- Home

- »

- Plastics, Polymers & Resins

- »

-

Liquid Crystal Polymer Films And Laminates Market Report 2030GVR Report cover

![Liquid Crystal Polymer Films And Laminates Market Size, Share & Trends Report]()

Liquid Crystal Polymer Films And Laminates Market Size, Share & Trends Analysis Report By Product (Films, Laminates), By Application (Packaging, Automotive, Electrical & Electronics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-924-1

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Market Size & Trends

The global liquid crystal polymer films and laminates market size was estimated at USD 147.2 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. The market growth is primarily driven by the increasing use of liquid crystal polymer (LCP) films & laminates as an alternative to polyimide films in various application industries. This trend is anticipated to continue over the forecast period. Liquid crystal polymer belongs to the family of thermoplastics, having a unique set of properties. It is a super engineering plastic, which is tolerant under harsh environments. It has high heat, electrical, and chemical resistance. LCPs are anisotropic (in both solid and liquid crystal phases), which means strength, stiffness, and thermal expansion will be greater in one direction but not the same in every direction.

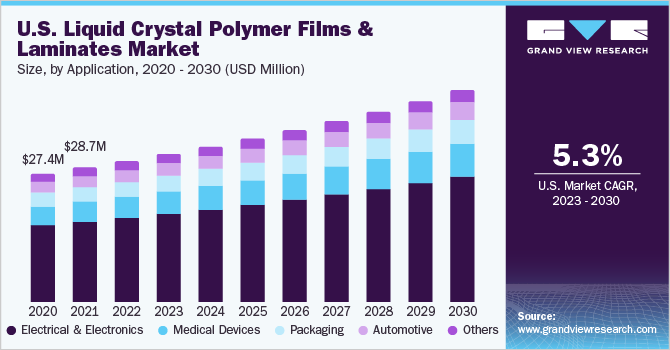

The U.S. presents a large market for electronics & automotive alike, with significant scope for growth in the medical devices market. The country is home to several large automakers, such as General Motors, Ford, Chrysler, Toyota, Nissan, Hyundai-Kia, and BMW.The need for sophisticated yet safe technology is driving innovation in the electronics industry. The semiconductor industry specifically remains a strong point in the U.S. economy, with companies, such as Intel, TI, and Micron, investing in new fabrication facilities in the U.S., while continuing to make lower-tech, low-cost products, and packaging/test offshore. Growing demand for flexible and high-performance circuit boards is, thus, expected to augment the demand for LCP films & laminates in the electronics industry.

Films and laminates constitute a relative niche market in the global LCP market; however, they have several applications on account of their improved creep resistance, low coefficient of thermal expansion, high modulus & strength, minimal moisture absorption, excellent flex/fold characteristics, high dielectric strength and high abrasion, chemical, cut, & impact resistance coupled with vibration & dampening characteristics.However, limitation in the melting process is anticipated to hinder the growth over the forecast period. The melt viscosity of LCP resins is much lower than other competitive thermoplastic resins. Other physical limitations include high anisotropy of the product’s properties, poor knit line strength, and the requirement of stoving or drying before melt processing.

Application Insights

The electrical & electronics segment led the industry in 2022 and accounted for more than 63.15% share of the overall revenue. Remarkable developments in the field of wireless communication and technology have paved the way for the use of LCP films in diverse and new applications. Foreign investors are investing heavily in modernizing the communication infrastructure, which, in turn, is propelling the demand for communication equipment.LCP films exhibit temperature- and moisture-resistant properties, strong vibration absorption qualities, low dielectric properties, good chemical & heat resistance, low melt viscosity & low linear expansion rate, and a self-reinforcing effect, which is expected to positively affect the segment growth over the forecast period.

They are slated to boost future markets from the automobile and transportation industries owing to chemical reaction resistance against corrosive fumes and gasoline alcohol fuels in vehicles. LCP films are used in the packaging industry due to their robust mechanical and chemical properties. They are slowly replacing polyamide films in the packaging industry. In cavity packing, LCP films have grown as an alternative to generally used metal and ceramic materials. Liquid crystal polymer films have the best properties among the polymeric material and are used in the cavity packing of sensors and Microelectromechanical (MEM) devices.

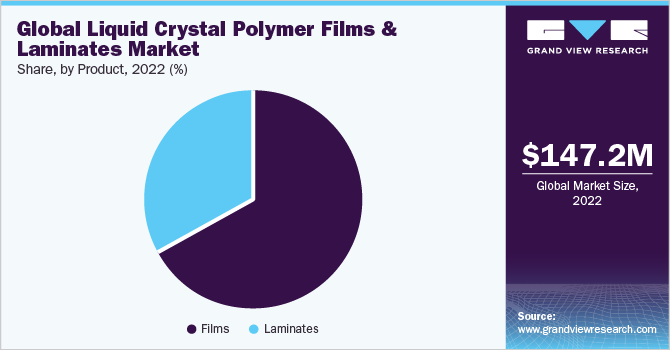

Product Insights

The films segment dominated the global industry with a high revenue share of more than 67.30% in 2022. The manufacturing process for films and laminates differs according to the type and grade of the end product. However, most films are processed via roll calendaring or extrusion, which helps manufacture the best products with optimum thickness and gauge. Laminates are formed by direct lamination of LCP resins onto copper foils, either with or without the application of adhesives. LCP films dominated the LCP films & laminates and are projected to progress at a steady CAGR over the forecast period.

