- Home

- »

- Medical Devices

- »

-

Medical Device Regulatory Affairs Market Size Report, 2030GVR Report cover

![Medical Device Regulatory Affairs Market Size, Share & Trends Report]()

Medical Device Regulatory Affairs Market Size, Share & Trends Analysis Report By Services (Regulatory Writing & Publishing, Legal Representation), By Type, By Service Provider, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-360-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global medical device regulatory affairs market was valued at USD 5.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 10.1% from 2023 to 2030. This growth can be attributed to the rising demand for faster approval processes, a shifting regulatory landscape, and expansion in emerging fields such as therapeutics and diagnostics. Besides, the increasing complexity of medical devices and favorable government initiatives are also supporting the growth of the market for medical device regulatory affairs. The pipeline of medical devices has witnessed a steady rise in recent years. The growing demand for new technology and the increasing need to make devices patient-friendly are expected to improve the pipeline of medical devices in the forecasted years. This is expected to create demand for medical device regulatory services and thus support the market in the post-pandemic period.

Artificial intelligence and machine learning technologies have the potential to transform health by extracting a massive amount of data during healthcare delivery. Recently, numerous pre-market approvals have been granted through the FDA's pre-market pathway. One such example is the algorithm used in the Apple Watch's AF detector and diabetes management support tools that provide personalized treatment plans. The FDA has signified a different strategy that shifts the center of mass for certification, particularly for AI-related technologies, away from a complete focus on the device or its performance and toward the company and its processes.

Besides, increasing cybersecurity threats and the financial impact of data breaches are making manufacturers of medical devices implement strategies to ensure that their products remain secure. This is accompanied by government support. For instance, in October 2018, the FDA collaborated with the U.S. Department of Homeland Security to improve information sharing and collaboration to address cybersecurity risks, including less secure communication and the prevention of unauthorized access when it comes to data transfer to and from the device.

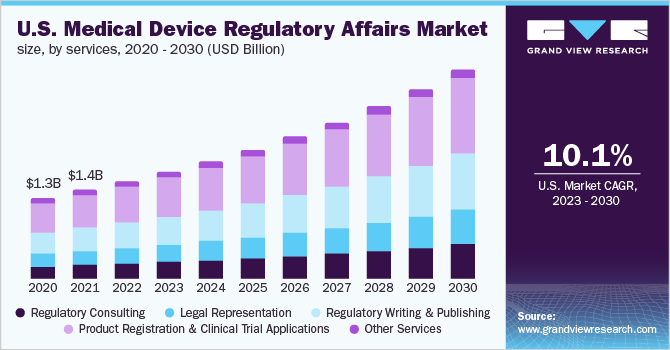

Services Insights

The regulatory writing and publishing segment led the market with the highest revenue share of 36.6% in 2022. Based on services, the market is segmented into regulatory consulting, legal representation, regulatory writing & publishing, product registration & clinical trial applications, and other services. The large share of the segment is attributed to the fact that these services are provided from the early stages of product development to premarket approval, as high-quality documentation is essential for regulatory affairs to avoid delays in the approval process. Hence, with the increasing number of products in development, the demand for these services is likely to increase, thereby contributing to the growth of the market for medical device regulatory affairs.

The segment of legal representation is anticipated to witness the fastest growth of 10.9% over the forecast period. This may be due to the increasing demand for legal representatives across the globe caused by the globalization of medical devices. The regulations are very complex and constantly changing. The changing regulatory landscape in regions such as Asia Pacific, MEA, and Latin America increases the demand for local experts for legal representation for obtaining regulatory approvals and customs clearance. These factors are promoting the demand for legal representation services globally.

Type Insights

The therapeutics segment held a maximum share of 55.6% in 2022. Based on type, the market is segmented into therapeutics and diagnostics. The segment is also projected to witness the fastest CAGR of 10.4% during the forecast period. This may be attributed to the increasing prevalence of various chronic diseases such as cancer, diabetes, cardiovascular diseases, and respiratory disorders that create demand for advanced therapeutic devices. For instance, rising demand for technologically advanced products such as auto-injectors or pen needles for effective and efficient insulin delivery in diabetic patients is fueling segment growth.

The diagnostics segment held a share of 44.4% in 2022. The high prevalence of chronic and infectious diseases is contributing to the demand for diagnosis and, thus, supporting the demand for technologically advanced diagnostic devices. Moreover, a significant number of diagnostic devices were launched in the last five years. For instance, in July 2022, Canon Medical launched the MRI machine Vantage Fortian with better scan technology and image enhancement. All these factors are expected to promote the demand for regulatory services for diagnostic devices.

Service Provider Insights

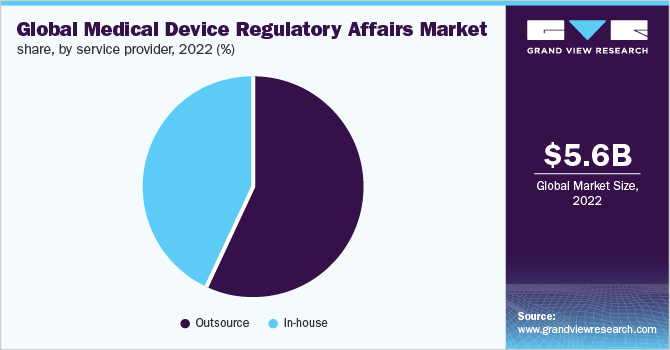

Based on service provider, the outsourcing segment led the market with a maximum share of 57.0% in 2022. This is largely attributed to the lack of an in-house regulatory team. Besides, the advantages, such as cost and time savings, associated with the outsourcing of these services are contributing to market growth. Besides, new regulatory challenges, such as medical device regulation and in vitro diagnostic device regulation in Europe, as well as regulatory cybersecurity scrutiny, make market launch and recertification timelines difficult. It is incredibly challenging for businesses to manage regulatory hurdles with unskilled personnel, which drives the demand for outsourcing these services.

