- Home

- »

- Clothing, Footwear & Accessories

- »

-

Maternity Innerwear Market Size, Share, Trends Report, 2030GVR Report cover

![Maternity Innerwear Market Size, Share & Trends Report]()

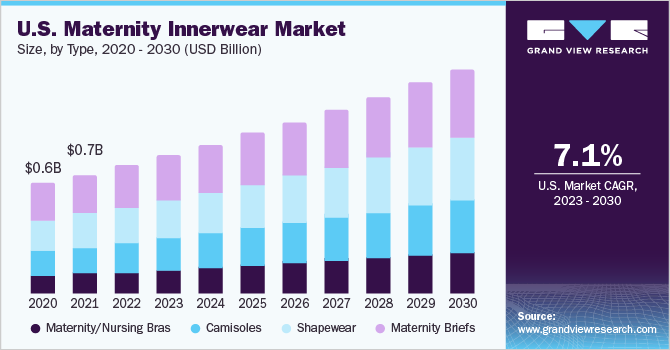

Maternity Innerwear Market Size, Share & Trends Analysis Report By Type (Maternity/Nursing Bras, Camisoles, Shapewear, Maternity Briefs), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-241-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

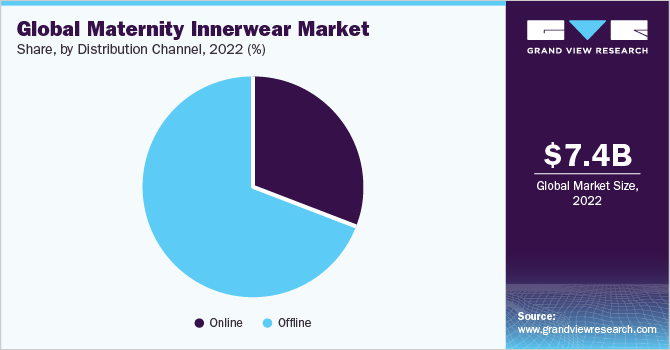

The global maternity innerwear market size was valued at USD 7.41 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. The increasing number of working women in the world, coupled with the growing inclination for pregnancy fashion, is foreseen to drive the growth of the industry in the forthcoming years. The constant launch of more convenient product varieties and the easy availability of these products through online retail channels are some key factors that positively affect the growth.

The outbreak of coronavirus has had a significant impact on the maternity innerwear market, both positively and negatively. One of the significant outcomes of this ongoing pandemic has been a reported rise in pregnancies in many parts of the world. The market has benefited from recent advances and innovative tactics. Competitors are improving their production capacities by incorporating technology into their manufacturing processes and purchasing raw materials.

Online-to-offline (O2O) platforms are also gaining traction in the industry. This model attracts customers in an online environment and compels them to make purchases in physical stores. One aspect of this channel is the ability to pay online and collect the product from an offline retail store.

The increasing growth of local commerce on the web is developing stronger links between online and offline retail. Additionally, many apparel brands are focusing on fashionable maternity innerwear collections and approaching online platforms to fulfill the evolving needs of pregnant women and drive revenue growth.

For instance, in February 2021, Hatch collection LLC launched a new maternity clothing line at Target, aiming at the mamas-to-be who are looking for stylish maternity clothes for under $40. The collection is available online and in select stores. The collection features 24 pieces with design details that accommodate growing bumps like elastic waistbands and stretchy, lightweight fabrics.

Companies use social media to influence consumer buying habits. Every year in the first week of August, World Breastfeeding Week shines a spotlight on intimate apparel that caters to this industry. ThirdLove, True&Co., and Pour Moi, among others, use Instagram to sell their nursing bras and raise awareness regarding the event. In recent years, e-commerce sales of maternity innerwear have increased in China, with platforms like Dangdang, Vipshop, Amazon China, and Alibaba1688 (Alibaba's clothing business) encouraging easy access to products for consumers.

By Type

In terms of value, maternity briefs held the largest revenue share of 30.2% in 2022. Pregnant women need comfortable underwear that will offer them extra give and won't pinch and pressure them in all the wrong places as their bodies develop and shift in unexpected ways. Undergarments developed for changing bodies can help them control discharge, keep them cool during hot flashes, and give them one less thing to yank on during this hard time, in addition to providing comfort and more wiggle space as they continue through the pregnancy adventure.

Nursing bras and maternity briefs have become more popular as the number of working pregnant women and mothers has increased. These bras allow women to breastfeed without having to take off their bras. Some are also designed to allow you to use a breast pump while working from home or in the office. The soft underwired design in some of the bras is ideal for modern mothers and can suit all stages of pregnancy and breastfeeding.

Shapewear is very popular among millennials and celebrities and has been gaining prominence in the maternity space as well. Shapewear can help mothers improve their posture and take some of the weight off as the pregnancy progresses. These are more comfortable to wear than regular underwear or tights and give a more seamless look.

Distribution Channel Insights

The online channel segment is expected to witness the fastest growth during the forecast period. The rise of the online category can be ascribed to technical improvements and the increasing importance given to online platforms for maternity innerwear, particularly by consumers looking for bargains. The main target demographic for online platforms is customers who are comfortable purchasing things without physically inspecting them. To boost product sales and profit margins, most manufacturers have turned to the direct sales approach.

Customers are enticed to shop for maternity innerwear clothes online owing to the availability of a wide choice of international brands, big discounts, free shipping, and simple return policies. Online stores provide a vast selection of products at varying prices, making it easier to meet the needs of a wide range of clients, especially those on a budget.

