- Home

- »

- Next Generation Technologies

- »

-

Light Sensor Market Size, Share And Trends Report, 2030GVR Report cover

![Light Sensor Market Size, Share & Trends Report]()

Light Sensor Market Size, Share & Trends Analysis Report By Function (Proximity Detection, Gesture Recognition), By Output (Digital, Analog), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-180-4

- Number of Pages: 109

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Light Sensor Market Size & Trends

The global light sensor market size was valued at USD 3.66 billion in 2022 and is anticipated to grow at a CAGR of 12.0% from 2023 to 2030. Major factors driving the demand for light sensors are the increasing use of consumer electronics, the miniaturization of sensors, and the growing demand for implementing renewable energy. Additionally, advancements in smart homes, outdoor lighting, and the automotive sector are expected to boost the market's growth. Low-cost and high-speed electronic circuits, advanced manufacturing technologies, and innovative signal-processing methods have fueled recent advancements in sensor technologies. These new developments in the field have provided promising technical solutions, thereby increasing technical products' reliability, quality, and economic efficiency.

Factors such as deference to multiplexing, immunity against electromagnetic interference, and superior sensitivity make light detectors a preferred technology in various sectors, such as healthcare, aerospace, automotive, and consumer electronics. All these factors are anticipated to boost the market's growth over the forecast period.

Light sensors have become common in emerging tech innovations and smart city applications, often supported by Machine Learning (ML) and Artificial Intelligence (AI) technologies. The market is expected to witness growth prospects across various industry verticals due to the growth in industrial automation, a surge in IoT and connected devices, and advancements in the telecommunication industry. Applications of photonics are already impacting smart city infrastructure in terms of sensing, smart lighting, and communication technologies. Meanwhile, other emerging technologies, such as nanoscale photonics, are also witnessing high demand in smart city infrastructure, boosting the demand for light sensors.

Miniaturization and enhancements in sensor technologies have resulted in an increased demand for smart electronics, such as LED televisions, smartphones, and smart lighting systems, across the globe. At the core of these devices are various sensor technologies and communication interfaces. The introduction of connected devices and 5G communication technologies is likely to propel the use of various sensors across industries. Besides, optical sensors are widely used in wearable electronics equipment on the commercial and domestic front.

Sensor systems find usage in a wide range of applications owing to features such as increased comfort, security, and automation. Continuous enhancements in the quality and reliability of lighting detection products have led to increased competition in the market. However, the rising cost of sensor design and manufacturing innovation poses a challenge for the market. Additionally, the COVID-19 pandemic hampered the global economy and disrupted global supply chains, causing short-term market uncertainty. These challenges must be overcome through innovative approaches and solutions, considering the future demand for light-sensing applications in various industries.

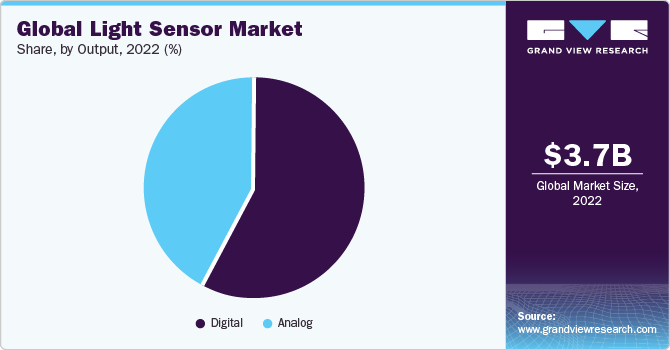

Output Insights

The digital segment accounted for the largest revenue share of around 58.2% in 2022. In applications such as heating, ventilation, air conditioning, lighting controls, or temperature control system, the control parameters need to be adjusted based on the intensity of ambient light. Digital light detectors have become significant in such conditions. With the increasing use of screen-based devices, such as laptops, cell phones, and television sets, the digital light sensor segment to likely witness significant growth in the coming years.

With technological advancements, various optical sensors are available in small packages at reasonable prices. Digital solutions have increased the utility and range of ambient light detectors. Moreover, analog-to-digital light sensors offer IR-blocking filters, an interrupt function, and an I2C interface for backlighting control and ambient light sensing. As power conservation has become an essential feature in several devices, the utility of digital light sensors is expected to be further propelled in the coming years.

