Mowers Market Size, Share & Trends Report]()

Lawn Mowers Market Size, Share & Trends Analysis Report By Product (Manual, Electric, Petrol, Robotic), By Product Type, By Propulsion, By End-use (Residential, Commercial/Government), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-927-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

Lawn Mowers Market Size & Trends

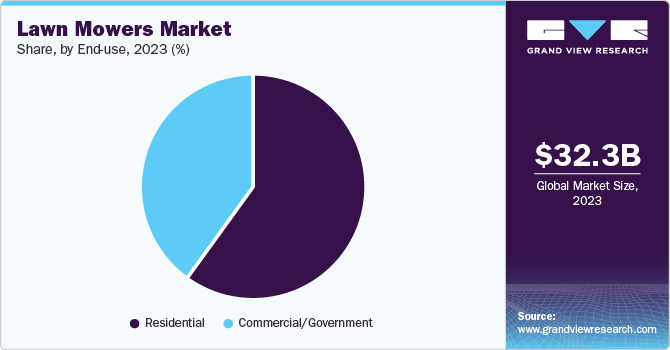

The global lawn mowers market size was valued at USD 32.31 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. Increasing awareness of environmental concerns is leading to a demand for eco-friendly, electric, and battery-powered mowers, reducing reliance on traditional gas-powered models. Consumer preferences for low-maintenance, easy-to-use, and durable lawn mowers also play a pivotal role in shaping the market, with manufacturers focusing on developing products that align with these expectations to gain a competitive edge in the industry. Moreover, with work from home, consumers have time to engage in activities like gardening, paving the way for the residential lawn mowers segment growth. In addition to this, households with increased disposable income have also increased consumer spending power, with demand for lawn maintenance activities on a rise.

In China, the demand for lawn mowers is expected to reach above pre-COVID levels in 2022 as the Chinese government pushes for eco-city project developments, subsequently creating avenues for future growth. Further, leisure gardening in China is witnessing a steady rise, projected to favor growth over the next few years. Despite changing consumer preferences or patterns in spending power, aesthetic appeal and eco-awareness for the gardening area within the household is a primary driver for the market.

In 2021, the global market rebounded to pre-COVID levels due to increased demand for battery-powered lawn mowers, notably from North America and Europe. However, ongoing semiconductor shortage concerns, disruption in supply chain activities, rising raw material prices, and a surge in oil prices due to the Russian-Ukraine conflict are expected to slow down the market in 2022. Due to these unfavorable macroeconomic conditions, OEMs and dealers are expected to increase the Average Selling Prices (ASP) of lawn mowers in 2022. These developments are likely to be short-lived and are expected to come down by H2 2023.

Over the next few years, vendor focus will be introducing robotic mowers as the demand for tech-advanced mowers is gaining a foothold with consumers seeking convenience. GPS, Wi-Fi, and other technologies are making inroads in the lawn mowing business and will keep vendors upkeep market growth over the future. Remote-controlled lawn mower is also emerging as a popular choice among consumers in developed regions. In addition to the demand for advanced products, the demand from the affluent middle class taking gardening as a hobby also promotes lawn mowers market growth. The development of government backed or commercial spaces infrastructure projects will also play a crucial part in propelling the demand for lawn mowers in the commercial sector.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The lawn mowers market is characterized by a high degree of innovation owing to integration with smart technologies, allowing for connectivity in the mowers. The integration often includes features such as GPS tracking, remote monitoring and control through Internet of Things (IoT) platforms to enhance gardening tools.

The lawn mowers market is also characterized by a significant level of merger and acquisition (M&A) activity by the leading players. The manufacturers of lawn mowers are progressively integrating cutting-edge technologies to augment productivity and sales and to gain competitive advantage across the globe.

The lawn mowers market is also subject to several regulatory considerations. These regulations often dictate emissions limits, noise levels, and safety features to ensure that lawn mowers are environmentally friendly and pose minimal risks to users and the surrounding community.

The threat of substitutes for lawn mowers is higher in the market. The threat of substitutes can be ascribed to the non-existence of any major external substitutes. However, several internal substitutes for a particular product exist. The replacement of electronically powered tools is transforming the grading equipment industry.

End-user concentration is a significant factor in the lawn mowers market. Several end-user industries such as residential and commercial are driving demand for lawn mowers.The significance of end-users in the market is paramount as their preferences and demands directly drive the industry's trends and innovations.

Product Insights

The electric-powered lawn mowers segment dominated the market and accounted for the largest revenue share of 29.18% in 2022. This growth is ascribed to ease of use and high torque to weight ratio, enabling these lawn mowers to cut tall grass. The segment captured a sizeable share in 2021 and is anticipated to register a steady CAGR exceeding 5.4% from 2023 to 2030. Furthermore, these lawn mowers are now one of the most often used alternatives among consumers due to innovation and development in battery-powered engines that have boosted their robustness and efficiency.

