- Home

- »

- Healthcare IT

- »

-

mHealth Apps Market Size, Share & Growth Report, 2030GVR Report cover

![mHealth Apps Market Size, Share & Trends Report]()

mHealth Apps Market Size, Share & Trends Analysis Report By Type (Medical Apps, Fitness Apps), By Platform (Android, iOS), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-555-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

mHealth Apps Market Size & Trends

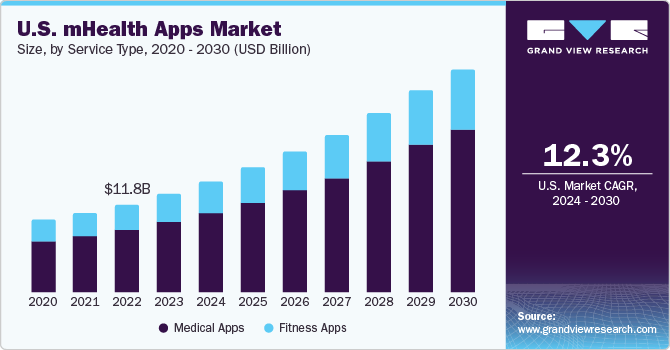

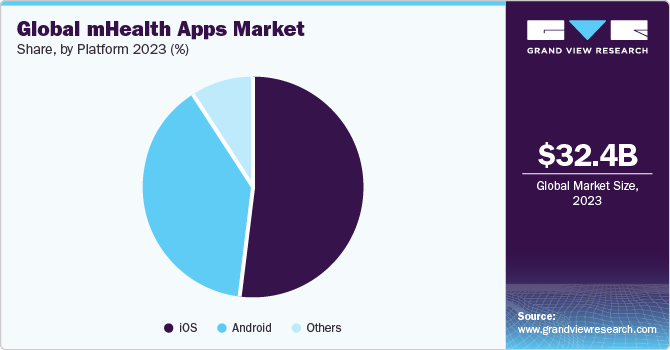

The global mHealth apps market size was estimated at USD 32.42 billion in 2023 and is anticipated to grow at a CAGR of 14.9% from 2024 to 2030. Growing adoption of fitness and medical apps to collect and track individuals’ health-related data and to improve the overall health of patients using smartphones are the major factors anticipated to drive market growth. In addition, increasing internet and smartphone penetration and growing awareness of maintaining physical health and lifestyle improvement further boost the adoption, thereby supporting market growth. For instance, in 2022, 84 million people in the U.S. utilized healthcare apps to monitor their health-related activities.

Furthermore, favorable government strategies, increasing funds, and rising collaboration activities between various healthcare institutions are expected to drive market growth over the forecast period. For instance, in April 2021, my mHealth Limited, a digital therapeutics company, and three European collaborators were granted a USD 2.75 million Eurostars Grant for their innovative project, CUOREMA. This joint program was funded by the national budgets of 36 EUREKA countries and the European Union's Horizon 2020 initiative. MyHeart app, developed by my mHealth Limited, has secured sponsorship from Innovate UK, a UK funding body, to develop a cardiac rehabilitation support feature in Europe.

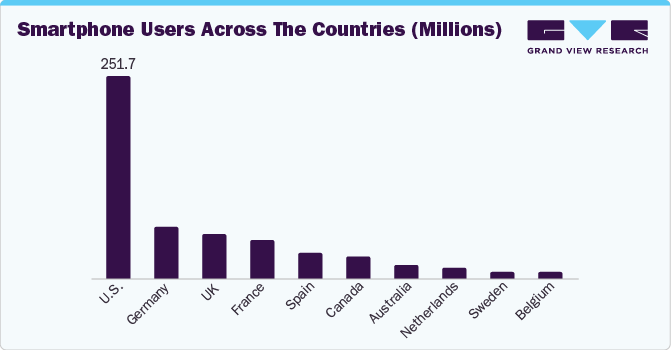

The industry growth is expected to be facilitated by the increasing penetration of smartphones. According to the Mobile Economy 2023 report, smartphone penetration was at 76% in 2022 and is predicted to reach 92% by 2030. Furthermore, continuous network infrastructure and coverage improvement are anticipated to boost the demand for mHealth apps. Mobile network operators view mHealth as an investment opportunity due to the growing adoption of smartphones and rising fitness awareness.

The rising prevalence of chronic diseases worldwide, including diabetes, hypertension, cardiovascular diseases, and respiratory conditions, is supplementing segment growth. For instance, in 2022, the estimated new cancer cases in India were around 1.5 million. Furthermore, the number of cancer cases is projected to rise by 12.8% in 2025 compared to 2020. The mHealth apps for chronic disease management offer a comprehensive suite of tools & features for self-monitoring, medication adherence, lifestyle tracking, and remote consultation, enabling individuals to manage their conditions more effectively and improve their quality of life.

