- Home

- »

- Digital Media

- »

-

Magazine Advertising Market Size Report, 2022 - 2028GVR Report cover

![Magazine Advertising Market Size, Share & Trends Report]()

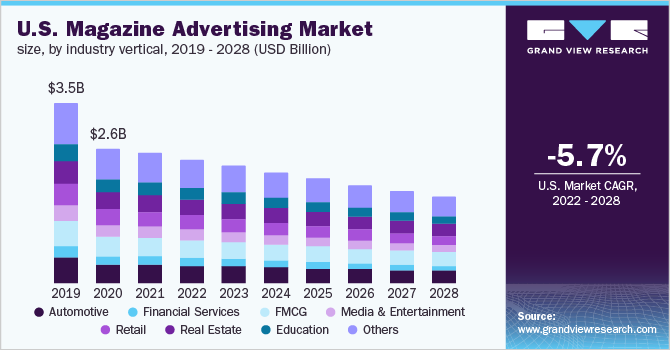

Magazine Advertising Market Size, Share & Trends Analysis Report By Industry Vertical (Automotive, Financial Services, FMCG, Media & Entertainment, Retail, Real Estate, Education), By Region, And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-929-8

- Number of Pages: 74

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

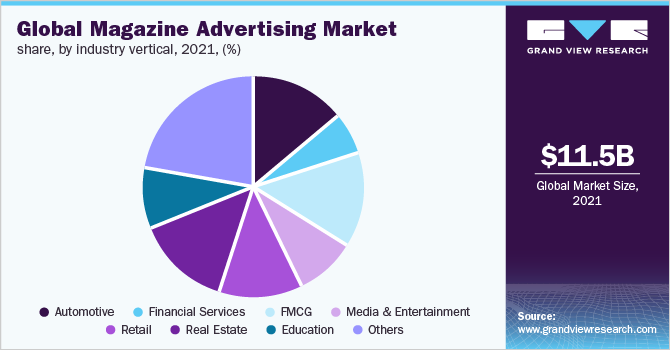

The global magazine advertising market size was valued at USD 11.50 billion in 2021 and is expected to expand at -4.5% from 2022 to 2028. Magazines have been regularly losing clients for years. However, growing subscriptions to digital magazines are hampering market development over the forecast period. Moreover, rising customers' inclination toward economical or more affordable alternatives such as online publications over the last couple of years is impeding the market growth. Furthermore, magazine circulation drops in recent years all over the globe is the vital factor that restrains the growth of the market. The rising investment in print advertising by industry verticals such as Automobile, FMCG, and many others to create trust as well as nurture relations with existing customers is driving the market growth.

Magazine advertising is the advertisements that the public see placed all over publications. The benefits of magazine advertising are their selectivity, exceptional reproduction superiority, creative flexibility, reputation, high participation of readers as well as services they provide to advertisers. The main benefit of magazines as a medium is the selectivity or their capability to reach a particular target audience. Magazine advertising has problems such as high prices of advertising, their restricted reach, and frequency, lengthy lead time for placing the advertisements, and the problem of growing heavy advertising rivalry and clutter.

Magazine advertising is one of the best powerful marketing mediums available, and an advertisement placed in a magazine can progress sales massively. As per Magazine Advertising price trends, large anti-dumping duties enforced by the governments in nations such as China, Germany, the US, France, and India will increase the price of exported magazine advertising. The continuous rise in crude oil cost will increase the cost of raw materials such as optical fiber, steel, PE, PVC, and aluminum. This will drive magazine advertising suppliers' production costs.

Magazine advertising is getting popularity in the advertising world as it generates brand awareness as well as praises the brand’s advertising operations on other platforms, which is estimated to drive the growth of the magazine advertising market. Though, the increasing penetration rate of smartphones along with affordable internet is quickening an online media platform which in turn has restrictions to the market growth. Moreover, stringent government regulations about magazine advertising will remain to hamper the market growth.

The fast growth in digitalization of media, and the public has moved from print to electronic channels is hampering the growth of the market. Additionally, large competition amongst the sellers of the print advertising industry is limiting the market growth. Moreover, the growing demand for creative as well as interactive print advertising is likely to drive the growth of the market. Advertisers mainly use magazine advertising platforms to reach a precisely targeted audience accelerating the growth of the magazine advertising market.

