- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Polymer Market Size, Share & Growth Report, 2030GVR Report cover

![Medical Polymer Market Size, Share & Trends Report]()

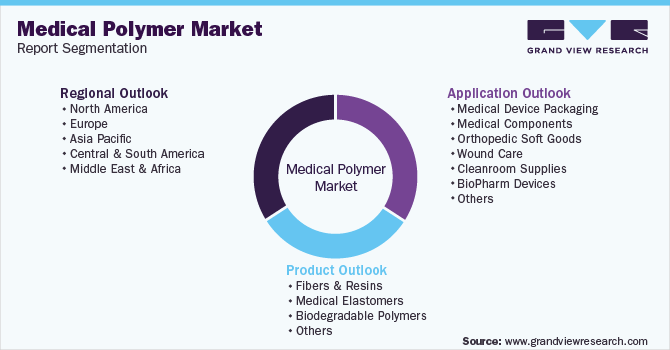

Medical Polymer Market Size, Share & Trends Analysis Report By Product, By Application (Medical Device Packaging, Tooth Implants, Wound Care, Mobility Aids, Denture-based Materials), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-143-6

- Number of Pages: 170

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Report Overview

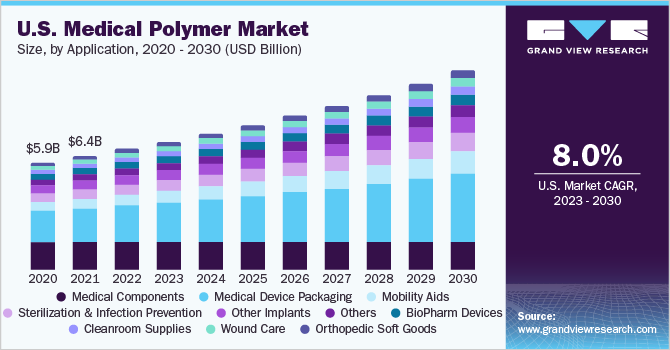

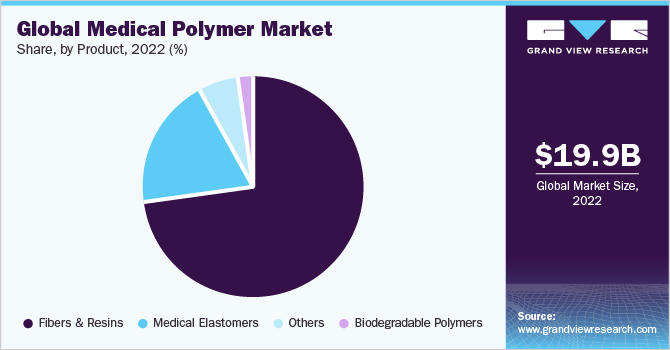

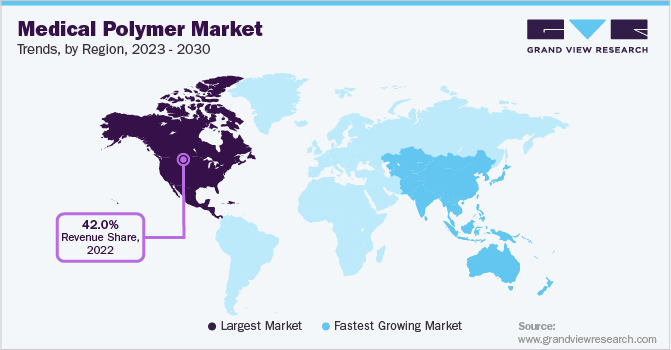

The global medical polymer market size was valued at USD 19.92 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. Factors, such as increasing demand from the medical industry are anticipated to fuel the demand for medical-grade polymers. Polymers are classified as synthetic and natural polymers based on raw materials. Naturally occurring polymers include bio-based polymers, wood, and natural rubber, whereas synthetic polymers include thermosets & thermoplastic resins, elastomers, and fibers. Increasing per capita healthcare spending in the form of health insurance in the U.S. has been one of the significant trends impacting the growth of the market in North America. This is expected to augment the demand for generic drugs and medical devices in the coming years, thereby driving the market in North America during the forecast period. This industry's critical applications include medical components manufacturing and pharmaceutical packaging.

The presence of key government initiatives such as the Affordable Care Act (ACA) and Medicaid has enabled a large percentage of the population to gain access to healthcare facilities and services in the U.S. This has further boosted the demand for branded drugs, medical devices, and healthcare services, thereby driving the need for medical polymers in the country, primarily in applications such as medical components, packaging, and wound care.

The Canadian healthcare industry is attracting significant investments from both the public and private sectors. According to Canadian Institute for Health Information (CIHI), the government planned to spend USD 308 billion in 2021 on the healthcare sector. The country is characterized by high health consciousness and high life expectancy, viz., 85 years for women and 79 years for men, thus, posing lucrative growth opportunities for medical polymer manufacturers in Canada.

Product Insights

Fibers & resins across the product segmentation dominated the market in 2022 in terms of both volume and revenue owing to the high chemical & electrical resistance offered by resins such as polypropylene (PP) and polyethylene (PE). Furthermore, polycarbonate polymer resins offer heat resistance, strength, and toughness, which enables them to replace metal and glass in many medical products. The optical clarity is a vital characteristic in clinical and diagnostic contexts where blood, tissues, and other fluids must be visible.