The analog segment is estimated to grow at a significant CAGR of 10.3% over the forecast period. Analog light sensors find extensive use in sectors such as automotive, consumer electronics, healthcare, industrial automation, and smart home systems. These sensors enable functionalities such as ambient light sensing, backlight control, proximity detection, and gesture recognition. The versatility of analog light sensors makes them essential for achieving accurate light measurement and precise control in diverse environments.

Function Insights

The ambient light sensing segment accounted for the largest revenue share of 28.9% in 2022. Light sensors have become an important element of consumer electronics to meet various design needs. Moreover, ambient light sensing technology is gaining prominence owing to its growing adoption in smart electronics. It is fundamental as light detectors help to adjust the intensity of LCD and LED screens as per the amount of ambient light. They also preserve energy and offer users an appropriate amount of screen brightness.

The proximity detection segment is expected to grow at the fastest CAGR of 13.0% during the forecast period. The growth of this segment can be attributed to its wide usage in automotive and industrial manufacturing. Proximity detectors respond to variations in infrared light to sense motion or proximity to other objects. They are commonly used to alert drivers when the vehicle is near other objects. Moreover, they are widely used in outdoor lights to detect movements for security purposes.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 34.5% in 2022, owing to its growing population and increasing demand for smartphones and consumer electronics. Moreover, the growing number of handheld devices with integral light sensors is expected to propel the market's growth. Stringent government regulations on the safety of consumers in developing countries, such as India and China, have led automobile manufacturers to incorporate more detectors in mid-segment vehicles. These factors are expected to drive the demand for light sensors in APAC over the forecast period.

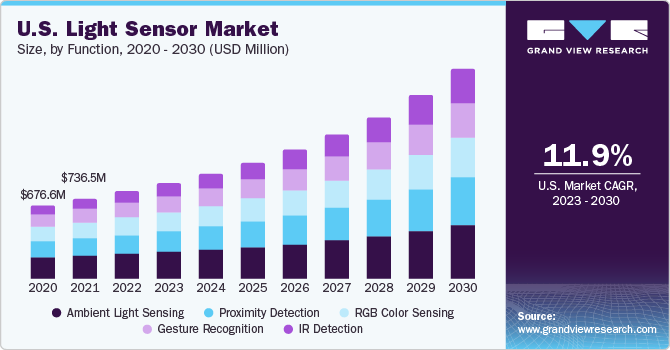

North America is expected to grow at a significant CAGR of 12.1% during the forecast period owing to the early adoption of light detection solutions. The regional market is characterized by many vendors, such as Analog Devices, Inc.; Broadcom, Inc.; and Maxim Integrated Products Inc., actively innovating and developing sensors. While the U.S. remains the global leader in sensor design and R&D, major manufacturing occurs in the Asia Pacific. This trend is projected to continue over the next decade. However, global geopolitical instability, especially concerning trade policy, has compelled the U.S. industry to adopt new strategies to stay ahead of the competition.

Application Insights

The consumer electronics segment held the largest revenue share of 35.2% in 2022, owing to the increasing demand and utility of electronic products among consumers. Light-sensing devices are witnessing an upsurge in demand from applications, such as smartphones, LCD/LED televisions, & laptops. The sensors automatically regulate the screen brightness in response to the amount of environmental light. These devices receive, thus enabling power saving. Modern IoT lighting platforms also focus on controlling lighting with various digital sensing elements involving illuminance detectors.

The healthcare segment is expected to grow at the fastest CAGR of 13.2% over the forecast period. Light sensors are widely used in the medical arena to detect pathogens, monitor patient oxygen levels (pulse oximeters), and diagnose blood. Moreover, there has been an increasing demand for integrated optoelectronic sensors in the medical equipment industry. These developments are likely to boost the market's growth in the healthcare domain over the forecast period.

Key Companies & Market Share Insights

The light sensor market players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in July 2021, Sharp Fukuyama Semiconductor Co., Ltd., a subsidiary of Sharp, introduced the GP2AP130S00F proximity sensor. This sensor is the smallest in its class and is specifically designed for wearable gadgets, supporting the I2C communication protocol. Its ultra-compact size and low current consumption can be easily integrated into various wearable gadgets.

Key Light Sensor Companies:

- ams-OSRAM AG

- Analog Devices, Inc.

- Broadcom

- ELAN Microelectronics Corp.

