- Home

- »

- Advanced Interior Materials

- »

-

Magnet Wire Market Size & Share, Industry Trends Report, 2019-2025GVR Report cover

![Magnet Wire Market Size, Share & Trends Report]()

Magnet Wire Market Size, Share & Trends Analysis Report By Material (Copper, Aluminum), By Product (Round, Flat), By End Use (Energy, Automotive, Industrial, Residential), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-090-3

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Advanced Materials

Industry Insights

The global magnet wire market size was valued at USD 25.6 billion in 2018 and is expected to witness a revenue-based CAGR of 3.7% from 2019 to 2025. Rising demand for the product from the energy sector is the significant factor driving the market for magnet wire.

Magnet wire also called winding wire, is an insulated electrical conductor that is wound around a coil and energized to create an electromagnetic field for energy transforming applications. The product is generally made from copper or aluminum and is utilized in transformers, motors, and other electromagnetic equipment.

Rising consumer disposable income and increasing population have led to a surge in demand for electricity in emerging economies of the Asia Pacific such as India, China, and Southeast Asia. A recent trend indicates high capacity additions for electrification in the Asia Pacific. This upward trajectory in electricity demand is expected to create substantial demand for power transformers, thereby driving the market for magnet wire.

Wind turbines represent one of the key applications of the product in the energy sector. Rising penetration of renewable energy is expected to provide lucrative opportunities for market growth. According to the Global Wind Energy Council (GWEC), the global cumulative wind capacity is expected to reach 731.9 GW by 2020, an increase of 22.5% from 2018.

The penetration of electric vehicles in the automotive industry is estimated to be a significant growth engine for the market. The product is used in regenerative braking systems, traction motors, and belt started generators in electric vehicles. The stringent government regulations especially in Europe and North America regarding CO2 emissions are expected to boost electric vehicle production and benefit the market for magnet wire.

Copper rod is the basic raw material used in the manufacturing of magnet wire. Major companies are characterized by integrated manufacturing operations. For instance, companies such as LS Group and Sumitomo Electric Industries, Ltd. produce in house copper rods for their magnet wire business. This enables companies to maintain the quality of their raw materials and reduce manufacturing costs.

Material Insights

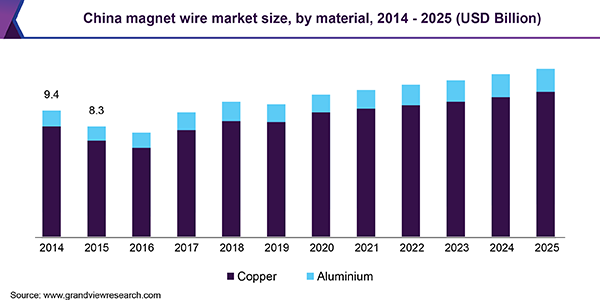

Copper dominated the market for magnet wire with a volume share of approximately 79% in 2018. This high share is attributable to overall better mechanical, physical, and chemical properties of copper when compared to aluminum. For instance, copper has better conductivity than aluminum. Utilization of copper magnet wire thereby enhances the electrical energy efficiency of motors and is therefore preferred by motor manufacturers.

Aluminum is projected to witness a significant CAGR of 3.9% from 2019 to 2025, in terms of volume. The primary factors stimulating segment growth are lower weight and significantly lower cost when compared to copper. Aluminum has only 30% of the copper weight while having 61% of the conductivity of copper. Moreover, significant price fluctuations in copper have resulted in the increasing adoption of aluminum whose prices are more stable and lower when compared to its counterpart.

Product Insights

The round wire held the largest revenue share of 76.3% in 2018. The product is extensively utilized in residential applications such as electric motors in household appliances, and electronics. The abundant availability of the product coupled with the lower cost when compared to the flat winding wire is the crucial factor contributing to its larger market share.

