- Home

- »

- HVAC & Construction

- »

-

Loader Market Size & Share, Industry Report, 2020-2027GVR Report cover

![Loader Market Size, Share & Trends Report]()

Loader Market Size, Share & Trends Analysis Report By Product Type (Backhoe, Skid Steer, Crawler, Wheeled), By Engine Type (Up To 250 HP, 250 - 500 HP, More Than 500 HP), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-678-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Technology

Report Overview

The global loader market size was valued at USD 16.80 billion in 2019 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.4% from 2020 to 2027. Growing infrastructural developments and large number of construction projects in the developing and emerging countries are contributing to the market growth. The infrastructure developments in such regions are likely to proliferate the demand for construction equipment, such as loaders, which are widely used for moving materials and lifting heavy loads at construction sites. The loaders are used for different kinds of activities including waste handling, material handling, and demolition of buildings and infrastructure. Increasing number of redevelopment projects has increased the prospects for waste handling and the demolition segment, which is expected to boost the demand for loaders.

Growing public-private partnerships to implement infrastructure works, increasing residential, commercial, and industrial construction activities, and global economic growth from 2021 onwards are expected to drive the market in future. The loader manufacturers are integrating advanced technology into the equipment machinery. A South Korean manufacturer Doosan is offering an auto shut-down feature that has been implemented to reduce the idle time of the engine, which would prevent the wasted operating time and over-consumption of fuel. The company has also provided loaders with maintenance-free air pre-filter that automatically separates more than 99% of particles that are 20 microns and larger and removes debris extending the air filter life. The manufacturers are focusing on improving the cabin comfort for the operator to drive the sales activity in regions, such as Europe and North America, as operators are the key participants when it comes to the purchasing decision.

Growing trend of electrification of vehicles can be observed as a key strategy. Companies are focusing on the development of electric construction equipment, such as loaders. For instance, in Beijing International Construction Machinery Exhibition & Seminar (BICES) 2019, a heavy construction equipment manufacturer LiuGong, revealed its purely electric loader, the model 856H-EV. The company also showcased an electric intelligent 5G remotely controlled wheeled loader, the model 856H. The model 856H was supported and co-developed by Huawei technology and China Telecom.

The world economy has been taken aback by the rate at which the COVID 19 crisis has escalated. The pandemic has impacted the public health, economy, and the social well-being of people around the world. The construction equipment industry also got impacted by the economic standstill caused owing to the lockdown directives provided by the government authorities in many countries. According to the Committee for European Construction Equipment (CECE) survey, a considerable number of construction equipment manufacturing facilities had been shut down in Europe, which is the worst hit region by the recent global pandemic. As per the CECE, the region is also facing customer related issues such as the shutdown of construction sites and cancellation of infrastructure projects. These effects would cause the sales of construction equipment to decline by 10% to 30%.

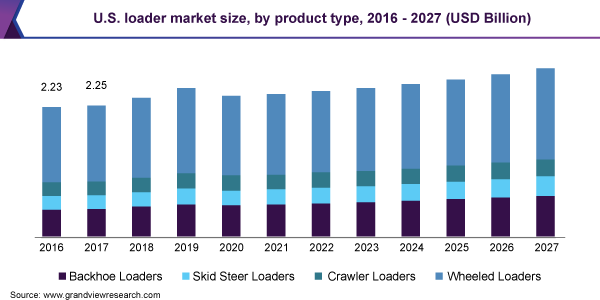

Product Type Insights

The market has been segmented based on the product type into backhoe, skid steer, crawler, and wheeled loaders. The wheeled loader segment led the market in 2019 with over 57.0% share of the overall revenue. The wheeled loader has the capability to travel on-road as well as off-road. These types of equipment are more flexible and more comfortable to handle on construction sites owing to their easy maneuvering capability. The wheeled loader is integrated with advanced hydraulics that provide better stability and control even under more significant weight holding operations.

The backhoe loader is anticipated to expand at the highest CAGR of 4.6% over the forecast period. The backhoe loader can perform multiple tasks such as digging, transporting building materials, small demolitions material excavation, powering building equipment, landscaping, and paving roads. This type of equipment is suitable for performing operations on medium and large-scale construction sites as a variety of attachments can be used with a backhoe loader. The multi-functional capabilities of the backhoe loader, coupled with the integration of eco-friendly technologies by the manufacturers, are anticipated to drive the segment in the near future.

