- Home

- »

- Clinical Diagnostics

- »

-

Molecular Diagnostics Market Size And Share Report, 2030GVR Report cover

![Molecular Diagnostics Market Size, Share & Trends Report]()

Molecular Diagnostics Market Size, Share & Trends Analysis Report By Product (Reagents, Instruments), By Technology (PCR, INAAT), By Application (Oncology, Genetic Testing), By Test Location, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-086-6

- Number of Pages: 270

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Molecular Diagnostics Market Size & Trends

The global molecular diagnostics market size was estimated at USD 15.20 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. Factors, such as technological advancements, an increasing geriatric population, and increasing demand for accurate & effective genetic testing are boosting market growth. Moreover, rising demand for point-of-care testing can be attributed to increasing demand for self-testing diagnostics and rising patient awareness about faster diagnostics, which is encouraging industry players to develop novel testing products. For instance, in February 2023, Huwel Lifesciences designed a portable RT-PCR machine to test different types of viruses.

The company claimed that the test takes around 30 minutes and can be used to conduct the test for respiratory and other infections using blood and gastrointestinal samples. The rising geriatric population globally is at a higher risk of developing numerous diseases, including cancer, cardiovascular diseases, obesity, neurological disorders, and diabetes. According to the World Bank Group data, in 2022, there were about 779 million people aged 65 years & above globally. In addition, the number of individuals aged 80 years and above is projected to double by 2050, to surpass more than 1.5 billion. Thus, growing geriatric population is expected to be a high-impact rendering driver of the market. In addition, the growing incidence of infectious diseases is expected to propel market growth.

Rising target population due to high incidence of STIs, such as HIV and HPV, is expected to drive industry growth. According to the WHO, the prevalence and incidence of HIV were approximately 39 million and 1.3 million, respectively, in 2022 across the globe. Furthermore, people suffering from HIV are highly susceptible to other infections, such as tuberculosis, which is the leading cause of death among HIV-affected people. Rising number of initiatives by key players to improve access to cost-effective resources is anticipated to drive market growth. Molecular diagnostics render accurate & effective results and have indispensable applications in disease diagnostics. For instance, in December 2023, Co-Diagnostics, Inc. submitted documents for review of the Co-Dx PCR COVID-19 test with Co-Dx PCR Pro instrument to the U.S. FDA for emergency use authorization.

These tests and instruments are designed for use at POC and at-home settings. Increasing introduction of novel molecular diagnostic products and favorable initiatives undertaken by government and non-government bodies further support the market expansion. For instance, in November 2023, F. Hoffmann-La Roche Ltd launched LightCycler PRO System to raise the usability of molecular PCR testing in translational research and in vitro diagnostic applications. Similarly, BARDA’s 2022-2026 Strategic Plan supports development and authorization of advance pathogen-specific diagnostics. Moreover, BARDA supports T2 Biosystems’s T2Biothreat Panel, a blood molecular diagnostic test, which can detect six pathogens in a single sample.

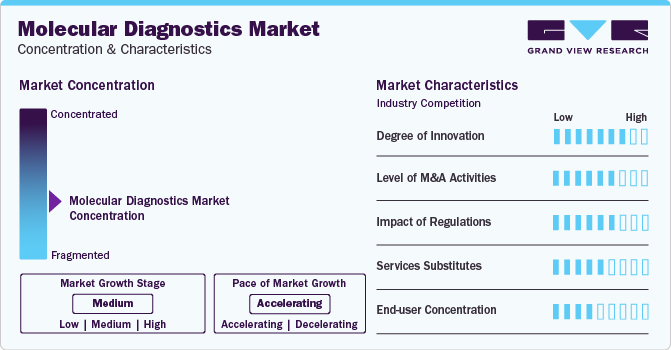

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the increasing introduction of novel tests using PCR, NGS, and other molecular diagnostic techniques for different healthcare conditions. Moreover, key players are actively involved in the development of novel POC testing products to capture the market opportunities.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, in April 2023, Quest Diagnostics Incorporated acquired MRD Platform of Haystack Oncology, a circulating tumor DNA-based technology for early detection of cancer and personalized medicine. Companies are adopting these strategies to increase their expertise and gain access to new regions in the rapidly growing market.

The market is subject to increasing regulatory scrutiny. The regulatory framework for diagnostic product approvals is one of the major factors restraining market growth. Moreover, the regulatory atmosphere is already complex, and the FDA is becoming more careful as dependency on molecular diagnostics for making serious medical decisions is growing. The FDA also conducts post-market investigations of diagnostic products to ensure parity between performances and claims.

The presence of substitute technologies, such as immunoassay and other microbiology testing, can hamper the market uptake of molecular diagnostic products. Moreover, the cost-effectiveness and increasing accuracy of immunoassay coupled with rapid test results make it a suitable substitute for molecular diagnostics.

End-user concentration is a major factor in the market. End-users, such as hospitals, clinics, laboratories, and POC facilities, are driving demand for MDx tests. Moreover, increasing demand for accurate, rapid, and self-tests for cancer, biological markers, genetic information for inherited conditions, and others opens new avenues for market players in different end-use applications.

