- Home

- »

- Homecare & Decor

- »

-

Living & Dining Room Market Size & Share Report, 2028GVR Report cover

![Living & Dining Room Market Size, Share & Trends Report]()

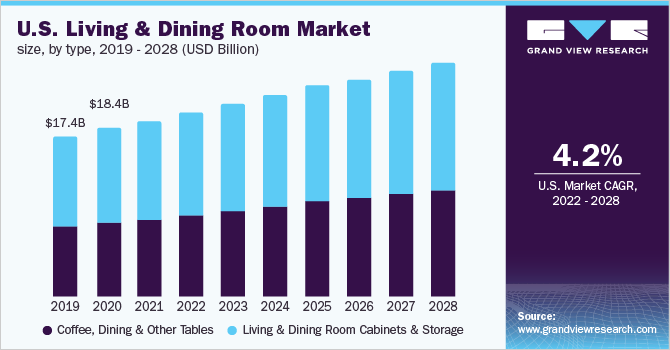

Living & Dining Room Market Size, Share & Trends Analysis Report By Type (Coffee, Dining & Other Tables, Living & Dining Room Cabinets And Storage), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-927-2

- Number of Pages: 78

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The global living & dining room market size was valued at USD 149.8 billion in 2021 and is expected to expand at a CAGR of 4.5% from 2022 to 2028. This can be credited to the growing demand for coffee table products in developed economies such as the U.S. and Germany. The growing demand for Airia desk & media cabinets in India is escalating the sales of living & dining room cabinets products. Moreover, the rising popularity of Nelson miniature chest products especially in the U.S. is further projected to boost market growth over the forecast period. In 2020, the COVID-19 outbreak acted as a significant restriction on the living and dining room manufacturing business, as supply chains were disrupted by trade restrictions and demand fell as a result of government-imposed lockdowns throughout the world. However, as various economies gradually lift their separate trade restrictions, a steady recovery trend is projected in the next years, with the living and dining room business seeing a significant increase in revenues.

Coronavirus has been staggering the global economy. The supply chain of the furniture industry had been slightly affected during the pandemic tenure. The business growth of offline distribution channels was hindered owing to the national lockdown executed across the globe. During the pandemic, the demand for living & dining room cabinets and storage had increased through the online platform. The major key players of the global market are evaluating the online sales methodology for door-step delivery.

Growing investments by the U.S.-based prime players such as HNI Corporation and Kimball International, Inc. to procure miniature chests and Nelson basic cabinet series are fueling the market growth. The major key players are procuring the premium quality of prelam storage products. The rapidly growing demand for metal storage products from the U.K. consumers is further propelling the industry growth.

The growing acceptance of wall units in Japan is the major factor driving the market growth. Moreover, the rising demand for TV trolleys in developing economies such as China and India is expected to boost market growth. Rising demand to procure occasional furniture products at a rational cost is the upcoming prospect for the market. At present, key players are focusing on launching sled base storage to fulfill the demand for cabinets and storage. Hence, the living & dining room market is expected to perform significant market growth during the assessment period.

The offline furniture shops have started showcasing their product lines on e-commerce portals and online websites in order to attract new customers during the spread of the coronavirus. The sales statistics are covered due to the growing demand for storage cabinets through electronic commerce. Fast delivery with minimal installation cost was escalating the business opportunity for the furniture products which in turn will refuel the market growth.

The growing demand for smart furniture is expected to considerably contribute to the market growth. Low financing rates and the growth of internet retailers in emerging nations might boost worldwide market share. The global market is extremely adaptable to shifting trends, and new entrants are becoming more competitive. Consumers are highly inclined towards foldable, multi-purpose, and technology-driven furniture that fits in smaller areas and sever different purposes.

Type Insights

The living & dining room cabinets and storage segment contributed to the highest share of over 55% in the global market revenue in 2021. The segment offers an adjustable flowery wenge finish-based kitchen cabinet. The growing adoption of embossed sideboards is escalating the market growth. The rising demand for camber mini sideboards in the U.S. will enhance the sales of the dining room cabinets and storage segment during the forecast period. Additionally, the availability of several living and dining room products on online portals and e-commerce websites is expected to create numerous opportunities for key market players to expand their product portfolios and generate new revenue streams.

The coffee, dining & other tables segment will register the highest growth over the forecast period. The segment is expected to grow at a CAGR of 5.2% over the forecast period. This can be credited to the growing demand for coffee tables, study tables, laptop tables, and computer tables in Europe. IKEA Systems B.V. is the rising brand in Europe to fulfill the demand for customizable side table products. AFC Systems will raise the sales of Occasional tables in the Asia Pacific during the forecast period. Furthermore, the increased demand for ready-to-assemble, eco-friendly, and designer furniture, as well as luxury furniture, will positively contribute to the growth of the segment.

