- Home

- »

- Distribution & Utilities

- »

-

LPG Vaporizer Market Size, Share & Trends, Global Report 2025GVR Report cover

![LPG Vaporizer Market Size, Share & Trends Report]()

LPG Vaporizer Market Size, Share & Trends Analysis Report By Product (Direct-Fired, Electric, Steam Bath), By Capacity, By End Use, By Region (North America, Europe, Africa), and Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-778-0

- Number of Pages: 63

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Energy & Power

Report Overview

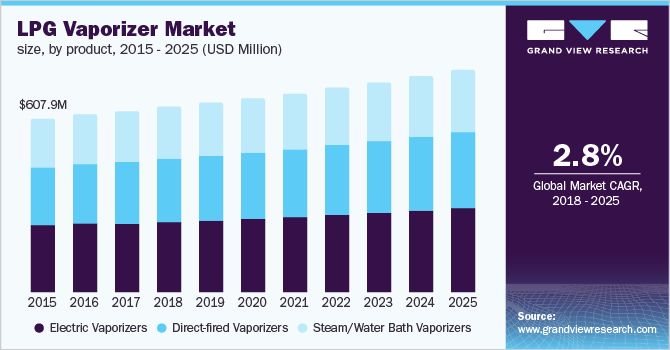

The global LPG vaporizer market size to be valued at USD 1.37 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 2.8% during the forecast period. Increasing the use of Liquefied Petroleum Gas (LPG) requiring high-pressure vaporization of the gas is the major driving force for the Liquified Petroleum Gas vaporizer market. The increasing gas developments have created investment opportunities in many segments of the LPG industry including equipment market, gas distribution, storage, terminal, and marketing. Growth prospect for the vaporizer industry in North America, Europe, and Africa continues to appear promising until the market in developing countries continues to expand. Also, an increasing number of customers are introduced to the gas with the improved infrastructure to distribute the product effectively.

This is a technology-driven market and the development of cutting-edge technologies has resulted in significant product penetration across various segments. Increasing vaporization requirements in industrial and commercial sectors have majorly driven the demand for LPG vaporizers.

The market has majorly witnessed significant growth across applications that require high-pressure vaporization of LPG. These applications have higher growth prospects in locations with unfavorable weather conditions, which lead to freeze-ups or frost on gas vessels and reduce efficiency through natural vaporization. Natural vaporization also fails in industrial applications, which require high-pressure LPG phase change. Thus, these are the two most prominent sectors for growth.

There are many uncertainties such as changes in regulatory policies, shifting trade patterns, the impact of price shifts on-demand growth, fluctuations in vaporizer export availability, and the development of new and related markets of LPG, which are anticipated to influence the future of liquefied petroleum gas vaporizer market. With increasing pollution and carbon emission levels in tandem with severe environmental implications, the utilization of LPG for several end-use sectors has witnessed a drift towards the growing usage of natural gas.

LPG Vaporizer Market Trends

One of the primary factors driving the market is government regulations regarding the use of alternative fuel sources to reduce emissions. LPG provides a cost-effective service in the industry and vaporizer consumption is expected to grow faster in industrialized and developing countries such as Malaysia, Turkey, Thailand and several underdeveloped countries. As a result, the market is likely to be driven by a significant increase in the use of LPG in various industries.

LPG vaporizers enable full utilization of LPG even at low pressure in cylinders and provide LPG at a steady flow rate in extremely cold climates making it useful in several industries. Furthermore, the rising utilization of LPG in power generation, commercial, and residential sectors is anticipated to boost the market growth during the forecast period.

Crude oil price volatility and fluctuation in government policies regarding the industrial use of LPG are estimated to be key attributes restricting the market. In addition, the changing availability of export units and fluctuation of the price of imports and export of certain goods obstruct the market expansion.

Product Insights

Direct-fired LPG vaporizer is the fastest growing product segment on account of several advantages associated with the product. The most significant advantage includes the utilization of liquefied gas as the source of energy. Globally, various consumers have prioritized direct-fired vaporizers over others as it results in 100% of the fuel with lower operating costs and higher fuel conversion. Also, it is easy to transport, produces a high amount of heat even in smaller units, has lower rental and maintenance costs, and is safer for unsupervised use.

Electric vaporizers are the most consumed product in North America. These are indirect-fired vaporizers and make use of an external heating element. The electric LPG vaporizers deliver approximately 80% efficiency and can operate in tightly sealed places as well. The product category also accounts for a significant market share. The product is used in a broad range of applications. The indirect-fired category also includes steam/hot water LPG vaporizers. These make use of hot water from the radiator inside a different chamber within the vaporizer.

