- Home

- »

- Electronic Devices

- »

-

LED Lighting Market Size, Share And Growth Report, 2030GVR Report cover

![LED Lighting Market Size, Share & Trends Report]()

LED Lighting Market Size, Share & Trends Analysis Report By Product (Lamps, Luminaires), By Application, By Installation Type, By Sales Channel, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-123-8

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Semiconductors & Electronics

LED Lighting Market Size & Trends

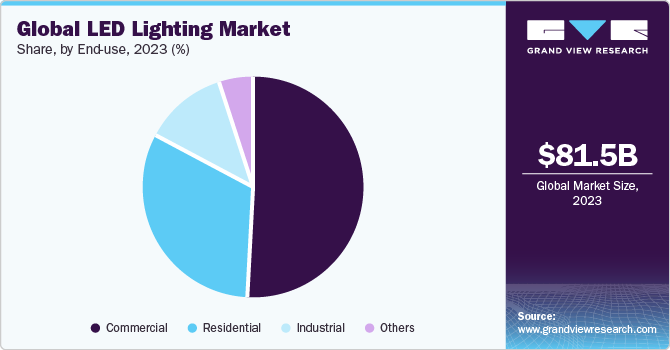

The global LED lighting market size was worth USD 81.48 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.0% from 2023 to 2030. Rising construction in both developing and developed countries, together with government laws limiting the use of inefficient lighting systems, & supportive government initiatives for lowering LED lighting prices, are the primary factors anticipated to drive the market. LED lighting has a long lifespan, no flicker, and great illumination strength while consuming less energy. Additionally, LED manufacturers are focusing on including features like Wi-Fi, occupancy sensors, and daylighting because these attract customers and increase product sales, thus fostering market growth. Furthermore, market players are offering extensive portfolios of various LED products, such as LED strips, LED bulbs, and LED tube lights, among others, to target diverse potential audiences. Thus, supporting the LED lighting industry's growth.

LED lights are often a better option when compared to alternative lighting options like incandescent, CFL, incandescent, and halogen lights, as they can operate with little energy input while delivering strong illumination. LEDs are extensively utilized in both indoor and outdoor situations. LEDs allow designers versatility in their designs and the durability to withstand frequent switching. The market is expected to expand as consumers become more aware of their benefits.

The American National Standards Institute, China Compulsory Certification, and International Electrotechnical Commission are a few significant regulatory bodies that manage product certification. Manufacturing after obtaining the required licenses permits to do business, offer services, and import and export products. Governments in both developed and developing economies are attempting to lower high energy usage, thereby boosting the demand for LED lamps and LED bulbs.

They are doing this by upholding a number of quality laws that assist them in preserving consumer safety, managing energy use, and monitoring environmental issues. LED lighting is an energy-saving solution with a 50,000-hour lifespan and lower electricity use. As a result, it is anticipated that stringent government rules limiting the use of lighting that uses a lot of energy will promote the expansion of the market.

When used as overhead surgical illumination earlier, halogen lights bothered medical workers during procedures or examinations. Additionally, the examination room's 50 to 100 W halogen bulbs with the tiny surgical illumination produced a lot of heat and consumed too much electricity.

As a result, one factor anticipated to fuel the expansion of the target LED lighting market is manufacturers' strategy for combining LEDs in surgical illumination, exam lights, phototherapy, and endoscopy to enhance patient treatment experiences. The development of the LED lighting industry is also anticipated to be impacted by technological advancements in the medical device sector that will replace older or less efficient equipment.

The COVID-19 pandemic negatively impacted the global economy. The demand for LED lighting was reduced as a result of rigorous suspensions and lockdowns imposed on construction sites. However, the second half of 2021 saw an increase in construction due to the introduction of new as well as upgrading projects, which contributed to the steady recovery of the industry for LED lighting.

Market Concentration & Characteristics

The growth of the LED lighting market is high, and the growth’s pace is accelerating. The LED lighting market is characterized by a high degree of innovation owing to the notable advancements in Internet-of-Things (IoT), human-centric LED lighting, Light Fidelity (Li-Fi), and Light Detection and Ranging (LiDAR) systems, among others. Growing usage of network connectivity in LED lighting is enabling information collection & analysis and allows that data to control energy consumption and light patterns, supporting the growth of smart LED lighting.

The companies operating in the market emphasize strengthening their LED lighting portfolio to expand their customer base and increase their revenue streams. For instance, in September 2023, lighting company Advanced Lighting Technologies, LLC (ADLT) announced the acquisition of LED lighting manufacturer Cree Lighting Inc. for an undisclosed amount.

Governments have set energy efficiency requirements and labeling systems for lighting items, which include LED lights. These standards indicate the minimum threshold for energy conservation and light efficacy, among other factors. Compliance with these requirements confirms that LED lighting products fulfill specified performance standards while contributing to conserving energy.

The substitutes for LED lights are conventional lights such as incandescent lamps, CFLs, and High-Intensity Discharge (HID) lights. Initially, the adoption cost of LED lights was greater as compared to conventional lights; hence, many price-sensitive consumers preferred conventional lights over LED lights. However, LED lights are currently replacing conventional lights owing to benefits such as moderate cost-effectiveness, a longer lifespan, and low energy consumption.

