- Home

- »

- Power Generation & Storage

- »

-

Lead Acid Battery Market Size, Share & Trends Report, 2023GVR Report cover

![Lead Acid Battery Market Size, Share & Trends Report]()

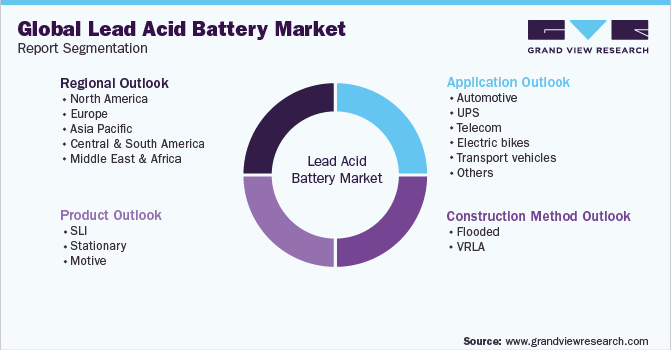

Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI, Stationary, Motive), By Construction Method (Flooded, VRLA), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-778-0

- Number of Pages: 95

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Energy & Power

Report Overview

The global lead acid battery market size was valued at USD 37.98 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. The market is estimated to witness growth owing to the growing adoption of lead acid batteries in automobiles and Uninterruptible Power Source (UPS) along with some developments in the manufacturing methods. The increasing demand for lead acid batteries in off-grid power generation is expected to boost the market size. The development in the transportation industry, along with an increase in energy storage applications is projected to drive industry demand in the upcoming future. Growing demand for UPS in various sectors which includes banking, oil & gas, healthcare, and chemicals has propelled industry demand further.

The adverse effects of lead batteries on the environment remain key restraining factors to growth. Also, the declining cost of lithium batteries has stalled the demand for lead-acid batteries, primarily owing to the former’s technological advancement. Continuous reduction in costs is likely to reinforce demand for the lithium-ion technology in various energy storage markets, which is also expected to restrain the market.

Advancement of the auto industry in India, Brazil, Mexico, South Korea, Indonesia, Thailand, and Vietnam is anticipated to expand the global industry size. Increasing demand for pollution-free electric automobiles coupled with technological developments is projected to fuel product demand over the upcoming years.

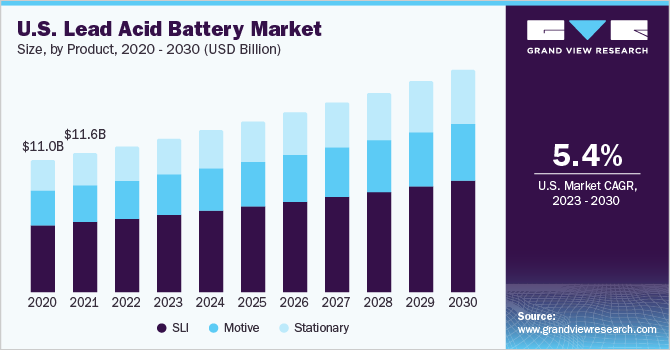

Product Insights

In terms of value, Starting, Lighting, and Ignition (SLI) batteries emerged as the largest product segment and accounted for more than 53.0% of the market in 2022. These are projected to witness sluggish growth due to higher demand for other types of products including stationary and motive. However, the segment is likely to expand due to increasing demand in applications requiring high power including automotive.

Increasing vehicle manufacturing, particularly in China, Japan, India, Brazil, Mexico, South Korea, and the U.S. is expected to promote expansion over the upcoming years. For instance, In October 2018, Amara Raja Batteries signed an agreement with Johnson Controls to launch a new battery technology in India which provides sophisticated consumer features and strict emission standards for the automotive industry. Such initiatives are anticipated to drive the demand for lead-acid batteries during the forecast period.

Construction Method Insights

In terms of value, the flooded lead acid battery segment emerged as the largest construction method segment and accounted for more than 65.0% of the market share in 2022. The segment is expected to lose market share owing to high maintenance costs along with complex construction. However, increasing demand for stationary applications will fuel industry growth over the forecast period.

VRLA batteries are anticipated to witness the highest gains and are alone expected to contribute to over 34.0% of the revenue market share by 2022. Rising demand for VRLA in automotive applications owing to its high output and low maintenance will fuel market growth over the forecast period. In addition, VRLA lead acid batteries including AGM offer high resistance to vibration, minimize terminal corrosion, extend shelf life, and offer a low self-discharge rate. The widespread availability of various sizes of AGM lead acid batteries will fuel its demand over the next nine years.

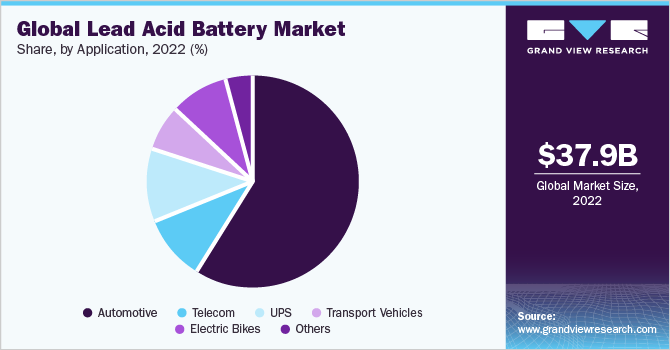

Application Insights

In terms of value, automotive emerged as the largest application segment and accounted for more than 58.0% of the market in 2022. The extensive usage of lead acid batteries in the automotive sector is expected to grow as a result of the rising automotive sector globally. The presence of big automotive players such as TATA, Maruti Suzuki, Infinium Toyota, Mahindra, Mitsubishi, Hyundai, Honda, and Nissan have fuelled the growth of the automotive sector in the Asia Pacific due to their strong distribution channels and easy availability of their products at a cheaper price.

