- Home

- »

- Pharmaceuticals

- »

-

Myeloproliferative Disorders Drugs Market Size Report, 2023GVR Report cover

![Myeloproliferative Disorders Drugs Market Size, Share & Trends Report]()

Myeloproliferative Disorders Drugs Market Size, Share & Trends Analysis Report By Indication (Ph- MPN (MF, PV, ET), Ph+ CML), By Major Markets, Competitive Landscape, And Segment Forecasts, 2018 - 2023

- Report ID: GVR-2-68038-436-9

- Number of Pages: 83

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Healthcare

Report Overview

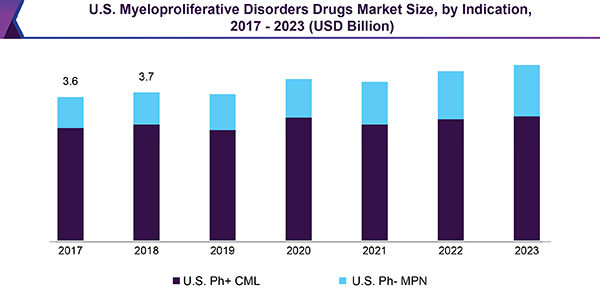

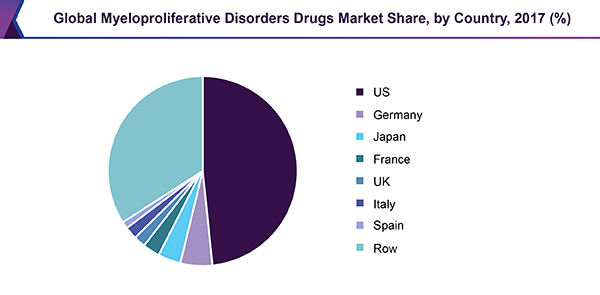

The global myeloproliferative disorders drugs market size was valued at USD 7.35 billion in 2017. It is expected to grow at a compound annual growth rate (CAGR) of 3.4% from 2018 to 2023. The U.S. dominated was at the forefront of the seven major markets. The availability of novel drugs along with the presence of a strong pipeline is one of the key trends stoking market growth. Besides this, increasing incidence of myeloproliferative disorders due to the growing geriatric population as well as changing lifestyles and rising public awareness are providing an upthrust to the market.

Chronic myeloproliferative disorders are rare hematological malignancies that involve abnormal accumulation of mature myeloid cells (red blood cells, granulocytes, and platelets) and their precursors (myelocytes, metamyelocytes, nucleated red blood cells, and megakaryocytes) in the peripheral blood and bone marrow.

The available drugs have not shown disease-modifying activity and are still largely inadequate for managing major unmet needs, which include prevention of hematological progression, normalization of life span, reduction of cardiovascular complications, and improved quality of life. Strong unmet needs within the market present a key opportunity to develop breakthrough first-in-class therapies.

The future myeloproliferative disorders treatment landscape has a high probability of gaining an array of first-in-class therapies and it is anticipated that several novel treatments will gain approvals within the forecast period. Although historically the growth graph of the market has been modest, companies continue to assess novel therapeutic approaches and combination regimens that could potentially improve treatment outcomes. Some prominent players operating in the market are Celgene, Bristol-Myers Squibb, Gamida Cell, Incyte, Geron, Promedior, and Johnson & Johnson.

Indication Insights

The market is segmented into Philadelphia chromosome-positive chronic myeloid leukemia (Ph+ CML) and Philadelphia chromosome-negative myeloproliferative neoplasms (Ph- MPNs). The latter can be further divided into myelofibrosis (MF), polycythemia vera (PV), and essential thrombocythemia (ET). Incidence rates of myeloproliferative disorders are the highest in North America and Western Europe and lowest in East-Asian countries. Most patients are diagnosed with MPNs after 60 years of age, however, the disease can occur in any age group.

Myelofibrosis (MF) is a disorder of bone marrow in which the proliferation of abnormal bone marrow stem cells results in fibrosis or replacement of the marrow with collagenous scar tissue. MF includes primary myelofibrosis (PMF) as well as myelofibrosis transformation from prior polycythemia vera (post-PV MF) or essential thrombocytosis (post-ET MF). Polycythemia vera (PV) is characterized by the uncontrolled proliferation of red blood cells. An elevation in hemoglobin leads to increased blood volume and viscosity, and an elevated rate of thrombosis. Essential thrombocythemia (ET) is characterized by an elevation in platelet count and a tendency towards vascular occlusive events and hemorrhage. Chronic myelogenous leukemia (CML) is a myeloproliferative neoplasm characterized by uncontrolled proliferation of granulocytes and the BCR-ABL1 fusion gene located in the Philadelphia chromosome. CML is classified as the Philadelphia chromosome-positive MPN.