LED lighting market growth is anticipated to be influenced positively in the forecast period due to the shifting focus of various end-users on LED lighting from enhanced brightness with minimum energy consumption.

Product Insights

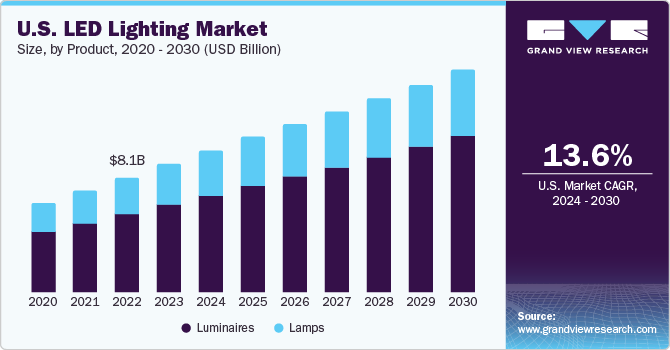

Based on product type, the LED luminaires segment accounted for the highest market share of over 54% in 2022 and is poised to continue its dominance in the global market. All luminaires used in track lighting, high bays, troffers, and street lighting, are identified as LED lights. The primary driver of the segment's growth is the installation of new track lights and light poles as a result of the expanding commercial building space and developing smart city initiatives.

The LED lamp category is anticipated to develop at the highest CAGR from 2023 to 2030 due to the expanding use of LED lighting systems in the residential sector. LED lamps provide advantages, including increased energy efficiency and greater stability over substitutes like incandescent bulbs and CFLs. They come in a wide range of forms as well. Another factor that is projected to support the growth of the LED lamps is the government's policy for raising public awareness of LEDs and their potential to help reduce and manage energy usage.

Application Insights

The indoor segment in application type had the highest revenue share of over 67% in 2022. This is the result of an increase in the demand for high-intensity discharge and fluorescent bulb substitutes from supermarkets, shopping malls, and retail establishments. LED lighting generates less heat, and costs less than conventional lighting options. The segment's growth is also predicted to be aided by rising demand in public institutions like hospitals and schools.

The outdoor market is expected to expand moderately during the projected period. This is because infrastructure-related projects including highways, airports, and public areas are being expanded. The market for LED lights for outdoor applications is also expected to increase due to growing government initiatives to attain net-zero emissions by reducing energy use.

End-use Insights

The commercial end-use segment posted the highest market share of over 51% in 2022. The need for sophisticated lighting among exhibition, museum, and gallery owners for improved lighting applications is one of the driving forces behind the rapid growth of the commercial building industry around the world and is anticipated to promote market expansion. The demand for high-luminance LED lights is expanding predominantly owing to the requirements for office lighting to conform to government regulations and norms, which is boosting the expansion of the market.

The residential market is growing worldwide, which has increased demand for LED floor lamps, architectural LED lamps, cabinet lights, etc. The LEDs used in domestic places have an efficiency of above 90-100 lumens per watt. Additionally, industrialized countries employ a lot of LEDs with an intensity of 110 lm/W -130 lm/W. It is therefore projected that quick advancements in LED efficiency will aid in the growth of the target market.

Regional Insights

Asia Pacific LED Lighting Market Trends

Asia Pacific accounted for the largest revenue share of around 43.0% in 2022. Over the forecast period, the market is expected to witness consistent growth. LED lighting demand is expected to grow due to the governments expand their energy-saving measures and infrastructure projects in emerging countries rapidly. It is anticipated that the growing infrastructure in countries such as, China, Japan, and India, with the numerous manufacturers concentrating on new product launches in these nations, would contribute to the growth of the regional market. Additionally, the regions' increasing use of smart home solutions is fostering an atmosphere that is conducive to the development of LED lighting. These factors collectively drive the growth of the Asia Pacific LED lighting market.

China LED Lighting Market Trends

The LED lighting market in China is projected to grow at a CAGR of 11.4% from 2023 to 2030. China is home to various key players, including Guangdong R&C Lighting Technology Co.; GS LIGHT; and FOSHAN ELECTRICAL AND LIGHTING Co., LTD, operating in the LED lighting market. Another major factor fueling the growth of the market in China is its manufacturing capability, which reduces the cost of the LED lighting solution.

Japan LED Lighting Market Trends

The LED lighting market in Japanis projected to grow at a CAGR of 12.2% from 2023 to 2030. The growth of the Japanese LED lighting market can be attributed to the launching of LED lighting solutions by Japanese companies, which help reduce the cost of the LED lighting solution. For instance, in June 2023, ENDO Lighting Corporation, a Japanese lighting solution provider, introduced Synca. Synca Lights offer multi-functional solutions for commercial and residential spaces.

India LED Lighting Market Trends

The LED lighting market in India is projected to grow at a CAGR of 12.4% from 2023 to 2030. The growth of the India LED lighting market can be attributed to companies based in the country coming up with advanced lighting systems such as smart lighting.