Product Insights

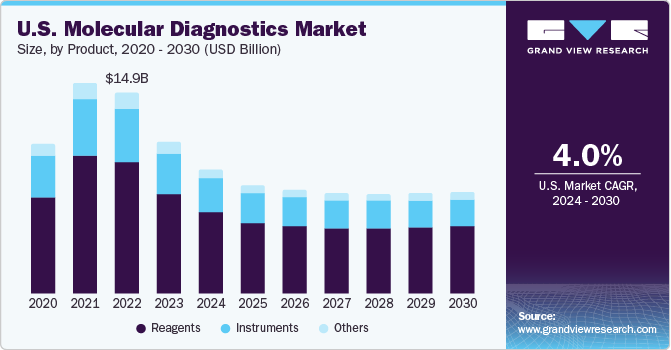

The reagents segment dominated the market and accounted for a share of 62.2% of the global revenue in 2023. It is expected to maintain its dominance throughout the forecast years owing to its wide application scope in research & clinical settings and increasing adoption of novel tests. For instance, in April 2023, Cepheid, a subsidiary of Danaher, announced a plan to introduce novel tests for a range of infectious diseases, including respiratory diseases and tuberculosis. The company has collaborated with researchers at Rutgers University to develop this novel technology that allow to detect 10 independent targets in one reaction. Moreover, standardized results, improved efficiency, and cost-effectiveness are anticipated to support market growth.

The instruments segment held the second-largest revenue share in 2023 due to the extensive use of instruments in different healthcare facilities to diagnose life-threatening diseases. Moreover, introduction of technologically advanced instruments is further supporting the segment growth. For instance, in February 2023, Thermo Fisher Scientific, Inc. announced the release of QuantStudio, Applied Biosystems, Absolute Q AutoRun dPCR Suite, a new digital PCR research tool. Moreover, in May 2023, Sansure Biotech presented its comprehensive range of IVD products, including the iPonatic III portable molecular workstation, at EuroMedLab Rome 2023.

Technology Insights

The polymerase chain reaction technology segment accounted for the largest revenue share in 2023. This is attributed to its use in detecting COVID-19 and other infectious diseases. The increasing use of high-throughput PCR technology to detect infectious diseases and genetic or inherited conditions is expected to drive market growth. For instance, in April 2023,Molbio Diagnostics launched Truenat H3N2/H1N1, the initial PoC Real-Time Polymerase Chain Reaction (PCR) test that assists in the proven identification of influenza infections. The sequencing technology segment is expected to grow at the fastest CAGR from 2024 to 2030.

The segment growth can be attributed to the rising penetration of technology in diagnostic applications, introduction of novel NGS tests, and favorable initiatives by key players. For instance, in April 2023, Alercell launched the LENA Molecular Dx Leukemia Platform, which comprises 12 molecular diagnostic tests based on next-gen DNA sequencing technology. Moreover, in January 2023, QIAGEN and Helix established an exclusive agreement to improve next-gen sequencing companion testing in genetic illnesses. DNA sequencing technologies are integrally linked to drug discovery, novel drug development, and personalized medicine. Companies are launching new NGS-based tests for early disease diagnosis.

Application Insights

The infectious diseases segment accounted for the largest revenue share in 2023. The increased usage of molecular, particularly PCR tests, for diagnosing COVID-19 has increased the segment share significantly. Moreover, the increasing prevalence of infectious diseases across the globe is further increasing the demand for novel molecular diagnostic tests. For instance, in May 2023, the U.S. FDA approved 510(k) clearance for Hologic's Panther Fusion SARS-CoV-2/Flu A/B/RSV assay. This assay is a molecular diagnostic test that discriminates between the four utmost common respiratory viruses. Moreover, in April 2023, Oxford Nanopore and bioMérieux formed a strategic partnership involving nanopore technology to develop novel treatments for infectious diseases.

The oncology segment is expected to grow at a high CAGR from 2024 to 2030. According to the American Cancer Society estimates, in 2023, about 288,300 new cases of prostate cancer and around 59,610 new cases of leukemia were estimated to be diagnosed in the U.S. Moreover, increasing collaboration activities between research institutes and market players to develop new diagnostic solutions for cancer is supporting the segment growth. For instance, in October 2023, QIAGEN and Myriad Genetics collaborated to develop companion diagnostic tests based on PCR, dPCR, and NGS technology for cancer.

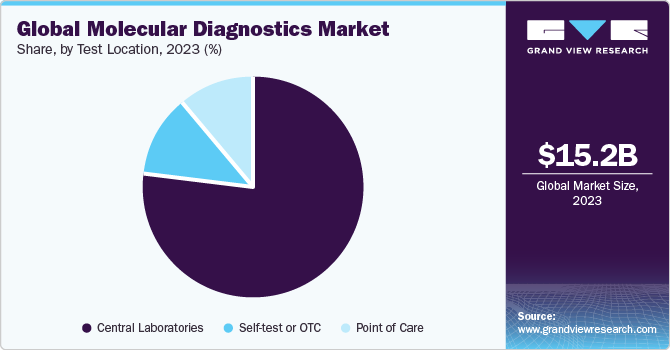

Test Location Insights

The central laboratories segment dominated the industry in 2023 owing to high procedure volumes for COVID testing and other healthcare indications in central laboratories.In April 2023, ELITechGroup announced its plans to introduce a high throughput sample-to-result molecular diagnostics equipment to help laboratories worldwide. Moreover, a rise in the number of initiatives undertaken by governments to provide various services, such as reimbursement for diagnostic tests, is another major factor anticipated to drive market growth.

There is an increasing interest in the development of molecular diagnostic platforms that can also be used as OTC or in at-home settings. Therefore, various companies are designing assays & molecular diagnostic platforms that patients can use without the help of healthcare professionals. For instance, in March 2023, Lucira Health launched the first and only at-home COVID-19 and flu tests in the U.S. The U.S. FDA gave the COVID-19 & Flu Home Test the first and only Emergency Use Authorization (EUA) for OTC usage at home and other non-laboratory locations.

