- Home

- »

- Semiconductors

- »

-

Multi-layer Ceramic Capacitor Market Size Report, 2030GVR Report cover

![Multi-layer Ceramic Capacitor Market Size, Share & Trends Report]()

Multi-layer Ceramic Capacitor Market Size, Share & Trends Analysis Report By Type, By Rated Voltage Range, By Case Size, By Dielectric Type, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-312-6

- Number of Pages: 145

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Market Size & Trends

The global multi-layer ceramic capacitor market size was valued at USD 10.90 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. Multi-layer ceramic capacitor (MLCCs) are multilayered capacitors made of alternating layers of ceramic and metal. These capacitors possess low impedance values at high operating frequencies, making them suitable for use in electronic devices for noise suppression. The increasing demand for MLCCs in high-specification gadgets such as smartphones and tablets is expected to drive the market. Also, its growing demand in various application areas, such as consumer electronics, data processing, and telecommunications, is driving the market growth.

The emergence of advanced designs with filtering, decoupling, higher capacitance, and improved bypassing capabilities have also worked well for the market in recent years. These new designs ensure thinner layers and better charge capacity. Moreover, MLCCs are widely used in DC-DC and AC-AC converters for Electromagnetic Interference (EMI) suppression.

MLCCs are also integrated into smart LCD and LED televisions. The increasing popularity of such televisions is expected to accelerate market growth. Moreover, the emergence of the Internet of Things (IoT) is creating diverse opportunities for the market, as MLCCs are an ideal solution for IoT devices owing to their long service life and intrinsic reliability.

Multilayer ceramic capacitors are widely used in indoor wireless access points, automobile electronic control units, digital cameras, and PC servers, further adding to the growth prospects of the multilayer ceramic capacitor market. However, the fact that MLCCs must be handled with the utmost care, as ceramic is prone to physical damage, could be a challenge for market growth.

The increasing adoption of MLCCs in various equipment such as mobile phones, set-top boxes, and wireless devices is expected to propel the market growth over the forecast period. In addition, benefits such as high durability against thermal shocks offered by these capacitors are expected to increase demand.

MLCCs are used in several consumer electronics, including drones, wearable electronic devices, smart TVs, camcorders, printers, computers, and laptops. The growing preference for using smart electronic devices and the changing lifestyles of individuals are fueling the growth of the consumer electronics market, and any rise in the demand for consumer electronics would subsequently translate into an increase in the adoption of MLCCs.

MLCCs offer lower impedance and lower resistance values at higher operating frequencies. These characteristics make MLCCs ideal for use in electronic devices for noise compression. The growing demand for MLCCs from the electronics industry, particularly for use in high-specification gadgets such as smartphones, tablets, smart TVs, and video cameras, is expected to propel the growth of the global market.

Besides, governments worldwide are increasingly supporting digitalization, which, in turn, is likely to promote the use of electronic devices among consumers. MLCC manufacturers are focusing on developing the smallest MLCCs that can potentially be used in wearable devices, health & fitness accessories, smartphones, and other mobile devices. The rapidly growing IoT market is opening new opportunities for MLCCs. MLCCs are increasingly used in automated lighting & heating and industrial automation, among other connected applications. In line with this trend, manufacturers offer different specifications of MLCCs related to power consumption, data processing speed, and costs, thereby allowing vendors of IoT solutions to choose MLCCs according to the specific IoT solutions they are designing.

The demand for MLCCs is expected to increase, particularly in developing economies, such as China and India, owing to the increasing demand for consumer electronics, including smartphones, tablets, wearables, advanced computers, and smart televisions. The rising levels of disposable income and the growing internet penetration are also driving the growth of the market.