The robotic mowers segment is projected to surpass 15,937.1 million by 2030, almost 2.2 times the market size in 2022. The massive segment growth is ascribed to consumer inclination towards tech-savvy products that offer convenience and environment-friendly options. Furthermore, the price for robotic products has reached affordable price points increasing their adoption in developed markets over the last few years. Consumers prefer to integrate these mowers with their existing smart home ecosystem, allowing them to control the device remotely using a smartphone-based app.

End-Use Insights

The residential segment dominated the market and accounted for the largest revenue share of over 59.0% in 2022. Lawn mowers are primarily used in a residential setting for gardening applications, whereas in commercial spaces, for large-scale landscaping applications and lawn maintenance. The demand for lawn mowers in the residential market witnessed an uptick post-2021 and exceeded USD 18 billion in 2022. This healthy demand is ascribed to the proliferation of remote working models worldwide, giving consumers time to engage in leisure activities such as gardening or DIY gardening from their homes. As consumers began to spend more time at home, the demand for products associated with gardening gained traction, a trend that is expected to go on for at least the next two years.

However, because to global shutdown restrictions, projects and associated investment for commercial gardening and landscaping came to a temporary standstill. Orders were put on hold for the specified time due to logistic disruptions, uncertain economic conditions, and reduced budgets. However, with the opening of trade channels, particularly e-commerce channels, and the restarting of infrastructure projects, the industry is anticipated to have a somewhat softer demand over the following few years. The segment is expected to register a CAGR of 5.2% from 2022 to 2030.

Regional Insight

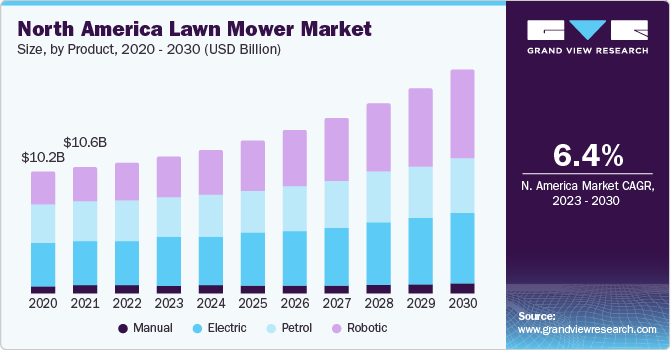

North America dominated the lawn mowers market and has the largest revenue share of 35.03% in 2022. Developed markets such as North America and Europe markets with high demand. In 2021, these regional markets held their leading positions in terms of market share, collectively surpassing 60%. Over the last few years, increasing urbanization in Western Europe has made houses smaller, in turn reducing garden size. This trend may become a serious threat to the uptake of lawn mowers in the region. However, the maintenance and development of lawns in commercial buildings will provide some respite to the otherwise challenged lawn mowers industry growth.

In America about 30% of residential houses are known to have kitchen- based gardens, suggesting that gardening is still popular in most parts of the U.S. This trend is projected to support the demand for lawn mower OEMs by increasing sales. In addition to this, more than 70% of the households in the U.S. have a back garden lawn, supporting the application of lawn mowers for maintaining the garden while creating growth avenues for OEMs who offer lawn maintenance equipment. North America is anticipated to register a CAGR of approximately 6.5% over the forecast period, primarily due to an increase in lawn maintenance activities amid the pandemic and an increase in construction activities in 2021.

Key Lawn Mowers Company Insights

Some of the key players operating in the market include Deere & Company; American Honda Motor Co., Inc.; The ; Husqvarna Group; and MTD Products.

-

American Honda Motor Co., Inc. offers nearly 70 models of power equipment in its product lines such as lawnmowers, snow blowers, generators, pumps, trimmers, and tillers. The company’s prominent products are assembled at more than 11 Honda manufacturing facilities across the globe.

-

Deere & Company has operation centers located in 30 countries across the globe. The company offers its products through various third-party dealers, some of which include Austin Turf & Tractor, Storm Lawn & Garden, LLC, United Ag & Turf, Lawn Land, Ag-Pro Texas, LLC, and Shoppa's Farm Supply, Inc.

Ariens Company; Briggs Stratton; Falcon Garden Tools; Fiskars; Robert Bosch GmbH; and Robomow Friendly House are some of the emerging market participants in the lawn mowers market.

-

Falcon Garden Tools is engaged in export and manufacturing of tools and equipment that are useful in agricultural, horticultural, forestry, and gardening. The company also offers after sales services along with its 300 dealers /distributors /stockiest.

-

Robert Bosch GmbH is a provider of consumer goods as well as industrial and automobile equipment. The key business segments of the company include mobility solutions, industrial technology, consumer goods, and energy & building technology.

Key Lawn Mowers Companies:

The following are the leading companies in the lawn mowers market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these lawn mowers companies are analyzed to map the supply network.

- American Honda Motor Co., Inc.