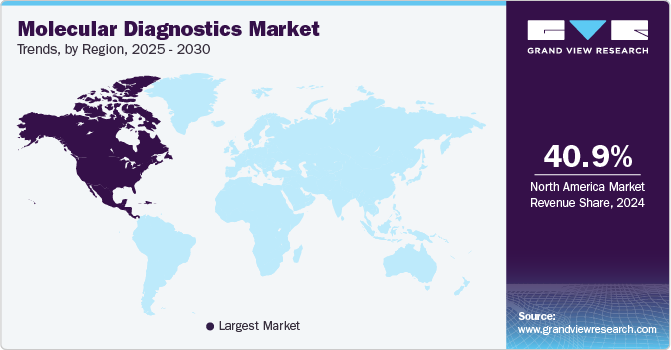

Regional Insights

North America dominated the market and accounted for a 39.3% share in 2023. This is attributed to the rising epidemiology of infectious as well as chronic diseases, thus, encouraging companies to introduce novel molecular diagnostic tests, thereby boosting market growth. For instance, in August 2023, QIAGEN received the U.S. FDA approval for therascreen PDGFRA RGQ PCR kit, this aids physicians in identifying patients with gastrointestinal stromal tumors (GIST). Moreover, in January 2023, the U.S. FDA approved EUA for the VIASURE Monkeypox Virus Real-Time PCR Reagents developed by BD and CerTest Biotec for Mpox virus detection. Moreover, high standards of living and consumer awareness about early diagnosis, as well as well-established healthcare system, act as key drivers for growth.

Asia Pacific is anticipated to exhibit significant growth from 2024 to 2030 owing to increased market penetration, initiatives of local market players to increase the adoption of novel diagnostic technologies, and high unmet market needs. For instance, in August 2023, Indian companies CrisprBits and MolBio Diagnostics entered into a strategic collaboration to revolutionize POC diagnostics by integrating CRISPR technology into POC tests to detect pathogens and genetic markers. Moreover, regional market growth can be attributed to several factors, such as the increasing adoption of NGS, rise in testing of life-threatening diseases, such as cancer, COVID-19, tuberculosis, and STDs, growing demand for personalized medicine, and increasing use of artificial intelligence (AI) & machine learning (ML).

Key Companies & Market Share Insights

Some of the key players operating in the market include F. Hoffmann-La Roche Ltd.; Abbott, Thermo Fisher Scientific Inc.; QIAGEN; and Danaher, among others. These players are adopting different market strategies, such as product launches, collaborations, and partnerships, to increase their industry presence. Market players are launching new molecular diagnostic tests and instruments to chase unmet needs and partnerships to share patented technologies to increase the geographical presence of their existing technologies.

Promega Corporation, Standard BioTools, Co-Diagnostics, Inc., T2 Biosystems, and Huwel Lifesciences are some of the emerging market participants in the molecular diagnostics market. Companies are increasing investment in the research & development of novel products for different end-use applications. Moreover, emerging players are getting financial aid from government and non-government organizations, which is supporting novel product development for the detection of multiple targeted diseases.

Key Molecular Diagnostics Companies:

- BD

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Abbott

- Agilent Technologies, Inc.

- Danaher

- Hologic Inc. (Gen Probe)

- Illumina, Inc.

- Grifols, S.A.

- QIAGEN

- F. Hoffmann-La Roche, Ltd.

- Siemens Healthineers AG

- Sysmex Corporation

Recent Developments

-

In January 2024, Illumina collaborated with Janssen to develop a molecular residual disease liquid biopsy test. The company plans to develop a cost-effective whole-genome sequencing multi-cancer test to detect ctDNA

-

In November 2023, Co-Diagnostics, Inc. received a grant of 8.97 million from the Bill & Melinda Gates Foundation to develop a novel tuberculosis test to be run on the Co-Dx PCR platform

-

In July 2023, T2 Biosystems received the Breakthrough Device designation from the U.S. FDA for its C. Auris direct-from-blood molecular diagnostic test

-

In March 2023, F. Hoffmann-La Roche Ltd. and Lilly announced their partnership to improve early Alzheimer’s disease diagnosis

-

In February 2023, Thermo Fisher Scientific Inc. partnered with MyLab to procure RT-PCR kits for various infectious diseases, such as tuberculosis & HIV

-

In January 2023, Agilent Technologies Inc. and Quest Diagnostics to launch ctDx FIRST liquid biopsy NGS test in the U.S.

Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.78 billion

Revenue forecast in 2030

USD 17.97 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, technology, application, test location, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Belgium; Switzerland; The Netherlands; Poland; Austria; Denmark; Sweden; Turkey; Norway; Japan; China; India; Australia; South Korea; New Zealand; Sri Lanka; Malaysia; Thailand; Vietnam; Singapore; Brazil; Mexico; Colombia; Chile; Peru; Argentina; South Africa; Saudi Arabia; Jordan; UAE; Qatar; Kuwait; Egypt

Key companies profiled

BD; bioMérieux SA; Bio-Rad Laboratories, Inc.; Abbott; Agilent Technologies, Inc.; Danaher; Hologic Inc. (Gen Probe); Illumina, Inc.; Grifols, S.A.; QIAGEN; F. Hoffmann-La Roche, Ltd.; Siemens Healthineers AG; Sysmex Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the molecular diagnostics market report based on product, technology, application, test location, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymerase chain reaction (PCR)

-

By Type

-

Multiplex PCR

-

Other PCR

-

-

By Product

-

Instruments

-

Reagents

-

Others

-

-

-

In Situ Hybridization (ISH)

-

Instruments

-

Reagents

-

Others

-

-

Isothermal Nucleic Acid Amplification Technology (INAAT)

