- Home

- »

- Beauty & Personal Care

- »

-

Global Men's Grooming Products Market Size Report, 2030GVR Report cover

![Men’s Grooming Products Market Size, Share, & Trends Report]()

Men’s Grooming Products Market Size, Share, & Trends Analysis Report By Product (Skin Care, Hair Styling, Shave/Beard Care, Accessories, Color Cosmetics), By Distribution Channel, By Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-887-9

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

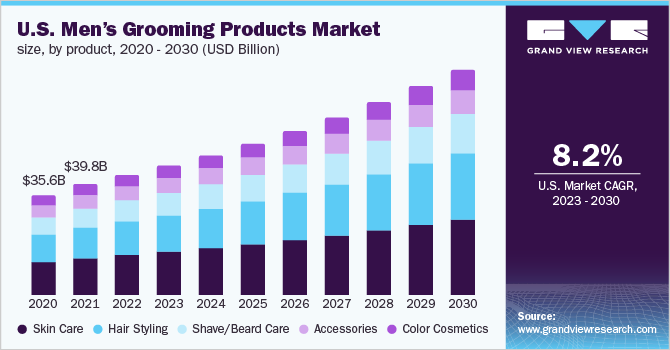

The global men’s grooming products market was valued at USD 202.6 billion in 2022 and is projected to expand at a CAGR of 8.0% from 2023 to 2030. Men are increasingly spending heavily on grooming goods as attitudes about conventional masculinity have shifted due to the rise of the metrosexual male and the growing influence of celebrities and influencers. Furthermore, an increase in the number of men’s salons is fueling demand for male grooming brands worldwide. Aside from that, some market participants are developing new electrical items, such as shavers and razors, by incorporating new performance characteristics based on cutting-edge technology. For instance, in November 2021, Philips launched Norelco Shaver Series 9000 with artificial intelligence for a smarter shaving experience, targeting the urban population.

During the spread of the COVID-19 pandemic, the men's segment witnessed a surge in demand across the globe as men were able to take extra care of themselves because they had taken a break from their routine. According to an article published by Entertainment Times, an authoritative source on Hollywood, celebrities, royals, movies, music, and TV shows in April 2022, 45% of GenZ men were encouraged to use grooming products at the same time. In addition, the pandemic led to stockpiling of items, which resulted to have altered people's shopping habits towards e-commerce platforms.

Growing skin concern among men such as sensitivity, aging, inflammatory conditions, acne, and dryness is expected to drive the demand for the skincare segment. Hence, key players are launching products to cater to the demand of consumers with serious skin conditions. For instance, in March 2022, Denver stepped into the advanced men’s grooming segment with the launch of a new product range backed by science. The new and improved catalog consists of body wash, beard oil, and a beard comb. Furthermore, new product launches will help increase the scope of the market in the coming years.

Males increasingly prefer natural grooming brands to chemical-based grooming brands. This has led to a rise in demand for brands that are safe, natural, organic, and cruelty-free in recent years. For instance, in July 2021, IDAM House of Brands, the parent company of Bella Vita Organic announced the launch of a new direct-to-consumer (D2C) skincare and grooming brand BRAVE Essentials, with products formulated using natural ingredients and no harsh chemicals. The rise in the trend of premiumization in demand for men's grooming products, with an increased impact of clean-label ingredients, has led to the high price of organic men's grooming products.

In addition, the increasing number of innovative brand launches to cater to the growing product demand from customers is expected to further support the growth of the market. For instance, in September 2021, CavinKare entered the men’s grooming market with the launch of a new personal care brand Biker’s. The brand’s product line includes 2-in-1 shampoo-conditioners, beard oil, beard cream, and shower gel to meet the needs of the urban male. The brand is said to be focused more on the mass market and is targeting the new spaces that are emerging in hair care, face care, and body care.

The increasing demand for toiletries and shaving products is propelling the demand for the market. Furthermore, awareness concerning cleanliness and personal hygiene is another significant factor boosting the market growth. According to an article published by Harvard University, in July 2019, on average men tidy up for 10 minutes every day. Moreover, the availability of a wide variety of these products online is accelerating the demand. The e-commerce platform further provides various offers on these products, which is boosting online sales.

