- Home

- »

- Beauty & Personal Care

- »

-

Lip Powder Market Size & Share, Industry Growth Report, 2019-2025GVR Report cover

![Lip Powder Market Size, Share & Trends Report]()

Lip Powder Market Size, Share & Trends Analysis Report By Product (Palette, Pen), By Distriution Channel (Offline, Online), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-925-8

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Industry Insights

The global lip powder market size was valued at USD 343.7 million in 2018 and is anticipated to witness significant growth in the forecast period. The rising demand for shine-free lightweight lip color is driving the demand for lip powder. Furthermore, the growing willingness of consumers to experiment with new cosmetics products is estimated to generate significant demand for the product in the near future.

Women are the main consumers of this industry, therefore this population segment is driving the industry across the globe. Over the past few years, an increasing participation rate of women in the workforce has been fueling the demand for luxury personal care products significantly. Financial independent women are now spending more on new makeup products. In addition, the rapidly expanding corporate sector in developing countries is boosting physical appearance enhancement products among working women. Currently, the majority of the female population wears lipstick regularly. This, in turn, increases the demand and scope for the product over the world.

Social media, such as YouTube, has become an important factor in influencing purchasing decisions. The rapid expansion of the social media platforms boosted the sale of makeup products across the world. Key producers of this industry are using this platform including Facebook, Instagram, Twitter, YouTube, and beauty-related blogs to promote their brands by including celebrities. These platforms also offer free product-centric beauty tutorials to the consumers. It directly connects the manufacturer to the consumers. In 2018, lipstick has been a popular search on google, especially in Taiwan, Indonesia, Hong Kong, Vietnam, and Malaysia.

Though the liquid and cream form of lip color products dominates the lip color industry, the powder form is expected to witness significant growth in the near future. The light and matte finish properties of the product gives advantage over the other forms of lip colors. It contains glycerin, coconut oil, and vitamin E, which help to hydrate the skin and the presence of silica spreads the pigments smoothly. Furthermore, it has better longevity than the conventional lipsticks.

Product Insights

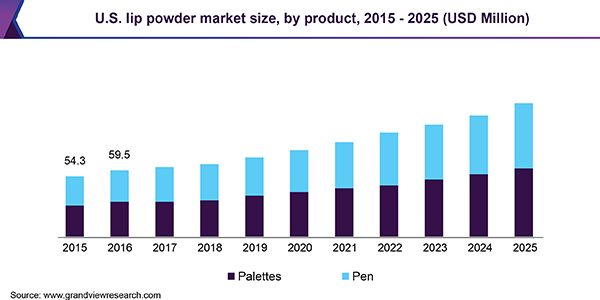

Palette was the largest product segment in the market, accounting for a 54.4% share of the global revenue in 2018. Palette is the lip kit that contains pigmented balm and metallic powder in the same kit. The balm offers the perfect base for the powder and keeps the skin hydrated. Furthermore, it allows the consumers to experiment with product.

The pen product segment is expected to register the fastest CAGR of 6.7% from 2019 to 2025. It is handier than the palettes and is easy to use and carry. Manufacturers have been investing in the pen product form due to the growing demand for this product. For instance, in March 2018, BY TERRY launched Lip Powder Essence, which is a lip powder pen. It makes use of the powder-to-liquid technology, where the powder instantly transforms into liquid upon contact with skin. Lip Powder Essence is available in four matte shades including Red Carpet, Pink Kiss, Chill Wine, and Nude Flirt.

Distribution Channel Insights

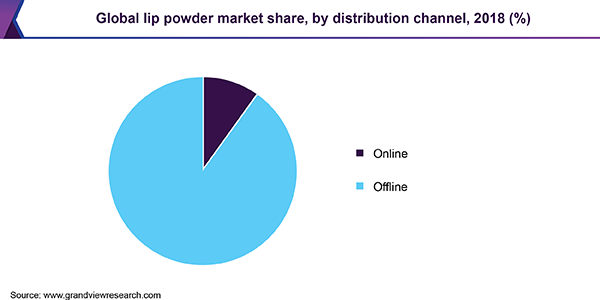

As of 2018, the offline distribution channel held the largest lip powder market share of 90.2% in terms of revenue. This segment includes mom-and-pop stores, drug stores, supermarkets and hypermarkets, direct selling, and brand outlets. Avon Products, Inc. is the leading direct selling channel of the personal care products in the world. However, Amway, Oriflame, Mary Kay, and NuSkin are also prominent direct sellers of beauty products.

The online distribution channel is anticipated to register the fastest CAGR of 9.0% from 2019 to 2025. The number of online shoppers is increasing remarkably due to rapid growth in the number of smartphone users across the world. Convenient purchasing and checkout of the online retailer have encouraged the consumers to purchase through digital platforms. As of 2018, beauty products are among the most common items purchased online.

Over the past few years,regular purchasing of cosmetic products has grown significantly. Foundation, face powder, artificial nails, lipstick, and lip-gloss are the most common beauty products purchased in the last few years. Young consumers aged between 18 and 24 are the largest online buyers. Key retailers of this industry include Sephora, Amazon, Strawberrynet, and FEELUNIQUE INTERNATIONAL LIMITD.

Regional Insights

As of 2018, Asia Pacific dominated the market with a 30.7% share of the overall revenue. Prominent markets of this region include China, Japan, South Korea, Indonesia, Philippines, Singapore, and Malaysia. The product has been innovated in South Korea. Rising spending on luxury makeup products, along with increasing per capita income, is driving the market in this region. Social media has also influenced the market growth significantly in these nations. Consumers in Indonesia, the Philippines, Singapore, and Malaysia have searched for the product on Google more than any other country in the world.

North America is projected to expand at a CAGR of 8.5% from 2019 to 2025. Increasing the per capita spending of consumers in this region is expected to boost the growth of the industry. In addition, increasing availability and accessibility of makeup products will remain an important driving factor in the regional market. In 2018, Urban Decay, a U.S.-based cosmetics brand, launched Lo-Fi Lip Mousses, which is a range of palette lip powders.

Lip Powder Market Share Insights

Key players of this industry include L'Oréal S.A.; The Estée Lauder Companies Inc.; BY TERRY; Shiseido Company; Stellar Beauty; Urban Decay; CLE COSMETICS; Revlon, Inc.; CHANEL International B.V.; and Sephora USA, Inc. The leading companies hold a significant market share of the overall revenue. Over the past few years, establishment of strategic partnerships with celebrities to promote products has become one of the major competitive strategies. Manufactures are expected to invest significantly in the product development in order to expand their product portfolio and enhance the quality of their products. New players are expected to enter the market due to significant growth opportunity.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Germany, France, China, Japan, South Korea, Brazil, and South Africa

Report coverage

Revenue forecast, company share, competitive landscape, and growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels, and provides an analysis on the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global lip powder market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Palette

-

Pen

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."