- Home

- »

- Beauty & Personal Care

- »

-

Lipstick Market Size, Share, Global Industry Trends Report, 2019-2025GVR Report cover

![Lipstick Market Size, Share & Trends Report]()

Lipstick Market Size, Share & Trends Analysis Report By Product (Shimmer, Matte), By Applicator, By Age, By Distribution Channel, By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-167-2

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Report Overview

The global lipstick market size was valued at USD 11.5 billion in 2018. Rising consciousness regarding personal grooming and appearance among young female consumers across the world is expected to be one of the key drivers. Furthermore, increasing purchasing power of the women population due to rising female workforce is expected to fuel the product’s demand in the near future.

Rising health consciousness among the consumers and awareness about the benefits of organic cosmetics are fueling the demand for natural and organic lip color products. Presence of high anti-oxidant in natural and organic products helps in repairing skin cell’s damage. This beneficial feature is expected to prompt the product’s consumption in the near future. Companies including Antipodes and Origins Natural Resources, Inc. launched natural and flower based lip colors in 2018.

Over the past few years, lip powder has gained significant popularity over the world. The matte finish and lightweight features of this product have been driving the market. Presence of coconut oil, glycerin, and vitamin E that hydrates skin is a key factor driving the product demand. Furthermore, it stays longer than conventional lipsticks.

Consumers are interested in experimenting with new colors and texture of lip color. The trend of colors varies with region and skin tones. In the western regions such as North America and Europe, the imperfect finish lip colors, which almost smudges into the lip line are getting popular. Similarly, some of the colors including pink, peach, and nude have been witnessing significant demand across the world.

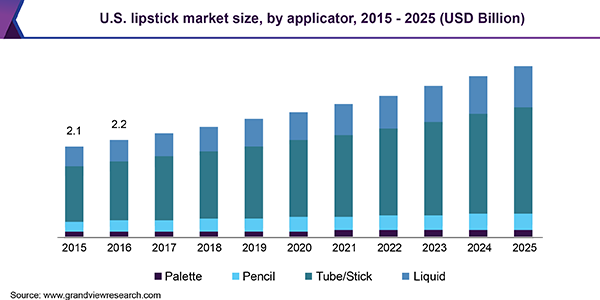

Applicator Insights

Based on the applicator, the tube/stick applicator segment dominated the market in 2018, accounting for 60.9% of the global revenue. Consumer prefers this applicator due to its easy application and easy convenient carry features. On the other hand, the liquid segment is projected to register the fastest CAGR of 7.9% from 2019 to 2025. Growing trend of matte finish and glitter finish product has been accelerating the growth of the liquid lipstick market.

A large number of products are introduced in the liquid form as it is well suited for the matte and glitter lip colors. For instance, in July 2018, Lakmé Cosmetics launched Matte Melt Liquid Lip Color in various shades including peach rose, mulberry feast, red smoke, firestarter red, and vintage pink. Similarly, in December 2018, Zara launched its new collection of matte liquid lip colors. This product line has a velvety texture, which prevents the lip from drying.

Age Insights

Under 20 age group dominated the market in 2018, accounting for over 30.0% of the global revenue. This age group is mostly active on social media, including fashion blogs, YouTube, and Instagram, which is a crucial marketing platform of the makeup manufacturers. Therefore, purchasing decision of this young consumer group is largely influenced by social media marketing campaigns. Furthermore, consumers aged under 20 are more interested in experimenting with new products.

The consumer group aged between 20 - 30 is expected to expand at the fastest CAGR of 7.8% from 2019 to 2025. Growing women participation in the workforce is driving the sales of the product among this age group. Furthermore, increasing appearance consciousness among the working women is expected to expand the product’s reach in the near future.

Distribution Channel Insights

The offline distribution channel dominated the market, accounting for more than 85.0% share of the overall revenue in 2018. Among the offline distribution channels, hypermarkets and supermarkets are growing significantly across the world. Shifting consumer preference towards hypermarkets and supermarkets from the conventional retail store due to the wide array of brands available with different price points. Some of the producers including Avon Products, Inc., Oriflame, Amway, NuSkin, and Mary Kay has grown remarkably through direct sales channels.

The online distribution channel is expected to register the fastest CAGR of 10.6% from 2019 to 2025. Rapid growth of smartphones and high-speed internet are expected to play a crucial role in the growth of e-commerce in the near future. Convenience and a wide collection of products have been encouraging the consumers to purchase through online platforms. As of 2018, lipstick is one of the most common beauty products purchased through online retails.