Magazines are mainly considered the most specific of all the ads media. The industry has often been termed as “survival of the discriminating.” The number of magazines has augmented constantly to serve the educational, entertainment, informational, and other particular requirements of customers, business as well as industry. Accessibility to an extensive range of magazines makes them relatively an attractive medium to a great number of advertisers. Moreover, magazine advertising is equally famous amongst large and small businesses. Their high-interest readers are generally willing to pay a premium for the magazines.

The COVID-19 pandemic has adversely affected the magazine advertising industry. As, governments all over the world imposed several limitations to try to contain the coronavirus, such as quarantines, travel bans, restrictions, shutdowns, and work-from-home orders. Furthermore, the pandemic and following slow economy affected some core magazine advertisers like promoting public events, retail, and movies. These groups cut back on their marketing funds, accelerating drops in advertising.

Industry Vertical Insights

The automotive segment contributed a share of around 15% in the global market in 2021. The rising implementation of the digital magazine by the automotive companies for endorsing their new launch as well as new featured products all over the globe is restraining market growth. However, the magazine industry has been in continuous decline generated by shrinking audiences across the world due to rising prices, fading credibility, and the rise of social media and other platforms. Besides, the growing popularity of magazine advertising for automotive marketing owing to the maximum conversion rate of the advertisements is further driving the growth of the market.

The FMCG segment of the market is expected to register the fastest growth, with a CAGR of -3.0% from 2021 to 2028. The growing acceptance of digital advertising from the customer is anticipated to drop the market development. Though, magazine circulation is regularly declining all over the globe will further hamper the market development. Furthermore, the increasing adoption of magazine advertising by several FMCG firms to bring attentiveness to the product as well as to create trust and credibility amongst the customers is driving the market growth.

Regional Insights

Asia Pacific made the largest contribution to the global market of over 35% in 2021 and is expected to grow at a CAGR of -3.7% from 2022 to 2028. The growing expenditure on online advertising by the several industries vertical is limiting the market development. The rising urbanization and increasing awareness regarding the branding of a specific product through numerous advertising tools are limiting the market development. This can be accredited to the large spending on magazine advertising in developing countries such as China, India, and Japan owing to the large consumer base.

Europe is the second-fastest-growing market and has expected to witness a CAGR of -4.2% from 2022 to 2028. The growing popularity and acceptance of magazine advertising amongst the many industry verticals are increasing the magazine advertising market over the last couple of years. Moreover, a large population of subscribers to print magazines in the European nations is driving the market development.

Key Companies & Market Share Insights

The market is categorized by the existence of several established market players in magazine advertising all over the globe. Some of them are Nine Entertainment Co., Gannett Co. Inc., and Axel Springer SE along with several small and medium companies as well. Companies are concentrating on launching new functions to meet customers’ expectations by providing a trending print advertisement type. Furthermore, sellers are increasing their reach across the world with an advanced business model. Some of the key players operating in the magazine advertising market include:

-

Gannett Co. Inc.

-

Nine Entertainment Co.

-

Axel Springer SE

-

Conduit, Inc

-

Valassis

-

NEWS CORP

-

Global Business Leaders Mag

Magazine Advertising Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 11.0 billion

Revenue forecast in 2028

USD 8.3 billion

Growth rate

CAGR of -4.5% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Billion/Million and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Gannett Co. Inc.; Nine Entertainment Co.; Axel Springer SE; Conduit, Inc; Valassis; NEWS CORP; Global Business Leaders Mag.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global magazine advertising market on the basis of Industry Vertical, and region.

-

Industry Vertical Outlook (Revenue, USD Million; 2017 - 2028)

-

Automotive

-

Financial Services

-

FMCGMedia & Entertainment

-

Retail

-

Real Estate

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global magazine advertising market size was estimated at USD 11.5 billion in 2021 and is expected to reach USD 11.0 billion in 2022.

b. The global magazine advertising market is expected to grow at a compound annual growth rate of -4.5% from 2022 to 2028 to reach USD 8.3 billion by 2028.

b. Asia Pacific dominated the magazine advertising market with a share of 35.5% in 2021. The growing expenditure in online advertising by the several industries vertical is limiting the market development. The rising urbanization and increasing awareness regarding the branding of a specific product through numerous advertising tool is limiting the market development.

b. Some key players operating in the magazine advertising market include Gannett Co. Inc.; Nine Entertainment Co.; Axel Springer SE; Conduit, Inc; Valassis; NEWS CORP; and Global Business Leaders Mag.

b. Key factors that are driving the magazine advertising market growth include rising investment in print advertising by industry verticals such as Automobile, FMCG and many others to create trust as well as nurture relations with existing customers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."