-

Instruments

-

Reagents

-

Others

-

-

Chips and Microarrays

-

Instruments

-

Reagents

-

Others

-

-

Mass Spectrometry

-

Instruments

-

Reagents

-

Others

-

-

Sequencing

-

Instruments

-

Reagents

-

Others

-

-

Transcription Mediated Amplification (TMA)

-

Instruments

-

Reagents

-

Others

-

-

Others

-

Instruments

-

Reagents

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Breast Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Kidney Cancer

-

Liver Cancer

-

Blood Cancer

-

Lung Cancer

-

Other Cancer

-

-

Pharmacogenomics

-

Infectious Diseases

-

Methicillin-resistant Staphylococcus Aureus (MRSA)

-

Clostridium Difficile

-

Vancomycin-resistant Enterococci (VRE)

-

Carbapenem-resistant Bacteria

-

Flu

-

Respiratory Syncytial Virus (RSV)

-

Candida

-

Tuberculosis and Drug-resistant TBA

-

Meningitis

-

Gastrointestinal Panel Testing

-

Chlamydia

-

Gonorrhea

-

HIV

-

Hepatitis C

-

Hepatitis B

-

Other Infectious Diseases

-

-

Genetic Testing

-

Newborn Screening

-

Predictive and Presymptomatic Testing

-

Other Genetic Testing

-

-

Neurological Disease

-

Cardiovascular Disease

-

Microbiology

-

Others

-

-

Test Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Point of Care

-

Self-test or OTC

-

Central Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Belgium

-

Switzerland

-

The Netherlands

-

Poland

-

Austria

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

New Zealand

-

Sri Lanka

-

Malaysia

-

Vietnam

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

Peru

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

Jordan

-

Qatar

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global molecular diagnostics market size was estimated at USD 15.20 billion in 2023 and is expected to reach USD 13.78 billion in 2024.

b. The global molecular diagnostics market is expected to witness a compounded annual rate of 4.5% from 2024 to 2030 to reach USD 17.97 billion by 2030.

b. The reagents segment accounted for the largest revenue share of 62.2% in 2023 in the molecular diagnostics market. It is anticipated to grow at a significant rate in the coming years, owing to its wide adoption in research and clinical settings.

b. The central laboratories segment dominated the molecular diagnostics market and accounted for the largest revenue share of 77.1% in 2023. This growth is attributable to the high market penetration and test volumes.

b. The Polymerase Chain Reaction (PCR) segment dominated the molecular diagnostics market and accounted for the largest revenue share of 49.6% in 2023. This is attributed to its use in the detection of Covid-19.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.2.1. Product

1.2.2. Technology

1.2.3. Application

1.2.4. Test Location

1.3. Regional Scope

1.4. Estimates and Forecast Timeline

1.5. Research Methodology

1.6. Information Procurement

1.6.1. Purchased Database

1.6.2. GVR’s Internal Database

1.7. Details of primary research

1.8. Market Formulation & Validation

1.9. Model Details

1.9.1. Commodity flow analysis (Model 1)

1.9.1.1. Approach 1: Commodity flow approach

1.9.2. Volume price analysis (Model 2)

1.9.2.1. Approach 2: Volume price analysis

1.10. Research Scope and Assumptions

1.10.1. List of Secondary Sources

1.10.2. List of Primary Sources

1.10.3. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Molecular Diagnostics Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Drivers Analysis

3.2.1.1. Increase in geriatric population

3.2.1.2. Introduction of technologically advanced products

3.2.1.3. Increase in demand for point-of-care Testing

3.2.1.4. Growing prevalence of target diseases

3.2.1.5. Increasing external funding for R&D

3.2.2. Market Restraints Analysis

3.2.2.1. Presence of ambiguous regulatory framework

3.2.2.2. High prices of molecular diagnostics tests

3.3. Molecular Diagnostics Market Analysis Tools

3.3.1. Porter’s Analysis

3.3.1.1. Bargaining power of the suppliers

3.3.1.2. Bargaining power of the buyers

3.3.1.3. Threats of substitution

3.3.1.4. Threats from new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic and Social landscape

3.3.2.3. Technological landscape

3.3.2.4. Legal landscape

3.4. Market Opportunity Analysis

3.5. CLIA-Waived Tests and Instruments

3.6. Pricing Analysis

Chapter 4. Molecular Diagnostics Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Molecular Diagnostics Market: Product Movement Analysis, USD Million, 2023 & 2030 (Volume Analysis)

4.3. Instruments

4.3.1. Instruments Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold)

4.4. Reagents

4.4.1. Reagents Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Tests Sold)

4.5. Software

4.5.1. Software Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Molecular Diagnostics Market: Technology Estimates & Trend Analysis

5.1. Technology Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Molecular Diagnostics Market by Technology Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Polymerase chain reaction (PCR)

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.1.2. PCR, by Type

5.4.1.2.1. Multiplex PCR

5.4.1.2.1.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4.1.2.2. Other PCR

5.4.1.2.2.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4.1.3. PCR, by Product

5.4.1.3.1. Instruments

5.4.1.3.1.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold)

5.4.1.3.2. Reagents

5.4.1.3.2.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Tests Sold)

5.4.1.3.3. Others

5.4.1.3.3.1. Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4.2. In Situ Hybridization (ISH)

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2.2. Instruments

5.4.2.2.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Instruments Sold)

5.4.2.3. Reagents

5.4.2.3.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Tests Sold)

5.4.2.4. Others

5.4.2.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.3. Isothermal Nucleic Acid Amplification Technology (INAAT)

5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.3.2. Instruments

5.4.3.2.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Instruments Sold)

5.4.3.3. Reagents

5.4.3.3.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Tests Sold)

5.4.3.4. Others

5.4.3.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.4. Chips and Microarrays