- EVERLIGHT ELECTRONICS CO., LTD.

- ROHM CO., LTD.

- SAMSUNG

- SHARP CORPORATION

- Sitronix Technology Corporation

- STMicroelectronics

- Vishay Intertechnology, Inc.

Recent Developments

-

In May 2023, DANLERS, an energy-saving lighting company, CALUMINO, a hardware and AI startup, and INGY joined forces to create an innovative, intelligent lighting control sensor. The groundbreaking DANLER's CAL-CEFL12V incorporates CALUMINO's advanced thermal sensor technology, embedded AI, and computer vision. Designed for installation at 2 to 4 meters in height, the CAL-CEFL12V includes a light sensor and wired DALI control lines. It is an affordable, dependable, and precise people-counting sensor that ensures real-time occupancy data collection while maintaining privacy.

-

In November 2022, ams-OSRAM AG introduced a three-channel UV-A/B/C Sensor AS7331. The AS7331 measures radiations at UV-C and UV-B, and UV-A wavelengths. It has applications in coffee brewing machines, robotic floor cleaners, and water and air purifiers. In addition, it has applications in healthcare for UV curing and Phototherapy.

-

In July 2022, Vishay Intertechnology, Inc.'s Optoelectronics group unveiled a reflective optical sensor suitable for automotive, smart home, industrial, and office purposes. This AEC-Q101-qualified sensor boasts a compact design with the emitting light source and detector positioned in the same plane. It is a space-efficient solution for optical switching in automotive electronics, office equipment, and home appliances. Additionally, it facilitates optical encoding in industrial automation systems and enables paper presence detection in printers and copy machines.

Light Sensor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.01 billion

Revenue forecast in 2030

USD 8.87 billion

Growth Rate

CAGR of 12.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, output, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

ams-OSRAM AG; Analog Devices, Inc.; Broadcom; ELAN Microelectronics Corp.; EVERLIGHT ELECTRONICS CO., LTD.; ROHM CO., LTD.; SAMSUNG; SHARP CORPORATION; Sitronix Technology Corporation; STMicroelectronics; Vishay Intertechnology, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Light Sensor Market Report Segmentation

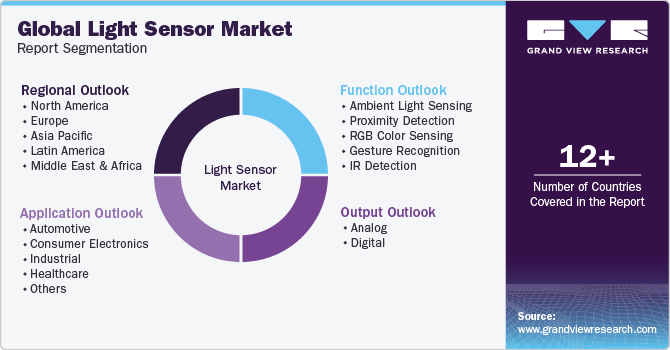

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global light sensor market based on function, output, application, and region:

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Ambient Light Sensing

-

Proximity Detection

-

RGB Color Sensing

-

Gesture Recognition

-

IR Detection

-

-

Output Outlook (Revenue, USD Million, 2018 - 2030)

-

Analog

-

Digital

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Industrial

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global light sensor market size was estimated at USD 3.66 billion in 2022 and is expected to reach USD 4.01 billion in 2023.

b. Proximity sensors led the light sensor market and accounted for around 21% share of global revenue in 2022. The growth of the sensors can be attributed to its increasing utility in automotive and industrial manufacturing.

b. Some key players operating in the light sensor market are AMS AG, STMicroelectronics, Sharp Corporation, and Samsung Electronics Co. Ltd. Some of the other players in the market include Analog Devices, Inc., Broadcom Inc., Elan Microelectronic Corp, Everlight Electronics Co. Ltd., Maxim Integrated Products Inc., ROHM Co. Ltd., Sitronix Technology Corporation, and Vishay Intertechnology Inc.

b. The global light sensor market is expected to witness a compound annual growth rate of 12.0% from 2023 to 2030 to reach USD 8.87 billion by 2030.

b. Key factors that are driving the light sensor market growth are the growing consumption of consumer electronics and the trend towards implementing renewable energy. The development in miniaturization of the sensors will further boost their demand.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."