- Ariens Company

- Briggs Stratton

- Deere & Company

- Falcon Garden Tools

- Fiskars

- Husqvarna Group

- MTD Products

- Robert Bosch GmbH

- Robomow Friendly House

- The Toro Company

Recent Developments

-

In June 2023, Deere & Company announced its partnership with EGO and its parent company Chevron. With this partnership, Deere & Company will be able to offer its customers lawn care solutions by gaining access to EGO’s top-quality powered lawn mower equipment. The partnership opens up opportunities for both companies to collaborate on new and innovative battery-powered lawn care equipment. This could involve combining EGO's expertise in battery technology with John Deere's experience in engineering and design.

-

In March 2023, Robert Bosch GmbH introduced the UniversalRotak 2x18V-37-550 cordless lawn mower. This has been designed for the cleaning of large lawns that are 500 m2. The mower utilizes two 18V batteries for extended runtime, ensuring complete lawn mowing.

-

In February 2023, Deere & Company introduced the Z370R Electric ZTrak Residential Zero-Turn Mower. The mower is launched targeting property owners with extensive yards. The mower can be charged without removing its batteries by 110 volts grounded outlet and a standardized outdoor extension cord. The Z370R eliminates the need for gasoline and oil changes, simplifying maintenance. Charging is done through a standard outlet, eliminating the need for specialized equipment.

Lawn Mowers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 32.31 billion

Revenue forecast in 2030

USD 48.60 billion

Growth rate

CAGR of 6.0 % from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Market representation

Revenue in USD million/billion, and CAGR from 2023 to 2030

Segments covered

Product, product type, propulsion, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Netherlands; Denmark; Finland; Spain; China; India; Japan; South Korea; Singapore; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lawn Mowers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lawn mowers market report based on product, product type, propulsion, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Electric

-

Petrol

-

Robotic

-

Others

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ride-on Mowers

-

Push Mowers

-

Robotic Mowers

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Professional Landscaping Services

-

Golf Courses

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Netherlands

-

Denmark

-

Finland

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lawn mowers market size was estimated at USD 31.18 billion in 2022 and is expected to reach USD 32.31 billion in 2023.

b. The global lawn mowers market is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 48.59 billion by 2030.

b. North America dominated the lawn mowers market with a share of 35.03% in 2022. This is attributable to the ongoing trend of backyard improvement or backyard beautification in the region.

b. Some key players operating in the lawn mowers market include Deere and Company; MTD products; American Honda Motor Co., Inc.; Robert Bosch GmbH; STIGA S.p.A.; Robomow Friendly House; Husqvarna Group; and AriensCo.

b. Key factors that are driving the lawn mowers market growth include increased consumer interest in gardening activities such as landscaping, backyard beautification, and backyard cookouts.

Table of Contents

Chapter 1. Lawn Mowers Market: Methodology And Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

1.3. List Of Data Sources

Chapter 2. Lawn Mowers Market: Executive Summary

2.1. Market Snapshot

Chapter 3. Lawn Mowers Market: Trends, Variables, And Scope

3.1. Market Segmentation

3.2. Market Size And Growth Prospects, 2018 - 2030

3.3. Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Market Opportunity Analysis

3.5. Key Opportunities Prioritized

3.6. Industry Analysis - Porter's Five Forces

3.7. PEST Analysis

3.8. COVID-19 Impact Analysis

Chapter 4. Lawn Mowers Market Product Outlook

4.1. Lawn Mowers Market Share by Product, 2023 & 2030 (USD Million)

4.2. Manual

4.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.3. Electric

4.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.4. Petrol

4.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.5. Robotic

4.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

4.6. Others

4.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 5. Lawn Mowers Market Product Type Outlook

5.1. Lawn Mowers Market Share by Product Type, 2023 & 2030 (USD Million)

5.2. Ride-on Mowers

5.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

5.3. Push Mowers

5.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

5.4. Robotic Mowers

5.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 6. Lawn Mowers Market Propulsion Type Outlook

6.1. Lawn Mowers Market Share by Propulsion Type, 2023 & 2030 (USD Million)

6.2. ICE

6.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

6.3. Electric

6.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 7. Lawn Mowers Market End Use Outlook

7.1. Lawn Mowers Market Share by End Use, 2023 & 2030 (USD Million)

7.2. Residential

7.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.3. Professional Landscaping Services

7.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.4. Golf Courses

7.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.5. Government

7.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

7.6. Others

7.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

Chapter 8. Lawn Mowers Market: Regional Outlook

8.1. Lawn Mowers Market Share by Region, 2023 & 2030 (USD Million)

8.2. North America

8.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.2.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.2.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.2.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.2.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.2.6. U.S.

8.2.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.2.6.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.2.6.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.2.6.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.2.6.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.2.7. Canada

8.2.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.2.7.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.2.7.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.2.7.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.2.7.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.3. Europe

8.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.3.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.3.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.3.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.3.6. U.K.