5.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.4.2. Instruments

5.4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Instruments Sold)

5.4.4.3. Reagents

5.4.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Tests Sold)

5.4.4.4. Others

5.4.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.5. Mass Spectrometry

5.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.5.2. Instruments

5.4.5.2.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Instruments Sold)

5.4.5.3. Reagents

5.4.5.3.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Tests Sold)

5.4.5.4. Others

5.4.5.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.6. Sequencing

5.4.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.6.2. Instruments

5.4.6.2.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Instruments Sold)

5.4.6.3. Reagents

5.4.6.3.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Tests Sold)

5.4.6.4. Others

5.4.6.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.7. Transcription Mediated Amplification (TMA)

5.4.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.7.2. Instruments

5.4.7.2.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Instruments Sold)

5.4.7.3. Reagents

5.4.7.3.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Tests Sold)

5.4.7.4. Others

5.4.7.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.8. Others

5.4.8.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.8.2. Instruments

5.4.8.2.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Instruments Sold)

5.4.8.3. Reagents

5.4.8.3.1. Market estimates and forecasts 2018 to 2030 (USD Million) (Volume, Number of Tests Sold)

5.4.8.4. Services

5.4.8.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 6. Molecular Diagnostics Market: Application Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Molecular Diagnostics Market: Application Movement Analysis, USD Million, 2023 & 2030

6.3. Oncology

6.3.1. Oncology Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.2. Breast Cancer

6.3.2.1. Breast Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.3. Prostate Cancer

6.3.3.1. Prostate Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.4. Colorectal Cancer

6.3.4.1. Colorectal Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.5. Cervical Cancer

6.3.5.1. Cervical Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.6. Kidney Cancer

6.3.6.1. Kidney Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.7. Liver Cancer

6.3.7.1. Liver Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.8. Blood Cancer

6.3.8.1. Blood Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.9. Lung Cancer

6.3.9.1. Lung Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.10. Other Cancer

6.3.10.1. Other Cancer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Pharmacogenomics

6.4.1. Pharmacogenomics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5. Infectious Diseases

6.5.1. Infectious Diseases Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.2. Methicillin-resistant Staphylococcus Aureus (MRSA)

6.5.2.1. Methicillin-resistant Staphylococcus Aureus (MRSA) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.3. Clostridium Difficile

6.5.3.1. Clostridium Difficile Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.4. Vancomycin-resistant Enterococci (VRE)

6.5.4.1. Vancomycin-resistant Enterococci (VRE) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.5. Carbapenem-resistant Bacteria

6.5.5.1. Carbapenem-resistant Bacteria Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.6. Flu

6.5.6.1. Flu Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.7. Respiratory Syncytial Virus (RSV)

6.5.7.1. Respiratory Syncytial Virus (RSV) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.8. Candida

6.5.8.1. Candida Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.9. Tuberculosis and Drug-resistant TBA

6.5.9.1. Tuberculosis and Drug-resistant TBA Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.10. Meningitis

6.5.10.1. Meningitis Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.11. Gastrointestinal Panel Testing

6.5.11.1. Gastrointestinal Panel Testing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.12. Chlamydia

6.5.12.1. Chlamydia Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.13. Gonorrhea

6.5.13.1. Gonorrhea Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.14. HIV

6.5.14.1. HIV Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.15. Hepatitis C

6.5.15.1. Hepatitis C Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.16. Hepatitis B

6.5.16.1. Hepatitis B Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.17. Other Infectious Disease

6.5.17.1. Other Infectious Disease Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. Genetic Testing

6.6.1. Genetic Testing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.2. Newborn Screening

6.6.2.1. Newborn Screening Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.3. Predictive and Presymptomatic Testing

6.6.3.1. Predictive and Presymptomatic Testing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.4. Other Genetic Testing

6.6.4.1. Other Genetic Testing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7. Neurological Disease

6.7.1. Neurological Disease Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.8. Cardiovascular Disease

6.8.1. Cardiovascular Disease Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.9. Microbiology

6.9.1. Microbiology Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.10. Others

6.10.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Molecular Diagnostics Market: Test Location Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Molecular Diagnostics Market: Test Location Movement Analysis, USD Million, 2023 & 2030

7.3. Point of Care

7.3.1. Point of Care Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4. Central Laboratories

7.4.1. Central Laboratories Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5. Self-Test or OTC

7.5.1. Self-Test or OTC Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Molecular Diagnostics Market: Regional Estimates & Trend Analysis

