- Home

- »

- Biotechnology

- »

-

Metagenomics Market Size, Share And Growth Report, 2030GVR Report cover

![Metagenomics Market Size, Share & Trends Report]()

Metagenomics Market Size, Share & Trends Analysis Report By Technology (Shotgun Sequencing, 16S Sequencing, Whole Genome Sequencing), By Product, By Workflow, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-452-9

- Number of Pages: 115

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Metagenomics Market Size & Trends

The global metagenomics market size was valued at USD 1.34 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.8% from 2023 to 2030. The reduced cost of sequencing is anticipated to accelerate the adoption of metagenomics in various applications. Therefore, a wide range of international and national genome projects have been introduced in recent years. For instance, in April 2023, Pattern Ag announced that it has created the largest single ecosystem database based on metagenomics. This project aims towards creating global soil microbiome map which will help in agro genomics research.

The revenue growth strategy is implemented by expanding its offering in infectious diseases across the U.S. Metagenomics played a vital role in developing a vaccination for COVID-19 through sequencing technology.

Numerous players extended sequencing programs for efficient monitoring of mutation for supporting the development of effective COVID-19 vaccines. For instance, in December 2021, researchers from the University of Calgary conducted a study on the use of metagenomics workflow in the identification of COVID-19 and its variants. The study concluded that the metagenomics technique can be useful when pathogens emerge.

Similarly, in April 2020, the overall COVID-19 vaccination R&D included 115 vaccine candidates. Around 72% of vaccines were developed by private players, while 28% were as developed as collaborative projects led by academic, public sector, and other nonprofit organizations. However, by February 2022, participation by Latin American and MEA regions impacted the regional growth, owing to increasing biotech startups and rising initiatives by international players to establish a domestic manufacturing facility in the regions to facilitate the supply & distribution.

The global metagenomics industry is surging as the outcome of advancement in technology have led to a substantial decline in the cost of genome sequencing over the past few years. For instance, Illumina introduced a sequencing system with higher throughput in 2010 for around USD 10,000. The innovation and technological advancement assisted the company to bring the cost to USD 600 in 2021. As a result, an increase in the number of metagenomics studies and their usage in clinical applications for sequence analysis has been reported.

Strategic initiatives undertaken by academic institutions and companies to advance innovative technologies are anticipated to support the upward market momentum of metagenomics. For instance, in September 2022, Illumina, Inc. announced to invest in six genomics startups from the U.K., South Africa, Ireland, Israel, Indonesia, and the U.S. As of September 2022, the company has invested in 74 genomics-based startups. Along with the seed investment, access to business guidance, Illumina's sequencing reagents and systems, operational labs, and genomics expertise are offered to the startups.

Although the deteriorating pricing of sequence analysis is projected to accelerate the industry’s growth, the variable costs have a considerable impact on revenue generation. The declining cost along with improved sensitivity made metagenomics sequencing a valuable supplement to PCR-based diagnostic assays. Hence, this resulted in the increasing use of multiple metagenomics services in clinics.

Technology Insights

The shotgun sequencing segment is projected to register a substantial CAGR of 16.0% from 2023 to 2030. Numerous academic institutions and research centers are adopting technology for their genetic studies. For instance, in July 2022, an article published on the portal of Arthritis & Rheumatology stated that the background of genetics along with disease activity impacts the composition of gut microbiota. The study performed shotgun sequencing to derive the conclusion.

Whole genome sequencing, on the other hand, has projected significant growth in the industry during the forecast period. Companies are making focused efforts to expand their business operations in the clinical rare disease diagnosis space. For instance, in June 2021, Rady Children’s Institute for Genomic Medicine partnered with Pacific Biosciences for research related to whole-genome sequencing. The initiatives aim to detect possible disease-causing genetic variants and increase the solve rates of rare disorders.