Europe LED Lighting Market Trends

The LED lighting market in Europe is growing significantly at a CAGR of 9.3% from 2023 to 2030. Europe is proactive in promoting energy conservation and reducing e-waste, among other things. Since LED lighting solutions tick both boxes, the adoption of LED lighting solutions in the region is expected to grow over the forecast period.

U.K. LED Lighting Market Trends

The LED lighting market in U.K. is growing significantly at a CAGR of 9.2% from 2023 to 2030. The U.K. government has set determined energy conservation and carbon reduction targets to address the evolving climate change and decrease greenhouse gas emissions. LED lighting is essential in meeting these targets as it consumes less energy compared to conventional lighting systems. The Carbon Trust Green Business Fund aids Small and Medium-sized Enterprises (SMEs) in the U.K. to implement energy-saving initiatives such as LED lighting upgrades.

Germany LED Lighting Market Trends

The LED lighting market in Germany is growing significantly at a CAGR of 8.8% from 2023 to 2030. The growth of the German LED lighting market can be attributed to the adoption of LED lighting in the automotive sector and the increasing strategic initiatives such as partnerships, mergers, and acquisitions.

France LED Lighting Market Trends

The LED lighting market in Franceis growing significantly at a CAGR of 12.4% from 2023 to 2030. Smart lighting solutions that combine modern control systems and networking are also being adopted in France. Moreover, online control, machine learning, and modification of lighting settings are readily accessible with smart lighting. Therefore, driving the growth of the France LED lighting market.

North America LED Lighting Market

The demand for LED lighting in the North America region is growing significantly, with a CAGR nearly of 8.5% from 2023 to 2030. The introduction of smart lighting solutions, which enables remote operation, automated processes, and energy usage monitoring via mobile applications or additional connected gadgets, has boosted the growth of the North America LED lighting market. Furthermore, the proliferation of the Internet of Things (IoT) and LED lighting integration has created new opportunities for lighting system customization and energy efficiency.

Middle East & Africa LED Lighting Market Trends

Middle East & Africa LED lighting market is anticipated to witness significant growth at a CAGR of 11.0% from 2023 to 2030. The region has been witnessing the increasing adoption of LED lighting technology owing to initiatives from the government to install energy-efficient lighting in the country. For instance, in June 2023, Shoprite Holdings Ltd., a South African retailer, announced that the company saved USD 17.5 Billion in electricity costs in the financial year 2022/2023, owing to the installation of LED lightbulbs across its stores, which are located across 11 African countries. The company announced the installation of 1,001,932 LED lightbulbs across 1,647 distribution centers and supermarkets. Such initiatives are expected to propel the growth of the Middle East & Africa LED lighting market.

Saudi Arabia LED Lighting Market Trends

Saudi Arabia LED lighting market is anticipated to witness significant growth from 2023 to 2030. The growth of the Saudi Arabia LED lighting market can be attributed to factors such as improving infrastructure, rising purchasing, improving supply chain networks, and increasing automotive sales.

Key LED Lighting Company Insights

Some of the key players operating in the market include Signify Holding, Acuity Brands, Inc., and Dialight.

-

Acuity Brands Lighting, Inc. is a provider of building and lighting technology solutions and services. Its product portfolio includes lighting controls, lighting components, prismatic skylights, power supplies, fluorescent, LED lighting products, high-intensity discharge, and embedded and standalone light control solutions.

-

Signify Holding’s product portfolio includes IoT-based lighting products for residential and commercial customers. The company sells its products under various brands, such as Philips, Interact, WiZ, and Color Kinetics, among others. The product portfolio of the company includes professional lights, indoor luminaires, outdoor luminaires, and consumer lights.

Halonix Technologies Private Limited, Nanoleaf, and YEELIGHT, are some of the emerging market participants in the LED lighting market.

-

Halonix Technologies Private Limited offers various LEDs with special functionalities, such as LED inverter bulbs, LED speaker bulbs, LED radar motion bulbs, and LED all-rounder bulbs, among others.

-

YEELIGHT specializes in designing, developing, & distributing smart bulbs, light strips, and ambient lighting. It offers a Yeelight Fun product line for entertainment lighting, Yeelight Pro for professional lighting, and Yeelight Home for daily lamination.

Key LED Lighting Companies:

The following are the leading companies in the LED lighting market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these LED lighting companies are analyzed to map the supply network.

- Acuity Brands, Inc.

- Cree Lighting USA LLC

- Dialight

- Halonix Technologies Private Limited

- Hubbell

- LSI Industries Inc.

- Nanoleaf

- Panasonic Corporation

- SAVANT TECHNOLOGIES LLC

- Seoul Semiconductor Co., Ltd.

- Signify Holding

- Siteco GmbH

- Syska

- YEELIGHT

- Zumtobel Group Ag

Recent Developments

-

In October 2023, YEELIGHT launched its new LED product, The Yeelight Beam, featuring a tabletop-style design with a headphone stand. This light is easy to set up and can be controlled with multiple smart control applications such as Apple HomeKit, Amazon Alexa, and Google.