8.3.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3.6.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.3.6.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.3.6.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.3.6.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.3.7. Germany

8.3.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3.7.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.3.7.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.3.7.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.3.7.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.3.8. France

8.3.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3.8.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.3.8.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.3.8.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.3.8.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.3.9. Italy

8.3.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3.9.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.3.9.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.3.9.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.3.9.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.3.10. Spain

8.3.10.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3.10.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.3.10.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.3.10.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.3.10.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.3.11. Netherlands

8.3.11.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3.11.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.3.11.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.3.11.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.3.11.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.3.12. Denmark

8.3.12.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3.12.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.3.12.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.3.12.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.3.12.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.3.13. Finland

8.3.13.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.3.13.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.3.13.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.3.13.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.3.13.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.4.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.4.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.4.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.4.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.4.6. China

8.4.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.4.6.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.4.6.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.4.6.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.4.6.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.4.7. India

8.4.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.4.7.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.4.7.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.4.7.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.4.7.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.4.8. Japan

8.4.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.4.8.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million) (

8.4.8.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.4.8.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.4.8.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.4.9. Australia

8.4.9.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.4.9.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.4.9.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.4.9.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.4.9.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.4.10. South Korea

8.4.10.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.4.10.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.4.10.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.4.10.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.4.10.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.4.11. Singapore

8.4.11.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.4.11.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.4.11.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.4.11.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.4.11.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.5. Latin America

8.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.5.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.5.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.5.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.5.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.5.6. Brazil

8.5.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.5.6.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.5.6.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.5.6.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.5.6.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.5.7. Mexico

8.5.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.5.7.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.5.7.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.5.7.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.5.7.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.5.8. Argentina

8.5.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.5.8.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.5.8.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.5.8.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.5.8.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.6. Middle East & Africa

8.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.6.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.6.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.6.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.6.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.6.6. U.A.E.

8.6.6.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.6.6.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.6.6.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.6.6.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.6.6.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.6.7. Saudi Arabia

8.6.7.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.6.7.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.6.7.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.6.7.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.6.7.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

8.6.8. South Africa

8.6.8.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

8.6.8.2. Market Estimates and Forecast by Product, 2018 - 2030 (USD Million)

8.6.8.3. Market Estimates and Forecast by Product Type, 2018 - 2030 (USD Million)

8.6.8.4. Market Estimates and Forecast by Propulsion Type, 2018 - 2030 (USD Million)

8.6.8.5. Market Estimates and Forecast by End Use, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Company Categorization

9.2. Company Share Analysis, 2023

9.3. Company Heat Map Analysis, 2023

9.4. Strategy Mapping

9.5. Company Profiles (Overview, Financial Performance, Product Overview, Strategic Initiatives)

9.5.1. American Honda Motor Co., Inc.

9.5.1.1. Company Overview

9.5.1.2. Financial Performance

9.5.1.3. Product Benchmarking

9.5.1.4. Recent Developments

9.5.2. Ariens Company

9.5.2.1. Company Overview

9.5.2.2. Financial Performance

9.5.2.3. Product Benchmarking

9.5.2.4. Recent Developments

9.5.3. Briggs Stratton

9.5.3.1. Company Overview

9.5.3.2. Financial Performance

9.5.3.3. Product Benchmarking

9.5.3.4. Recent Developments

9.5.4. Deere & Company

9.5.4.1. Company Overview

9.5.4.2. Financial Performance

9.5.4.3. Product Benchmarking

9.5.4.4. Recent Developments

9.5.5. Falcon Garden Tools

9.5.5.1. Company Overview

9.5.5.2. Financial Performance

9.5.5.3. Product Benchmarking

9.5.5.4. Recent Developments

9.5.6. Fiskars

9.5.6.1. Company Overview

9.5.6.2. Financial Performance

9.5.6.3. Product Benchmarking

9.5.6.4. Recent Developments

9.5.7. Husqvarna Group

9.5.7.1. Company Overview

9.5.7.2. Financial Performance

9.5.7.3. Product Benchmarking

9.5.7.4. Recent Developments

9.5.8. MTD Products

9.5.8.1. Company Overview

9.5.8.2. Financial Performance

9.5.8.3. Product Benchmarking

9.5.8.4. Recent Developments

9.5.9. Robert Bosch GmbH

9.5.9.1. Company Overview

9.5.9.2. Financial Performance

9.5.9.3. Product Benchmarking

9.5.9.4. Recent Developments

9.5.10. Robomow Friendly House

9.5.10.1. Company Overview

9.5.10.2. Financial Performance

9.5.10.3. Product Benchmarking

9.5.10.4. Recent Developments

9.5.11. The Toro Company

9.5.11.1. Company Overview

9.5.11.2. Financial Performance

9.5.11.3. Product Benchmarking

9.5.11.4. Recent Developments

List of Tables

TABLE 1 Global lawn mowers market 2018 - 2030 (USD Million)

TABLE 2 Global lawn mowers market, by product 2018 - 2030 (USD Million)

TABLE 3 Global lawn mowers market, by propulsion type 2018 - 2030 (USD Million)

TABLE 4 Global lawn mowers market, by end use 2018 - 2030 (USD Million)

