- Home

- »

- Medical Imaging

- »

-

Medical Imaging Market Size, Share & Growth Report, 2030GVR Report cover

![Medical Imaging Market Size, Share & Trends Report]()

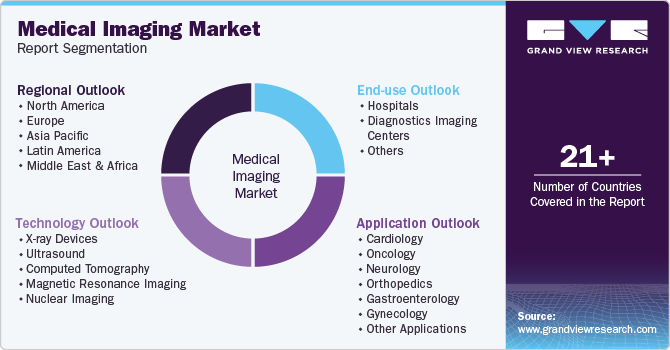

Medical Imaging Market Size, Share & Trends Analysis Report By Technology (X-ray Devices, Computed Tomography, Ultrasound, Nuclear Imaging), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-139-9

- Number of Pages: 200

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Medical Imaging Market Size & Trends

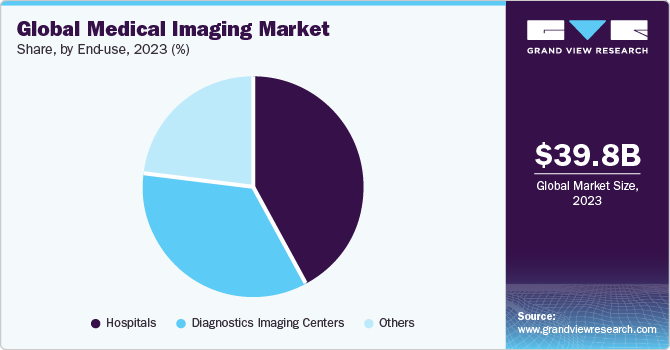

The global medical imaging market size was estimated at USD 39.8 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. The increasing prevalence of chronic diseases, demand for early disease diagnosis and detection tools, along with growing geriatric population are anticipated to drive this growth. Factors such as the rising investments by key players, product innovations, and technological advancements such as integration of Artificial Intelligence (AI) in medical imaging and development of point-of-care medical imaging equipment are expected to further fuel the growth.

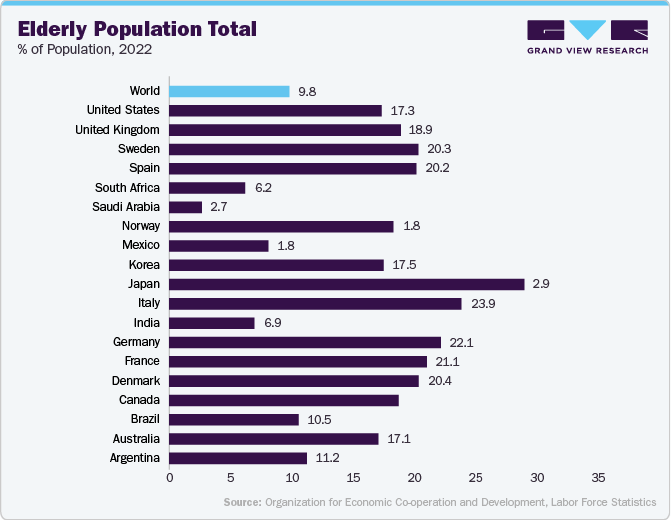

The growing geriatric population is significantly influencing the growth of the medical imaging market as aging is associated with an increased risk of chronic diseases such as heart disease, stroke, cancer, and osteoporosis, often requiring diagnostic imaging for accurate diagnosis and management. The United Nations Population Division anticipates that the population of individuals aged 65 and above will double in the next 30 years, hitting a total of 1.6 billion by 2050.