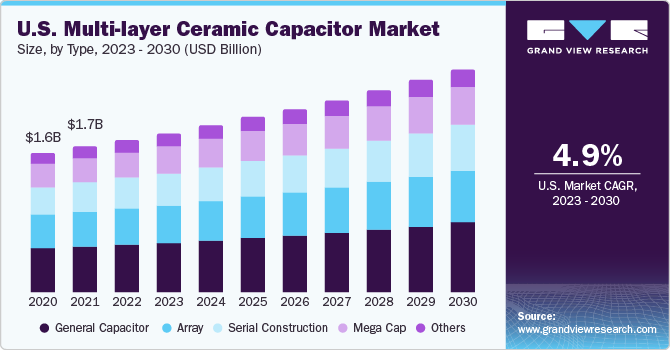

Type Insights

The general capacitor segment accounted for the largest revenue share of 31.0% in 2022. It is primarily attributed to the rising requirement for general capacitors in applications such as DC-DC converters, cellular telephones, gaming machines, memory modules, LCDs, and televisions. Additionally, general capacitors help eliminate noise from electronic circuits, and their miniature sizes allow easy installation in electronic devices.

MLCC arrays use passive technology, integrating various capacitor elements into one monolithic structure. These capacitors promote increased throughput, cost savings, and reduced placement costs. They are used in game consoles, LCD modules, computers, automotive, and telecommunication applications.

Mega cap MLCC is one of the fastest-growing segments, expanding at a CAGR of 6.2% from 2023 to 2030. The market growth is attributed to the demand for higher capacitance values in electronic devices, the need for advanced technologies like 5G and IoT, the trend toward miniaturization, and advancements in manufacturing technologies. These capacitors offer greater energy storage, improved performance, and compact designs, making them ideal for applications in various industries.

Case Size Insights

The 0603-1206 inches case size segment accounted for the largest revenue share of 56.8% in 2022. The growth is attributed to the increasing demand for smaller components, improved performance characteristics, and compatibility with automated manufacturing processes. These MLCCs offer a smaller form factor, higher capacitance values, lower equivalent series resistance (ESR), and easier assembly, making them suitable for space-constrained applications and contributing to their increasing popularity in the market.

The less that 0603 inches case size MLCC is the fastest growing segment with a CAGR of 6.9% from 2023 to 2030. The rapid growth can be attributed to several factors including advancements in miniaturization and microelectronics, increasing demand for smaller and more compact components, rise in demand for portable & wearable electronics, and the growth in the adoption of IoT devices & smart technologies. The smaller MLCCs allow for the design of smaller and lighter electronic devices without compromising performance, making them ideal for various applications in the electronics industry.

Dielectric Type Insights

The X7R segment accounted for the largest revenue share of 32.4% in 2022. X7R dielectric features a maximum operating temperature and is considered temperature stable. These ceramic dielectric capacitors are suited for frequency-discriminating circuits and bypass & decoupling applications. Also, these dielectric MLCCs are used in filtering and transient voltage suppression.

Y5V dielectric is experiencing the fastest growth at a CAGR of 6.2% from 2023 to 2030. Y5V dielectric features miniature size and wide capacitance and is available for vapor and wave solder. These dielectric capacitors are widely used in decoupling applications that require a limited temperature range. They are easy to handle, have easier inventory control, and are recyclable.

End-use Insights

The electronic segment accounted for the largest revenue share of 32.7% in 2022. The increasing deployment of electronic devices that use multilayer ceramic capacitors in automobiles, such as powertrains, vehicle frames, and infotainment devices, is expected to emerge as a key market driver. The trend has encouraged manufacturers to develop MLCCs catering to automobile applications, covering various voltage options, case sizes, and capacitance values. MLCCs are also being increasingly adopted in electrically powered vehicles as they can withstand the high temperatures common to control circuits in such vehicles.

The automotive segment is the fastest-growing segment, registering a CAGR of 6.3% from 2023 to 2030. Factors such as the increasing number of electric vehicles, increasing integration of Advanced Driver Assistance Systems (ADAS), and infotainment features in vehicles are driving the market growth in the automotive industry.

MLCCs are also being increasingly used in telecom, military, medical, and industrial equipment sectors. They are used in instruments such as military communications systems, lasers, telecom base stations, and high-frequency RF applications due to benefits such as ease of mounting on circuit boards, greater efficiency of assembly, and shorter circuit tracks with low inductance.