TABLE 5 Global lawn mowers market, by region, 2018 - 2030(USD Million)

TABLE 6 Manual lawn mowers market 2018 - 2030 (USD Million)

TABLE 7 Manual lawn mowers market by region 2018 - 2030 (USD Million)

TABLE 8 Electric lawn mowers market 2018 - 2030 (USD Million)

TABLE 9 Electric lawn mowers market by region 2018 - 2030 (USD Million)

TABLE 10 Petrol lawn mowers market 2018 - 2030 (USD Million)

TABLE 11 Petrol lawn mowers market by region 2018 - 2030 (USD Million)

TABLE 12 Robotic lawn mowers market 2018 - 2030 (USD Million)

TABLE 13 Robotic lawn mowers market by region 2018 - 2030 (USD Million)

TABLE 14 Other lawn mowers market 2018 - 2030 (USD Million)

TABLE 15 Other lawn mowers market by region 2018 - 2030 (USD Million)

TABLE 16 Ride-on mowers market 2018 - 2030 (USD Million)

TABLE 17 Ride-on mowers market by region 2018 - 2030 (USD Million)

TABLE 18 Push mowers market 2018 - 2030 (USD Million)

TABLE 19 Push mowers market by region 2018 - 2030 (USD Million)

TABLE 20 Robotic lawn mowers market 2018 - 2030 (USD Million)

TABLE 21 Robotic lawn mowers market by region 2018 - 2030 (USD Million)

TABLE 22 ICE lawn mowers market 2018 - 2030 (USD Million)

TABLE 23 ICE lawn mowers market by region 2018 - 2030 (USD Million)

TABLE 24 Electric lawn mowers market 2018 - 2030 (USD Million)

TABLE 25 Electric lawn mowers market by region 2018 - 2030 (USD Million)

TABLE 26 Lawn mowers demand in residential 2018 - 2030 (USD Million)

TABLE 27 Lawn mowers demand in residential by region 2018 - 2030 (USD Million)

TABLE 28 Professional Landscaping Services lawn mowers market 2018 - 2030 (USD Million)

TABLE 29 Professional Landscaping Services lawn mowers market by region 2018 - 2030 (USD Million)

TABLE 30 Golf Courses lawn mowers market 2018 - 2030 (USD Million)

TABLE 31 Golf Courses lawn mowers market by region 2018 - 2030 (USD Million)

TABLE 32 Lawn mowers demand in government 2018 - 2030 (USD Million)

TABLE 33 Lawn mowers demand in government by region 2018 - 2030 (USD Million)

TABLE 34 Lawn mowers demand in other end uses 2018 - 2030 (USD Million)

TABLE 35 Lawn mowers demand in other end uses by region 2018 - 2030 (USD Million)

TABLE 36 North America lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 37 North America lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 38 North America lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 39 North America lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 40 U.S. lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 41 U.S. lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 42 U.S. lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 43 U.S. lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 44 Canada lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 45 Canada lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 46 Canada lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 47 Canada lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 48 Europe lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 49 Europe lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 50 Europe lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 51 Europe lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 52 U.K. lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 53 U.K. lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 54 U.K. lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 55 U.K. lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 56 Germany lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 57 Germany lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 58 Germany lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 59 Germany lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 60 France lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 61 France lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 62 France lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 63 France lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 64 Italy lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 65 Italy lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 66 Italy lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 67 Italy lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 68 Netherlands lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 69 Netherlands lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 70 Netherlands lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 71 Netherlands lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 72 Denmark lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 73 Denmark lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 74 Denmark lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 75 Denmark lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 76 Finland lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 77 Finland lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 78 Finland lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 79 Finland lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 80 Spain lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 81 Spain lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 82 Spain lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 83 Spain lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 84 Asia Pacific lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 85 Asia Pacific lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 86 Asia Pacific lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 87 Asia Pacific lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 88 China lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 89 China lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 90 China lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 91 China lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 92 India lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 93 India lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 94 India lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 95 India lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 96 Japan lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 97 Japan lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 98 Japan lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 99 Japan lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 100 South Korea lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 101 South Korea lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 102 South Korea lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 103 South Korea lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 104 Singapore lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 105 Singapore lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 106 Singapore lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 107 Singapore lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 108 Australia lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 109 Australia lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 110 Australia lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 111 Australia lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 112 Latin America lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 113 Latin America lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 114 Latin America lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 115 Latin America lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 116 Brazil lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 117 Brazil lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 118 Brazil lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 119 Brazil lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 120 Mexico lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 121 Mexico lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 122 Mexico lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 123 Mexico lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 124 Argentina lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 125 Argentina lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 126 Argentina lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 127 Argentina lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 128 MEA lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 129 MEA lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 130 MEA lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 131 MEA lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 132 UAE lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 133 UAE lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 134 UAE lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 135 UAE lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 136 Saudi Arabia lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 137 Saudi Arabia lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 138 Saudi Arabia lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 139 Saudi Arabia lawn mowers market by end use 2018 - 2030 (USD Million)