The following charts illustrate that the world is heading towards an aging population. Japan has the highest share of the elderly population, followed by Italy, Germany, France, and Denmark will have the highest proportions of elderly population in 2022. This is due to significant improvements in life expectancy over recent years, a trend that is expected to continue. By 2050, approximately 40% of the population in Hong Kong, South Korea, and Japan will be 65 or older. This marks a substantial increase from the current percentages in highly developed regions, where only about 20% of the population falls into this age group.

A rise in global life expectancy is a critical growth driver for the medical imaging industry. As people live longer, they become more susceptible to chronic diseases. Medical imaging plays a pivotal role in accurately diagnosing, managing, and treating these diseases, offering detailed views of the body's internal state without invasive procedures. Therefore, as the global population ages, the demand for diagnostic imaging services is expected to surge, propelling the market growth. This trend underscores the importance of advanced imaging technologies in meeting the healthcare needs of an increasingly aging population. According to the United Nations, a newborn in 2021 is projected to have an average lifespan of nearly 25 years longer than someone born in 1950, achieving an average age of 71 years, with females typically living five years longer than males.

“The world is ageing fast, and we have only a couple of regions that are still very young, one is Africa,”

-Daniela Bas, director of the Division for Inclusive Social Development at the UN's Department of Economic and Social Affairs.

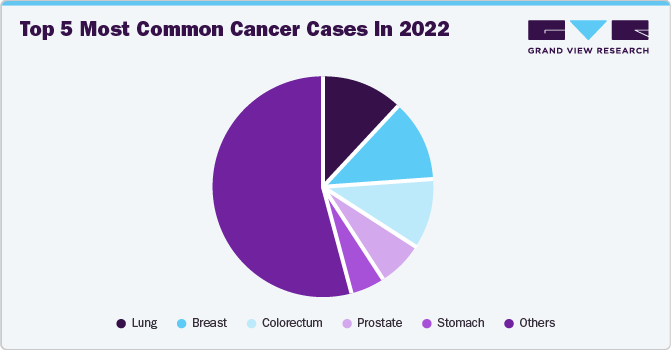

The growing prevalence of chronic diseases is expected to drive the demand for medical imaging devices. Medical imaging aids in the early and accurate diagnosis of diseases, enabling effective treatment. The U.S. National Center for Health Statistics estimates 1,958,310 new cancer cases and 609,820 cancer-related deaths in the country in 2023. Furthermore, the rise in chronic disorders has significantly boosted the demand for medical imaging, resulting in a global increase in diagnostic imaging tests. A World Health Organization (WHO) report indicates that around 3.6 billion diagnostic tests are conducted worldwide annually, with about 350 million of these exams involving pediatric patients.

According to the Global Cancer Observatory, Globocan 2022, the top 5 most commonly found new cancer cases in 2022 are as follows:

R&D in the healthcare sector remains highly competitive and adaptable due to advancing technologies and an uncertain economic climate. Companies prioritize research from fundamental exploration to advanced manufacturing of medical imaging technologies to gain a competitive advantage. Consequently, private and government entities are investing significantly in R&D. For instance, in April 2024, Canon Medical introduced a significant advancement in MRI technology with the launch of the Vantage Galan 3T / Supreme Edition. This cutting-edge system integrates exclusively Canon-produced components, featuring a novel Real-time platform and superior magnet technology crafted in Japan. It stands out by offering the most advanced suite of AI capabilities designed for MRI settings, providing a collection of smart solutions that improve image quality, elevate efficiency, and enhance patient comfort.

The integration of AI in medical imaging has been a transformative force in the healthcare sector, significantly contributing to market growth. By enhancing the accuracy and efficiency of diagnostic processes, AI algorithms are capable of analyzing complex medical images faster than traditional methods, thereby improving patient outcomes. This technological advancement facilitates early detection of diseases such as cancer and streamlines workflow in radiology departments, reducing the burden on healthcare professionals.

AI in medical imaging has opened new avenues for personalized medicine, allowing for treatments tailored to the individual characteristics of a patient's condition. As a result, the demand for AI-powered medical imaging tools is on the rise, attracting substantial investments and fostering innovation within the healthcare industry. For instance, in March 2024, GE Healthcare and Mass General Brigham are set to incorporate foundational models of medical imaging into their AI research initiatives, prioritizing the principles of responsible AI under their prolonged partnership in artificial intelligence. Both entities have been dedicatedly progressing on AI innovations, aiming to broaden the application of AI in various diagnostic and therapeutic areas through the development of AI in a sustainable manner.