-

In October 2023, electric company Halonix Technologies launched an LED bulb, UP-DOWN GLOW, featuring three switch-enabled modes in India. This light's dome, an upper part and stem, a lower part glows in multiple colors, enhancing the consumer's experience.

-

In September 2023, LED lighting provider US LED introduced a new series of outdoor LED luminaires, Right Choice, to improve the user's experience in sightseeing. The LED lighting design is contractor friendly as it poses trunnion mount, direct pole mount, and adjustable slip fitter.

-

In July 2023, Zumtobel introduced two intelligent lighting technology systems and three new luminaires in its product portfolio. These cutting-edge solutions include the TRAMAO pendant luminaire for hotels and offices, which effectually absorbs sound and delivers the highest light quality, and the SLOTLIGHT infinity II light line family.

-

In May 2023, Dialight announced the launch of its industry-leading 7-year warranty for Aviation Obstruction Lighting Solutions. This initiative highlighted the company’s commitment to both customer satisfaction and product quality in the LED lighting market.

-

In May 2023, Zumtobel launched the all-new high-accuracy positioning luminaires. These new luminaires are integrated with IoT for smart analyses in logistic, retail, and industrial applications.

-

In May 2023, Dialight launched the ProSite High Mast, an extension of the company’s ProSite Floodlight series. This advanced solution is a precision-engineered LED lighting fixture purposed to support mounting heights of up to 130 feet for diverse outdoor industrial applications, including airports, rail yards, container yards, transport, parking lots, product stockpiles, and perimeter lighting.

-

In April 2023, Cree Lighting unveiled the launch of its OSQ Series C mid-power LED Area and Flood luminaires. These solutions feature the groundbreaking NanoComfort Technology, delivering matchless efficiency, astonishing visual comfort, precise control, reduced wind load requirements, and ease of installation.

LED Lighting Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 81.48 billion

Revenue forecast in 2030

USD 168.87 billion

Growth rate

CAGR of 11.0% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, application, installation type, sales channel, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; South Africa; Saudi Arabia

Key companies profiled

Acuity Brands, Inc.; Cree Lighting USA LLC; Dialight; Halonix Technologies Private Limited; Hubbell; LSI Industries Inc.; Nanoleaf; Panasonic Corporation; SAVANT TECHNOLOGIES LLC; Seoul Semiconductor Co., Ltd.; Signify Holding; Siteco GmbH; Syska; YEELIGHT; Zumtobel Group Ag

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LED Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global LED lighting market based on product, application, installation type, sales channel, end use, and region:

-

Product Outlook (Revenue, USD Billion; 2018 - 2030)

-

Lamps

-

A-Lamps

-

T-Lamps

-

Other

-

-

Luminaires

-

Streetlights

-

Downlights

-

Troffers

-

Others

-

-

-

Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Installation Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

New LED

-

Retrofit LED

-

-

Sales Channel Outlook (Revenue, USD Billion; 2018 - 2030)

-

Online

-

Offline

-

-

End-use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global LED lighting market size was valued at USD 70.94 billion in 2022 and is expected to reach USD 81.48 billion in 2023

b. The global LED lighting market is expected to witness a compound annual growth rate of 11.0% from 2023 to 2030 to reach USD 168.87 billion by 2030.

b. The commercial segment dominated the LED lighting market with a share of 51.92% in 2022. This is attributable to the rising demand for LED troffers, downlights across office space, and malls among others.

b. The LED luminaires segment dominated the global LED lighting market in 2022 and accounted for over 54.75% of the global revenue share.

b. The indoor segment led the global LED lighting market and accounted for over 67.62% share of the global market in 2022.

Table of Contents

Chapter 1. LED Lighting Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. LED Lighting Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. LED Lighting Market: Variables, Trends & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. LED Lighting Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. LED Lighting Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. LED Lighting Market: Product Movement Analysis, 2023 & 2030 (USD Billion)

4.3. Lamps

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.3.2. A-Lamps

4.3.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.3.3. T-Lamps

4.3.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.3.4. Other

4.3.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Luminaires

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.2. Streetlights

4.4.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.3. Downlights

4.4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.4. Troffers

4.4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.5. Others

4.4.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. LED Lighting Market: Application Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. LED Lighting Market: Application Movement Analysis, 2023 & 2030 (USD Billion)

5.3. Indoor

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Outdoor

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. LED Lighting Market: Installation Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. LED Lighting Market: Installation Type Movement Analysis, 2023 & 2030 (USD Billion)

6.3. New LED

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. Retrofit LED

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. LED Lighting Market: Sales Channel Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. LED Lighting Market: Sales Channel Movement Analysis, 2023 & 2030 (USD Billion)

7.3. Online

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Offline

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. LED Lighting Market: End Use Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. LED Lighting Market: End Use Movement Analysis, 2023 & 2030 (USD Billion)

8.3. Commercial

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4. Residential

8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5. Industrial

8.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6. Others

8.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 9. LED Lighting Market: Regional Estimates & Trend Analysis

9.1. LED Lighting Market Share by Region, 2023 & 2030 (USD Billion)

9.2. North America

9.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.2.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.2.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.2.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.2.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.2.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.2.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.2.7. U.S.