TABLE 140 South Africa lawn mowers market by product 2018 - 2030 (USD Million)

TABLE 141 South Africa lawn mowers market by product type 2018 - 2030 (USD Million)

TABLE 142 South Africa lawn mowers market by propulsion type 2018 - 2030 (USD Million)

TABLE 143 South Africa lawn mowers market by end use 2018 - 2030 (USD Million)

List of Figures

FIG. 1 Research process

FIG. 2 Information procurement

FIG. 3 Lawn mowers regional marketplace: Key takeaways

FIG. 4 Lawn mowers market - Trends & outlook

FIG. 5 Lawn mowers - Market segmentation & scope

FIG. 6 Lawn mowers - Market size and growth prospects (USD Million)

FIG. 7 Lawn mowers - Value chain analysis

FIG. 8 Lawn mowers - Market dynamics

FIG. 9 Lawn mowers - Market driver relevance analysis (Current & future impact)

FIG. 10 Lawn mowers - Market restraint/challenge relevance analysis (Current & future impact)

FIG. 11 Lawn mowers - Market opportunity relevance analysis (Current & future impact)

FIG. 12 Lawn mowers - Penetration & growth prospect mapping

FIG. 13 Lawn mowers - Porter’s Five Forces Analysis

FIG. 14 Lawn mowers - Company market share analysis, 2026

FIG. 15 Lawn mowers - PESTEL analysis

FIG. 16 Lawn mowers market product outlook key takeaways

FIG. 17 Global lawn mowers product outlook, 2023 & 2030

FIG. 18 Lawn mowers market product type outlook, 2023 & 2030

FIG. 19 Global lawn mowers propulsion type outlook, 2023 & 2030

FIG. 20 Lawn mowers market end-use outlook key takeaways

FIG. 21 Global lawn mowers end-use outlook, 2023 & 2030

FIG. 22 Lawn mowers market regional outlook key takeaways

FIG. 23 Global lawn mowers regional outlook, 2023 & 2030

FIG. 24 North America lawn mowers market - Key takeaways

FIG. 25 Europe lawn mowers market - Key takeaways

FIG. 26 Asia Pacific lawn mowers market - Key takeaways

FIG. 27 Latin America lawn mowers market - Key takeaways

FIG. 28 Middle East & Africa (MEA) lawn mowers market - Key takeawaysWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Lawn mowers Product Outlook (Revenue, USD Million, 2018 - 2030)

- Manual

- Electric

- Petrol

- Robotic

- Others

- Lawn mowers Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Lawn mowers Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

- Lawn mowers End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Lawn mowers Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- North America Lawn Mowers Market, By Product Type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- North America Lawn Mowers Market, By Propulsion Type

- ICE

- Electric

- North America Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- U.S.

- U.S. Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- U.S. Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- U.S. Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- U.S. Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Canada

- Canada Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Canada Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Canada Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Canada Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Canada Lawn Mowers Market, By Product

- Europe

- Europe Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Europe Lawn Mowers Market, By Product Type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Europe Lawn Mowers Market, By Propulsion Type

- ICE

- Electric

- Europe Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- U.K.

- U.K. Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- U.K. Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- U.K. Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- U.K. Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- U.K. Lawn Mowers Market, By Product

- Germany

- Germany Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Germany Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Germany Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Germany Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Germany Lawn Mowers Market, By Product

- France

- France Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- France Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- France Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- France Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- France Lawn Mowers Market, By Product

- Italy

- Italy Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Italy Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Italy Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Italy Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Italy Lawn Mowers Market, By Product

- Netherlands

- Netherlands Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Netherlands Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Netherlands Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Netherlands Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Netherlands Lawn Mowers Market, By Product

- Denmark

- Denmark Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Denmark Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Denmark Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Denmark Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Denmark Lawn Mowers Market, By Product

- Finland

- Finland Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Finland Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Finland Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Finland Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Finland Lawn Mowers Market, By Product

- Spain

- Spain Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Spain Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Spain Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Spain Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Spain Lawn Mowers Market, By Product

- Europe Lawn Mowers Market, By Product

- Asia Pacific

- Asia Pacific Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Asia Pacific Lawn Mowers Market, By Product Type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Asia Pacific Lawn Mowers Market, By Propulsion Type

- ICE

- Electric

- Asia Pacific Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- China

- China Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- China Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- China Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- China Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- China Lawn Mowers Market, By Product

- India

- India Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- India Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- India Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- India Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- India Lawn Mowers Market, By Product

- Japan

- Japan Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Japan Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Japan Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Japan Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Japan Lawn Mowers Market, By Product

- South Korea

- South Korea Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- South Korea Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- South Korea Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- South Korea Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- South Korea Lawn Mowers Market, By Product

- Singapore

- Singapore Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Singapore Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Singapore Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Singapore Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Singapore Lawn Mowers Market, By Product

- Australia

- Australia Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Australia Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Australia Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Australia Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Australia Lawn Mowers Market, By Product

- Asia Pacific Lawn Mowers Market, By Product

- Latin America

- Latin America Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Latin America Lawn Mowers Market, By Product Type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Latin America Lawn Mowers Market, By Propulsion Type