“The relationship between Mass General Brigham’s commercial AI business (Mass General Brigham AI) and GE HealthCare has helped accelerate the introduction of AI into a range of product offerings and digital health solutions. With foundation models, we are witnessing the next wave of AI innovation, and it is already reshaping how we build, integrate and use AI,”

-Dr. Keith Dreyer, Chief Data Science Officer, Mass General Brigham.

Technological advancement is driving the medical imaging market growth, particularly through the development and adoption of portable, wearable, and point-of-care (POC) medical imaging devices. These innovations have expanded the capabilities of medical imaging and made it more accessible and convenient. By integrating cutting-edge technologies, the medical imaging sector is now able to offer solutions that can be used outside of traditional hospital settings, enabling continuous monitoring and immediate diagnostics in various environments. This shift towards more mobile and user-friendly devices has the potential to revolutionize patient care, making it easier to diagnose and monitor conditions in real time, thus significantly improving the efficiency and effectiveness of healthcare services.

For instance, in February 2024, Visage Imaging, a diagnostic imaging and multimedia enterprise, introduced its new product, Visage Ease VP. This innovative imaging platform is designed for use with Apple's augmented reality headset, the Apple Vision Pro. The company provides cloud-based, AI-driven enterprise imaging solutions such as Visage 7, Visage Ease, and Visage Ease Pro. These platforms enable users to review diagnostic images and work together with peers. Visage Imaging states that its technology enhances the efficiency and accuracy of radiologists' analyses and their overall workflow.

"The visualization of three-dimensional medical imaging in immersive space creates exciting opportunities to improve patient care,"

-Dr. Paul Murphy, associate clinical professor at UC San Diego School of Medicine and radiologist at UC San Diego Health

Aspen state developed AiRTouch, a portable X-ray system equipped with a built-in touchscreen workstation. The touchscreen workstation allows medical professionals to acquire an image directly from the device and transmit it to a Picture Archiving and Communication System (PACS) without using a PC. The portability of the device proved to be advantageous; various imaging centers in South Korea are using it for medical imaging purposes. For instance, in November 2022 , Siemens Healthineers introduced Magnetom Viato Mobile, an MRI unit at 1.5 Tesla. This latest MRI scanner is specifically designed for mobile applications and incorporates a patient bore diameter of 70 centimeters. Therefore, rapid advancements in medical imaging devices are expected to boost their adoption, thereby driving the overall market growth.

Market Concentration & Characteristics

The medical imaging industry is characterized by a significant level of concentration, with a few major players dominating the industry. Key players such as GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems Corporation, and Fujifilm Holdings, are dominating the industry. The industry is in a mature growth stage, with steady technological advancements and incremental innovation. Its pace is relatively fast, driven by rapid technological advancements and the demand for early and accurate disease diagnosis. The industry sees a steady stream of innovation, particularly in areas such as artificial intelligence, machine learning, and 3D imaging, which enhance imaging systems' capabilities and diagnostic accuracy.

The medical imaging industry is characterized by a high degree of innovation, with companies consistently developing products that enhance efficiency and safety. For instance, in February 2023, Boston Imaging (a subsidiary of Samsung Medison Co., Ltd.) unveiled the Hera W10 Elite, a specialized version of the Hera platform tailored for obstetrics and gynecology. This advanced model offers clinicians robust AI capabilities and clinical applications to improve diagnostic accuracy. Boston Imaging is the U.S. headquarters responsible for marketing, sales, and distribution of all Samsung digital radiography and ultrasound systems.

Regulations play a significant role in the medical imaging industry, as products must meet stringent safety and efficacy standards set by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The impact of regulations can be seen in the lengthy and expensive process of bringing new imaging technologies to market. For instance, in December 2023, The U.S. Food and Drug Administration (FDA) classified the recall of Philips' medical imaging devices, specifically some models of the Panorama 1.0T HFO device (MRI Systems), as the most critical type, indicating that their usage could potentially lead to serious injuries or even fatalities. This action comes in light of concerns that an explosion could occur during a "quench procedure" due to an excessive accumulation of helium gas. Following the announcement, shares of Philips listed in the U.S. saw a decrease of approximately 1%.