Flat winding wire is estimated to exhibit the fastest CAGR of 3.8%, in terms of volume, from 2019 to 2025. Flat magnet wire consists of rectangular and square magnet wire. These products allow more electrical power efficiency and space when compared to round products. As a result, they are mainly utilized in the energy sector. The growing number of electrification projects is thereby expected to contribute to segment growth over the coming years.

End-use Insights

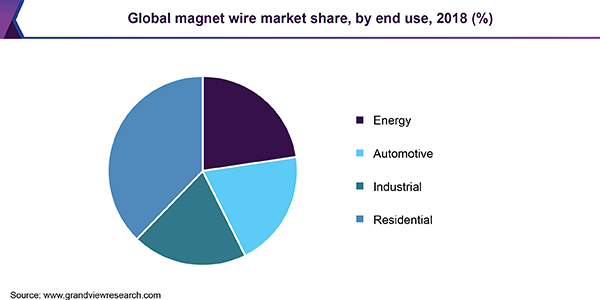

The residential segment dominated the magnet wire market in 2018 with a revenue share of approximately 38%. This dominance in market share is attributable to a vivid range of the product’s applications such as heating pumps, hermetic motors for refrigeration and HVAC, household appliances, and lighting to electronics products such as cell phones, computers, and television.

The energy segment is predicted to witness the fastest CAGR of 3.7% from 2019 to 2025, in terms of volume. There is surging demand for distribution transformers, power transformers, and power generators owing to rising electricity demand around the globe.

Further, a recent trend indicates increasing installations of wind energy systems especially in developed regions like Europe. Such developments in the energy sector are likely to propel the demand for magnet wire.

Automotive applications of the product include motors, electrical devices, and electronics used in cars and other transport vehicles. The exponential growth in the electric vehicles industry is predicted to be a crucial driver for market growth, as the consumption of magnet wire per electric vehicle is larger when compared to cars operating on fossil fuels.

Regional Insights

The Asia Pacific acquired a substantial volume share of roughly 66% in 2018. China held a sizeable share in the market for magnet wire as it is one of the largest manufacturing bases in the region. The migration of end-product manufacturing companies to emerging economies like China and India owing to low labor and manufacturing cost is expected to significantly contribute to regional growth over the coming years.

North America is projected to witness a CAGR of 3.2%, in terms of revenue, from 2019 to 2025. Significant drivers of the market for magnet wire in the region include high replacement rates of transformers in the U.S. and the booming electronics production in Mexico. The U.S. is expected to reduce its dependence on imports by increasing local production of power transformers, which in turn is anticipated to benefit market growth in the region.

In Europe, the energy sector represents a significant market for magnet wire. According to the European Environment Agency, wind energy is estimated to play an important role in achieving the European renewable energy targets. Furthermore, increasing electric vehicle production is predicted to drive product demand over the coming years.

In Central and South America, the market is projected to take an upward trend owing to the economic recovery of key countries like Brazil. This economic recovery has led to increased private consumption and a surge in electricity demand. These factors are expected to drive the growth of end-use industries such as energy and consumer appliances, thereby propelling the magnet wire demand.

Magnet Wire Market Share Insights

The global market consists of several large players such as Furukawa Electric Co., Ltd., Irce S.P.A., LS Group., REA Magnet Wire, Tongling Jingda Special Magnet Wire Co., Ltd., Sumitomo Electric Industries, Ltd., LWW Group, and Samdong Co., Ltd. The players are highly competitive and majorly differentiate their products based on quality and price.

Merger and acquisitions and joint ventures are the prominent strategies adopted by the industry players to extend their market reach. For instance, in September 2019, Superior Essex Inc, an American subsidiary of LS Group, entered into a joint venture with Furukawa Electric Co., Ltd., to supply advanced magnet wires to the electric vehicle industry.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Million, Volume in Kilotons, and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, Italy, France, China, India, Japan, and Brazil

Report coverage

Revenue and volume forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global magnet wire market report based on material, product, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Copper

-

Aluminum

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Round wire

-

Flat wire

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Energy

-

Automotive

-

Industrial

-

Residential

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

The Middle East and Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."