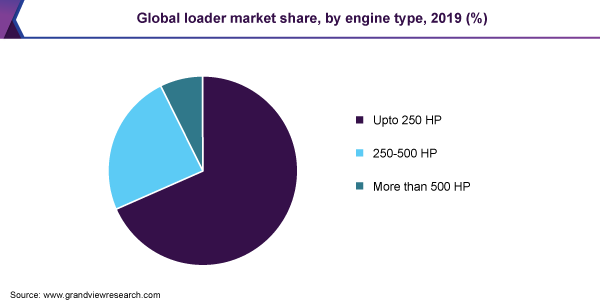

Engine Type Insights

The market has been segmented based on the engine type, including up to 250 HP engines, 250-500 HP engines, and more than 500 HP engines. The up to 250 HP engine type loader dominated the market in 2019 with a share of more than 68.0%. The up to 250 HP engine type loaders constitute efficient and compact loaders. These types of loaders are used for small scale applications, such as agricultural operations, landscaping, and ground maintenance work. Demand for low capacity engine loaders has significantly increased over the past few years in order to enhance productivity at lower operating expenses.

The 250-500 HP engine type segment is anticipated to register the highest CAGR of 4.1% over the forecast period. The 25-500 HP engine type loaders provide higher torque as compared to low engine capacity loaders. The higher torque produced by the loaders is suitable for tasks such as small building demolition, breaking and removing concrete, material handling, earthmoving, digging in hard soils. These types of loaders provide higher hydraulic output and are appropriate for applications in agricultural settings and construction site prep jobs.

Regional Insights

Asia Pacific dominated the market with a share of over 47.0% in 2019 and is anticipated to witness the fastest growth over the forecast period. The growth can be attributed to rising infrastructural developments and construction activities in emerging countries, such as India and China. Infrastructural investments made by the governments of these countries are driving the demand for construction equipment, such as loaders. For instance, in China, amid the global COVID-19 pandemic outbreak, the Chinese government headed by Chinese President Xi Jinping ordered to construct a hospital in a mere ten days. These steps were taken to treat and quarantine the patients affected by the novel COVID-19 pandemic. The Huoshenshan hospital was built by digging up a 269,000-square-foot plot of land and would encompass around 1000 beds. Furthermore, Asia Pacific is characterized by the presence of prominent players, such as Hyundai Heavy Industries Co. Ltd., Komatsu Ltd., and Kubota Corporation.

North America is a prominent region and it plays a crucial role in the market. The growth of the region can be attributed to increasing demand for steer skid loaders in the region. Moreover, the region has a steady demand for backhoe loaders, whose sale has declined significantly in other areas, such as Europe. Europe is witnessing sluggish growth in the market as the region is the worst hit from the novel COVID-19 pandemic. As per the Committee for European Construction Equipment CECE survey, the region would witness a decline in sales of construction equipment, including all types of loaders, and is optimistic about the market recovery post the COVID crisis.

Key Companies & Market Share Insights

The market is highly competitive and relatively concentrated with the prominent companies accounting for a maximum share of the global revenue. Market players are competing based on key parameters, including improved design, technological innovation, and fuel-efficient products. The companies are also engaged in mergers and acquisitions as an attempt to diversify product portfolio and gain a foothold in the market. For instance, Case Construction Equipment announced the launch of Project Zeus 580 EV. It is a construction industry’s first fully electric backhoe loader and was unveiled at the ConExpo in Las Vegas, the U.S. Furthermore, Yanmar Holdings Co., Ltd. announced the acquisition of ASV Holdings Inc., which is a manufacturer of compact tracked loader and skid-steer loader. Some of the prominent players operating in the global loader market are:

-

Caterpillar

-

Komatsu

-

Volvo Construction Equipment

-

Hitachi Construction Equipment

-

Sany Group

-

Liebherr

-

Deere & Company

Loader Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 16.04 billion

Revenue forecast in 2027

USD 20.24 billion

Growth Rate

CAGR of 3.4% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, engine type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

Caterpillar; Komatsu; Volvo Construction Equipment; Hitachi Construction Equipment; Sany Group; Liebherr; Deere & Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global loader market report on the basis of product type, engine type, and region:

-

Product Type Outlook (Revenue, USD Billion, 2016 - 2027)

-

Backhoe

-

Skid Steer

-

Crawler

-

Wheeled

-

-

Engine Type Outlook (Revenue, USD Billion, 2016 - 2027)

-

Upto 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global loader market size was estimated at USD 16.8 billion in 2019 and is expected to reach USD 16.0 billion in 2020.

b. The global loader market is expected to grow at a compound annual growth rate of 3.4% from 2020 to 2027 to reach USD 20.2 billion by 2027.

b. Asia Pacific dominated the loader market with a share of 47.5% in 2019. This is attributable to rising government funding for the development of advanced public infrastructure in the region.

b. Some key players operating in the loader market include Caterpillar Inc.; Komatsu Ltd.; Hitachi Construction Machinery Co., Ltd.; Liebherr; and AB Volvo.

b. Key factors that are driving the market growth include growing popularity towards robust and compact equipment and rising government investments on infrastructure development.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."