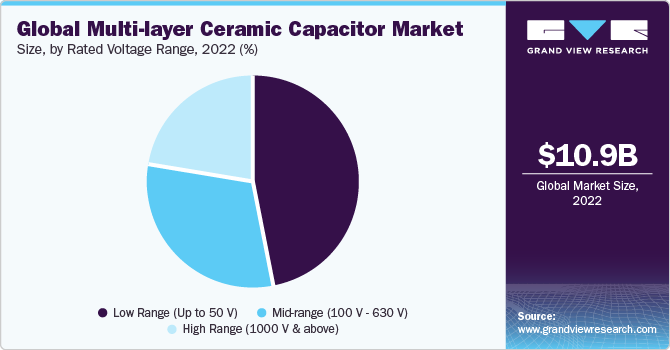

Rated Voltage Range Insights

Low-range voltage (up to 50 V) is the leading segment in the market, with a market share of 46.6% in 2022. These capacitors are widely used in consumer electronics, automotive, industrial, and telecommunications sectors. The dominance of low-range MLCCs can be attributed to several factors, including their versatility, compact size, high capacitance range, and competitive pricing. Additionally, advancements in manufacturing processes have made it easier to produce low-range MLCCs in large quantities, further driving their market dominance.

High-range voltage (1000V & above) is the fastest-growing segment in the market, registering a CAGR of 6.1% from 2023 to 2030. High-range voltage MLCC capacitors use multi-layering technologies and advanced ceramic dielectric thin-layers to offer high capacitance and high voltage to electronic devices. They are used in lighting ballasts, high-voltage coupling capacitors, switched-mode power supply devices, and inverter circuits.

Mid-range (100V to 630V) voltage MLCCs offer features such as good capacitance-to-volume ratio, low cost, no-polarity, and low leakage, allowing their efficient usage in various electronic devices. Moreover, these capacitors offer higher mechanical strength and lower Equivalent Series Inductance (ESL)/Equivalent Series Resistance (ESR) than electrolytic capacitors.

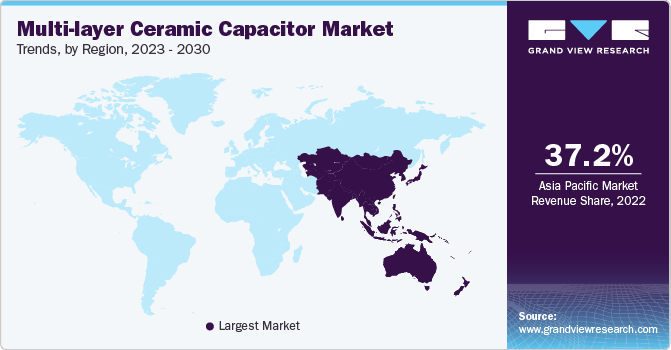

Regional Insights

The market in Europe is anticipated to account for a significant CAGR during the forecast period. It is attributed to the significant presence of automotive manufacturers in the region. MLCCs are widely used in the automotive industry as these capacitors cover a wide range of working voltages, capacitance values, and case sizes. Numerous MLCC manufacturers are developing and manufacturing MLCCs for automotive applications, thereby boosting their adoption in the automotive industry.

Likewise, MLCCs are used in several industrial applications, such as high-frequency, high-voltage, soft termination, and general-purpose applications. Thus, the growing demand for MLCCs in the industrial sector is expected to support the Europe market growth.

Asia Pacific accounted for the largest revenue share of 37.2% in 2022. It is attributed to the region being a key manufacturing hub for electronic devices. The emergence of MLCC manufacturers in various countries such as Japan, South Korea, Taiwan, and India is expected to drive regional growth in the forthcoming years.

Asia Pacific is also projected to emerge as the fastest-growing region over the forecast period, owing to increasing demand from end-use industries due to increased capacitance levels of MLCC and miniaturization of capacitors. Furthermore, the regional MLCC manufacturers are focusing on adopting improved technology to withstand the high competition. Growing demand for consumer electronics in developing countries such as China and India is also expected to propel the regional consumption of multilayer ceramic capacitors.

Key Companies & Market Share Insights

The global market is witnessing significant growth globally, driven by factors such as the increasing demand in the automotive sector, the need for smaller & more compact electronic devices, the adoption of advanced technologies like 5G and IoT, and the focus on environmental sustainability and energy efficiency. The key players in the industry are focusing on organic and inorganic growth strategies to maintain their market position.