8.1. Molecular Diagnostics Market Share, By Region, 2023 & 2030, USD Million

8.2. North America

8.2.1. North America Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.2.2. U.S.

8.2.2.1. Key Country Dynamics

8.2.2.2. Regulatory Landscape/Reimbursement Scenario

8.2.2.3. Competitive Insights

8.2.3. U.S. Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.2.4. Canada

8.2.4.1. Key Country Dynamics

8.2.4.2. Regulatory Landscape/Reimbursement Scenario

8.2.4.3. Competitive Insights

8.2.4.4. Canada Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3. Europe

8.3.1. Europe Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.2. UK

8.3.2.1. Key Country Dynamics

8.3.2.2. Regulatory Landscape/Reimbursement Scenario

8.3.2.3. Competitive Insights

8.3.2.4. UK Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.3. Germany

8.3.3.1. Key Country Dynamics

8.3.3.2. Regulatory Landscape/Reimbursement Scenario

8.3.3.3. Competitive Insights

8.3.3.4. Germany Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.4. France

8.3.4.1. Key Country Dynamics

8.3.4.2. Regulatory Landscape/Reimbursement Scenario

8.3.4.3. Competitive Insights

8.3.4.4. France Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.5. Italy

8.3.5.1. Key Country Dynamics

8.3.5.2. Regulatory Landscape/Reimbursement Scenario

8.3.5.3. Competitive Insights

8.3.5.4. Italy Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.6. Spain

8.3.6.1. Key Country Dynamics

8.3.6.2. Regulatory Landscape/Reimbursement Scenario

8.3.6.3. Competitive Insights

8.3.6.4. Spain Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.7. Sweden

8.3.7.1. Key Country Dynamics

8.3.7.2. Regulatory Landscape/Reimbursement Scenario

8.3.7.3. Competitive Insights

8.3.7.4. Sweden Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.8. Denmark

8.3.8.1. Key Country Dynamics

8.3.8.2. Regulatory Landscape/Reimbursement Scenario

8.3.8.3. Competitive Insights

8.3.8.4. Denmark Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.9. Norway

8.3.9.1. Key Country Dynamics

8.3.9.2. Regulatory Landscape/Reimbursement Scenario

8.3.9.3. Competitive Insights

8.3.9.4. Norway Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.10. Belgium

8.3.10.1. Key Country Dynamics

8.3.10.2. Regulatory Landscape/Reimbursement Scenario

8.3.10.3. Competitive Insights

8.3.10.4. Belgium Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.11. Switzerland

8.3.11.1. Key Country Dynamics

8.3.11.2. Regulatory Landscape/Reimbursement Scenario

8.3.11.3. Competitive Insights

8.3.11.4. Switzerland Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.12. The Netherlands

8.3.12.1. Key Country Dynamics

8.3.12.2. Regulatory Landscape/Reimbursement Scenario

8.3.12.3. Competitive Insights

8.3.12.4. The Netherlands Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.13. Poland

8.3.13.1. Key Country Dynamics

8.3.13.2. Regulatory Landscape/Reimbursement Scenario

8.3.13.3. Competitive Insights

8.3.13.4. Poland Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.14. Austria

8.3.14.1. Key Country Dynamics

8.3.14.2. Regulatory Landscape/Reimbursement Scenario

8.3.14.3. Competitive Insights

8.3.14.4. Austria Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.3.15. Turkey

8.3.15.1. Key Country Dynamics

8.3.15.2. Regulatory Landscape/Reimbursement Scenario

8.3.15.3. Competitive Insights

8.3.15.4. Turkey Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4. Asia Pacific

8.4.1. Asia Pacific Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.2. China

8.4.2.1. Key Country Dynamics

8.4.2.2. Regulatory Landscape/Reimbursement Scenario

8.4.2.3. Competitive Insights

8.4.2.4. China Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.3. Japan

8.4.3.1. Key Country Dynamics

8.4.3.2. Regulatory Landscape/Reimbursement Scenario

8.4.3.3. Competitive Insights

8.4.3.4. Japan Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.4. India

8.4.4.1. Key Country Dynamics

8.4.4.2. Regulatory Landscape/Reimbursement Scenario

8.4.4.3. Competitive Insights

8.4.4.4. India Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.5. South Korea

8.4.5.1. Key Country Dynamics

8.4.5.2. Regulatory Landscape/Reimbursement Scenario

8.4.5.3. Competitive Insights

8.4.5.4. South Korea Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.6. Australia

8.4.6.1. Key Country Dynamics

8.4.6.2. Regulatory Landscape/Reimbursement Scenario

8.4.6.3. Competitive Insights

8.4.6.4. Australia Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.7. Thailand

8.4.7.1. Key Country Dynamics

8.4.7.2. Regulatory Landscape/Reimbursement Scenario

8.4.7.3. Competitive Insights

8.4.7.4. Thailand Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.8. New Zealand

8.4.8.1. Key Country Dynamics

8.4.8.2. Regulatory Landscape/Reimbursement Scenario

8.4.8.3. Competitive Insights

8.4.8.4. New Zealand Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.9. Sri Lanka

8.4.9.1. Key Country Dynamics

8.4.9.2. Regulatory Landscape/Reimbursement Scenario

8.4.9.3. Competitive Insights

8.4.9.4. Sri Lanka Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.10. Malaysia

8.4.10.1. Key Country Dynamics

8.4.10.2. Regulatory Landscape/Reimbursement Scenario

8.4.10.3. Competitive Insights

8.4.10.4. Malaysia Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.11. Vietnam

8.4.11.1. Key Country Dynamics

8.4.11.2. Regulatory Landscape/Reimbursement Scenario

8.4.11.3. Competitive Insights

8.4.11.4. Vietnam Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.4.12. Singapore

8.4.12.1. Key Country Dynamics

8.4.12.2. Regulatory Landscape/Reimbursement Scenario

8.4.12.3. Competitive Insights

8.4.12.4. Singapore Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.5. Latin America

8.5.1. Latin America Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.5.2. Brazil

8.5.2.1. Key Country Dynamics

8.5.2.2. Regulatory Landscape/Reimbursement Scenario

8.5.2.3. Competitive Insights

8.5.2.4. Brazil Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.5.3. Mexico

8.5.3.1. Key Country Dynamics

8.5.3.2. Regulatory Landscape/Reimbursement Scenario

8.5.3.3. Competitive Insights

8.5.3.4. Mexico Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.5.4. Argentina

8.5.4.1. Key Country Dynamics

8.5.4.2. Regulatory Landscape/Reimbursement Scenario

8.5.4.3. Competitive Insights

8.5.4.4. Argentina Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.5.5. Colombia

8.5.5.1. Key Country Dynamics

8.5.5.2. Regulatory Landscape/Reimbursement Scenario

8.5.5.3. Competitive Insights

8.5.5.4. Colombia Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.5.6. Chile

8.5.6.1. Key Country Dynamics

8.5.6.2. Regulatory Landscape/Reimbursement Scenario

8.5.6.3. Competitive Insights

8.5.6.4. Chile Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.5.7. Peru

8.5.7.1. Key Country Dynamics

8.5.7.2. Regulatory Landscape/Reimbursement Scenario

8.5.7.3. Competitive Insights

8.5.7.4. Peru Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.6. Middle East and Africa

8.6.1. Middle East and Africa Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.6.2. Saudi Arabia

8.6.2.1. Key Country Dynamics

8.6.2.2. Regulatory Landscape/Reimbursement Scenario

8.6.2.3. Competitive Insights

8.6.2.4. Saudi Arabia Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.6.3. UAE

8.6.3.1. Key Country Dynamics

8.6.3.2. Regulatory Landscape/Reimbursement Scenario

8.6.3.3. Competitive Insights

8.6.3.4. UAE Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.6.4. South Africa

8.6.4.1. Key Country Dynamics

8.6.4.2. Regulatory Landscape/Reimbursement Scenario

8.6.4.3. Competitive Insights

8.6.4.4. South Africa Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.6.5. Kuwait

8.6.5.1. Key Country Dynamics

8.6.5.2. Regulatory Landscape/Reimbursement Scenario

8.6.5.3. Competitive Insights

8.6.5.4. Kuwait Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.6.6. Jordan

8.6.6.1. Key Country Dynamics

8.6.6.2. Regulatory Landscape/Reimbursement Scenario

8.6.6.3. Competitive Insights

8.6.6.4. Jordan Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.6.7. Qatar

8.6.7.1. Key Country Dynamics

8.6.7.2. Regulatory Landscape/Reimbursement Scenario

8.6.7.3. Competitive Insights

8.6.7.4. Qatar Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

8.6.8. Egypt

8.6.8.1. Key Country Dynamics

8.6.8.2. Regulatory Landscape/Reimbursement Scenario

8.6.8.3. Competitive Insights

8.6.8.4. Egypt Molecular Diagnostics Market Estimates and Forecasts, 2018 - 2030 (USD Million) (Volume, Number of Instruments Sold) (Volume, Number of Tests Sold)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Global Company Market Share Analysis for Molecular Diagnostics and PCR, 2023

