- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Meat Stabilizers Blends Market Share Report, 2019-2025GVR Report cover

![Meat Stabilizers Blends Market Size, Share & Trends Report]()

Meat Stabilizers Blends Market Size, Share & Trends Analysis Report By Source (Plant, Seaweed, Animal, Microbial, Synthetic), By Application (Meat Processing, HoReCa, Pet Food), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-171-9

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Report Overview

The global meat stabilizers blend market size was valued at USD 1.99 billion in 2018. The rising importance of stabilizing agents for improving the texture and smoothness of the finished goods is expected to drive the growth. Rising product applications in developing economies including China and India is anticipated to positively influence the product demand. The expansion of the meat industry is expected to further drive the demand for stabilizer blends in the near future.

The trend of dining out is on the rise among millennial consumers across the world. Changing lifestyle along with increasing purchasing power has been fueling the restaurant industry. According to the United States Department of Agriculture, the millennial population spends 44 % of their food expenditure on eating out. A growing number of working professionals along with work-life imbalance has been supporting this trend in the developing countries. As a result, the demand for stabilizing blends in the foodservice sector is expected to witness growth in the near future.

Increasing demand for organic foods in developed countries including the U.S., Germany, France, and U.K. is expected to expand the scope of application for the organic stabilizing agents in the industry. Manufacturers focus on R&D of organic products to meet consumer demand. A growing number of organic meat producers on a global scale is expected to expand the utility of various stabilizing additives in the near future.

The incorporation of stabilized blends results in improved product quality and taste of the finished goods. The producers add additives to maintain the taste of the product to reduce the fat content of the meat-based on consumer preference. This trend is expected to expand the scope of stabilizers in the food processing market.

Source Insights

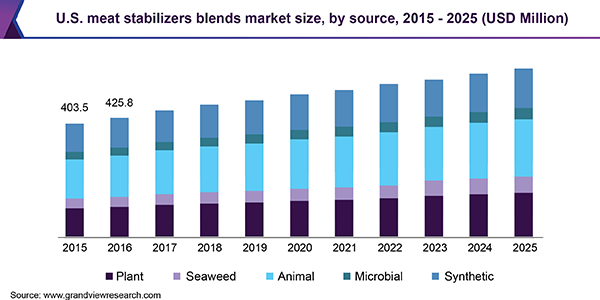

Animal and synthetic sources together held the largest share of the global meat stabilizers blends market, accounting for more than 55% of the total revenue. Blood plasma is a widely used stabilizer in the food processing industry. It works as an emulsifier, clarifier, nutritional component, and color additive. Its ability to form gel increases the demand from the food processing industry. It provides the required texture and color to processed food including hot dogs and cooked ham.

The plant segment is expected to expand at a CAGR of 8.5% from 2019 to 2025 due to the growing demand for natural food stabilizer agents. In addition, continuous R&D is expected to expand the scope of plant-based food additives. The food processing industry has been rapidly adopting this trend due to the increasing demand for natural ingredients in developed countries including the U.S., U.K., and Germany.

Application Insights

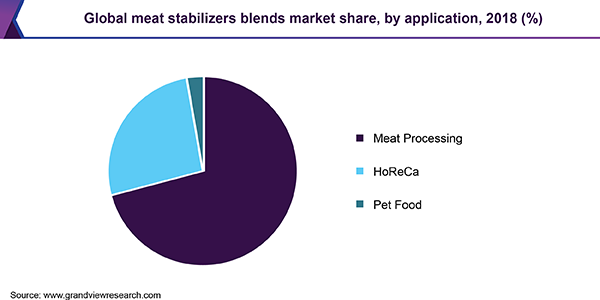

The meat processing industry led the market in 2018, accounting for over 70% of the global revenue. Over the past few years, the meat processing industry has witnessed significant expansion across the world. The expansion of the broiler meat industry in developing countries including Brazil, China, and India due to reduced production cost and increased spending on advanced technology is projected to remain a favorable factor for the growth. Furthermore, the significant rise in demand for frozen meat in developed economies including the U.S. and Germany as a result of the increasing consumption of products among millennials is projected to open new avenues.