Capacity Insights

LPG vaporizers are manufactured in different capacities depending on the end-use and rate of vaporization required. For instance, large-scale industrial applications, such as peak shaving utility plants require high-pressure LPG phase change and thus require higher capacity vaporizers. Different ranges of LPG vaporizer capacities include 40-160 gal/hr, 168-455 gal/hr, 555-1005 gal/hr, and >1000 gal/hr.

The 168-455 gal/hr, category was the most installed capacity range, especially in countries, such as the U.S. These vaporizers are used in both commercial and industrial sectors and thus account for the largest market share.

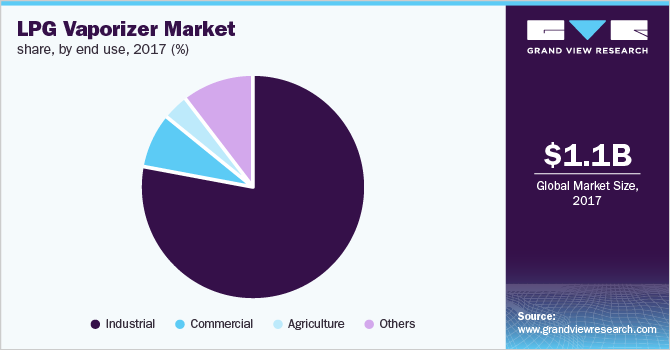

End-use Insights

LPG vaporizers can be installed in several industries based on vapor pressure requirements. Large and medium scale industrial applications, such as the utilization of liquefied petroleum gas in power generation, peak shaving utility plants, and commercial applications, such as resorts and hotels are the significant application prospects driving the market growth. Large-scale industrial applications require a higher vaporization rate of the liquefied gas and thus primarily make use of high-capacity vaporizers.

The industrial sector is the largest and fastest-growing end-use segment in North America as propane consumption accounted for approximately 78% of this sector in 2017. Some other significant application categories include the agricultural and residential sectors. In agricultural and residential sectors, LPG vaporizers are used for crop drying and heating purposes respectively.

Regional Insights

North America and Europe are two significant markets for LPG vaporizers. These regional markets are majorly driven by the growth of liquefied petroleum gas and related equipment utilization in several industries. Major applications for the North America LPG vaporizer market include industrial, commercial, and residential applications. Also, the region constitutes most of the manufacturing companies which have a global widespread distribution network.

The U.S. emerged as the major contributing country in 2017 and accounted for over 76% of the total market share in North America. In Europe, Italy and the U.K. have significantly contributed to the regional penetration. The Europe Liquified Petroleum Gas vaporizer market is majorly driven by commercial applications including LPG used in hotels, resorts, and restaurants. Europe constitutes more number of distributors as compared to domestic manufacturers.

Key Companies & Market Share Insights

Key industry players compete on different competitive factors including cutting-edge manufacturing technologies, new product development, technological advancements, and abiding by manufacturing & safety codes/policies.

Major manufacturers include Algas-SDI; Standby Systems, Inc.; Ransome Gas Industries, Inc.; and Pegoraro Gas Technologies Srl. There is a high degree of integration by companies such as Algas-SDI and Ransome Gas Industries, Inc. across the manufacturing and distribution channels of the industry value chain. The other companies are working toward strengthening their distribution network within the region as well as outside their regional presence.

Recent Developments

-

In March 2021, SHV Energy acquired United Propane and Collins Propane's assets and customers. With this acquisition, the company further strengthened its position and added 15,000 new consumers to its portfolio. This resulted in the expansion of SHV Energy and constituted to lead and flourish in the Texan market

-

Algas-SDI, a leading provider of LP-Gas Vaporization, collaborated with Product Creation Studio to create a new brand for their Electric LPG Vaporizers that embodies their concept of dependability, safety, and efficiency based on more than80 years of industry expertise

LPG Vaporizer Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 1.37 billion

Growth rate

CAGR 2.8% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD billion/million and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, capacity, end-use, region

Regional scope

North America, Europe & Africa

Country scope

U.S., Canada, Germany, U.K., Italy

Key companies profiled

Algas-SDI; Standby Systems, Inc.; Ransome Gas Industries, Inc.; Pegoraro Gas Technologies Srl.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LPG Vaporizer Market Segmentation

This report forecasts volume and revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the North America, Europe, and Africa LPG vaporizer market based on product, capacity, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Direct-fired

-

Electric

-

Steam/Water Bath

-

-

Capacity Outlook (Revenue, USD Million, 2014 - 2025)

-

40-160 gal/hr

-

168-455 gal/hr

-

555-1005 gal/hr

-

>1000 gal/hr

-

-

End-use Outlook (Revenue, USD Million, 2014 - 2025)

-

Industrial

-

Commercial

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

-

Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."