- Home

- »

- Medical Devices

- »

-

Medical Equipment Calibration Services Market Report, 2028GVR Report cover

![Medical Equipment Calibration Services Market Size, Share & Trends Report]()

Medical Equipment Calibration Services Market Size, Share & Trends Analysis Report By Service (OEM, Third-party Services), By End User (Hospitals, Clinical Laboratories), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-275-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The global medical equipment calibration services market size was valued at USD 1.0 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2021 to 2028. This growth can be attributed to advancements in the medical device sector, stringent regulations pertaining to calibration of devices, as well as increasing awareness about preventative medical equipment maintenance. Other factors, such as increasing demand for refurbished medical equipment and rising corporate investments in healthcare infrastructure, are also driving the market growth. COVID-19 has created immense pressure on the healthcare industry. It has brought challenges to all the businesses & industries, but none more than hospitals & healthcare facilities.

Medical equipment maintenance has become even more essential than in normal times. It is subject to stringent regulations owing to the substantial health risks in the sector. The global COVID-19 pandemic is further reinforcing these constraints. Besides, the U.K.’s Medicines and Healthcare Products Regulatory Agency (MHRA) has issued recommendations to laboratories & manufacturers who require outside engineers to calibrate their equipment during the COVID-19 pandemic. For companies that need their equipment maintained or calibrated, the MHRA has provided numerous options.

For instance, if an engineer is available to visit the site, the company should assess the risk of COVID-19 transmission and take precautions to keep them apart from other employees and adequately monitored. MHRA has allowed electronic signatures on protocols and site visit documents. Companies that are unable to get even remote support can benefit from the MHRA's instructions. In that case, the MHRA encourages companies to keep track of their quality systems and consider the risk of postponing maintenance.

If a piece of equipment is taken out of operation after a risk assessment, any remaining maintenance tasks should be completed before it is reintroduced. Calibration ensures the instrument's precision and accuracy to reduce measurement errors. To promote improved patient safety, equipment calibration is essential in the healthcare industry. The FDA has a code of regulations for medical device calibration requirements Part 820, QSR, Section 72, which deals with inspection, measuring, and testing equipment stipulates that medical device calibration criteria must address the control of certain parts of the medical device.

Regulatory agencies accept the necessity of precision in medical instruments, and regulatory criteria for instrument calibration have been established. Since device makers prioritize patient health and safety, device accuracy and precision are critical. Instrument calibration services that adhere to regulatory requirements defined by governing organizations are becoming increasingly popular in the medical, pharmaceutical, and biomedical industries.

According to the FDA’s medical device calibration regulations, the manufacturers must have systems in place that provide clear guidance and limits in terms of precision and accuracy. Whenever a medical device fails to fulfill these precision and accuracy standards, the FDA will assess whether it poses a risk of damage to the patient in the form of an adverse impact. If these flaws are detected, the producer of the device must calibrate it to enhance quality until the standards are fulfilled. All of these steps must be documented.

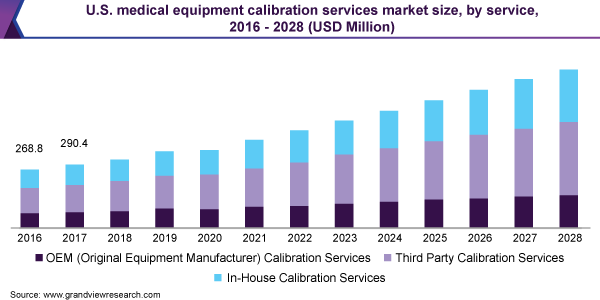

Service Insights

The third-party calibration service segment dominated the market in 2020 with a revenue share of over 40% and will expand further at the fastest CAGR from 2021 to 2028. This is largely attributed to the fastest turnaround time for equipment calibration results when using a third-party source on-site. It’s hard to recreate a calibration lab environment. Strict controls over every component of the environment provide the most precise outcomes. Manufacturers do not use calibration labs frequently enough to justify the high expense of maintaining such a tightly controlled environment.

During the tuning process, the instruments must be exposed to the same environmental conditions as the manufacturer specifies. When shipping equipment to a lab for modifications, it’s very crucial to keep the conditions similar to those set by the manufacturer. One may not be able to rely on results until the facility’s lab follows tight standards and procedures. When a corporation holds accreditation from reputable testing organizations, the risks of outsourcing services to a third party are significantly reduced.

The original Equipment Manufacturer (OEM) services segment is anticipated to witness the second-fastest growth rate of more than 9.5% over the forecast period. The OEM eliminates the necessity to choose a reliable calibration firm. Because it would be calibrated by the same company that designed the device, knowing all of the options, parameters, and ranges would satisfy the original specs.