9.2.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.7.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.2.7.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.2.7.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.2.7.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.2.7.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.2.7.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.2.7.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.2.8. Canada

9.2.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.8.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.2.8.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.2.8.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.2.8.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.2.8.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.2.8.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.2.8.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.3. Europe

9.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.3.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.3.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.3.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.3.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.3.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.3.7. U.K.

9.3.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.7.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.3.7.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.3.7.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.3.7.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.7.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.3.7.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.3.7.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.3.8. Germany

9.3.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.8.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.3.8.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.3.8.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.3.8.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.8.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.3.8.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.3.8.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.3.9. France

9.3.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.9.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.3.9.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.3.9.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.3.9.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.3.9.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.3.9.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.3.9.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4. Asia Pacific

9.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.4.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.4.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.4.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.4.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4.7. China

9.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.7.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.7.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.4.7.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.4.7.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.7.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.4.7.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.4.7.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4.8. India

9.4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.8.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.8.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.4.8.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.4.8.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.8.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.4.8.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.4.8.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4.9. Japan

9.4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.9.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.9.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.4.9.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.4.9.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.9.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.4.9.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.4.9.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4.10. Australia

9.4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.10.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.10.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.4.10.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.4.10.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.10.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.4.10.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.4.10.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.4.11. South Korea

9.4.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.11.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.4.11.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.4.11.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.4.11.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.4.11.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.4.11.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.4.11.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.5. Latin America

9.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.5.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.5.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.5.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.5.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.5.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.5.7. Brazil

9.5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.7.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.5.7.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.5.7.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.5.7.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5.7.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.5.7.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.5.7.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.5.8. Mexico

9.5.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.8.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.5.8.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.5.8.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.5.8.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.5.8.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.5.8.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.5.8.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.6. Middle East & Africa

9.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.6.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.6.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.6.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.6.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.6.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.6.7. UAE

9.6.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.7.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.6.7.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.6.7.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.6.7.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.7.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.6.7.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.6.7.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.6.8. Saudi Arabia

9.6.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.8.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.6.8.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.6.8.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.6.8.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.8.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.6.8.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.6.8.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

9.6.9. South Africa

9.6.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.6.9.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

9.6.9.2.1. Market Size Estimates and Forecasts by Lamps, 2018 - 2030 (USD Billion)

9.6.9.2.2. Market Size Estimates and Forecasts by Luminaires, 2018 - 2030 (USD Billion)

9.6.9.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Billion)

9.6.9.4. Market Size Estimates and Forecasts by Installation Type, 2018 - 2030 (USD Billion)

9.6.9.5. Market Size Estimates and Forecasts by Sales Channel, 2018 - 2030 (USD Billion)

9.6.9.6. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis by Key Market Participants