Extrusion of medical polymers can result in monofilaments, which are single threadlike synthetic fibers. These medical-grade monofilaments can be used in magnetic resonance imaging (MRI) as an alternative to metal filaments. Also, medical polymer fibers exhibit a high strength-to-weight ratio, making them an ideal choice for many minimally invasive devices and medical clothing.

Silicone is a widely used medical elastomer in medical applications. Its favorable characteristics include the ability to operate in temperatures ranging between -50°C and +250°C, water repellency, non-allergic nature, excellent resistance to ozone, weather, and UV rays, and compatibility with steam, ETO, and gamma radiations making it ideal for use in medical applications.

Application Insights

The applications considered for the North America medical polymers industry include medical device packaging, medical components, wound care, mobility aids, and tooth implants. Increasing incidences of lifestyle-related diseases in the region, including diabetes and cardiac arrests, have resulted in increased spending on healthcare by the population. This is expected to boost the demand for medical devices, generic drugs, and healthcare services, thereby positively influencing the global medical polymer market size.

Increased global usage of orthopedic soft goods has led to a surge in demand for propylene and polyether ether ketone (PEEK) polymers. PEEK polymer is chosen as a premium material for developing plastic casts and braces used in medical applications owing to its high strength and resistance to adverse environmental conditions. In addition, the global demand for PEEK polymers is expected to rise owing to the increasing efforts by manufacturers of orthopedic goods for reducing the overall weight of their products by material substitution. Moreover, the global demand for PEEK polymers is projected to be driven by their easy molding abilities leading to superior shaping of orthopedic goods.

Region Insights

North America was the largest segment in 2022 and accounted for more than 42.0% of the overall revenue share.Medical Components led the market in 2021, in terms of both volume and revenue in the region. The rising demand for medical polymers in pharmaceutical packaging applications and the rapid growth of pharmaceutical industries in Mexico and Canada is expected to further fuel the growth. For instance, the repealing of stringent regulations by the Mexican government that restricted the establishment of new manufacturing units has resulted in the establishment of new pharmaceutical manufacturing facilities by major companies such as Takeda and Astellas in Mexico.

An increasing geriatric population and rising occurrence of chronic diseases in the region have augmented the demand for medical devices. This is expected to drive the demand for medical polymers in equipment manufacturing over the forecast period. Increasing government investments in the healthcare sector and the growing home healthcare market are anticipated to drive the demand for medical devices, which, in turn, is expected to positively influence the growth of the market for medical polymers over the forecast period.

Key Companies & Market Share Insights

Major players are continuously working on expanding manufacturing capabilities with the rise in demand from the medical industry.In July 2021, Celanese Corporation has announced the expansion of a drug delivery feasibility lab to its Florence, Kentucky R&D center. The building of a new feasibility lab will advance the development of long-acting controlled-release medication delivery. Rising population, pandemics like the COVID-19 outbreak, better living conditions, and rising disposable income are all driving global medical business growth. Some prominent players in the global medical polymer market include:

-

BASF SE

-

NatureWorks LLC

-

Covestro AG

-

Celanese Corporation

-

Eastman Chemical Corporation

-

Evonik Industries AG

-

Dow Inc.

-

Exxon Mobil Corporation

-

Arkema

-

Koninklijke DSM NV

-

Formosa Plastics Corporation

-

Foryou Medical

-

KRATON CORPORATION

-

SABIC

-

Trinseo S.A.

Medical Polymer Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 21.51 billion

Revenue forecast in 2030

USD 36.77 billion

Growth Rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan; Malaysia; Singapore; Oceania; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Celanese Corporation; SABIC; Dow Inc.; NatureWorks LLC.; Exxon Mobil Corporation; Covestro AG; Eastman Chemical Corporation; Evonik Industries AG; Arkema; koninklijke DSM NV; Formosa Plastic Corporation; Foryou medical; KRATON CORPORATION; Trinseo SA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Polymer Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical polymer market report based on, product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fibers & Resins

-

Medical Elastomers

-

Biodegradable Polymers

-

Polylactic Acid (PLA)

-

Polyhydroxyalkanoate (PHA)

-

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Medical Device Packaging

-

Medical Components

-

Orthopedic Soft Goods

-

Wound Care

-

Cleanroom Supplies

-

BioPharm Devices

-

Mobility Aids

-

Sterilization & Infection Prevention

-

Tooth Implants

-

Denture-based Materials

-

Other Implants

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Singapore

-

Oceania

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical polymer market size was estimated at USD 19.92 billion in 2022 and is expected to reach USD 21.51 billion in 2023.

b. The global medical polymer market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 36.77 billion by 2030.

b. The fibers & resins segment dominated the medical polymer market with a share of 73.20% in 2022. The growing use of fibers and resins in various applications including spinal implants, cranial injuries, and hip and joint replacements is anticipated to drive the demand in the segment.

b. Some key players operating in the medical polymer market include BASF SE, Bayer Material Science AG, Celanese Corporation, DSM N.V., and Exxon Mobil Corporation.

b. Key factors that are driving the medical polymer market growth include the high adoption of polymers for implants due to chemical inertness and superior fatigue resistance.

b. The medical components segment dominated the global medical polymer market in 2022, accounting for 42.93% of the global revenue share.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."