However, many consumers prefer to buy maternity innerwear products through offline stores as these stores have a variety of options available in terms of color, type, and material. The main advantage of an offline retail store is that consumers can touch and feel the product before making a purchase decision.

For instance, in January 2020, H&M Group’s brand Monki opened its first store in the Philippines, located in Manila. Furthermore, in January 2020, H&M Group signed a franchise agreement with Hola Mola S.A. in Central America to expand in the region.

Regional Insights

In 2022, Asia Pacific held the largest share of 41.3% in the market. The need for various types of maternity clothes is supplemented by the increasing spending power of the people, which is a key factor expected to fuel the regional growth. Consumers in China have a high level of trust in multinational brands and products. Western trademarks are synonymous with high quality and most importantly, safety. When it comes to pregnant women and their unborn children, Chinese customers are willing to pay a premium for high-quality goods and services. This means that multinational brands have a lot of room to grow in China's prenatal care sector.

North America is likely to hold a significant revenue share in the forthcoming years due to the presence of a large fashion-conscious female population in countries, such as the U.S. and Canada. Moreover, the flourishing apparel and textile industries in the region are expected to drive this growth. While the concept of social distancing is expected to dent the U.S. market for maternity innerwear, the main concern for maternity innerwear manufacturers in the country is likely to be the disruption in retail sales in the near term.

Key Companies & Market Share Insights

The market is characterized by the presence of several well-known players as well as a number of small- and medium-sized players. The usage of sustainable fabrics is growing and the chemical and physical properties of their constituent fibers, fiber content, physical and mechanical features of their constituent yarns, and finishing treatments all influence fabric behavior. As a result, prominent fiber manufacturers such as Nylstar, Invista, and Lenzing have introduced new fibers, including Meryl Skinlife, Tactel, and Tencel, for intimate apparel.

Due to the pandemic, online sales of all companies have increased, but for brands like Clovia, online sales have always had the majority share (75 percent online and 25 percent offline sales). Brands have broadened their e-commerce reach; for instance, H&M launched their wares throughout Southeast Asia on Zalora.

The impact of major players on the market is quite high as a majority of them are characterized by a global presence. Major players are making efforts to strengthen their presence across new regions in the global market through partnerships with established distributors:

-

In August 2022, Nike launched its maternity colletion in India. The collection features bra, tanks, leggings, among other apparels.

-

In April 2021, H&M launched the e-commerce platform Zalora in Southeast Asia. The collaboration will enable the brand to reach 400 million consumers across Malaysia, the Philippines, Singapore, and Indonesia

-

In June 2021, Seraphine announced its plans for an IPO. The company intends to list on the London Stock Exchange and raise a gross amount of USD 84.3 million (£61 million), which will help repay its term loan and other IPO expenses. The remaining gross primary proceeds of around USD 62.2 million will be used to repay the retailer's loan notes, which are held by some of the company's existing owners.

-

In February 2021, Hatch launched a new maternity clothing line at Target aimed at mamas-to-be who are looking for stylish maternity clothes under $40. The collection is available in online and select stores and features 24 pieces with design details that accommodate growing bumps like elastic waistbands and stretchy, lightweight fabrics.

-

In December 2020, Seraphine was acquired by Mayfair Equity Partners in a deal valuing the company at USD 69.11 million. This acquisition was a management buyout

-

In April 2020, Seraphine was awarded a second Queen's Award for Enterprise for International Trade.

-

In May 2020, H&M Group brands launched on new online markets. Brands, including COS, Weekday, Monki, & Other Stories, and ARKET, have expanded and made their collections available to nine additional markets across Europe.

Some prominent players in the global maternity innerwear market include:

-

Seraphine

-

Wacoal

-

H & M Hennes & Mauritz AB

-

Hatch Collection LLC

-

MamaCouture

-

Hotmilk Lingerie

-

Belabumbum

-

Fresh Venturz LLP

-

Clovia

-

Triumph Holding AG

Maternity Innerwear Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 7.97 billion

The revenue forecast in 2030

USD 12.88 billion

Growth Rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, brand share analysis, and trends

Segments covered

Type, distribution channel region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; India; China; South Korea; Australia; Brazil; South Africa

Key companies profiled

Seraphine; Wacoal; H & M Hennes & Mauritz AB; Hatch Collection LLC; MamaCouture; Hotmilk Lingerie; Belabumbum; Fresh Venturz LLP; Clovia; Triumph Holding AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Maternity Innerwear Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the maternity underwear market on the basis of type, distribution channel, and region.

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Maternity/Nursing Bras

-

Camisoles

-

Shapewear

-

Maternity Briefs

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global maternity innerwear market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 12.88 billion by 2030.

b. The Asia Pacific dominated the maternity innerwear market with a share of 41.34% in 2022. This is attributable to rising healthcare awareness coupled with cloud-based technology acceptance and constant research and development initiatives.

b. Some key players operating in the maternity innerwear market include Seraphine; FirstCry; H&M; Triumph International; Wacoal; Mamacouture; Hotmilk Lingerie; Adore Me, Inc. (Belabumbum); Fresh Venturz LLP; CLOVIA.

b. Key factors that are driving the maternity innerwear market growth include increasing medicare reimbursement for telehealth services, reducing emergency room visits and hospitalization rates, and technological innovation in communication technology across the world.

b. The global maternity innerwear market size was estimated at USD 7.41 billion in 2022 and is expected to reach USD 7.97 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."