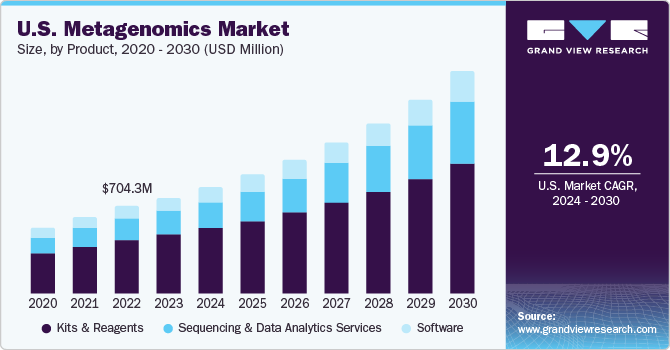

Product Insights

Kits and reagents dominate the metagenomics market with the largest share of 61.3% in 2022. A variety of reagents are employed in sequencing during the experimental preparation of the sample. The market comprises established companies such as F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., and Illumina Inc. with a wide range of reagents to match the requirements in sequencing.

On the other hand, sequencing and data analytics services are estimated to report the fastest growth. This is attributed to the increase in the adoption of sequencing leads to a higher demand for data analysis platforms. Similarly, Companies are either providing services to perform metagenomics data interpretation or introducing products in the market so that research entities are involved in clinical practice.

For instance, ArrayGen Technologies Pvt. Ltd. offers a wide range of NGS data analysis services in the field of cancer genomics, disease association studies, agriculture biotechnology, and personalized medicine. The company utilizes 454, Illumina, Ion-Torrent, SOLID, Nanopore, PacBio, and other platforms to provide services for de novo assembly of transcriptome and genome, metatranscriptome analysis, Comparative Genomics Analysis (CGA) & annotation, 16S/28S/ITS rRNA metagenomic analysis, and custom arrays for validation of NGS data.

Workflow Insights

The sequencing segment held the largest revenue share of 53.9% in 2022 and is expected to maintain a similar trend with the fastest CAGR. This can be attributed to the technological advancement in sequencing resulting in it becoming more cost-effective and accurate. Companies are employing sequencing methods regularly for their genetic research, which is an essential part of genetic testing. Advancements in technology have decreased the cost of sequencing by 28% yearly.

Globally, the adoption of sequencing is a significant determinant of industry growth. According to an article published in September 2022, African regions lagged in the sequencing of genomics during the initial years of COVID-19. However, owing to increased funding, more than 100,000 genomes have been sequenced from the region. Such factors are anticipated to drive growth in the coming years.

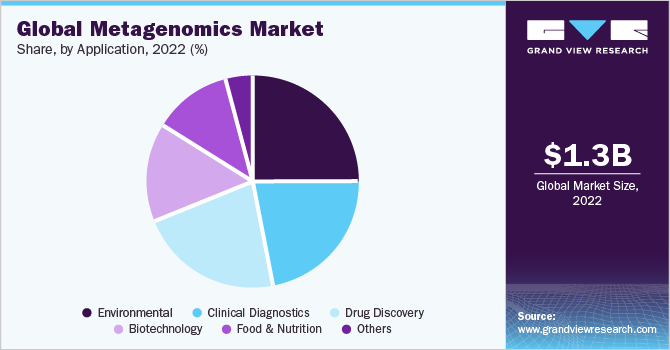

Application Insights

The environmental segment captured the highest revenue share of 25.1% in 2022. Metagenomics research is rapidly developing its space in agriculture and environmental protection. Metagenomics is a new technique to understand microorganisms received from a particular environment through sequencing analysis or gene screening. According to the research conducted by Capital Medical University and Peking University Ditan Teaching Hospital in December 2021, next-generation sequencing and third-generation sequencing have showcased the advantages of rapid identification of pathogenic microorganisms.