Product Insights

The skin care segment led the market and accounted for a share of around 33.3% in 2022. Increasing awareness among males regarding personal hygiene and grooming globally has been driving the demand for men’s skincare products over the years. According to an article published by Tiege Honley, in January 2020, 83% of men aged 65 and up agreed that guys need to get serious about taking care of their skin. Furthermore, macro-level factors such as rising disposable income among consumers and mushrooming growth of distribution channels are bolstering the demand for men’s skincare brands worldwide.

The hair styling segment is anticipated to expand at the fastest CAGR of 8.8% over the forecast period. Growing adoption of organic hair styling products, rising trends for grooming and styling, and the emergence of various hair colorants and hair styling brands are some of the key factors driving the hair styling market growth revenue. According to an article published by the University of Halmstad, in November 2019 23% said hair styling is as important for men as it is for women. In addition, increasing fashion trends and beauty awareness among individuals is another factor driving the growth of the market.

Distribution Channel Insights

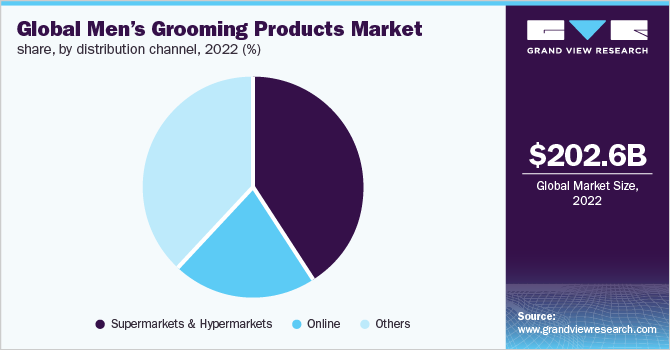

The supermarkets and hypermarkets segment captured the major share of over 41.3% in 2022. The growth of the segment is mainly driven by the rising consumer inclination towards supermarkets & hypermarkets as a primary source to purchase beauty and personal care products. According to a study by FashionNetwork.com in 2020, men are more likely to buy brands after touch and feel the experience in supermarkets & hypermarkets as only 22% of men shop frequently on their mobile devices. These establishments also provide a reasonable selection of products and assist customers in making rapid purchasing decisions for the required skincare product.

The online segment is anticipated to expand at the highest CAGR of 12.6% over the forecast period. E-commerce development in the personal care and skincare industry has been rapid, with companies launching online websites and shopping apps to increase their brand visibility among consumers. For instance, in December 2022, Nykaa launched NykaaMan.com dedicated to men’s grooming. The website will offer brands across categories like shaving, hair care, grooming kits, bath & body, beard care, sexual wellness, and sports nutrition. In addition, it will also offer the best brands and products for men along with expert advice and opinions on choosing the best regime.

Type Insights

The mass segment accounted for the largest revenue share of 72.3% in the year 2022. The focused marketing and expansion of product portfolio by mass personal care and cosmetics companies such as Procter & Gamble and Beiersdorf have increased the demand for mass personal care products. For instance, in May 2022, Nivea, a brand of Beiersdorf, launched a themed U.K. campaign called "Strength in Numbers” to encourage men to open up about their mental health. These activities make brands more visible and attract new customers. Also, the increasing trend of grooming among men in the middle-income group in developing regions is propelling the demand for the mass segment.

The premium segment is anticipated to expand at the highest CAGR of 10.5% over the forecast period. Increased social media marketing by premium product such as LVMH is creating curiosity and awareness among the targeted crowd and is likely to boost the market in the forecasted period. Furthermore, the surge in the use of professional brands in salons is also a key driver of premium products in the men’s segment. For instance, L’Oreal Professionnel, a brand of L’Oreal Groupe, has premium brands in its portfolios such as Ends-Filler Concentrate (In-Salon) and Single Dose Treatment (15 ML - PRO LONGER).