UPS accounted for more than 9.0% of global revenue in 2022 and is expected to witness the highest CAGR of 7.4% from 2023 to 2030. The growing demand in various industries including the medical industry, educational institutes, corporate offices, research institutions, and houses promises further growth during the forecast period.

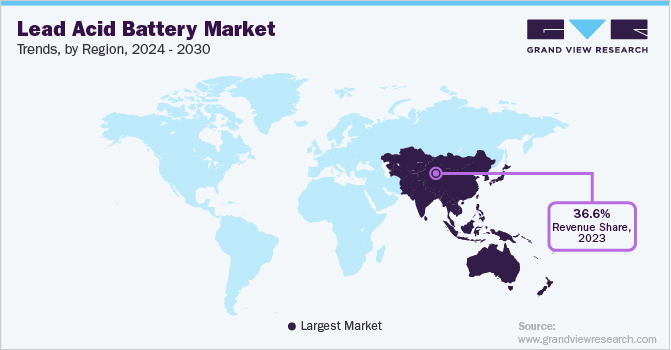

Regional Insights

Asia Pacific dominated the lead acid batteries industry and accounted for more than 55.0% share of the global revenue in 2022. The growing construction industry in emerging countries including China, India, Japan, Malaysia, South Korea, Vietnam, and Indonesia is projected to drive the utilization of lead-acid batteries. According to the Society of Indian Automobiles Manufacturers, total automotive sales grew by 24.0 percent in 2020-2021 over 2021-2022. Expansion in the automobile sector will lead to significant growth in sales of SLI lead acid batteries.

Asia Pacific is anticipated to be the most lucrative market during the forecast period on account of the increasing demand for energy storage batteries in China and India. Furthermore, favorable government regulations which are designed to generate investments from public-private partnerships and foreign direct investments (FDI) are estimated to fuel lead acid battery demand till 2030.

Key Companies & Market Share Insights

The market is fragmented in nature due to the presence of many manufacturers. The market is categorized with a large number of market players in the U.S., China, and Japan. Mergers & acquisitions and joint ventures are key characteristics of the market players, to increase their market presence. The industry is highly competitive with participants involved in continuous product innovation and R&D. Some prominent players in the global lead acid battery market include:

-

East Penn Manufacturing Co.

-

Exide Technologies

-

Johnson Controls

-

ATLASBX Co. Ltd.

-

NorthStar

-

C&D Technologies, Inc.

-

Narada Power Source Co., Ltd.

-

Amara Raja Corporation

-

GS Yuasa Corp

-

Crown Battery Manufacturing

-

Leoch International Technology Ltd.

Lead Acid Battery Market Report Scope

Report Attribute

Details

Market Size value in 2023

USD 40,274.9 million

Revenue forecast in 2030

USD 55.23 billion

Growth rate

CAGR of 4.6% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD million, CAGR from 2023 to 2030

Regional scope

North America; Europe; Asia Pacific; Central & South America & MEA

Countryscope

U.S.; Germany; U.K.; Italy; Russia; China; India; Brazil; South Africa; UAE

Segments covered

Product, construction method, application, region

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Key companies profiled

East Penn Manufacturing Co.; Exide Technologies; Johnson Controls; ATLASBX Co. Ltd.; NorthStar; C&D Technologies, Inc.; Narada Power Source Co., Ltd.; Amara Raja Corporation; GS Yuasa Corp; Crown Battery Manufacturing; Leoch International Technology Ltd.

15% free customization scope (equivalent to 5 analysts’ working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lead Acid Battery Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2030. For the purpose of this study, Grand View Research has segmented the global lead acid battery market report based on product, construction method, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

SLI

-

Stationary

-

Motive

-

-

Construction Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Flooded

-

VRLA

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

UPS

-

Telecom

-

Electric bikes

-

Transport vehicles

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

MEA

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global lead acid battery market size was valued at USD 37.99 billion in 2022 and is expected to reach USD 40.27 billion in 2023.

b. The global lead acid battery market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 55.23 billion by 2030.

b. The automotive was the largest application segment that dominated the lead acid battery market with a revenue share of over 58.0% in 2022 due to extensive usage of lead-acid batteries in the automotive sector.

b. Some key players operating in the lead acid battery market include EnerSys, C&D Technologies, Inc, East Penn Manufacturing, Johnson Controls, Crown Battery, NorthStar, Fujian Quanzhou Dahua Battery Co., Ltd., Leoch International Technology Limited, Zibo Torch Energy Co., Ltd, B.B. Battery Co., Ltd., Chloride Batteries S E Asia Pte. Ltd., Nipress, Panasonic Corporation, Exide Technologies, ATLASBX Co., Ltd., GS Yuasa Corporation, Fengfan Co., Ltd., Narada Power Source Co., Ltd., Trojan Battery Company, and Others.

b. Key factors that are driving the lead acid battery market growth include the rapid growth of the commercial vehicle, motorcycle, and passenger car manufacturing industries. Moreover, the growing demand for UPS in various sectors, such as banking, oil and gas, healthcare, and chemicals is positively driving the market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."