Mergers and acquisitions in the medical imaging industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in July 2022, Canon Medical Systems USA, Inc., a branch of Canon Medical Systems Corporation, finalized the purchase of NXC Imaging, a company based in Minneapolis, Minnesota, specializing in medical devices and services.

Product substitutes in the medical imaging industry include alternative diagnostic methods, such as blood tests and biopsy procedures. However, medical imaging offers unique advantages, such as the ability to visualize internal body structures non-invasively, which often makes it the preferred diagnostic method.

The medical imaging industry is experiencing robust global expansion due to increasing healthcare expenditure, technological advancements, and growing demand for diagnostic services. For instance, in January 2022, Shanghai United Imaging Healthcare Co., LTD is building a manufacturing and R&D center, integrating technology, research, and intelligent manufacturing, with a USD 490 million investment. The campus, spanning 420,000 square meters, will accommodate 8,000 to 10,000 employees, focusing on global branding and international training.

Technology Insights

The magnetic resonance imaging segment accounted for the largest market share of 27.2% in 2023. MRI systems have applications in imaging of various organs, including the abdomen, pelvis, brain, spine, heart, and breast as well as musculoskeletal structure. For instance, in June 2023, GE HealthCare disclosed the FDA endorsement and release of Sonic DL, a deep learning-driven technology that notably expedites image capturing in magnetic resonance imaging (MRI).

“Sonic DL is a paradigm shift for MR enabling high-quality imaging in a single heartbeat,” said Jie Xue, President & CEO, Global MR, GE HealthCare.

Advancements in MRI technology aimed at broadening their application range are predicted to propel market growth during the forecast period. Recent innovations, including diffusion and diffusion tensor imaging using tractography, perfusion imaging, and neuroimaging methods like MR spectroscopy, along with the use of the BOLD technique for functional imaging, are expected to enhance the growth of the magnetic resonance imaging market. Moreover, the growing advancements in intraoperative MRI, along with its varied uses in areas like neurosurgery, are anticipated to contribute to market growth.

The computed tomography segment is expected to showcase the fastest CAGR from 2024 to 2030. It produces high-resolution images that allow healthcare professionals to visualize internal structures with exceptional clarity, aiding in diagnosing and treating various medical conditions. CT scans are commonly used to detect organ, tissue, and bone abnormalities and guide surgical procedures. With technological advancements, CT imaging has become faster, more accurate, and safer, contributing significantly to medical diagnostics and patient care across various medical specialties.

Furthermore, several private and government organizations are investing heavily in R&D. For instance, TriState Health has been granted USD 2.5 million in federal funds for its Patient Imaging Project in April 2023. This initiative includes the acquisition of two CT scanners and one MRI scanner. It aims to enhance imaging services and speed up patient diagnoses across a three-state, eight-county region.

Application Insights

The orthopedic imaging segment dominated the market in 2023 by capturing 32.33% of global revenue share. A rise in bone injuries and orthopedic conditions, along with the expanding use of imaging technology in orthopedic care, are key drivers for the growth of the orthopedic imaging market. According to the data published by the WHO in December 2023, about 1.19 million people die each year as a result of road traffic accidents.

The following table shows number of road accidents, injuries / deaths for the key countries for 2022:

Country

Injuries

Deaths

Germany

361,134

2,788

Japan

355,995

3,216

Korea

281,803

2,735

Italy

223,475

3,159

United Kingdom

141,576

1,750

France

65,430

3,267

Sweden

15,261

227

Norway

4,485

116

The cardiology segment is expected to grow at the fastest CAGR from 2024 to 2030, attributed to the increased prevalence of cardiovascular disorders, awareness of early disease diagnosis, and product innovations specifically for cardiology applications. For instance, as reported by the British Heart Foundation, in September 2023, about 620 million of the global population is living with heart and circulatory diseases. Moreover, 60 million people around the world develop a heart or circulatory disease every year. Therefore, the growing prevalence of CVD is expected to boost the demand for early disease diagnoses, propelling the market growth.