Regional Insights

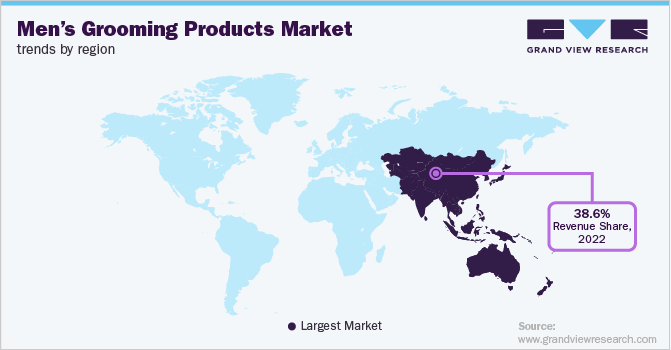

Asia Pacific dominated the market and accounted for the largest revenue share of over 38.6% in 2022. An increase in awareness regarding personal care among consumers is a key factor behind this growth in the region. Over the past years, the skincare routine has become more elaborate for men of all ages and this factor has led to the emergence of several startups serving the unmet needs and growing demand in this field. For instance, in September 2021, Macscaped expanded its business to the men’s grooming market in the Asia Pacific.

North America is expected to witness the second-fastest growth in the coming years. Rising demand on account of the rising metrosexual culture in the region is expected to drive the growth of the market. North America is home to prominent players, such as Louis Vuitton, Beiersdorf, and Estée Lauder, who manufacture luxury and high-quality products, which is further expected to increase product visibility among consumers. For instance, in April 2022, intimate men’s brand Balls launched the Hero trimmer for men in the U.S. with a three-month automatic blade renewal.

Key Companies & Market Share Insights

Some of the major companies operating in the market are increasingly focusing on product launches and expansion of the distribution channel to gain prominent visibility among consumers. Some of the initiatives are:

-

For instance, in September 2022, Michael Strahan launched a skincare collection for men, the product range includes a hydrating face and beard wash, clear shave lotion, calming post-shave balm, face and neck moisturizer, and conditioning beard oil.

-

In June 2022, Shiseido launched the men's skincare line Sidekick for the Asian market.

-

launched men’s facial cleanser.

Some of the prominent players in the men’s grooming products market include:

-

Beiersdorf AG

-

Procter & Gamble Co.

-

L'Oréal SA

-

Shiseido Co., Ltd.

-

Vi-john Group

-

Colgate-Palmolive Company

-

Kao Corporation

-

Estee Lauder Companies, Inc.

-

Reckitt Benckiser

-

Coty, Inc.

Men’s Grooming Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 218.5 billion

Revenue forecast in 2030

USD 376.4 billion

Growth rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Beiersdorf AG; Procter & Gamble Co.; L'Oréal Groupe; Shiseido Co., Ltd.; Vi-john Group; Colgate-Palmolive Company; Kao Corporation; Estee Lauder Companies, Inc.; Reckitt Benckiser; Coty, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Men’s Grooming Products Market Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global men’s grooming products market based on product, distribution channel, type, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Skin Care

-

Hair Styling

-

Shave/Beard Care

-

Accessories

-

Color Cosmetics

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Online

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Mass

-

Premium

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global men’s grooming products market size was valued at USD 202.6 billion in 2022 and is expected to reach USD 218.5 billion in 2023.

b. The global men’s grooming products market is expected to witness a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 376.4 billion by 2030.

b. The skin care segment led the market and accounted for a share of around 33.3% in 2022. Increasing awareness among males regarding personal hygiene and grooming globally has been driving the demand for men’s skincare products over the years.

b. Some key players operating in the men’s grooming products market Beiersdorf AG; Procter & Gamble Co.; L'Oréal Groupe; Shiseido Co., Ltd.; Vi-john Group; Colgate-Palmolive Company; Kao Corporation; Estee Lauder Companies, Inc.; Reckitt Benckiser; Coty, Inc.

b. Key factors such as the increase in the number of men’s salons and increased spending on grooming products are expected to drive the market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."