9.4. North America Company Market Share Analysis for Molecular Diagnostics and PCR, 2023

9.5. Europe Company Market Share Analysis for Molecular Diagnostics and PCR, 2023

9.6. Asia Pacific Company Market Share Analysis for Molecular Diagnostics and PCR, 2023

9.7. Latin America Company Market Share Analysis for Molecular Diagnostics and PCR, 2023

9.8. MEA Company Market Share Analysis for Molecular Diagnostics and PCR, 2023

9.9. Company Heat Map Analysis

9.10. Strategy Mapping

9.10.1. Expansion

9.10.2. Mergers & Acquisition

9.10.3. Partnerships & Collaborations

9.10.4. New Product Launches

9.10.5. Research And Development

9.11. Company Profiles

9.11.1. QIAGEN

9.11.1.1. Participant’s Overview

9.11.1.2. Financial Performance

9.11.1.3. Product Benchmarking

9.11.1.4. Recent Developments

9.11.2. BD

9.11.2.1. Participant’s Overview

9.11.2.2. Financial Performance

9.11.2.3. Product Benchmarking

9.11.2.4. Recent Developments

9.11.3. bioMérieux SA

9.11.3.1. Participant’s Overview

9.11.3.2. Financial Performance

9.11.3.3. Product Benchmarking

9.11.3.4. Recent Developments

9.11.4. F. Hoffmann-La Roche, Ltd.

9.11.4.1. Participant’s Overview

9.11.4.2. Financial Performance

9.11.4.3. Product Benchmarking

9.11.4.4. Recent Developments

9.11.5. Hologic, Inc. (Gen Probe)

9.11.5.1. Participant’s Overview

9.11.5.2. Financial Performance

9.11.5.3. Product Benchmarking

9.11.5.4. Recent Developments

9.11.6. Abbott

9.11.6.1. Participant’s Overview

9.11.6.2. Financial Performance

9.11.6.3. Product Benchmarking

9.11.6.4. Recent Developments

9.11.7. Agilent Technologies, Inc.

9.11.7.1. Participant’s Overview

9.11.7.2. Financial Performance

9.11.7.3. Product Benchmarking

9.11.7.4. Recent Developments

9.11.8. Siemens Healthineers AG

9.11.8.1. Participant’s Overview

9.11.8.2. Financial Performance

9.11.8.3. Product Benchmarking

9.11.8.4. Recent Developments

9.11.9. Bio-Rad Laboratories, Inc.

9.11.9.1. Participant’s Overview

9.11.9.2. Financial Performance

9.11.9.3. Product Benchmarking

9.11.9.4. Recent Developments

9.11.10. Danaher

9.11.10.1. Participant’s Overview

9.11.10.2. Financial Performance

9.11.10.3. Product Benchmarking

9.11.10.4. Recent Developments

9.11.11. Illumina, Inc.

9.11.11.1. Participant’s Overview

9.11.11.2. Financial Performance

9.11.11.3. Product Benchmarking

9.11.11.4. Recent Developments

List of Tables

Table 1 Country share estimation

Table 2 North America molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 3 North America molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 4 North America molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 5 North America PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 6 North America PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 7 North America ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 8 North America INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 9 North America chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 10 North America mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 11 North America sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 12 North America TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 13 North America others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 14 North America molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 15 North America molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 16 North America molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 17 North America molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 18 U.S. molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 19 U.S. molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 20 U.S. molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 21 U.S. PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 22 U.S. PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 23 U.S. ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 24 U.S. INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 25 U.S. chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 26 U.S. mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 27 U.S. sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 28 U.S. TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 29 U.S. others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 30 U.S. molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 31 U.S. molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 32 U.S. molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 33 U.S. molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 34 Canada molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 35 Canada molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 36 Canada molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 37 Canada PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 38 Canada PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 39 Canada ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 40 Canada INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 41 Canada chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 42 Canada mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 43 Canada sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 44 Canada TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 45 Canada others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 46 Canada molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 47 Canada molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 48 Canada molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 49 Canada molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 50 Europe molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 51 Europe molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 52 Europe molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 53 Europe PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 54 Europe PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 55 Europe ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 56 Europe INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 57 Europe chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 58 Europe mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 59 Europe sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 60 Europe TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 61 Europe others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 62 Europe molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 63 Europe molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 64 Europe molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 65 Europe molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 66 UK molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 67 UK molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 68 UK molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 69 UK PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 70 UK PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 71 UK ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 72 UK INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 73 UK chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 74 UK mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 75 UK sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 76 UK TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 77 UK others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 78 UK molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 79 UK molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 80 UK molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 81 UK molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 82 Germany molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 83 Germany molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 84 Germany molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 85 Germany PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 86 Germany PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 87 Germany ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 88 Germany INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 89 Germany chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 90 Germany mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 91 Germany sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 92 Germany TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 93 Germany others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 94 Germany molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 95 Germany molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 96 Germany molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 97 Germany molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 98 France molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 99 France molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 100 France molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 101 France PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 102 France PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 103 France ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 104 France INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 105 France chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 106 France mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 107 France sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 108 France TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 109 France others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 110 France molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 111 France molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 112 France molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 113 France molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 114 Spain molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 115 Spain molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 116 Spain molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 117 Spain PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 118 Spain PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 119 Spain ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 120 Spain INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 121 Spain chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 122 Spain mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 123 Spain sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 124 Spain TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 125 Spain others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 126 Spain molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 127 Spain molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 128 Spain molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 129 Spain molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 130 Italy molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 131 Italy molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 132 Italy molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 133 Italy PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 134 Italy PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 135 Italy ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 136 Italy INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 137 Italy chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 138 Italy mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 139 Italy sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 140 Italy TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 141 Italy others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 142 Italy molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 143 Italy molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 144 Italy molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 145 Italy molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 146 Belgium molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 147 Belgium molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 148 Belgium molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 149 Belgium PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 150 Belgium PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 151 Belgium ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 152 Belgium INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 153 Belgium chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 154 Belgium mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 155 Belgium sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 156 Belgium TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 157 Belgium others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 158 Belgium molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 159 Belgium molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 160 Belgium molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 161 Belgium molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 162 Switzerland molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 163 Switzerland molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 164 Switzerland molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 165 Switzerland PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 166 Switzerland PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 167 Switzerland ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 168 Switzerland INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 169 Switzerland chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 170 Switzerland mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 171 Switzerland sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 172 Switzerland TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 173 Switzerland others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 174 Switzerland molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 175 Switzerland molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 176 Switzerland molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 177 Switzerland molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 178 Netherlands molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 179 Netherlands molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 180 Netherlands molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 181 Netherlands PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 182 Netherlands PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 183 Netherlands ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 184 Netherlands INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 185 Netherlands chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 186 Netherlands mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 187 Netherlands sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 188 Netherlands TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 189 Netherlands others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 190 Netherlands molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 191 Netherlands molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 192 Netherlands molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 193 Netherlands molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 194 Poland molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 195 Poland molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 196 Poland molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 197 Poland PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 198 Poland PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 199 Poland ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 200 Poland INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 201 Poland chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 202 Poland mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 203 Poland sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 204 Poland TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 205 Poland others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 206 Poland molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 207 Poland molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 208 Poland molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 209 Poland molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 210 Austria molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 211 Austria molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 212 Austria molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 213 Austria PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 214 Austria PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 215 Austria ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 216 Austria INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 217 Austria chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 218 Austria mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 219 Austria sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 220 Austria TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 221 Austria others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 222 Austria molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 223 Austria molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 224 Austria molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 225 Austria molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 226 Denmark molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 227 Denmark molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 228 Denmark molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 229 Denmark PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 230 Denmark PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 231 Denmark ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 232 Denmark INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 233 Denmark chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 234 Denmark mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 235 Denmark sequencing market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 236 Denmark TMA market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 237 Denmark others technology market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 238 Denmark molecular diagnostics market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 239 Denmark molecular diagnostics market estimates and forecasts, by oncology, 2018 - 2030 (USD Million)

Table 240 Denmark molecular diagnostics market estimates and forecasts, by infectious diseases, 2018 - 2030 (USD Million)

Table 241 Denmark molecular diagnostics market estimates and forecasts, by genetic testing, 2018 - 2030 (USD Million)

Table 242 Sweden molecular diagnostics market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 243 Sweden molecular diagnostics market estimates and forecasts, by test location, 2018 - 2030 (USD Million)

Table 244 Sweden molecular diagnostics market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 245 Sweden PCR market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 246 Sweden PCR market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 247 Sweden ISH market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 248 Sweden INAAT market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 249 Sweden chips and microarrays market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 250 Sweden mass spectrometry market estimates and forecasts, by product, 2018 - 2030 (USD Million)