- Home

- »

- Clothing, Footwear & Accessories

- »

-

Loafers Market Share & Trends, Industry Report, 2019-2025GVR Report cover

![Loafers Market Size, Share & Trends Report]()

Loafers Market Size, Share & Trends Analysis Report By Product (Leather, Fabric), By Distribution Channel (Specialty Stores, Online), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-519-9

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Report Overview

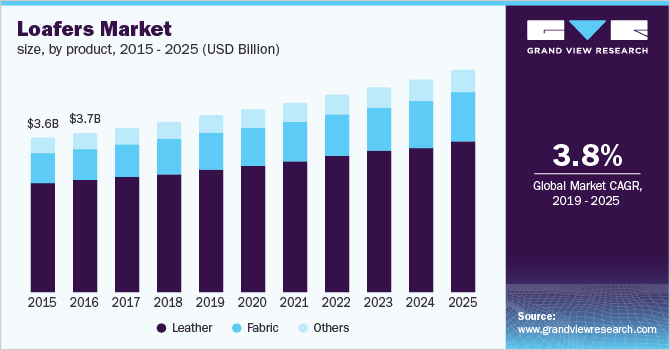

The global loafers market size to be valued at USD 31.4 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 3.8% during the forecast period. Rising requirements of stylish and comfortable footwear among the middle-aged working population is promoting the utility of loafers. Loafers are considered to be convenient and comfortable footwear among different age-groups with features including not overly fitted in the heel and easier to get on and off. Millennial population and Generation X prefer to purchase trendy, comfortable, and fancy shoes. Leather shoes are extensively taken into consideration as a premium product and it occupies a good-sized proportion in the market.

It has been observed that men are the major customers of loafers. They wear this product as an alternative to formal shoes, along with a stylish component. The companies are investing in branding and promotional activities to increase their customer reach. They are investing in fashion shows and uploading product videos on a social media page to attract more consumers.

Over the past few years, a growing working-class population, coupled with increasing spending on personal attire including footwear products in the developing economies including China and India, is expected to promote the market size. The companies including Woodland and Hush Puppies are expanding their product portfolio, which is attracting the consumers to spend more on the footwear segment. Some of the popular loafers’ types available in the market are tassel, footbed slip, black calf, suede leather, velvet slippers, no lace casual, and folded leather.

An increasing number of fashion style videos on social media platforms and satellite television by fashion experts is expected to promote awareness among the buyers. As a result, the buyers are expected to increase spending on the inclusion of premium products including canvas loafers and penny loafers as a part of their fashion style.

Loafers Market Trends

Loafers are convenient footwear and are made from a wide variety of materials. They are available in a range of colors, with and without design elements. They also do not involve lacing or tying, and that's a huge benefit for the elderly population who lack the agility to tie their shoelaces. These factors have increased the demand for loafers and are expected to drive market growth during the forecast period.

The growing demand for comfortable and stylish footwear is another factor driving the market forward. In addition, rising living standards of consumers and enhancement in online shopping platforms owing to increased internet penetration in various areas are driving the global demand for loafers.

Lockdowns imposed amid the COVID-19 pandemic across the globe, resulted a slump in demand for loafers. Many brands had to halt their manufacturing operations, causing loafer production to be delayed. These factors have hampered the expansion of the market.

Product Insights

Leather loafers generated a revenue of USD 16.1 billion in 2018. A large number of consumers prefer to purchase these products due to their long shelf life. Besides this, leather loafers come with features including breathable, water resistance, better fit, and easy to clean characteristics. These leather loafers are considered to be luxury goods as the raw material is sleek and shiny. Furthermore, the companies are shifting their raw material preference from natural leather to synthetic leather materials including leatherette, faux leather, vegan leather, PU leather, and leather.

An increasing number of consumer awareness initiatives by animal rights organizations including PETA is driving the footwear manufacturers to use synthetic leather as a raw material for the production of various footwear products. However, synthetic leather loafers are also economical and effective for the rainy session, which is expected to promote the product’s utility in the upcoming years.

The fabric loafers are expected to expand at the fastest CAGR of 4.5% from 2019 to 2025. These products are made from hemp or cotton, which makes the footwear breathable enough to offer extra-comfort to the consumers at different temperatures. A large number of consumers purchase these fabric loafers due to their lightweight features. Furthermore, these products are hypoallergenic, which attracts consumers with sensitive skin to purchase fabric made loafers. The availability of varieties of color and design of fabric loafer is driving consumers to purchase fabric loafers.