Furthermore, Siemens, Canon, and Hitachi introduced four new scanners specifically designed for cardiovascular CT at RSNA 2023 (December 2023). These vendors highlighted that their latest models are equipped with improved capabilities for coronary imaging, responding to the increasing market demand for such technologies. The field of Coronary Computed Tomography Angiography (CCTA) has experienced swift expansion and widespread acceptance, especially after receiving a Class 1A endorsement as a primary imaging technique in the 2021 guidelines from the American Heart Association (AHA) and the American College of Cardiology (ACC) for managing chest pain.

"I predict in the next four to five years, we are going to see a lot of growth in cardiac CT and we are going to need more people. We already see that interest coming from the cardiology side. I am talking to colleagues here at RSNA, and there is also interest on the radiology side,"

-Joao Cavalcante, MD, section head for cardiac imaging for the Allina Health Minneapolis Heart Institute,

End-use Insights

The hospitals segment accounted for the largest revenue share of 42.0% in 2023. The hospital segment encompasses healthcare facilities primarily providing inpatient and outpatient care, diagnostic services, and treatment interventions. This segment plays a crucial role in adopting and utilizing medical imaging technologies, including X-ray, MRI, CT scans, and ultrasound, to aid in disease diagnosis, treatment planning, and patient health monitoring. For instance, in October 2022, Philips introduced ClarifEye, an Augmented Reality (AR) surgical navigation solution in Japan. The company highlights the positive outcomes of the first treated patients by the International University of Health and Welfare, Mita Hospital in Tokyo, Japan. Hospitals invest significantly in advanced imaging equipment and technology to enhance diagnostic accuracy, improve patient outcomes, and meet the growing demand for medical imaging services driven by an aging population and increasing prevalence of chronic diseases.

The diagnostic imaging centers segment is projected to showcase the highest CAGR over the forecast period, owing to an increase in awareness about chronic diseases such as cancer, neurological diseases, and neurodegenerative disorders. This has accelerated the demand for CT and MRI procedures used for diagnosis, treatment planning, and prevention of chronic disorders. Additionally, diagnostic imaging centers are focusing on the integration of technology such as AI to enhance their imaging capabilities. For instance, In April 2023, Unilabs partnered with SmartSoft Healthcare to enhance the lumbar spine MRI reading and reporting. This partnership demonstrated the expansion of AI in the field of diagnostic imaging services for improving efficiency and accuracy.

Regional Insights

The North America medical imaging market held the largest revenue share of 36.6% in 2023. This can be attributed to various factors, such as increased adoption of medical imaging technology in primary care settings, improved accessibility, and high healthcare spending in countries with efficient reimbursement policies. The increasing incidence of chronic diseases, including breast cancer, cardiovascular disorders, and neurological diseases, has created a high demand for imaging analysis. The region is expected to maintain its dominance over the forecast period. Technological innovations and the growing incidence of chronic conditions are anticipated to further propel the regional market growth.

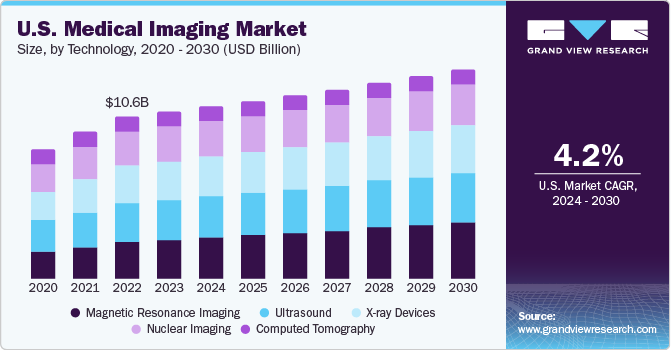

U.S. Medical Imaging Market Trends

The medical imaging market in the U.S. held a significant share of North America in 2023. This can be attributed to factors such as advancing technologies, changing patient care strategies, and evolving epidemiological patterns. The need for radiologists in imaging continues to be robust nationwide in urban and rural settings. The American Society of Radiologic Technologists reports that about 350,000 radiologists are registered and employed in healthcare environments. Furthermore, projections from the U.S. Bureau of Labor Statistics anticipate a 9% growth in the employment of radiologic and MRI technologists by 2030, resulting in an additional 21,600 job opportunities.