The in-house segment is expected to expand at a CAGR of 7.9% across the forecast period. Large biotechnology and medical device firms have a strong in-house team for regulatory affairs due to their varied product portfolios, pipelines, and the ability to hire skilled & experienced professionals; these are some of the key factors supporting the in-house segment. However, these firms are also shifting toward outsourcing to focus on their core competencies and address capacity issues. This is expected to reduce the demand for in-house services in the coming years.

Regional Insights

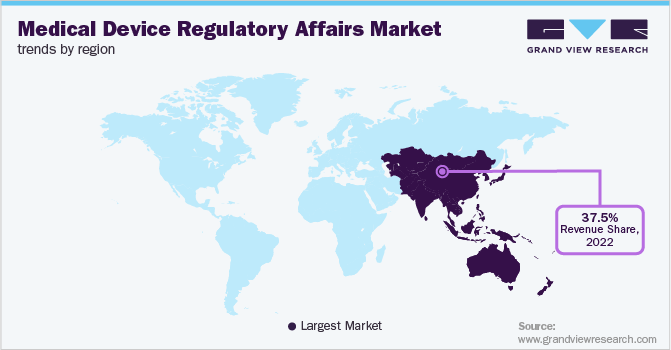

Asia Pacific dominated the medical device regulatory affairs market and accounted for the largest revenue share of 37.5% in 2022, owing to the improved regulatory landscape, cost savings, a growing number of clinical trials conducted in the region, and an increasing number of medical device companies venturing in the region. Furthermore, the availability of a skilled workforce within the region at a lower cost compared to the U.S. is another factor expected to propel growth. The growing geriatric population, rising prevalence of chronic diseases among people, and increase in government support for the healthcare sector are expected to increase the demand for cost-effective devices in the region. This is anticipated to increase the number of market entrants, thereby raising the need for regulatory services.

North America and Europe are also expected to be key markets for medical device regulatory affairs, owing to the presence of two major international regulatory agencies—the European Medicines Agency (EMA) and the U.S. FDA, which regulates more than half of all medical devices worldwide. The U.S. FDA issues various guidelines for medical device manufacturers to help in the process. Moreover, North America is home to numerous medical device companies, which are outsourcing part of their regulatory functions to regulatory service providers, thereby contributing to the growth of the regional market.

Key Companies & Market Share Insights

Market players are undertaking various strategic initiatives such as the launch of new services partnerships, collaborations, mergers and acquisitions, and geographic expansion, aiming to strengthen their product portfolio and manufacturing capacities, and provide a competitive advantage. For instance, in October 2022, Freyr partnered with an orthopedic implants manufacturing company in Korea and, as per the agreement, Freyr provided them with regulatory device registration and legal representation services. Some of the prominent players in the global medical device regulatory affairs market include:

-

ICON, Plc

-

Emergo

-

Freyr

-

Laboratory Corporation of America Holdings

-

IQVIA, Inc.

-

Intertek Group plc

-

SGS Société Générale de Surveillance SA

-

Promedica International

-

Integer Holdings Corporation

-

Medpace

Medical Device Regulatory Affairs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.2 billion

Revenue forecast in 2030

USD 12.1 billion

Growth rate

CAGR of 10.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments Covered

Services, type, service provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

ICON, Plc; Emergo; Freyr; Laboratory Corporation of America Holdings; IQVIA, Inc.; Intertek Group plc; SGS Société Générale de Surveillance SA; Promedica International; Integer Holdings Corporation; Medpace

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Regulatory Affairs Market Segmentation

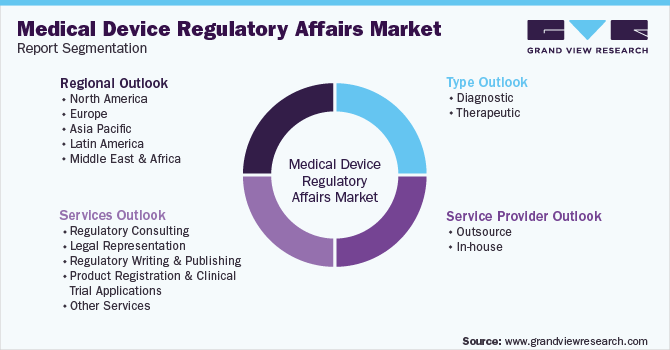

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical device regulatory affairs market report based on services, type, service provider, and region:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Other Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic

-

Therapeutic

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Outsource

-

In-house

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical device regulatory affairs market size was estimated at USD 5.6 billion in 2022 and is expected to reach USD 6.2 billion in 2023.

b. The global medical device regulatory affairs market is expected to witness a compound annual growth rate of 10.1% from 2023 to 2030 to reach USD 12.1 billion by 2030.

b. The Asia Pacific region held the largest share of 37.5% in 2022. The region is also expected to grow at a significant rate during the forecast period. This is due to the highly evolved regulatory systems in countries like Australia and Japan.

b. Some key players operating in the medical device regulatory affairs market include ICON Plc, Emergo, IQVIA, Covance, SGS, Medpace, Intertek, Integer Holdings, Freyr, and Promedica International.

b. Rising demand for faster approval processes, a shifting regulatory landscape, and expansion in emerging fields such as therapeutics & diagnostics. Besides, the increasing complexity of medical devices & favorable government initiatives is also supporting the medical device regulatory affairs market growth.

b. The regulatory writing and publishing service segment dominated the market for medical device regulatory affairs with 36.6% of revenue share in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."