The HoReCa or food service application is projected to register the fastest CAGR of 8.3% from 2019 to 2025. The rising trend of dining out is the major driving factor for this growth. A study has found that 18% of European consumers eat all of their meals away from home. The number of drinking places, restaurants, and cafés has been increasing significantly across the world. The fast-growing food chains in the developing nations including China, India, and Brazil are anticipated to accelerate the growth of the market in the upcoming years. In addition, the rapid penetration of online food services has fueled market growth. Over the past few years, online food services have gained huge popularity among millennial and working professionals. This trend is expected to benefit the market in the near future.

Regional Insights

In 2018, North America held the leading market share of more than 30% in terms of revenue. Rising consumption of hot dogs, sausages, ham, and bacon among the American consumers has fueled the regional product demand. The U.S. is considered one of the leading producers of beef and poultry meat. Therefore, the demand for meat stabilizers has been witnessing a significant rise in demand in this nation.

Europe also held a significant market share in 2018, owing to the high demand for processed food in this region. A study has found that 18% of European population eats all of their meals away from home. This trend is anticipated to widen the scope of product application in the foodservice sector of Europe.

Asia Pacific is expected to witness the fastest CAGR of more than 10% from 2019 to 2025. China was one of the largest producers of meat products including pork, poultry, and beef in 2018. In addition, the growing food processing industry in developing countries including India, Pakistan, Indonesia, and Vietnam is anticipated to fuel regional growth.

Key Companies & Market Share Insights

The key manufacturers include Cargill, Incorporated; DowDuPont Inc.; The Meat Cracks Technologie GmbH; Kerry Group plc; The Archer Daniels Midland Company; Tate & Lyle PLC; Palsgaard A/S; Ashland; Hydrosol GmbH & Co. KG; and Ingredion Incorporated. The market is highly fragmented with a few large and many small players.

The producers are strategically expanding their business by entering new regional markets and extending the product portfolio. For instance, in September 2018, Kerry Group plc built the first production plant in Moscow, Russia. The production facility started with the production of meat and snacks processing ingredients. This new facility is expected to expand the company’s global reach in the upcoming years.

Meat Stabilizers Blends Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 2.13 billion

Revenue forecast in 2025

USD 3.25 billion

Growth Rate

CAGR of 7.2% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Germany, U.K., China, India, Brazil, South Africa

Key companies profiled

Cargill, Incorporated; DowDuPont Inc.; The Meat Cracks Technologie GmbH; Kerry Group plc; The Archer Daniels Midland Company; Tate & Lyle PLC; Palsgaard A/S; Ashland; Hydrosol GmbH & Co. KG; and Ingredion Incorporated.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global meat stabilizers blends market report based on source, application, and region:

-

Source Outlook (Revenue, USD Million, 2015 - 2025)

-

Plant

-

Seaweed

-

Animal

-

Microbial

-

Synthetic

-

-

Application Outlook (Revenue, USD Million, 2015 - 2025)

-

Meat Processing

-

HoReCa

-

Pet Food

-

-

Region Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global meat stabilizers blends market size was estimated at USD 2.13 billion in 2019 and is expected to reach USD 2.27 billion in 2020.

b. The global meat stabilizers blends market is expected to grow at a compound annual growth rate of 7.2% from 2019 to 2025 to reach USD 3.25 billion by 2025.

b. Asia Pacific dominated the meat stabilizers blends market with a share of 34.9% in 2019. This is attributable to growing food processing industry in the developing countries including India, Pakistan, Indonesia, and Vietnam, which is anticipated to fuel the regional growth.

b. Some key players operating in the meat stabilizers blends market include Cargill, Incorporated; DowDuPont Inc.; The Meat Cracks Technologie GmbH; Kerry Group plc; The Archer Daniels Midland Company; Tate & Lyle PLC; Palsgaard A/S; Ashland; Hydrosol GmbH & Co. KG; and Ingredion Incorporated.

b. Key factors that are driving the market growth include rising product application in developing economies including China and India coupled with increasing importance of stabilizing agents for improving texture and smoothness of the finished goods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."