Therapeutic Class Insights

Allogeneic bone marrow transplantation (BMT) is a potentially curative treatment in the early stage of myeloproliferative disorders, although relapses and mortality from complications such as chronic graft-vs-host disease (GVHD) may occur after transplantation. Less than 10.0% of patients undergo the procedure owing to the presence of severe comorbidities, advanced age, or lack of donors. Standards of care are targeted agents such as Gleevec, Tasigna, and Sprycel for CML and Jakafi for MF and PV along with generic chemotherapeutics such as busulfan and hydroxyurea.

The treatment landscape for myeloproliferative disorders patients has undergone multiple changes since the approval of Gleevec and Jakafi for CML and MF, respectively. Opportunities remain in the Ph- MPNs setting where there exist unmet needs for a safer drug than Jakafi with higher cure rates as well as treatment options for patients who are Jakafi intolerant. Therapeutic development in the second-line setting of Jakafi intolerant patients is estimated to have a major impact on the MF and PV market. Currently, there are no drugs approved for patients who are refractory or become unresponsive to Jakafi treatment. Novel agents are likely to be introduced in later-lines of treatment to target major unmet needs including overcoming tumor resistance, improving progression-free survival, and maintaining the quality of life.

Country Insights

The U.S. dominated the global myeloproliferative disorders drugs market in 2017, followed by Germany. The country is anticipated to maintain its leading position until 2023. Multiple product launches during the forecast period, increasing adoption of novel therapeutics, and the presence of a large target population are among the primary growth stimulants for the market in the U.S.

Germany will lead to the top five EU markets until 2023. The U.K., Italy, and France markets are projected to exhibit modest growth over the forecast period. New product launches during the forecast period will play a pivotal role in driving these markets. The seven major markets are poised to experience higher growth rates than the rest of the world.

Key Companies & Market Share Insights

Some of the prominent companies operating in the market are Novartis, Bristol-Myers Squibb, Pfizer, Takeda, Incyte, and Teva. Collaborations for development, broader product portfolios, and regional expansion in emerging markets are the key strategic undertakings of these companies to increase their market share. Low-cost generic Gleevec is expected to achieve rapid uptake and become the most popular first-line treatment for CML.

As the only treatment approved for MF and PV for refractory patients, Incyte has significant pricing power and has a first-mover advantage over competing for pipeline treatments. Novel pipeline candidates targeting MF indication are estimated to be used for Jakafi intolerant or refractory patients.

Recent Development

- In October 2021, Novartis announced Scemblix® (asciminib) has been licensed by the US Food and Drug Administration (FDA) for the treatment of chronic myeloid leukemia (CML) in two different indications

Myeloproliferative Disorders Drugs Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 8.3 billion

Revenue forecast in 2023

USD 9.26 billion

Growth Rate

CAGR of 3.4% from 2017 to 2023

Base year for estimation

2017

Historical data

2015 - 2017

Forecast period

2017 - 2023

Quantitative units

Revenue in USD Million & CAGR from 2017 to 2023

Report coverage

Revenue forecast; company share; competitive landscape; growth factors and trends

Segments covered

Indication, therapeutic class, country

Country scope

U.S.; U.K.; Germany; France; Italy; Spain; Japan

Key companies profiled

Novartis AG; Bristol-Myers Squibb Company; Pfizer Inc.; Takeda Pharmaceutical Company Limited; Incyte Corporation; Teva Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report provides an analysis of the market trends in each sub-category as well as forecasts revenue growth from 2017 to 2023. For this study, Grand View Research has segmented the myeloproliferative disorders drugs market report based on indications and seven major markets:

-

Indication Outlook (Revenue, USD Million, 2017 - 2023)

-

Ph+ CML

-

Ph- MPN

-

MF

-

PV

-

ET

-

-

-

Country Outlook (Revenue, USD Million, 2017 - 2023)

-

The U.S.

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Japan

-

Frequently Asked Questions About This Report

b. The global myeloproliferative disorders drugs market size was estimated at USD 8.0 billion in 2019 and is expected to reach USD 8.3 billion in 2020.

b. The global myeloproliferative disorders drugs market is expected to grow at a compound annual growth rate of 3.4% from 2017 to 2023 to reach USD 9.3 billion by 2023.

b. Ph+ Chronic myelogenous leukemia (CML) dominated the myeloproliferative disorders drugs market with a share of 80.7% in 2019. This is attributable to high prevalence of Ph+ CML in key regions.

b. Some key players operating in the myeloproliferative disorders drugs market include Novartis AG; Bristol-Myers Squibb Company; Pfizer Inc.; Takeda Pharmaceutical Company Limited; Incyte Corporation; and Teva Pharmaceutical Industries Ltd.

b. Key factors that are driving the market growth include introduction of novel drugs, presence of a strong pipeline, and increasing incidence of myeloproliferative disorders.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."