10.2. Company Categorization

10.3. Company Market Positioning

10.4. Company Market Share Analysis

10.5. Company Heat Map Analysis

10.6. Strategy Mapping

10.6.1. Expansion

10.6.2. Mergers & Acquisition

10.6.3. Partnerships & Collaborations

10.6.4. New Product Launches

10.6.5. Research And Development

10.7. Company Profiles

10.7.1. Acuity Brands, Inc.

10.7.1.1. Participant’s Overview

10.7.1.2. Financial Performance

10.7.1.3. Product Benchmarking

10.7.1.4. Recent Developments

10.7.2. Cree Lighting USA LLC

10.7.2.1. Participant’s Overview

10.7.2.2. Financial Performance

10.7.2.3. Product Benchmarking

10.7.2.4. Recent Developments

10.7.3. Dialight

10.7.3.1. Participant’s Overview

10.7.3.2. Financial Performance

10.7.3.3. Product Benchmarking

10.7.3.4. Recent Developments

10.7.4. Halonix Technologies Private Limited

10.7.4.1. Participant’s Overview

10.7.4.2. Financial Performance

10.7.4.3. Product Benchmarking

10.7.4.4. Recent Developments

10.7.5. Hubbell

10.7.5.1. Participant’s Overview

10.7.5.2. Financial Performance

10.7.5.3. Product Benchmarking

10.7.5.4. Recent Developments

10.7.6. LSI Industries Inc.

10.7.6.1. Participant’s Overview

10.7.6.2. Financial Performance

10.7.6.3. Product Benchmarking

10.7.6.4. Recent Developments

10.7.7. Nanoleaf

10.7.7.1. Participant’s Overview

10.7.7.2. Financial Performance

10.7.7.3. Product Benchmarking

10.7.7.4. Recent Developments

10.7.8. Panasonic Corporation

10.7.8.1. Participant’s Overview

10.7.8.2. Financial Performance

10.7.8.3. Product Benchmarking

10.7.8.4. Recent Developments

10.7.9. SAVANT TECHNOLOGIES LLC

10.7.9.1. Participant’s Overview

10.7.9.2. Financial Performance

10.7.9.3. Product Benchmarking

10.7.9.4. Recent Developments

10.7.10. Seoul Semiconductor Co., Ltd.

10.7.10.1. Participant’s Overview

10.7.10.2. Financial Performance

10.7.10.3. Product Benchmarking

10.7.10.4. Recent Developments

10.7.11. Signify Holding

10.7.11.1. Participant’s Overview

10.7.11.2. Financial Performance

10.7.11.3. Product Benchmarking

10.7.11.4. Recent Developments

10.7.12. Siteco GmbH

10.7.12.1. Participant’s Overview

10.7.12.2. Financial Performance

10.7.12.3. Product Benchmarking

10.7.12.4. Recent Developments

10.7.13. Syska

10.7.13.1. Participant’s Overview

10.7.13.2. Financial Performance

10.7.13.3. Product Benchmarking

10.7.13.4. Recent Developments

10.7.14. YEELIGHT

10.7.14.1. Participant’s Overview

10.7.14.2. Financial Performance

10.7.14.3. Product Benchmarking

10.7.14.4. Recent Developments

10.7.15. Zumtobel Group Ag

10.7.15.1. Participant’s Overview

10.7.15.2. Financial Performance

10.7.15.3. Product Benchmarking

10.7.15.4. Recent Developments

List of Tables

Table 1 LED lighting market 2018 - 2030 (USD Billion)

Table 2 Global LED lighting market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Table 3 Global LED lighting market estimates and forecasts by products, 2018 - 2030 (USD Billion)

Table 4 Global LED lighting market estimates and forecasts by lamps, 2018 - 2030 (USD Billion)

Table 5 Global LED lighting market estimates and forecasts by luminaires, 2018 - 2030 (USD Billion)

Table 6 Global LED lighting market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 7 Global LED lighting market estimates and forecasts by installaiton type, 2018 - 2030 (USD Billion)

Table 8 Global LED lighting market estimates and forecasts by sales channel, 2018 - 2030 (USD Billion)

Table 9 Global LED lighting market estimates and forecasts by end use, 2018 - 2030 (USD Billion)

Table 10 Products market by region, 2018 - 2030 (USD Billion)

Table 11 Lamps market by region, 2018 - 2030 (USD Billion)

Table 12 A-Lamps market by region, 2018 - 2030 (USD Billion)

Table 13 T-Lamps market by region, 2018 - 2030 (USD Billion)

Table 14 Other market by region, 2018 - 2030 (USD Billion)

Table 15 Luminaires market by region, 2018 - 2030 (USD Billion)

Table 16 Streetlights market by region, 2018 - 2030 (USD Billion)

Table 17 Downlights market by region, 2018 - 2030 (USD Billion)

Table 18 Troffers market by region, 2018 - 2030 (USD Billion)

Table 19 Others market by region, 2018 - 2030 (USD Billion)

Table 20 Application market by region, 2018 - 2030 (USD Billion)

Table 21 Indoor market by region, 2018 - 2030 (USD Billion)

Table 22 Outdoor market by region, 2018 - 2030 (USD Billion)

Table 23 Installation type market by region, 2018 - 2030 (USD Billion)

Table 24 New LED market by region, 2018 - 2030 (USD Billion)

Table 25 Retrofit LED market by region, 2018 - 2030 (USD Billion)

Table 26 Sales channel market by region, 2018 - 2030 (USD Billion)

Table 27 Online market by region, 2018 - 2030 (USD Billion)

Table 28 Offline market by region, 2018 - 2030 (USD Billion)

Table 29 End-use market by region, 2018 - 2030 (USD Billion)

Table 30 Commercial market by region, 2018 - 2030 (USD Billion)

Table 31 Residential market by region, 2018 - 2030 (USD Billion)

Table 32 Industrial market by region, 2018 - 2030 (USD Billion)

Table 33 Others market by region, 2018 - 2030 (USD Billion)