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in May 2023, Murata Manufacturing Co., Ltd. introduced their latest GRM series MLCCs. The new variant addresses the increasing demand for advanced components that combine high capacitance levels, compact sizes, and improved temperature performance.

Key Multi-layer Ceramic Capacitor Companies:

- Murata Manufacturing Co., Ltd.

- TAIYO YUDEN CO., LTD.

- KYOCERA Corporation

- YAGEO Group

- Walsin Technology Corporation

- SAMSUNG ELECTRO-MECHANICS

- Future Electronics

- TDK Corporation

- Vishay Intertechnology, Inc.

Recent Developments

-

In May 2023, Avatech announced a significant investment of 101.8 billion won in the Gumi 5 National Industrial Complex Hi-Tech Valley to expand its MLCC manufacturing plant. The expansion is planned to be completed by 2024. Avatech recently signed a memorandum of understanding with North Gyeongsang Province and Gumi City, reinforcing the investment agreement. Avatech aims to bolster its global supply chain through this investment and meet the increasing demand for MLCCs in various industries. The expansion is anticipated to contribute to the company's growth and position it as a key player in the market.

-

In April 2023, Kyocera Corporation announced a significant achievement in electronic components. The company's Electronic Components Department successfully developed MLCC, a new capacitor with an EIA 0201 size measuring 0.6 mm x 0.3 mm. This innovative capacitor boasts the highest capacitance in the industry, reaching an impressive ten microfarads.

-

In December 2021, Murata introduced the GCM31CC71C226ME36 MLCC, designed specifically for safety applications and automotive powertrains. This groundbreaking product boasts the highest capacitance of 22 µF among MLCCs in the compact 1206-inch, with a voltage rating of 16V.

-

In September 2020, Richardson Electronics, Ltd. declared its support for AMOTECH's MLCCs, specifically the broadband and High-Q series. AMOTECH's ACQ (High-Q) series has exceptional features, including high working voltage, enhanced equivalent series resistance, and improved self-resonance frequencies. These RoHS-compliant capacitors deliver excellent performance for frequencies up to 7-8 GHz.

Multi-layer Ceramic Capacitor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.46 billion

Revenue forecast in 2030

USD 16.77 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, rated voltage range, case size, dielectric type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Murata Manufacturing Co., Ltd.; TAIYO YUDEN CO., LTD.; KYOCERA Corporation; YAGEO Group; Walsin Technology Corporation; SAMSUNG ELECTRO-MECHANICS; Future Electronics; TDK Corporation; Vishay Intertechnology, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multi-layer Ceramic Capacitor Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global multi-layer ceramic capacitor market report based on type, rated voltage range, case size, dielectric type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

General Capacitor

-

Array

-

Serial Construction

-

Mega Cap

-

Others

-

-

Rated Voltage Range Outlook (Revenue, USD Million, 2017 - 2030)

-

Low Range (Up to 50 V)

-

Mid-range (100 V - 630 V)

-

High Range (1000 V & above)

-

-

Case Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 0603 Inches

-

0603-1206 Inches

-

More than 1206 Inches

-

-

Dielectric Type Outlook (Revenue, USD Million, 2017 - 2030)

-

X7R

-

X5R

-

C0G

-

Y5V

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Electronics

-

Automotive

-

Industrial

-

Telecommunication

-

Data Transmission

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global multi-layer ceramic capacitor market size was estimated at USD 10.90 billion in 2022 and is expected to reach USD 11.46 billion in 2023.

b. The global multi-layer ceramic capacitor market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 16.77 billion by 2030.

b. The Asia Pacific dominated the multi-layer ceramic capacitor market with a share of over 37% in 2022. This is attributable to the emergence of MLCC manufacturers from various countries such as Japan, South Korea, Taiwan, and India.

b. Some key players operating in the multi-layer ceramic capacitor market include Eyang Holdings Group Co., Ltd.; Future Electronics Inc.; Kyocera Corporation; Samsung Electro-Mechanics; Murata Manufacturing Co., Ltd.; Taiyo Yuden Co., Ltd.; TDK Corporation; Vishay Intertechnology, Inc.; Walsin Technology Corporation; and Yageo Corporation.

b. Key factors that are driving the market growth include increasing demand in the electronics industry and high demand in automotive production.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."