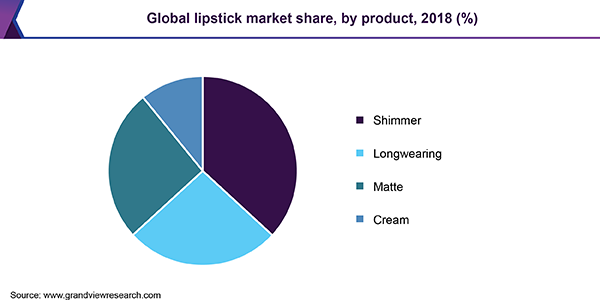

Product Insights

As of 2018, shimmer lip colors held the largest share of more than 35.0% of the total revenue. The high moisture content of this product makes it more comfortable to wear on lips. Shimmer finished lip colors are also easier to remove as compared to matte cream and longwearing lip colors. As a result, this product has gained significant popularity as everyday wear makeup. Shimmer lip colors are suitable for both daytime and nighttime looks. Furthermore, the producers of this market offer a wide range of colors in this shimmer finished lip colors. In June 2018, L'Oréal S.A. launched Color Riche Shine lipsticks, which is a non-sticky, glossy finish, and comfortable wear product available in a wide range of colors.

Matte lip color is expected to expand at the fastest CAGR of 7.9% from 2019 to 2025. Over the past few years, the matte finish products have witnessed remarkable popularity among the consumers across the globe. Consumer preference is shifting towards these dry lip colors owing to their long-lasting and natural look properties. Key players have introduced a wide variety of matte finished products, considering this trend. In October 2018, MAC Cosmetics launched matte Powder Kiss lipsticks in different shades. This weightless product has a powdery-matte finish that moisturizes lip.

Regional Insights

As of 2018, Europe dominated the market, accounting for 31.0% of the global revenue. U.K., Germany, France, Italy, Poland, and Spain are the prominent markets of this region. Shifting consumer preference towards organic lip colors due to growing concerns over harmful effects of chemical-based cosmetics is a key driving factor. Furthermore, demand for lip colors among youth consumers is rising in this region in order to get a trendy and fashionable look.

Asia Pacific is expected to register the fastest CAGR of 11.0% from 2019 to 2025. Rapid urbanization in the developing countries including China, India, Malaysia, and Taiwan has been fueling the demand for luxury personal care product over the region. Growing penetration of global brands is expected to affect the market growth positively in the near future. Furthermore, innovative and attractive packaging is anticipated to expand the consumer base of the market in this region.

Key Companies & Market Share Insights

Key manufacturers include L'Oréal S.A.; Shiseido Company, Limited; The Estée Lauder Companies Inc.; Coty, Inc.; Revlon, Inc.; Avon Products, Inc.; AmorePacific Corporation; Oriflame Holding AG; Chanel S.A.; and Christian Dior SE. The producers are focusing on strategic mergers and acquisitions, product development, and innovative packaging to expand their business.

For instance, in August 2016, L'Oréal S.A. acquired IT Cosmetics, LLC, a U.S. based producer of makeup and skincare product. This acquisition has expanded the product portfolio of the Luxe Division of L'Oréal. In addition, June 2016, AXILONE USA, a cosmetics packaging solution provider, introduced an innovative environmentally friendly lipstick case made with bamboo.

Lipstick Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 13.1 billion

Revenue forecast in 2025

USD 18.9 billion

Growth Rate

CAGR of 7.4% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, applicator, age, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; China; India; Brazil; South Africa

Key companies profiled

L'Oréal S.A.; Shiseido Company, Limited; The Estée Lauder Companies Inc.; Coty, Inc.; Revlon, Inc.; Avon Products, Inc.; AmorePacific Corporation; Oriflame Holding AG; Chanel S.A.; Christian Dior SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis on the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global lipstick market report based on product, applicator, age, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Shimmer

-

Matte

-

Cream

-

Longwearing

-

-

Applicator Outlook (Revenue, USD Million, 2015 - 2025)

-

Palette

-

Pencil

-

Tube/stick

-

Liquid

-

-

Age Outlook (Revenue, USD Million, 2015 - 2025)

-

Under 20

-

20 - 30

-

31 - 50

-

Over 50

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lipstick market size was estimated at USD 12.3 billion in 2019 and is expected to reach USD 13.1 billion in 2020.

b. The global lipstick market is expected to grow at a compound annual growth rate of 7.4% from 2019 to 2025 to reach USD 18.9 billion by 2025.

b. Europe dominated the lipstick market with a share of 30.5% in 2019. This is attributable to shifting consumer preference towards organic lip colors due to growing concerns over the harmful effects of chemical-based cosmetics.

b. Some key players operating in the lipstick market include L'Oréal S.A.; Shiseido Company, Limited; The Estée Lauder Companies Inc.; Coty, Inc.; Revlon, Inc.; Avon Products, Inc.; AmorePacific Corporation; Oriflame Holding AG; Chanel S.A.; and Christian Dior SE.

b. Key factors that are driving the lipstick market growth include rising consciousness regarding personal grooming and appearance among young female consumers across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."