Europe Medical Imaging Market Trends

The medical imaging market in Europe is witnessing growth fueled by increased investments in research and development from the public and private sectors. Moreover, the escalating demand for healthcare equipment and the prevalence of chronic and pain-related conditions in the region are key drivers expected to further boost market expansion.

The medical imaging market in the UK is one of the major markets in the region. Increasing General Practice (GP) referrals for MRI examinations in the UK is expected to boost the demand for MRI systems. According to NHS England, in 2021, the total number of MRI examinations performed for NHS patients in England was around 3,544,475. Furthermore, the presence of efficient reimbursement policies and the growing burden of chronic diseases are contributing to the increasing volume of MRI examinations.

The France medical imaging market is expected to grow over the forecast period, due to the growing burden of cancer in the country. According to the International Agency for Research on Cancer, in 2022[, there were about 483,568 new cancer cases in the country and 190,612 related deaths. Furthermore, the growing burden of breast cancer is expected to boost the adoption of medical imaging devices.

The medical imaging market in Germany is projected to expand over the forecast period, owing to a rapidly aging population, prevalence of chronic diseases, presence of a sophisticated healthcare system, a highly qualified workforce, and high healthcare spending.Germany has a lucrative environment for technologically innovative startups. Around 80% of the medical device manufacturers, including companies of medical imaging devices in the country are SMEs. The presence of major market players, such as Siemens Healthcare GmbH, is anticipated to create lucrative opportunities in Germany.

Asia Pacific Medical imaging Market Trends

The medical imaging market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. This can be attributed to the rapid growth of the population and increased R&D activity in this region. In addition, there is a high need for traditional and advanced devices in Asia Pacific, contributing the regional industry growth.

The Japan medical imaging market is expected to grow at the fastest CAGR in the coming years. This can be attributed to the launch of novel medical imaging devices, which are available at affordable prices, coupled with a growing interest shown by physicians in early clinical interventions For instance, in June 2020, Philips declared that Lumify, its handheld ultrasound solution, is available in Japan commercially.

The medical imaging market in China is expected to grow over the forecast period. Changes in demographics & disease patterns and growth of the private healthcare sector are among the key factors expected to drive this growth. For instance, in May 2020, the China National Medical Product Administration (NMPA) granted system Class III medical product qualification to MGIUS-R3 developed by MGI, the world's first remote robotic ultrasound, allowing it to enter the Chinese market and provide state-of-the-art long-distance ultrasound diagnostic services.

The India medical imaging market in India is expected to grow over the forecast period, due to the increasing birth rates, awareness about prenatal care, and economic reform activities Many manufacturers are investing and expanding their businesses, boosting the regional market growth. For instance, in May 2022, Philips announced the expansion of its Manufacturing and Research and Development Facility in Maharashtra, India. The unit houses the MR radio frequency coil, mobile surgery systems, and ultrasound assembly businesses, among others.

Latin America Medical imaging Market Trends

The medical imaging market in Latin America is experiencing significant growth attributed to various factors, such as the increasing awareness about chronic diseases leading to a substantial number of diagnosed cases, boosting the demand for early disease diagnosis. Furthermore, clinical education through conferences, symposiums, and webinars is becoming crucial in improving the adoption of medical imaging devices. For instance, Bracco, a global leader in diagnostic imaging, and the European Society of Radiology (ESR), a non-profit professional organization committed to enhancing and consolidating European radiology, are pleased to announce a renewed collaboration to introduce "Next Generation Radiology" at the European Congress of Radiology (ECR) 2024. Thus, such initiatives are expected to increase the application & reach and awareness of ultrasound technology in Mexico, thereby fueling market growth.

The medical imaging market in Saudi Arabia is anticipated to expand during the forecast period due to technological innovation. The country is focusing on the digitalization of healthcare by leveraging innovative technologies, such as AI, big data, and cloud computing. There are currently 150 health-tech startups in the country. Such advancements are resulting in shorter hospital stays and a rise in the number of surgical procedures, which, in turn, is driving the demand for medical imaging devices.