- ICE

- Electric

- Latin America Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Brazil

- Brazil Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Brazil Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Brazil Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Brazil Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Brazil Lawn Mowers Market, By Product

- Mexico

- Mexico Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Mexico Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Mexico Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Mexico Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Mexico Lawn Mowers Market, By Product

- Argentina

- Argentina Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Argentina Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Argentina Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Argentina Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Argentina Lawn Mowers Market, By Product

- Latin America Lawn Mowers Market, By Product

- Middle East & Africa

- Middle East & Africa Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- MEA Lawn Mowers Market, By Product Type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- MEA Lawn Mowers Market, By Propulsion Type

- ICE

- Electric

- MEA Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- UAE

- UAE Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- UAE Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- UAE Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- UAE Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- UAE Lawn Mowers Market, By Product

- Saudi Arabia

- Saudi Arabia Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- Saudi Arabia Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- Saudi Arabia Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- Saudi Arabia Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- Saudi Arabia Lawn Mowers Market, By Product

- South Africa

- South Africa Lawn Mowers Market, By Product

- Manual

- Electric

- Petrol

- Robotic

- Others

- South Africa Lawn Mowers Market, By Product type

- Ride-on Mowers

- Push Mowers

- Robotic Mowers

- South Africa Lawn Mowers Market, By Propulsion type

- ICE

- Electric

- South Africa Lawn Mowers Market, By End-use

- Residential

- Professional Landscaping Services

- Golf Courses

- Government

- Others

- South Africa Lawn Mowers Market, By Product

- Middle East & Africa Lawn Mowers Market, By Product

Lawn Mowers Market Dynamics

Drivers: Surging Demand For Landscaping Services In The U.S.

Lawn mowers, which are essential for maintaining high-quality lawns, are commonly used in parks, golf courses, and sports fields. Their demand is driven by the growing trend of outdoor living and increasing environmental awareness, particularly in the U.S. The desire to improve the visual appeal of both commercial and residential properties worldwide is a key factor boosting market growth. Landscaping is thought to increase a property’s value by about 12% due to its visual attractiveness. Adverse weather conditions like dry summers, floods, and heavy snowfalls necessitate the repair of lawns, hedges, trees, and gardens, thereby increasing the demand for lawn mowers. The expansion of the domestic housing and property markets has led to a surge in demand for landscaping services. Moreover, the steady growth in per capita disposable income is likely to prompt households to outsource yard care. The overall economic recovery is expected to stimulate commercial growth, leading to a greater need for industry providers to maintain large corporate and resort campuses. The market for robotic lawn mowers is predicted to experience substantial growth in the future. This can be attributed to the growing shift from traditional hand-guided mowers to automatic electric mowers, which simplify landscaping. The increasing need to enhance the aesthetic appeal of commercial properties for both official and recreational uses has boosted the popularity of landscaping in the U.S. As a result, the landscaping of outdoor areas and yards has gained significant traction.

Growing Interest In Gardening As A Hobby

The lawn mowers market is expected to grow, largely due to the increasing interest in gardening, particularly in developed economies. As people lead busy lives, they seek hobbies like gardening for relaxation. Gardening, a leisure activity enjoyed by all age groups, helps individuals divert their attention from daily tasks, acting as a therapeutic replacement. The benefits of gardening have increased its popularity, thereby driving the sales of lawn mowers. Awareness of the health and environmental benefits of gardening is also expected to contribute to market growth. Factors such as robust GDP growth and rising disposable income have encouraged gardening, indirectly increasing the demand for gardening tools like lawn mowers. The growing interest in outdoor activities and backyard gatherings, fueled by disposable income in developing countries, is anticipated to drive market growth. Improvements in social lifestyles and an increase in home decoration and remodeling activities are expected to drive demand. The availability of technologically advanced equipment, such as remote-controlled and GPS-equipped lawn mowers, has made gardening more convenient, thereby boosting its popularity and the demand for lawn mowers.

Restrains: Seasonal Variations

The lawn mowers market is largely seasonal, with most sales occurring during the spring and summer months when lawn care and gardening activities are most prevalent. The market’s growth is hindered by its seasonality and short-term demand fluctuations caused by weather patterns. This mature market’s sales are primarily influenced by factors such as the economy, housing, weather, household formation, and seasonality. Persistent economic challenges have resulted in an uneven market recovery, significantly affecting lawn mower sales. Additionally, year-to-year weather fluctuations negatively impact sales. Ongoing drought conditions and strict water restrictions in parts of the U.S. are expected to further impact market growth. Weather conditions and seasonal changes lead to short-term demand fluctuations, affecting price competition. This occurs when supply exceeds or falls short of demand. If supply outstrips demand, it may lead to lower prices. To mitigate the risk of overproduction, key players like Husqvarna Group have established a flexible production structure with relatively low fixe

What Does This Report Include?

