- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Metallic Pigments Market Size, Share, Industry Report, 2022GVR Report cover

![Metallic Pigments Market Size, Share & Trends Report]()

Metallic Pigments Market Size, Share & Trends Analysis Report By Product (Aluminum, Zinc, Copper), By Application (Paints & Coatings, Cosmetics), By Region, And Segment Forecasts, 2015 - 2022

- Report ID: 978-1-68038-770-4

- Number of Pages: 159

- Format: Electronic (PDF)

- Historical Range: 2012 - 2013

- Industry: Bulk Chemicals

Industry Insights

The global metallic pigments market size was valued at USD 773.5 million in 2014. The industry is driven by increasing demand for high-performance pigments with eco-friendly attributes in major applications such as coatings, printing, cosmetics, and building materials. Growing consumer demand for specialty products and attractive packaging has made metallic pigment an ideal option for printing decorative labels and eye-catching graphics.

Printing ink manufacturers have been increasingly incorporating these pigments into various formulations to offer fashionable, durable, and long-lasting special effects for flexible packaging and other applications. Automotive paints and industrial coatings have been the major consumers and are likely to generate high demand owing to economic rec

Development of innovative metal oxides with unique substrate layering and new flake technology has opened up lucrative avenues for growth, even in developed markets that are hampered by stringent regulations. Metallic pigment or metallic is widely used in personal care products and cosmetics to manufacture high quality, dermatologically safe make-up, and skincare solutions.

High-performance zinc-copper blends offer unique and long-lasting gold-bronze effects to various cosmetics, thereby leading to rapid growth in this product segment. Metallics have been rapidly gaining importance over conventional solid colors, on account of their sustainability, versatility, compatibility, low maintenance, and high resistance to chemicals and degradation.

Increasing regulatory intervention by the Swiss Chemicals Ordinance (ChemO) and REACH in Europe, tightening VOC and environmental legislation in China, and growing concerns globally over pigment migration in packaging inks are likely to hamper market growth over the forecast period. Heavy metals such as cadmium and chromium are also phased out by manufacturers owing to environmental and toxicity concerns associated with exposure of these metals in cosmetics, paints, construction materials, and related applications.

Emerging economies such as India, China, Brazil, and Argentina are the major consumers of pigment, where the automotive and manufacturing sectors have been expanding at a rapid pace for the last few years. Automotive sales across the globe have witnessed significant growth from 42 million in 2012 to 45 million in 2015. Metallics, especially aluminum pigments, are increasingly adopted in numerous high sheen powder coatings and paints to impart special effects to vehicles.

Recent innovations and technological advancements have led to the development of pigments based on silver dollar aluminum flakes that offer enhanced brilliance, unique sparkling behavior, and extreme saturation. Moreover, they have given rise to various other inventions such as energy curable pigments that help conserve energy in the building and construction industry.

The global industry is regulated by various agencies with policies and regulations ranging from environmental to economical. Major regulatory policymakers that command industry dynamics include the U.S. Food & Drug Administration (FDA), the U.S. Environment Protection Agency (EPA), European Commission, Registration, Evaluation, Authorization & Restriction of Chemicals (REACH), and European Chemicals Agency (ECHA).

Product Insights

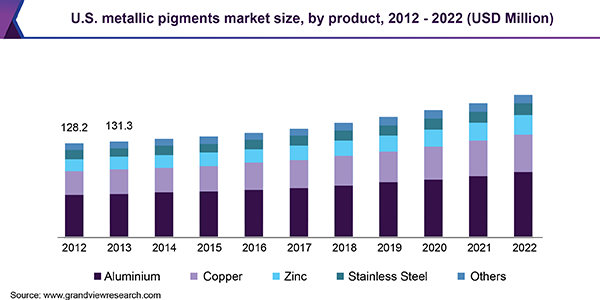

The global market can be classified based on product as aluminum, zinc, copper, stainless steel, and other heavy metals such as cadmium, chromium, and iron oxide. In 2014, aluminum occupied the largest market share of over 40.0% in terms of revenue as well as volume. It is available in various grades such as leafing, non-leafing, and vacuum metalized. Growing acceptance of the product in automotive paints and coatings on account of high metallic luster and durability is likely to boost the segment growth.

In 2014, copper held the second largest market share in terms of revenue and volume. Zinc is anticipated to emerge as the fastest-growing product at a volume-based CAGR of 6.9% over the forecast period. Copper and zinc witnessed high demand on account of rising consumer preference for unique gold-bronze color effects, especially in cosmetics.

Application Insights

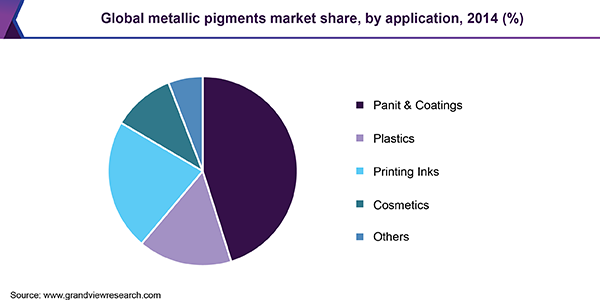

The global industry is segmented on the basis of application into paints and coatings, plastics, printing inks, cosmetics, and others including food, paper, textiles, and construction materials. Paints and coatings occupied 45.1% share of the overall revenue in 2014. The segment growth is attributed to increasing construction activities in emerging economies to support growing population, coupled with stringent regulations encouraging low VOC content in paints.

The cosmetics sector is expected to expand at the fastest CAGR in terms of revenue as well as volume over the forecast period. Moreover, the segment is anticipated to account for 10.9% share of the overall volume by 2022. Increasing focus on beauty and appearance, coupled with rising preference for unique color effects and brilliant finishes, is boosting the segment growth.

Regional Insights

Asia Pacific led the global industry and accounted for over 35.0% share of the overall revenue and volume in 2014. The growth is attributed to high product penetration in expanding end-use industries such as packaging, plastics, and automotive. The region is also anticipated to emerge as the fastest-growing market over the forecast period.

Increasing urbanization and evolving fashion trends are contributing to high product demand in Central and South America and Middle East and Africa. Rapid industrialization and growing consumer awareness regarding sustainability and low toxicity of these coloring agents are favoring market growth in countries such as Brazil, Argentina, South Africa, UAE, and Saudi Arabia.

Metallic Pigments Market Share Insights

The global industry is characterized by the presence of multinational and domestic companies that are integrated along the value chain from metal granulate processing to pigment manufacturing. Key industry participants include BASF, Sudarshan Chemicals, Eckhart Pigments, Schlenk Metallic Pigments, Sun Chemical Performance Pigments, Ferro Corporation and Carlfors Bruk. Other key companies include Toyal America Inc.; Asahi Kasei Corporation; Umicore; and Siberline Manufacturing Co.

Report Scope

Attribute

Details

Base year for estimation

2014

Actual estimates/Historical data

2012 - 2013

Forecast period

2015 - 2022

Market representation

Volume in Kilotons, Revenue in USD Million, and CAGR from 2015 to 2022

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S., Germany, U.K., France, China, India, and Brazil

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."