Some examples of mHealth apps are as follows

Unmind, Ovia Health, Nutrimedy, Sony’s mSafety Mobile Health, Sony’s mSafety Mobile Health, and MDCalc mHealth apps are revolutionizing the healthcare sector.

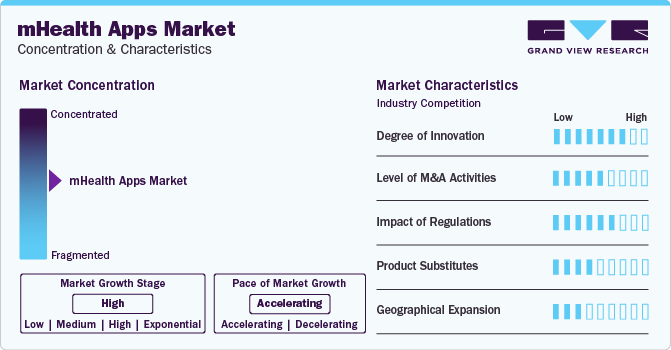

Market Concentration & Characteristics

The global mHealth apps market is characterized by a high degree of innovation, with new apps and technologies being developed and introduced regularly. Many people are adopting these apps as they enable patients to monitor their health-related activities and maintain an updated health record. Thus, industry players invest in new technologies and methods to meet the growing demand. For instance, in August 2023, Suniel Shetty, an Indian Bollywood actor, collaborated with Veda Rehabilitation & Wellness to launch Let’s Get Happi, a mental health app. The app provides features, such as assessment tests & meditation, and 24/7 access to therapy from psychologists

The market is characterized by a moderate level of merger and acquisition (M&A) activities by leading players. Market players are adopting this strategy to gain access to new technologies and advancements and the need to consolidate in a rapidly growing market. In February 2022, Stryker completed the acquisition of Vocera Communications, Inc. This acquisition would provide multiple growth opportunities in the digital healthcare space. In addition, Vocera Communications’ innovative product portfolio enhanced Stryker’s advanced digital healthcare business segment

Developing mHealth apps and wearables can be expensive, as some apps require regulatory approval from the FDA and government bodies to diagnose diseases. Furthermore, the FDA encourages the advancement of mobile medical apps (MMAs) that have the potential to enhance healthcare and provide patients and healthcare providers with valuable health-related insights. In addition, the FDA is responsible for ensuring that medical devices, including MMAs, comply with safety and efficacy standards to safeguard public health. Furthermore, mHealth software must comply with HITECH, HIPAA, FDA regulations for Medical Devices, and GDPR to ensure the security, privacy, and integrity of patient information

To facilitate the FDA approval process of mHealth apps, the FDA suggests using the STRIDE framework, which helps market players ensure the safety, efficacy, and security of their apps. This framework can streamline the FDA approval process.

STRIDE framework

-

S - Spoofing

-

T - Tampering

-

R - Repudiation

-

I - Information Disclosure

-

D - Denial of Service

-

E - Elevation of Privileges

Apart from mHealth, several other options are available that rely on conventional services and interventions. These include standard medical treatments, traditional practices such as face-to-face consultations, and paper-based health records, which can also be used in the healthcare sector

Many companies are strengthening their market positions by expanding geographically. This can be achieved by partnerships, collaborations, launching new facilities, and acquiring & merging with companies based in different locations. In October 2021, Vodafone Group entered a strategic partnership with Deloitte to launch Vodafone Center for Health, a virtual care center, utilizing its connected health solutions and Deloitte’s healthcare consulting expertise to enhance healthcare accessibility across Europe

Type Insights

The medical apps segment accounted for the largest revenue share in 2023 and is expected to register the fastest CAGR of 15.3% from 2024 to 2030. Increasing awareness to adopt medical applications among patients and healthcare professionals for better communication and healthcare outcomes is helping boost segment growth. Moreover, an increase in the number of new apps and easy availability of many medical apps in the market is anticipated to boost their demand. Some popular medical apps are Epocrates, Medscape, MedPage Today, 3D4Medical, AHRQ ePSS, and Airstrip Cardiology.