This section will provide insights into the contents included in this lawn mowers market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Lawn mowers market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Lawn mowers market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the lawn mowers market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for lawn mowers market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of lawn mowers market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Lawn Mowers Market Categorization:

The lawn mowers market was categorized into three segments, namely product (Manual, Electric, Petrol, Robotic), end-use (Residential, Commercial/Government), and regions (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The lawn mowers market was segmented into product, end-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The lawn mowers market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-seven countries, namely, the U.S.; Canada; the UK.; Germany; France; Italy; Netherlands; Denmark; Finland; Spain; Russia; Rest of Europe; China; India; Japan; South Korea; Singapore; Australia; Rest of Asia Pacific; Brazil; Mexico; Argentina; Rest of Latin America; UAE; Saudi Arabia; South Africa; Rest of Middle East & Africa.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Lawn mowers market companies & financials:

The lawn mowers market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

AriensCo. , AriensCo, a global manufacturer of outdoor power equipment, caters to both residential and commercial customers in the gardening and farming sectors. Their product line is divided into two main categories: lawn and snow. The lawn category comprises zero-turn mowers, walk-behind mowers, and finishing tools, while the snow category features snow blowers and finishing tools. AriensCo’s products are available through a variety of channels, including online retailers, regional farm retailers, independent power equipment dealers, and broadline suppliers. The company operates manufacturing facilities in the U.S. and the UK and has distribution centers in the U.S., the U.K., Canada, and Australia.

-

Briggs Stratton , Briggs & Stratton Corporation is a company that specializes in the design, manufacture, marketing, and distribution of gasoline engines, mainly for outdoor power equipment. Their engines are marketed under various brands including Simplicity, Ferris, Snapper, Allmand, Vanguard, Murray, Branco, Briggs & Stratton, Billy Goat, and Victa. The company operates under two main business segments: engines and products. Their product range includes engines, generators, pressure washers, snow blowers, lawn mowers, and air compressors. They serve a variety of sectors such as construction, oil & gas, marine, and agriculture, among others. Approximately 85% of their products are manufactured in the U.S., with engine and parts production facilities in Wisconsin, Kentucky, Missouri, Alabama, Georgia, and China. The assembly of finished products takes place in New York, Missouri, Wisconsin, Nebraska, Australia, and Brazil. Briggs & Stratton Corporation is publicly traded on the New York Stock Exchange under the NYSE: BGG ticker. Their products are sold in over 100 countries through about 40,000 authorized service organizations and dealers and are available through consumer home centers, online retail, mass merchants, warehouse clubs, department stores, and independent dealers. The company’s key markets for residential lawn and garden equipment are North America, Europe, and Australia, while its commercial products are primarily focused on North America.

-

Deere & Company , Kindly rephrase the following paragraph “Deere & Company is engaged in the manufacturing of construction, agricultural, forestry machinery, drivetrains, and lawn care machinery, among others. The company serves diverse sectors/industries such as agriculture, forestry, construction, government and military, and sports turf. Deere & Company operates through three business segments, namely agriculture and turf, construction and forestry, and financial services. The company’s product portfolio includes mowers, utility vehicles, tractors, cutters, shredders, harvesting equipment, seeding equipment, dump trucks, excavators, wheeled feller bunchers, and swing machines, among others. Deere & Company has operation centers located in 30 countries across the globe. The company is listed on the New York Stock Exchange and is traded under the ticker symbol NYSE: DE. The company offers its products through various third-party dealers, some of which include Austin Turf & Tractor, Storm Lawn & Garden, LLC, United Ag & Turf, Lawn Land, Ag-Pro Texas, LLC, and Shoppa's Farm Supply, Inc. The company also focuses on product innovations and upgrades. Its research & development expenses amounted to USD 1,783 million in 2019 as compared to USD 1,658 million in 2018.

-

Falcon Garden Tools , Falcon Garden Tools is a privately owned company that specializes in the export and production of tools and equipment for agricultural, horticultural, forestry, and gardening applications. The company’s offerings include plant care tools, soil care tools, wood preparation tools, bonsai tools, bio shredders, and lawn care tools. In addition to manufacturing, Falcon Garden Tools also provides after-sales services through its network of 300 dealers, distributors, and stockists. The company has a robust export network that spans over 15 countries across Europe, the Americas, New Zealand, Africa, and South Asia.

-

Honda Power Equipment (American Honda Motor Co. Inc.) , Honda Power Equipment, a subsidiary of Honda Motor Company, specializes in the production of 4-stroke engines used in various power equipment such as generators, lawn mowers, water pumps, outboard motors, and more. The company is structured into three main divisions: Honda Marine, Honda Power Equipment, and Honda Engines. Honda Power Equipment offers a wide range of products, with over 60 models across six major product families, including generators, snow blowers, pumps, lawn mowers, trimmers, and tillers. These products are assembled at more than 11 Honda manufacturing facilities worldwide. The company’s research, testing, and development activities are overseen by Honda R&D Americas, Inc. in the U.S. and Honda R&D Co., Ltd. in Japan.

-