Table 34 North America LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 35 North America LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 36 North America LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 37 North America LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 38 North America LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 39 North America LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 40 North America LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 41 U.S. LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 42 U.S. LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 43 U.S. LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 44 U.S. LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 45 U.S. LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 46 U.S. LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 47 U.S. LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 48 Canada LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 49 Canada LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 50 Canada LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 51 Canada LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 52 Canada LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 53 Canada LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 54 Canada LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 55 Europe LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 56 Europe LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 57 Europe LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 58 Europe LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 59 Europe LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 60 Europe LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 61 Europe LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 62 U.K. LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 63 U.K. LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 64 U.K. LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 65 U.K. LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 66 U.K. LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 67 U.K. LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 68 U.K. LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 69 Germany LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 70 Germany LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 71 Germany LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 72 Germany LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 73 Germany LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 74 Germany LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 75 Germany LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 76 France LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 77 France LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 78 France LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 79 France LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 80 France LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 81 France LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 82 France LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 83 Asia Pacific LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 84 Asia Pacific LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 85 Asia Pacific LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 86 Asia Pacific LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 87 Asia Pacific LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 88 Asia Pacific LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 89 Asia Pacific LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 90 China LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 91 China LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 92 China LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 93 China LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 94 China LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 95 China LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 96 China LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 97 India LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 98 India LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 99 India LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 100 India LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 101 India LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 102 India LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 103 India LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 104 Japan LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 105 Japan LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 106 Japan LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 107 Japan LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 108 Japan LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 109 Japan LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 110 Japan LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 111 Australia LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 112 Australia LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 113 Australia LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 114 Australia LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 115 Australia LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 116 Australia LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 117 Australia LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 118 South Korea LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 119 South Korea LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 120 South Korea LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 121 South Korea LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 122 South Korea LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 123 South Korea LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 124 South Korea LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 125 Latin America LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 126 Latin America LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 127 Latin America LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 128 Latin America LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 129 Latin America LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 130 Latin America LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 131 Latin America LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 132 Brazil LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 133 Brazil LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 134 Brazil LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 135 Brazil LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 136 Brazil LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 137 Brazil LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 138 Brazil LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 139 Mexico LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 140 Mexico LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 141 Mexico LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 142 Mexico LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 143 Mexico LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 144 Mexico LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 145 Mexico LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 146 MEA LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 147 MEA LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 148 MEA LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 149 MEA LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 150 MEA LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 151 MEA LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 152 MEA LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 153 UAE LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 154 UAE LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 155 UAE LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 156 UAE LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 157 UAE LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 158 UAE LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 159 UAE LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 160 Saudi Arabia LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 161 Saudi Arabia LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 162 Saudi Arabia LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 163 Saudi Arabia LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 164 Saudi Arabia LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 165 Saudi Arabia LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 166 Saudi Arabia LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 167 South Africa LED lighting market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 168 South Africa LED lighting market, by lamps, 2018 - 2030 (Revenue, USD Billion)

Table 169 South Africa LED lighting market, by luminaires, 2018 - 2030 (Revenue, USD Billion)

Table 170 South Africa LED lighting market, by application, 2018 - 2030 (Revenue, USD Billion)

Table 171 South Africa LED lighting market, by installation type, 2018 - 2030 (Revenue, USD Billion)

Table 172 South Africa LED lighting market, by sales channel, 2018 - 2030 (Revenue, USD Billion)

Table 173 South Africa LED lighting market, by end use, 2018 - 2030 (Revenue, USD Billion)

List of Figures

Fig. 1 LED Lighting Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/3)

Fig. 9 Segment Snapshot (2/3)

Fig. 10 Segment Snapshot (3/3)

Fig. 11 Competitive Landscape Snapshot

Fig. 12 LED Lighting Market: Industry Value Chain Analysis

Fig. 13 LED Lighting Market: Market Dynamics

Fig. 14 LED Lighting Market: PORTER’s Analysis

Fig. 15 LED Lighting Market: PESTEL Analysis

Fig. 16 LED Lighting Market Share by Product, 2023 & 2030 (USD Billion)

Fig. 17 Lamps Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 A-Lamps Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 T-Lamps Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 20 Other Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 21 Luminaires Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 22 Streetlights Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 23 Downlights Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 24 Troffers Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 LED Lighting Market, by Application: Market Share, 2023 & 2030

Fig. 27 Indoor Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 28 Outdoor Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 LED Lighting Market, by Installation Type: Market Share, 2023 & 2030

Fig. 30 New LED Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 31 Retrofit LED Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 32 LED Lighting Market, by Sales Channel: Market Share, 2023 & 2030

Fig. 33 Online Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 34 Offline Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 35 LED Lighting Market, by End Use: Market Share, 2023 & 2030

Fig. 36 Commercial Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 37 Residential Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 38 Industrial Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 39 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 40 Regional Marketplace: Key Takeaways

Fig. 41 North America LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 42 U.S. LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 43 Canada LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 44 Europe LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 45 U.K. LED Lighting Market Estimates and Forecasts, 2018 - 2030) (USD Billion)

Fig. 46 Germany LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 47 France LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Asia Pacific LED Lighting Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 49 China LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 50 Japan LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 51 India LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 52 South Korea LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 53 Australia LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 Latin America LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 55 Brazil LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 Mexico LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 MEA LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 58 UAE LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 59 Saudi Arabia LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 60 South Korea LED Lighting Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 61 Key Company Categorization

Fig. 62 Company Market Positioning

Fig. 63 Key Company Market Share Analysis, 2023

Fig. 64 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- LED Lighting Product Outlook (Revenue, USD Billion; 2018 - 2030)

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- LED Lighting Application Outlook (Revenue, USD Billion; 2018 - 2030)

- Indoor

- Outdoor

- LED Lighting Installation Type Outlook (Revenue, USD Billion; 2018 - 2030)

- New LED

- Retrofit LED

- LED Lighting Sales Channel Outlook (Revenue, USD Billion; 2018 - 2030)

- Online

- Offline

- LED Lighting End Use Outlook (Revenue, USD Billion; 2018 - 2030)

- Commercial

- Residential

- Industrial

- Others

- LED Lighting Regional Outlook (Revenue, USD Billion; 2018 - 2030)

- North America

- North America LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- North America LED Lighting Market, by Application

- Indoor

- Outdoor

- North America LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- North America LED Lighting Market, by Sales Channel

- Online

- Offline

- North America LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- U.S.