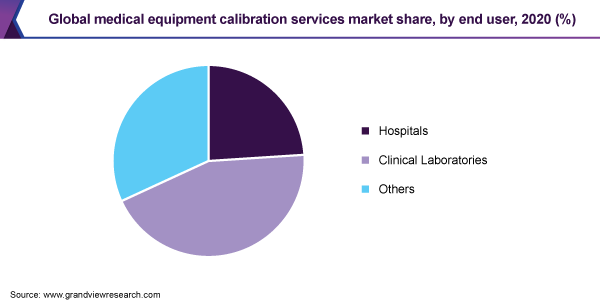

End-user Insights

The hospitals segment accounted for the largest revenue share of 44.4% of the global market in 2020. The health and safety of patients remain a major priority for hospitals. Thus, the calibration of hospital equipment is vital for more than just ensuring the best possible patient care as doctors and nurses rely on the tools they use to monitor patients for accuracy and precision. Moreover, it can also assist the facility in compliance with FDA standards.

On the other hand, the clinical laboratories segment is anticipated to register the fastest growth rate of more than 11% during the forecast period. Clinical laboratories prefer to subscribe to annual or periodic service plans that cover the validation of all of the lab’s instruments. Diagnostic centers are also contributing to the growth of the global market by meeting regulatory quality criteria.

Regional Insights

North America led the global market accounting for the largest revenue share of 37.0% in 2020. The region is also expected to grow at a significant CAGR during the forecast period. As medical equipment technology becomes more complex, there are more incidents of medical device recalls as a result of technology-related issues. In 2018, the major causes of recalls were software, mislabeling, and quality issues, all of which are predicted to increase the demand for medical equipment calibration services.

On the other hand, Asia Pacific is estimated to be the fastest-growing regional market from 2021 to 2028. Europe is also expected to be a key regional market. In Europe, many universities offer specialist programs in the field of biomedical devices and also have the availability of skilled engineers and technicians who can act as valuable resources for medical device players for calibration services. Moreover, the presence of key players, such as Rohde & Schwarz GmbH & Co KG, Endress+Hauser, IBM Corp., and Siemens AG, in Europe will support the market growth.

Key Companies & Market Share Insights

Market players are undertaking various strategic initiatives, such as signing new partnership agreements, collaborations, mergers & acquisitions, and geographic expansions, to strengthen their product portfolio and to gain a higher market share & a competitive edge. For example, in December 2020, Tektronix launched Tek Drive, a ground-breaking data collaboration tool. It enables real-time data exchange and recall on an oscilloscope. It’s the first general-purpose test and measurement file system with data visualizations that look like scopes. Moreover, the company leaped into action to make sure the continuity of maintenance & calibration services during the COVID-19 pandemic. Some prominent players in the medical equipment calibration services market are:

-

Tektronix

-

Fluke Biomedical

-

Biomedical Technologies Inc.

-

NS Medical Systems

-

Transcat, Inc.

-

JM Test Systems

-

JPen Medical

-

TAG Medical

-

Hospicare Equipment Services Corp.

Medical Equipment Calibration Services Market Report Scope

Report Attribute

Details

Market Size value in 2021

USD 1.16 billion

Revenue forecast in 2028

USD 2.2 billion

Growth rate

CAGR of 9.4 % from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Thailand; Singapore; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Tektronix; Fluke Biomedical; Biomedical Technologies, Inc.; NS Medical Systems; Transcat, Inc.; JM Test Systems; JPen Medical; TAG Medical; Hospicare Equipment Services Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global medical equipment calibration services market report on the basis of service, end user, and region:

-

Service Outlook (Revenue, USD Million, 2016 - 2028)

-

In-house

-

Third-party Services

-

Original Equipment Manufacturer (OEM)

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Clinical Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical equipment calibration services market size was estimated at USD 1.0 billion in 2020 and is expected to reach USD 1.16 billion in 2028.

b. The global medical equipment calibration services market is expected to grow at a compound annual growth rate of 9.4% from 2021 to 2028 to reach USD 2.2 billion by 2028.

Which service segment accounted for the highest medical equipment calibration services market share?b. The third-party calibration service segment dominated the medical equipment calibration services market in 2020 with a revenue share of over 40% and will expand further at the fastest CAGR from 2021 to 2028.

b. Some key players operating in the medical equipment calibration services market include Fluke Biomedical, Biomed Technologies Inc., JM Test Systems, Inc., Industrial Calibration and Service Company, Inc., Tektronix, Inc., JPen Medical, TAG Medical, NS Medical Systems, Transcat, Inc., and Medserve Ltd.

b. Key factors that are driving the medical equipment calibration services market growth include improving regulations for medical equipment coupled with growing demand for accuracy and quality.

b. The hospital segment accounted for the largest revenue share of 44.4% of the global medical equipment calibration services market in 2020.

b. North America led the global medical equipment calibration services market accounting for the largest revenue share of 37.0% in 2020.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."