The fitness apps segment is anticipated to grow lucratively during the forecast period due to the rising adoption of fitness-related applications and increasing awareness of self-health management. Growing emphasis on adopting a healthy lifestyle and increasing usage of wearable devices, tablets, and smartphones to access fitness apps are driving the segment growth. For instance, MyFitnessPal, a calorie-tracking app, reported the most users in 2020 at 200 million. There were 560 million health users in 2022, a 22.5% increase from 2021. Moreover, rising awareness regarding diet-related diseases is anticipated to propel segment growth over the forecast period.

Platform Insights

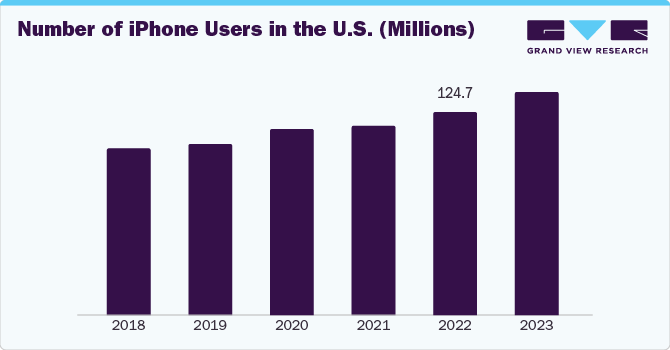

The iOS platform segment dominated the global industry, in terms of revenue share, in 2023. The growth of this segment can be attributed to the high adoption and popularity of the iOS platform among consumers across the globe. According to data published by Business of Apps in 2021, market share of iOS in the UK increased from 47% in Q3 of 2020 to 51.6% in Q3 of 2021.

The Android segment is anticipated to grow at the fastest CAGR of 15.9% over the forecast period owing to the increasing adoption of Android-based smartphones on account of their cost-effectiveness. For instance, according to BankMyCell.com, there are 3.9 billion Android smartphone users across the globe. Similarly, in the U.S., 43.8% of residents use Android smartphones. Thus, such a rise in the number of smartphone users will lead to segment growth in the coming years.

To stand out among the multitude of mHealth apps available on the App Store and Google Play store, an app should possess the following features, regardless of the platform it is designed for:

-

Streamlined, user-friendly UX

-

Cybersecurity infrastructure

-

Reminder integration for appointments, routines, and medication

-

Integration for health goals with related mHealth apps and infrastructure

-

Engaging prompts for health promotion

-

Document management

-

Telehealth communications

-

AR/VR for appointments and health management

-

Back-up options to track and store data

-

Educational features

Regional Insights

The North America mHealth apps marketdominated the global industry with a revenue share of 46.6% in 2023. Increasing mobile usage & healthcare expenditure, growing 5G networks, and rising number of government initiatives & funding are driving the regional market growth. As per the World Bank statistics, the per capita national health expenditure in North America in 2022 was about USD 11,076.74. Furthermore, rising chronic disease prevalence and increasing geriatric population in the region are expected to support market growth. For instance, as per the Population Reference Bureau, the U.S. population aged 65 years and above was estimated to grow from 58 million in 2022 to 82 million by 2050.

U.S. mHealth Apps Market Trends

The mHealth apps market in the U.S. led the North America regional market owing to the presence of a large number of companies operating in various areas, such as mobile & network operations, healthcare management, and software development. Market players are involved in introducing innovative healthcare apps, building network infrastructure, and increasing the adoption of various mHealth apps in the U.S. For instance, in August 2023, MedWorks, a Canadian tech company, brought its health and wellness service app to the U.S., starting with Florida.

Asia Pacific mHealth Apps Market Trends

The Asia Pacific mHealth apps market is expected to grow at the fastest CAGR from 2024 to 2030 owing to increasing usage of smartphones & smart wearables and high adoption of mHealth apps. Factors, such as increasing incidence of chronic & infectious diseases, rising healthcare expenditure, ineffective hospital service management, and a growing elderly population, are compelling governments & healthcare providers to develop new healthcare delivery models. For instance, in January 2024, JD Health introduced a new elderly care channel on its app to provide a comprehensive platform for the various healthcare needs of China's aging population.

The mHealth apps market in India holds a significant share of the Asia Pacific regional market revenue. The rising use of smartphones and the launch of new healthcare apps are expected to drive the adoption of mobile platforms for various healthcare services. For instance, in February 2024, the “Health On Us” app was introduced offering, two primary services, such as care at home and care at the center.

Middle East & Africa mHealth Apps Market Trends

The Middle East & Africa mHealth apps market is expected to see significant growth in the coming years. The mHealth solutions are transforming healthcare in this region, driven by the growing internet connectivity and government initiatives. Telemedicine, mHealth apps, wearable devices, and Artificial Intelligence (AI) are the major trends revolutionizing healthcare accessibility, costs, & outcomes in the region. For instance, the UAE aims to leverage advanced technologies, such as AI and big data analytics, to improve healthcare outcomes & patient experiences.