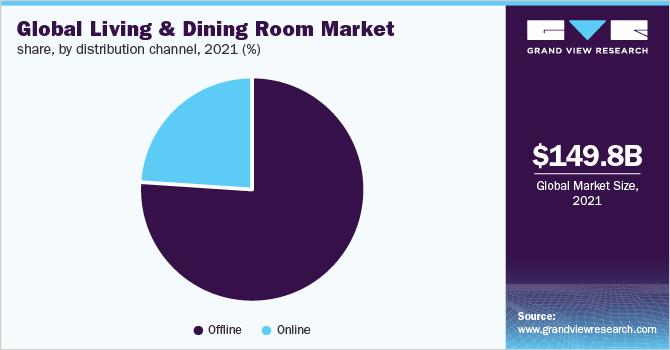

Distribution Channel Insights

Offline segment contributed a share of more than 75% of the global market revenue in 2021. The necessity of household furniture will evaluate the scope of the living & dining room furniture business. The growing drift of the consumers to give a preference for jett sideboard is projected to boost the market growth. Moreover, the segmental growth is attributed to the ease of availability of walnut finish-based kitchen cabinet products in the furniture shops.

The furniture shops are providing the customized design of sideboards with multiple drawer products at an affordable cost which will turn to refuel the segmental growth. Supportive measures taken by the government of China to reopen the furniture shops will expect to propel the market growth.

Online segment is projected to register the fastest growth during the forecast timeline. This growth is owing to the acceleration of the e-commerce industry across the world. Fast go-to-market time, customer data insights, and content marketing strategy are the prime features of the online sales channel. The increased focus of furniture suppliers to adopt e-commerce portals is attributed to boosting the market. The rise in consumer inclination towards online shopping channels and the growth of the global e-commerce industry is expected to contribute to the growth of the market.

Regional Insights

Asia Pacific made the largest contribution in the market of around 50% share in 2021 owing to the comprehensive product portfolio provided by the KOKUYO Co., Ltd., Okamura Corporation, and AFC Systems. The increasing demand for Okamura Corporation-based height-adjustable tables in Japan is expected to propel market growth. Asia Pacific is projected to witness a CAGR of 5.1% from 2022 to 2028. The rising trend to adopt Gunlocke tables will help to boost the market growth. The market share of India is driven by the growing use of Godrej & Boyce Manufacturing Company Limited-based dining and coffee tables. Furthermore, private Japanese enterprises are expected to give funds to offer value-added TV and media furnishings, which is expected to support market growth.

North America is projected to witness significant market growth during the forecast period. This can be attributed to the increasing use of cabin tables, training tables, and cafe tables. The emerging trend in the U.S. to adopt the Canvas office landscape storage system is propelling market growth. The growing adoption of Berco Design-based Excalibur, Palisade, and Starfire table products is estimated to showcase a significant growth rate over the forecast period. The U.S. witnessed an increase in construction activity in recent years. As a result, house furniture sales have increased. The availability of many customizable furniture alternatives is driving house furniture sales even further. Furthermore, the need for flexible and compact furniture has risen as a result of studio and penthouse residences.

Key Companies & Market Share Insights

Companies' main focus is to launch the compactors such as com-5, com-6, and com-7 to provide storage requirements. The prime key players are focusing to launch wooden prelam storage products. However, implementing powder coating methodologies will improve the sales statistics of the global market. Multiple companies are targeting the expansion and launches of value-added premium coffee table products in the market. Some of the prominent players in the global living & dining room market include:

-

KOKUYO Co., Ltd.

-

Okamura Corporation

-

Godrej & Boyce Manufacturing Company Limited

-

Inter IKEA Systems B.V.

-

HNI Corporation

-

Kimball International, Inc.

-

Herman Miller, Inc.

-

AFC Systems

-

Ashley Furniture Industries, Inc.

-

Berco Design

Living & Dining Room Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 157.5 billion

Revenue forecast in 2028

USD 203.9 billion

Growth Rate

CAGR of 4.5% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K; Germany; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

KOKUYO Co., Ltd.; Okamura Corporation; Godrej & Boyce Manufacturing Company Limited; Inter IKEA Systems B.V.; HNI Corporation, Kimball International, Inc.; Herman Miller, Inc.; AFC Systems; Ashley Furniture Industries, Inc.; Berco Design

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the living & dining room market based on type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Coffee, dining & other tables

-

Living & dining room cabinets and storage

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia-Pacific

-

-

Central & South America

-

Brazil

-

Argentina

-

Rest of Central & South America

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global living & dining room market size was estimated at USD 149.8 billion in 2021 and is expected to reach USD 157.5 billion in 2022.

b. The global living & dining room market is expected to grow at a compound annual growth rate of 4.5% from 2022 to 2028 to reach USD 203.9 billion by 2028.

b. The Asia Pacific dominated the living & dining room market with a share of 48.7% in 2021. This is attributable comprehensive product portfolio provided offered by key market players in the region and the easy availability of high-end dining and living room furniture.

b. Some key players operating in the living & dining room market include KOKUYO Co., Ltd.; Okamura Corporation; Godrej & Boyce Manufacturing Company Limited; Inter IKEA Systems B.V.; HNI Corporation; Kimball International, Inc.; Herman Miller, Inc.; AFC Systems; Ashley Furniture Industries, Inc.; and Berco Design.

b. Key factors that are driving the living & dining room market growth include growing demand for coffee table products in the developed economies, escalating the sales of living & dining room cabinets products, and consumer inclination towards easy to assemble and manage furniture products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."