- U.S. LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- U.S. LED Lighting Market, by Application

- Indoor

- Outdoor

- U.S. LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- U.S. LED Lighting Market, by Sales Channel

- Online

- Offline

- U.S. LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- U.S. LED Lighting Market, by Product

- Canada

- Canada LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- Canada LED Lighting Market, by Application

- Indoor

- Outdoor

- Canada LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- Canada LED Lighting Market, by Sales Channel

- Online

- Offline

- Canada LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- Canada LED Lighting Market, by Product

- North America LED Lighting Market, by Product

- Europe

- Europe LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- Europe LED Lighting Market, by Application

- Indoor

- Outdoor

- Europe LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- Europe LED Lighting Market, by Sales Channel

- Online

- Offline

- Europe LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- U.K.

- U.K. LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- U.K. LED Lighting Market, by Application

- Indoor

- Outdoor

- U.K. LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- U.K. LED Lighting Market, by Sales Channel

- Online

- Offline

- U.K. LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- U.K. LED Lighting Market, by Product

- Germany

- Germany LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- Germany LED Lighting Market, by Application

- Indoor

- Outdoor

- Germany LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- Germany LED Lighting Market, by Sales Channel

- Online

- Offline

- Germany LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- Germany LED Lighting Market, by Product

- France

- France LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- France LED Lighting Market, by Application

- Indoor

- Outdoor

- France LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- France LED Lighting Market, by Sales Channel

- Online

- Offline

- France LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- France LED Lighting Market, by Product

- Europe LED Lighting Market, by Product

- Asia Pacific

- Asia Pacific LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- Asia Pacific LED Lighting Market, by Application

- Indoor

- Outdoor

- Asia Pacific LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- Asia Pacific LED Lighting Market, by Sales Channel

- Online

- Offline

- Asia Pacific LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- China

- China LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- China LED Lighting Market, by Application

- Indoor

- Outdoor

- China LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- China LED Lighting Market, by Sales Channel

- Online

- Offline

- China LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- China LED Lighting Market, by Product

- India

- India LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- India LED Lighting Market, by Application

- Indoor

- Outdoor

- India LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- India LED Lighting Market, by Sales Channel

- Online

- Offline

- India LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- India LED Lighting Market, by Product

- Japan

- Japan LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- Japan LED Lighting Market, by Application

- Indoor

- Outdoor

- Japan LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- Japan LED Lighting Market, by Sales Channel

- Online

- Offline

- Japan LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- Japan LED Lighting Market, by Product

- Australia

- Australia LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- Australia LED Lighting Market, by Application

- Indoor

- Outdoor

- Australia LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- Australia LED Lighting Market, by Sales Channel

- Online

- Offline

- Australia LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- Australia LED Lighting Market, by Product

- South Korea

- South Korea LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- South Korea LED Lighting Market, by Application

- Indoor

- Outdoor

- South Korea LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- South Korea LED Lighting Market, by Sales Channel

- Online

- Offline

- South Korea LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- South Korea LED Lighting Market, by Product

- Asia Pacific LED Lighting Market, by Product

- Latin America

- Latin America LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- Latin America LED Lighting Market, by Application

- Indoor

- Outdoor

- Latin America LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- Latin America LED Lighting Market, by Sales Channel

- Online

- Offline

- Latin America LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- Brazil

- Brazil LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- Brazil LED Lighting Market, by Application

- Indoor

- Outdoor

- Brazil LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- Brazil LED Lighting Market, by Sales Channel

- Online

- Offline

- Brazil LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- Brazil LED Lighting Market, by Product

- Mexico

- Mexico LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- Mexico LED Lighting Market, by Application

- Indoor

- Outdoor

- Mexico LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- Mexico LED Lighting Market, by Sales Channel

- Online

- Offline

- Mexico LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- Mexico LED Lighting Market, by Product

- Latin America LED Lighting Market, by Product

- MEA

- MEA LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- MEA LED Lighting Market, by Application

- Indoor

- Outdoor

- MEA LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- MEA LED Lighting Market, by Sales Channel

- Online

- Offline

- MEA LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- UAE

- UAE LED Lighting Market, by Product

- Lamps

- A-Lamps

- T-Lamps

- Other

- Luminaires

- Streetlights

- Downlights

- Troffers

- Others

- Lamps

- UAE LED Lighting Market, by Application

- Indoor

- Outdoor

- UAE LED Lighting Market, by Installation Type

- New LED

- Retrofit LED

- UAE LED Lighting Market, by Sales Channel

- Online

- Offline

- UAE LED Lighting Market, by End Use

- Commercial

- Residential

- Industrial

- Others

- UAE LED Lighting Market, by Product

- Saudi Arabia

- Saudi Arabia LED Lighting Market, by Product

- Lamps

- A-Lamps