Distribution Channel Insights

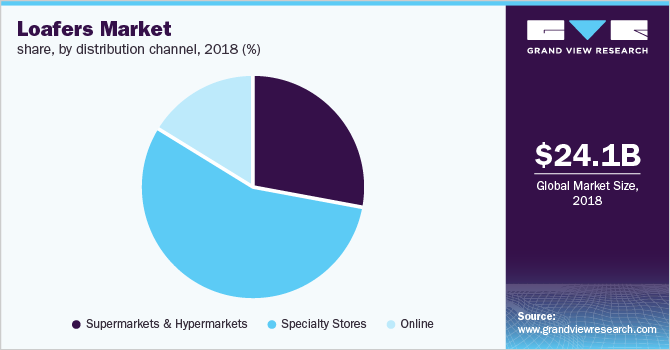

Specialty stores generated a revenue of USD 13.5 billion in 2018. Due to the availability of different types of products under a single window, it becomes convenient for the consumers to select their preferred product. Furthermore, some footwear needs repair with special tools and training. These channels deploy trained professionals who provide better repairing tools to consumers.

Online channels are expected to foresee the fastest growth in the coming years on account of easy product selection and doorstep product delivery services. Ease of product selection and availability of customer reviews are expected to increase the penetration of this segment in developed economies including the U.S., Germany, the U.K., and France. Furthermore, growing smartphone adoption at the global level is expected to propel the sales from online channels soon.

Regional Insights

Asia Pacific held the largest share in 2018 and is expected to be the fastest-growing region at a CAGR of 4.6% from 2019 to 2025. Rising spending power among middle-class population groups, who are investing in comfortable and stylish apparel and footwear products, in countries including China, India, Bangladesh, and South Korea is expected to remain a favorable factor for the industry growth. China is the largest footwear manufacturer and it exports its products in countries including the U.S., Canada, U.K., and Germany. Furthermore, growing penetration of e-commerce companies including Flipkart, Alibaba, and Amazon in developing economies including China and India is expected to remain a favorable factor for the industry growth over the next few years.

Europe was the second-largest market, accounting for exceeding a 25.0% share of the global revenue in 2018. The increasing importance of stylish footwear among the consumers of developed economies including Germany and the U.K. is a major trend observed in this region. Furthermore, increasing awareness regarding personal grooming among the consumers of Europe is driving consumers to spend on apparel and footwear, which is generating the demand for convenient footwear, including loafers. Furthermore, consumer shift towards premium products in countries including Germany, France, Italy, and the U.K. will continue to generate the demand for loafers in the upcoming years.

Key Companies & Market Share Insights

Key industry participants include The Rockport Group, Wolf and Shepherd, Clark International, Lee Cooper, Hush Puppies, PUMA, WOODLAND, Relaxo Footwears Limited, BACCA BUCCI FASHIONS PVT. LTD., and Allen Edmonds Corporation. Companies are taking up strategies such as mergers and acquisitions to increase their market share.

For instance, in December 2018, Landan based company “Farfetch” completed the acquisition of New York-based startup “Stadium Goods” in USD 250 million. Additionally, new product launches in terms of canvas loafers in developing economies including China and India, targeting the growing millennial population, is expected to open new avenues over the next few years.

Loafers Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 25.86 billion

Revenue forecast in 2025

USD 31.37 billion

Growth Rate

CAGR of 3.8% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; China; India; Brazil; South Africa

Key companies profiled

The Rockport Group; Wolf and Shepherd; Clark International; Lee Cooper; Hush Puppies; PUMA; WOODLAND; Relaxo Footwears Limited; BACCA BUCCI FASHIONS PVT. LTD.; Allen Edmonds Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Loafers Market SegmentationThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Grand View Research has segmented the global loafers market report based on the product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2015 - 2025)

-

Leather

-

Fabric

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2015 - 2025)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global loafers market size was estimated at USD 24.96 billion in 2019 and is expected to reach USD 25.86 billion in 2020.

b. The global loafers market is expected to grow at a compound annual growth rate of 3.8% from 2019 to 2025 to reach USD 31.37 billion by 2025.

b. North America dominated the loafers market with a share of 37.6% in 2019. This is attributable to the rising demand for premium products among consumers, most notably in the U.S. and Canada.

b. Some key players operating in the loafers market include The Rockport Group, Wolf and Shepherd, Clark International, Lee Cooper, Hush Puppies, PUMA, WOODLAND, Relaxo Footwears Limited, BACCA BUCCI FASHIONS PVT. LTD., and Allen Edmonds Corporation.

b. Key factors that are driving the loafers market growth include rapidly evolving fashion trends and the increasing demand for vegan footwear worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."