The LCP films segment is expected to witness considerable growth over the forecast period on account of the product’s inherent properties, such as low Coefficient of ThermalExpansion (CTE), reduced moisture absorption, high tensile strength, and abrasion resistance. These properties result in enhanced performance of these films, thus, making them suitable for diverse applications in the above-mentioned end-use industries.

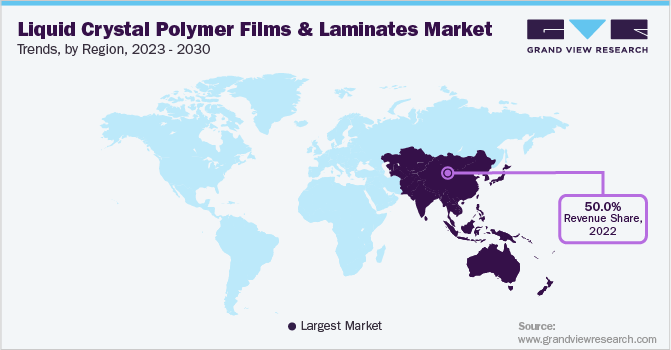

Regional Insights

Asia Pacific accounted for the largest revenue share of more than 50.0% in 2022. Growth in the Asia Pacific region is driven by rapid urbanization and growing industrialization in countries, such as China, India, Vietnam, Thailand, Singapore, and Taiwan. China is one of the largest smartphone users and manufacturers in the world due to which, it achieved significant market share in this region. Transitioning lifestyles coupled with changing preferences for advancing telecommunication technologies and IT infrastructure are expected to drive the demand for LCP films & laminates.

North America emerged as the second-largest market in 2022. Growing consumer demand for miniaturized electronics is expected to drive the product demand in the electrical & electronics industry in North America. The rapidly growing automotive sector, particularly in Mexico, is anticipated to positively impact product demand over the forecast period.

Key Companies & Market Share Insights

Manufacturers, such as Sumitomo Chemicals and Kuraray Co., Ltd., are integrated along the value chain from raw material processing to final production and distribution as well. These companies have the added competitive advantage of lower procurement costs and highly efficient distribution and logistics.Some of the key companies in the global liquid crystal polymer films and laminates market include:

-

Murata Manufacturing Co., Ltd.

-

Azotek Co., Ltd.

-

Panasonic Corp.

-

Furukawa Electric Co., Ltd.

-

Rogers Corp.

-

Kuraray Co., Ltd.

-

Chiyoda Integre Co., Ltd.

-

KGK Chemical Corp.

-

iQLP

Liquid Crystal Polymer Films And Laminates Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 157.0 million

Revenue forecast in 2030

USD 254.2 million

Growth rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Taiwan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Murata Manufacturing Co., Ltd.; Azotek Co., Ltd.; Panasonic Corp.; Furukawa Electric Co., Ltd.; Rogers Corp.; Kuraray Co., Ltd.; Chiyoda Integre Co.; Ltd.; KGK Chemical Corp.; iQLP

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

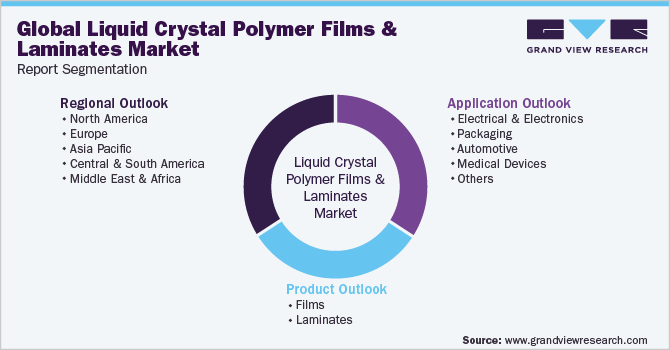

Global Liquid Crystal Polymer Films And Laminates Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global liquid crystal polymer films & laminates market report on the basis of product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Films

-

Laminates

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Electrical & Electronics

-

Packaging

-

Automotive

-

Medical Devices

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global liquid crystal polymer films and laminates market size was estimated at USD 147.2 million in 2022 and is expected to reach USD 157.0 million in 2023.

b. The global liquid crystal polymer films and laminates market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 254.2 million by 2030.

b. Electrical & electronics segment dominated the lliquid crystal polymer films and laminates market with a share of 63.20% in 2022. Films are preferred in this application on account of the polymer’s ion-free polycondensation production process.

b. Some key players operating in the liquid crystal polymer films and laminates market include Solvay, Inc.; Kuraray; PolyOne Corporation; Celanese Corporation; Sumitomo Chemicals; Toray International; Rogers Corporation; and other independent regional companies, such as RTP Company, Shanghai PRET Composites, Samsung Fine Chemicals, and PolyPlastics Co. Ltd.

b. Key factors that are driving the liquid crystal polymer films and laminates market growth include technological innovations that have laid the foundation for high-performance, durable films & laminates with eco-friendly properties, low maintenance costs, and enhanced performance characteristics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."