The medical imaging market in Kuwait is expected to grow over the forecast period, due to a favorable investment outlook, with the country focusing on investments in the private sector. Moreover, the country offers medical imaging devices at subsidized rates in the public sector, owing to the plans of Kuwait’s Ministry of Health. This is expected to drive the demand for medical imaging and provide significant growth opportunities for players in the country.

Key Medical Imaging Company Insights

The market is characterized by its dynamic and competitive nature. The market is led by key players such as GE Healthcare; Siemens Healthineers; and Koninklijke Philips N.V., Canon Medical Systems Corporation, and FUJIFILM VisualSonics Inc. Companies are heavily investing in R&D to introduce innovative products with better imaging capabilities and reduced radiation exposure. There is a notable trend of mergers and acquisitions as companies aim to expand their product portfolios and enter new markets. Many companies are forming strategic partnerships with healthcare providers to improve the adoption and integration of advanced imaging technologies in clinical practice.

Key Medical Imaging Companies:

The following are the leading companies in the medical imaging market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Mindray Medical International

- FUJIFILM VisualSonics Inc.

- Carestream Health

- Hitachi

- Samsung Medison Co., Ltd.

- Koning Corporation

- PerkinElmer Inc.

- Konica Minolta

- Esaote

- Hologic, Inc.

- Varex Imaging

Medical Imaging Market Trends And Emerging Players/Startups:

The introduction of artificial intelligence (AI) and machine learning (ML) has significantly enhanced the precision and efficiency of medical imaging. The AI in medical imaging market has seen substantial growth recently, drawing heavy investments from both new startups and well-established firms. These firms are utilizing AI technologies to create cutting-edge solutions for medical imaging. These innovations aim to increase diagnostic accuracy, expedite the diagnostic process, and enhance the overall outcomes for patients.

Some of the startups in the medical imaging market include:

-

FUSE-AI: Specializes in developing advanced artificial intelligence solutions to interpret medical imaging, aiding in faster and more accurate diagnoses for various conditions.

-

Care Mentor AI: This company leverages AI technology to provide decision support for healthcare professionals, enhancing patient care through intelligent diagnostics and treatment recommendations.

-

Brainomix: Focuses on stroke imaging software that utilizes AI to support clinicians in identifying the extent of brain damage and making swift treatment decisions, aiming to improve outcomes for stroke patients.

-

Caption Health: Uses artificial intelligence to make ultrasound technology more accessible and easier to use. Their software assists medical professionals in capturing and interpreting ultrasound images, broadening the scope of where and by whom ultrasounds can be performed.

-

FITPU Healthcare: A tech company that develops AI-driven applications designed to improve healthcare delivery, including tools for patient monitoring, diagnostics, and treatment optimization.

-

Medical Harbour: Provides digital platforms that connect patients with healthcare services, leveraging AI to personalize care plans and recommendations, thus improving patient engagement and outcomes.

-

AetherAI: Specializes in digital pathology, offering AI-powered solutions that assist pathologists in diagnosing diseases by analyzing tissue samples more efficiently and accurately.

-

Dr CADx: A startup focused on developing AI systems to help diagnose medical images more accurately in regions with insufficient radiologists, particularly in developing countries.

-

Exo Imaging: Aims to revolutionize medical imaging through handheld ultrasound technology. Their AI-enhanced devices are designed to deliver high-quality imaging at a lower cost, making diagnostic imaging more accessible.

Recent Developments

-

In March 2024, GE Healthcare has developed its latest research model, SonoSAMTrack1, utilizing NVIDIA technology. This innovative model is built upon a promptable foundational model known as SonoSAM1, which is designed for object segmentation in ultrasound imagery. The primary function of SonoSAMTrack is to delineate anatomical structures, lesions, and other critical regions within ultrasound images. A more simplified iteration of this model, dubbed SonoSAMLite, has also been introduced.