Furthermore, clinical diagnostics is the emerging application of metagenomics with the fastest CAGR during the forecast period. Along with the diagnostics of infectious diseases, the adoption of metagenomics in clinical laboratories is also increasing and various applications have been incorporated into a regular practice of clinical.

Regional Insights

North America dominated with a share of 47.6% in 2022. This dominance can be determined by the existence of key companies in the region with an increased circulation of funds in R&D, coupled with advancements in sequencing technology. The market witnessed collaboration between companies and academic institutions and is one of the key strategies used in the region. For instance, in September 2021, the Broad Institute established a partnership with the CDC and Theiagen Genomics to accelerate support for public health labs in the U.S. The primary focus of the partnership is to enable the surveillance of pathogen genomics around the U.S.

The Asia Pacific region is anticipated to witness the fastest growth during the forecast period owing to the extensive developments by India and China in the adoption of metagenomics in numerous applications. The increasing focus on genomics and proteomics research, coupled with increasing strategic initiatives by academic institutions for innovative development in sequencing have impacted the Asia Pacific market of metagenomics with lucrative growth opportunities throughout the forecast period.

Key Companies & Market Share Insights

Numerous companies are undertaking several strategies including product discovery and development, vertical collaboration, and building a robust product portfolio via mergers and acquisitions. For instance, in February 2021, QIAGEN extended its collaboration with INOVIO Pharmaceuticals for the development of liquid biopsy-based CDx products that can deploy the NGS method to complement INOVIO's therapy, VGX-3100. VGX-3100 is an immunotherapy designed for the treatment of advanced cervical dysplasia associated with HPV. This initiative is anticipated to strengthen clinical applications of metagenomics. Some prominent players in the global metagenomics market include:

-

Bio-Rad Laboratories

-

Illumina, Inc.

-

PerkinElmer, Inc.

-

Thermo Fisher Scientific, Inc.

-

Novogene Co., Ltd.

-

Promega Corporation

-

QIAGEN

-

Takara Bio, Inc.

-

Oxford Nanopore Technologies

-

F. Hoffmann-La Roche Ltd.

Metagenomics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.53 billion

Revenue forecast in 2030

USD 4.02 billion

Growth rate

CAGR of 14.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

technology, product, application, workflow, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bio-Rad Laboratories, Illumina, Inc., PerkinElmer, Inc., Thermo Fisher Scientific, Inc., Novogene Co., Ltd., Promega Corporation, QIAGEN, Takara Bio, Inc., Oxford Nanopore Technologies, F. Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Metagenomics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global metagenomics market report on the basis of technology, products, application, workflow, and region:

-

Product Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits & Reagents

-

Sequencing & Data Analytics Services

-

Software

-

-

Technology Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Shotgun Sequencing

-

16S Sequencing

-

Whole Genome Sequencing

-

Others

-

-

Workflow Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-sequencing

-

Sequencing

-

Data Analysis

-

-

Application Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Environmental

-

Clinical Diagnostics

-

Drug Discovery

-

Biotechnology

-

Food & Nutrition

-

Others

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global metagenomics market size was estimated at USD 1.34 billion in 2022 and is expected to reach USD 1.53 billion in 2023.

b. The global metagenomics market is expected to grow at a compound annual growth rate of 14.8% from 2023 to 2030 to reach USD 4.02 billion by 2030.

b. Kits & reagents segment dominated the metagenomics market with a share of 61.3% in 2022. This is attributed to a substantial number of kits and reagents being launched and used to support the rising demand for library preparation workflows from research laboratories.

b. Some key players operating in the metagenomics market include Illumina, Inc.; Promega Corporation; Novogene Corporation; Oxford Gene Technology, Inc.; Thermo Fisher Scientific, Inc.; TAKARA BIO INC.; Danaher; QIAGEN; and ELITechGroup.

b. Key factors that are driving the market growth include increasing interest of researchers in metatranscriptomics, metaproteomics, & metabolomics; and rapid advancements in genomic technologies & ancillary protocols.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."