The mHealth apps market in Saudi Arabia is undergoing substantial growth. The adoption of mHealth technologies in Saudi Arabia is in its nascent stage. Increasing smartphone penetration and improving internet connectivity are some of the major drivers boosting the adoption rate. According to Ubuy estimates, approximately 92% of the Saudi population either has access to or owns a smartphone. The number of smartphone users has significantly increased from 14.31 million individuals in 2013 to 33.55 million individuals in 2024.

Key mhealth Apps Company Insights

Market players are adopting strategies, such as partnerships & collaborations, product launches, and M&As, to increase their industry share. For instance, in January 2021, Google, Inc. acquired Fitbit, a health and fitness app. The strategy aims to make health and wellness more accessible to people. In November 2022, Hartford HealthCare entered a long-term partnership with Google Cloud to advance the healthcare system by improving data analytics digital transformation and enhancing the delivery of care & access.

Key mhealth Apps Companies:

The following are the leading companies in the mHealth apps market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Google Inc.

- AirStrip Technologies, Inc.

- Samsung Electronics Co. Ltd.

- Veradigm LLC (Allscripts Healthcare Solutions)

- Qualcomm Technologies, Inc.

- AT&T

- Orange

- Teladoc Health, Inc.

- AstraZeneca

- Abbott

- Sanofi

- Johnson & Johnson Services, Inc.

- Novartis AG

- Pfizer Inc.

Recent Developments

-

In September 2023, Enovacom, a subsidiary of Orange Business, acquired NEHS Digital and Xperis to develop solutions for the healthcare sector and strengthen its position in e-health

-

In March 2023, Google launched Open Health Stack, an open-source program for developers to build health-related apps by including strategies such as AI partnerships focusing on cancer screening

-

In February 2022, Stryker completed the acquisition of Vocera Communications, Inc. This acquisition would provide multiple growth opportunities in the digital healthcare space. In addition, Vocera Communications’ innovative product portfolio enhanced Stryker’s advanced digital healthcare business segment

-

In January 2022, AT&T collaborated with Smart Meter to develop advanced digital health solutions for monitoring and tracking chronic ailments, such as diabetes, using Smart Meter’s IoT devices and AT&T’s well-established IoT network

-

In October 2021, Greenway Health, in partnership with MD Revolution, expanded its Greenway Care Coordination Services—its care management solutions. These solutions are used in chronic care management and remote patient monitoring in ambulatory care settings

mHealth Apps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.48 billion

Revenue forecast in 2030

USD 86.37 billion

Growth rate

CAGR of 14.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; Australia; Singapore; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Apple Inc.; Google Inc.; AirStrip Technologies, Inc.; Samsung Electronics Co. Ltd.; Veradigm LLC (Allscripts Healthcare Solutions); Qualcomm Technologies, Inc.; AT&T; Orange; Teladoc Health, Inc.; AstraZeneca; Abbott; Sanofi; Johnson & Johnson Services, Inc.; Novartis AG; Pfizer Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global mHealth Apps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the mHealth apps market report on the basis of type, platform, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Apps

-

Women's Health

-

Fitness & Nutrition

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Disease Management

-

Menopause

-

Others

-

-

Chronic Disease Management Apps

-

Obesity Management Apps

-

Mental Health Management Apps

-

Diabetes Management Apps

-

Blood Pressure and ECG Monitoring Apps

-

Cancer Management Apps

-

Other Chronic Disease Management Apps

-

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

Fitness Apps

-

-

Platform Outlook (Revenue, USD Million; 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mHealth apps market size was estimated at USD 32.42 billion in 2023 and is expected to reach USD 37.48 billion in 2024.

b. The global mHealth apps market is expected to grow at a compound annual growth rate of 14.9% from 2024 to 2030 to reach USD 86.37 billion by 2030.

b. Medical apps dominated the mHealth apps market with a share of 71.5% in 2023. This is attributable to the high availability of a broad category of services that help a user manage and track different conditions.

b. Some key players operating in the mHealth apps market include Abbott Laboratories; Johnson and Johnson; AstraZeneca PLC; F. Hoffmann-La Roche Ltd.; Novartis AG; Bristol-Myers Squibb Company; GlaxoSmithKline plc; Merck and Co., Inc.; Pfizer, Inc.; and Sanofi.

b. Key factors that are driving the mHealth apps market growth include the rising promotion of mHealth apps to create positive health outcomes along with the increasing preference for mobile apps.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."