“Combining NVIDIA’s accelerated computing and AI technology stack with GE HealthCare’s medical imaging expertise will help enhance patient care by making ultrasound diagnostics quicker and more accurate,”

-David Niewolny, Director of Business Development for Healthcare and Medical, NVIDIA.

-

In January 2024, Canon introduced Aplio me, a cutting-edge shared-service ultrasound system engineered to address the varied needs of everyday users in a broad range of medical environments. This exceptionally portable and light system is ideal for ultrasound experts who prioritize high efficiency in their workflow and seek sophisticated standard solutions, from smaller clinics to major hospitals.

“Aplio me is more than just another ultrasound machine; it is a personalized companion for each individual user, improving their specific workflow and giving them diagnostic confidence with every exam. The highly customizable, user-centric system design ensures that users can not only get their work done quickly and with high quality, but also set up their workplace ergonomically, quietly and efficiently,"

- Akihiro Sano, General Manager of the Ultrasound Systems Division at Canon Medical Systems Corporation in Japan.

-

In January 2024, Canon Medical Systems Corporation along with Olympus Corporation declared their partnership to work together on Endoscopic Ultrasound Systems. Under this agreement, Canon Medical is tasked with the development and manufacturing of diagnostic ultrasound systems for use in Endoscopic Ultrasonography, while Olympus will handle the sales and marketing activities. This partnership aims to merge the capabilities of Canon's Aplio i800 diagnostic ultrasound system for EUS with Olympus' Ultrasound Endoscope, aiming to supply advanced EUS equipment to the market, ensuring high-quality imaging diagnostics.

-

In November 2023, Canon Medical Systems has introduced significant upgradation to its CT product line, featuring the launch of two new scanners. The introduction includes a new premium model (Aquilion ONE / INSIGHT Edition) and a model designed for high efficiency (Aquilion Serve SP), both of which were presented at the Radiological Society of North America Congress (RSNA) happening in Chicago, Illinois, USA.

-

In February 2023, GE Healthcare announced that it reached an agreement to acquire a privately held AI healthcare provider, Caption Health, Inc. Caption Health develops clinical applications to help with early disease diagnosis and uses AI to help with ultrasound scans.

-

In May 2023, Koninklijke Philips N.V. announced the launch of the Philips CT 3500, which is a high-end CT system targeting the requirements of routine radiology and high-volume screening programs.

Medical imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.6 billion

Revenue forecast in 2030

USD 55.4 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation; Mindray Medical International; FUJIFILM VisualSonics Inc.; Carestream Health; Hitachi; Samsung Medison Co., Ltd.; Koning Corporation; PerkinElmer Inc.; Konica Minolta; Esaote; Hologic, Inc.; Varex Imaging

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Imaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical imaging market report based on technology, application, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray Devices

-

Radiography

-

Fluoroscopy

-

Mammography

-

-

Ultrasound

-

Handheld

-

Compact

-

Cart/Trolley based

-

-

Computed Tomography

-

High end slice CT

-

Mid end slice CT

-

Low end slice CT

-

Cone beam CT

-

-

Magnetic Resonance Imaging

-

Closed system

-

Open system

-

-

Nuclear Imaging

-

SPECT

-

PET

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Oncology

-

Neurology

-

Orthopedics

-

Gastroenterology

-

Gynecology

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics imaging centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical imaging market size was estimated at USD 39.8 billion in 2023 and is expected to reach USD 41.6 billion in 2024.

b. The global medical imaging market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 55.4 billion by 2030.

b. North America dominated the medical imaging market with a share of 36.63% in 2023. This is attributable to the presence of a large number of industry players and the high frequency of new product launches within the region.

b. Some key players operating in the medical imaging market include GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation; Mindray Medical International; Esaote.; Hologic; Samsung MedisonCo., Ltd. , Koning Coporation; Perkin Elmer; FUJIFILM VisualSonics Inc.; Cubresa Inc.

b. Key factors that are driving the medical imaging market growth include increasing prevalence of lifestyle-related diseases, rising demand for early detection tools, technological advancements to improve turnaround time, increased investment and reimbursement initiatives undertaken by the government

b. Hospitals accounted for the largest share of 42.0% in the end-use segment of the medical imaging market in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."